This version of the form is not currently in use and is provided for reference only. Download this version of

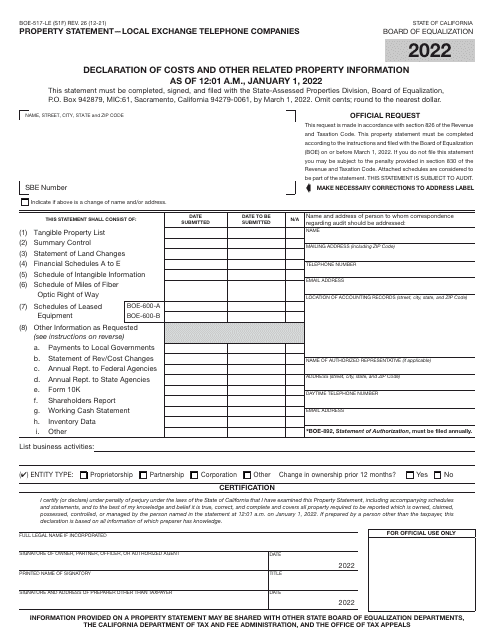

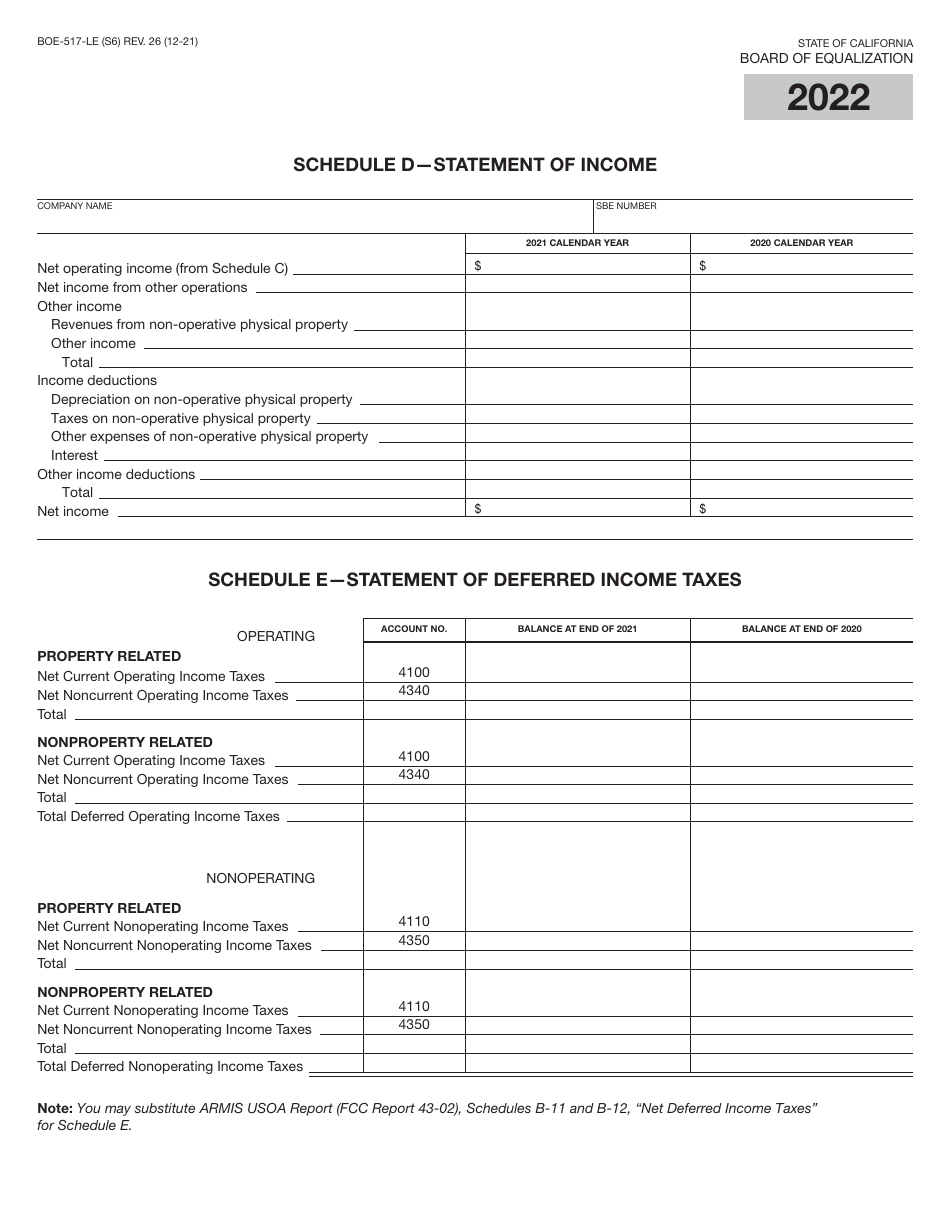

Form BOE-517-LE

for the current year.

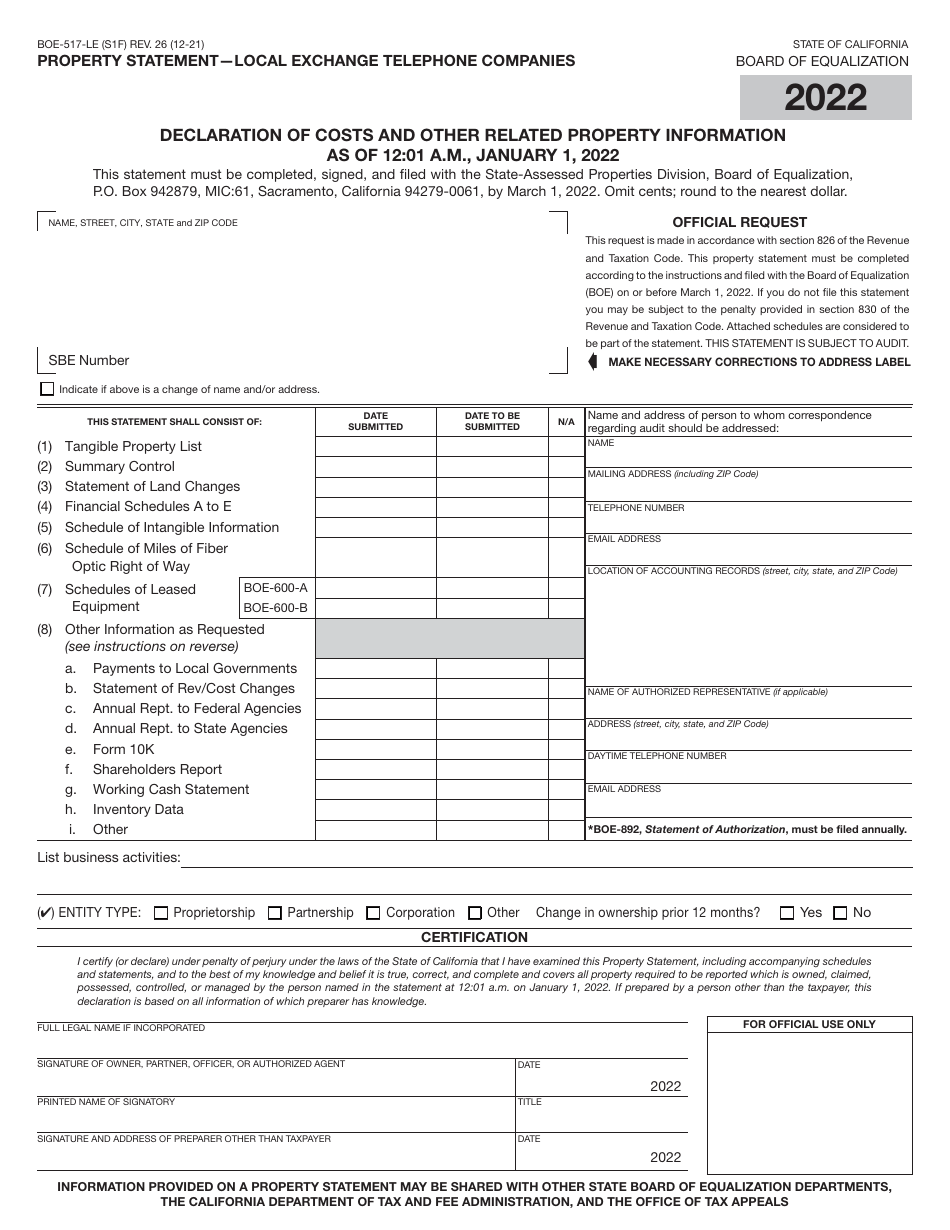

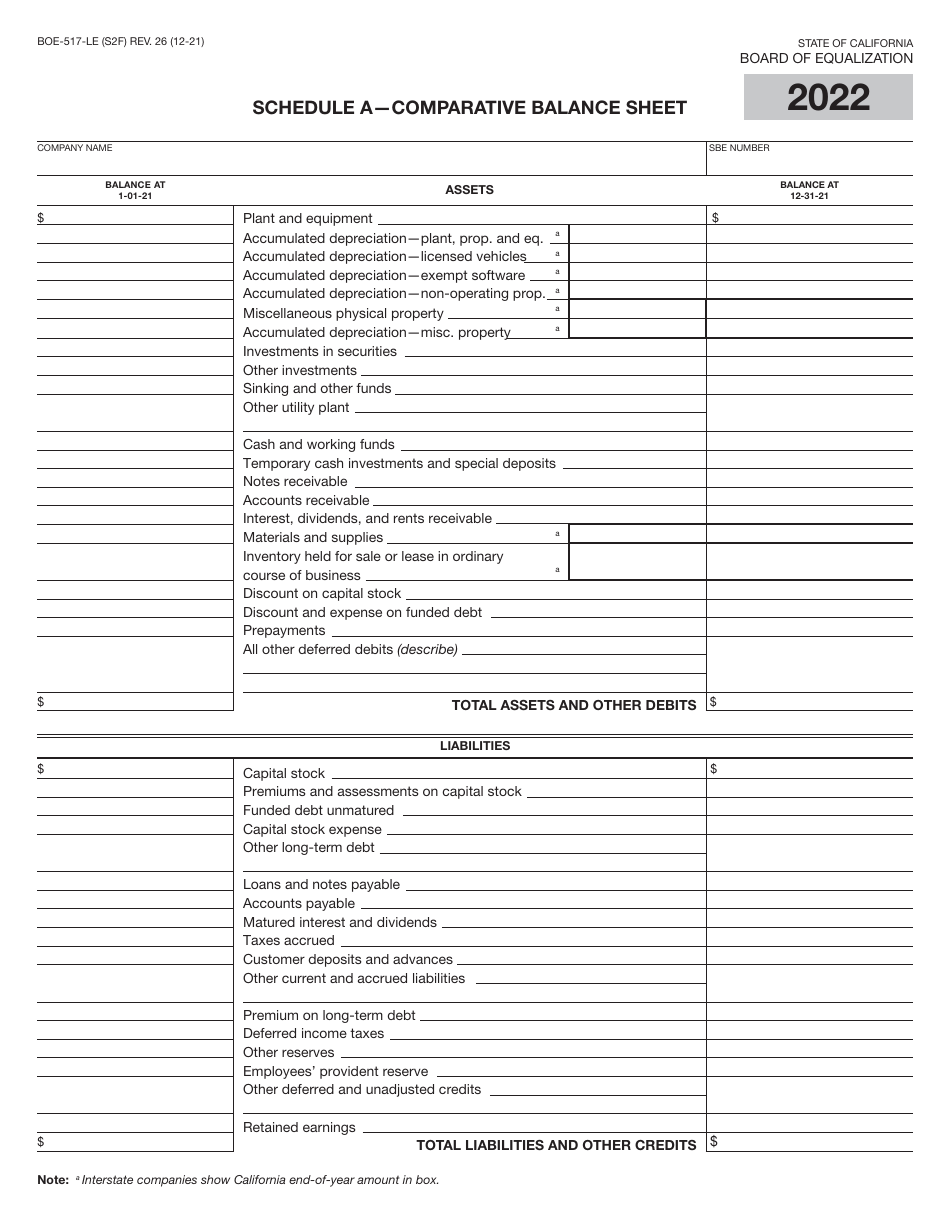

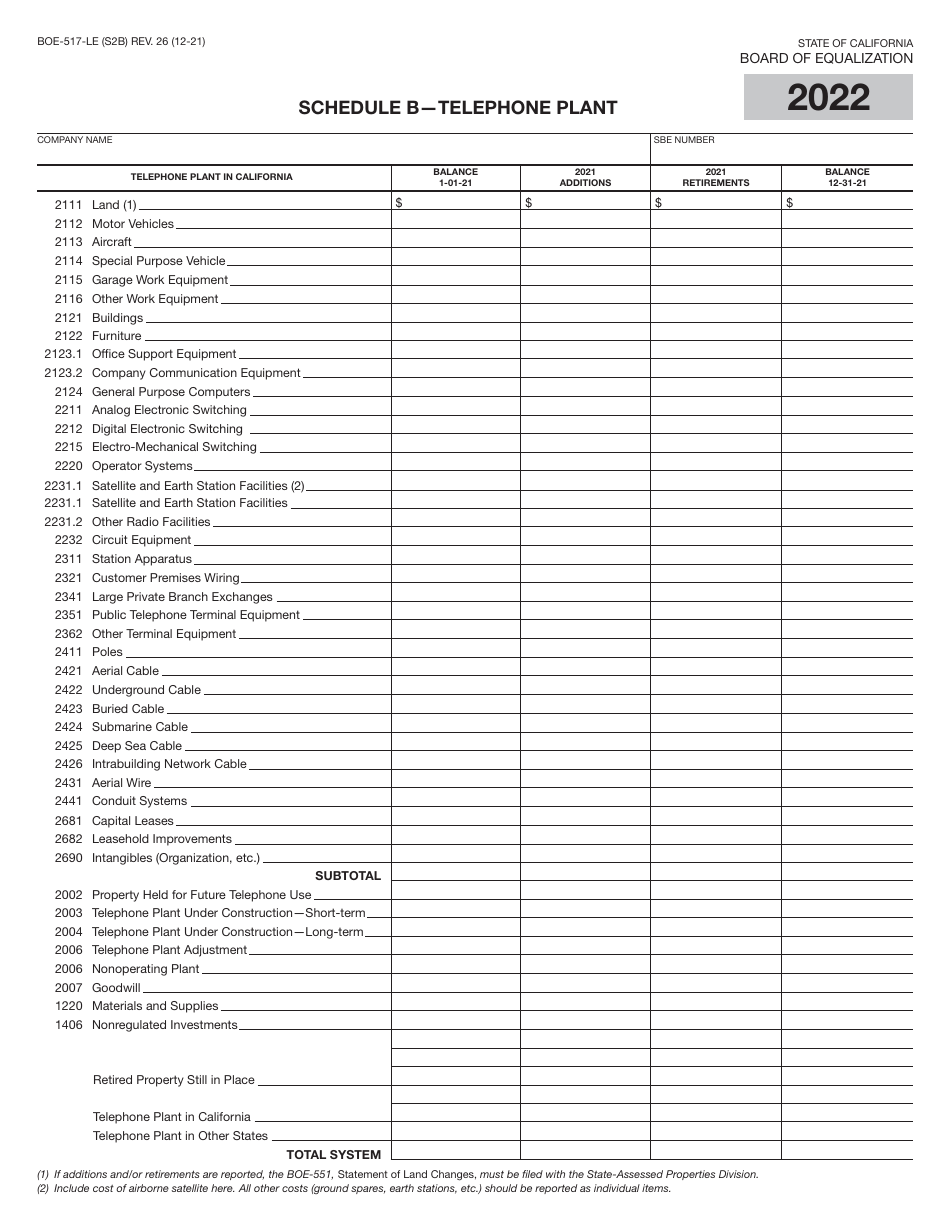

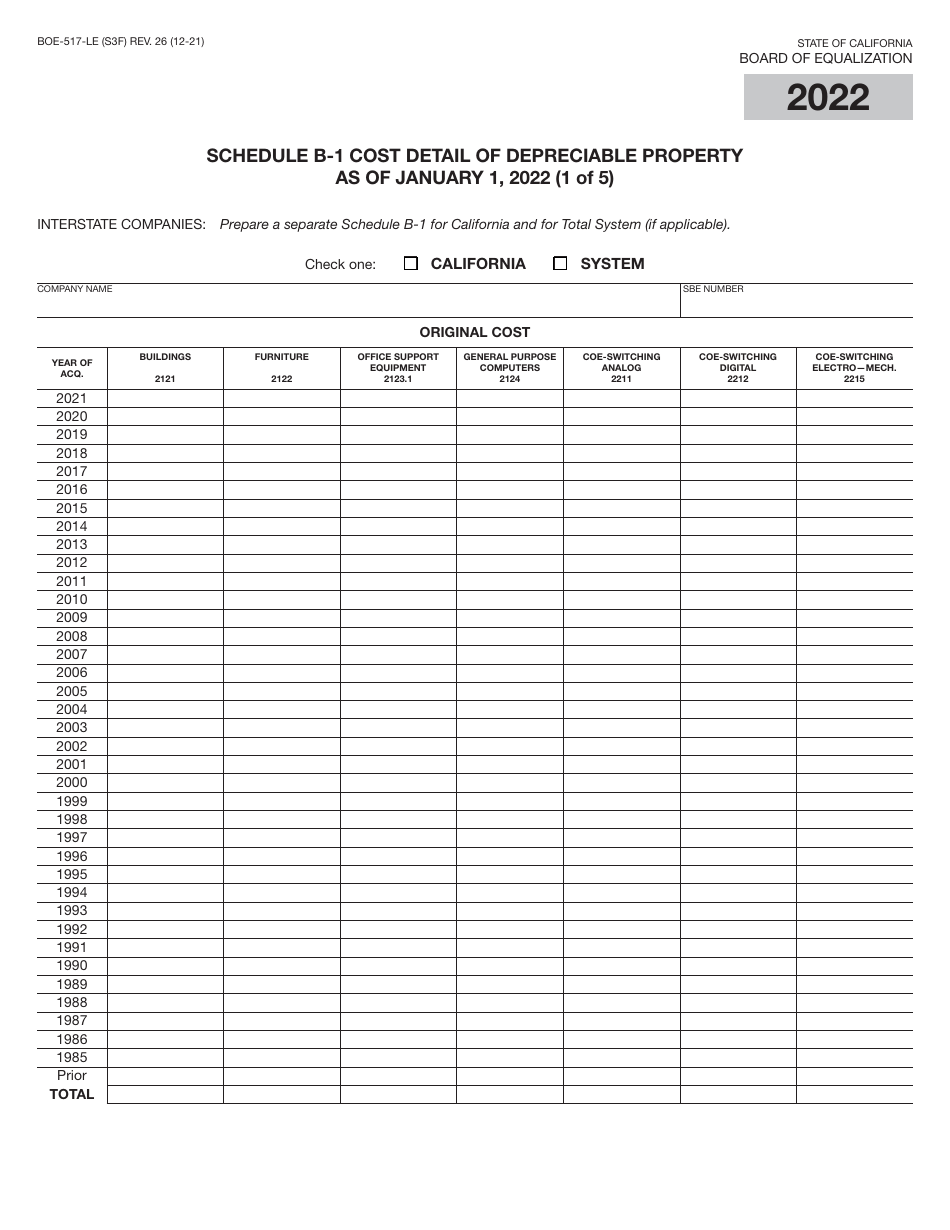

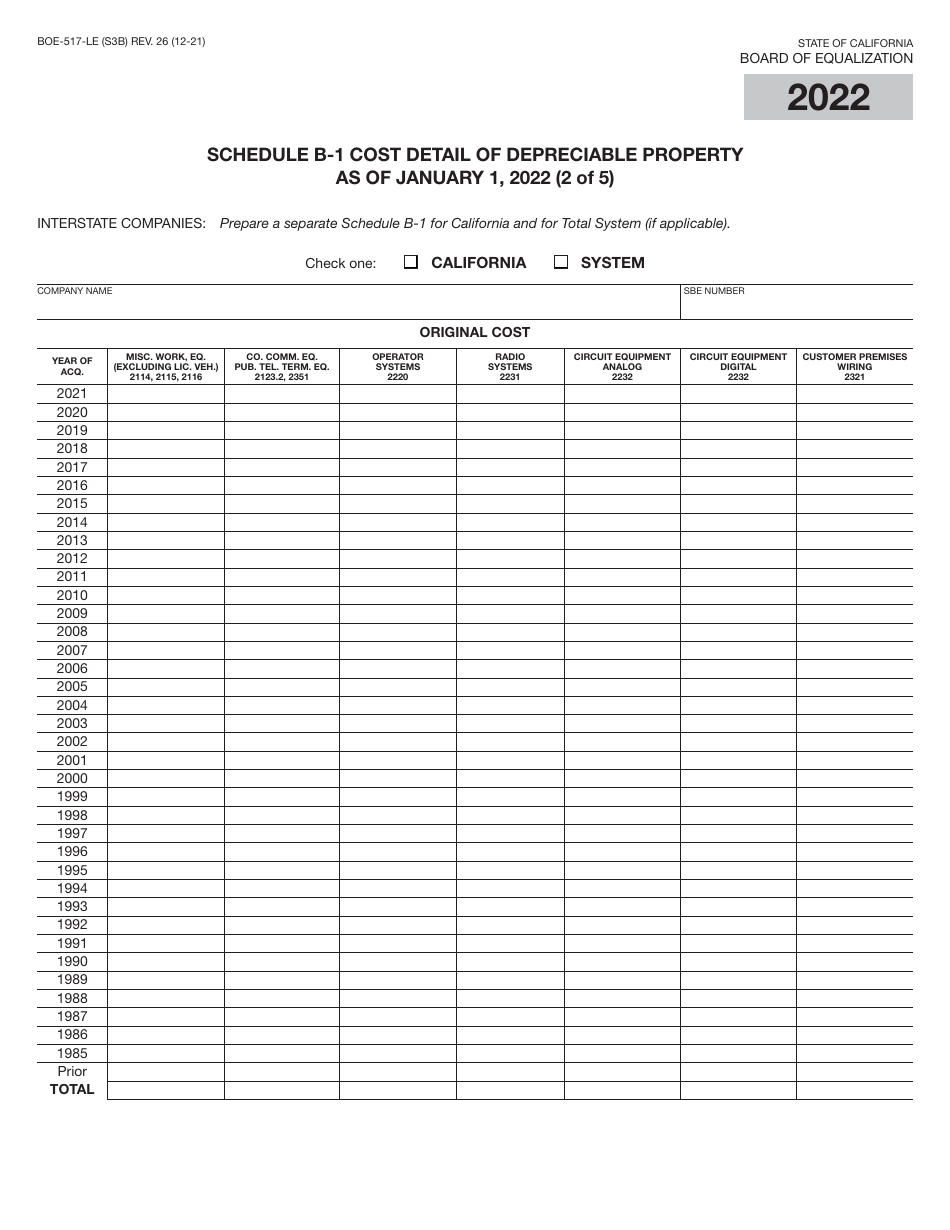

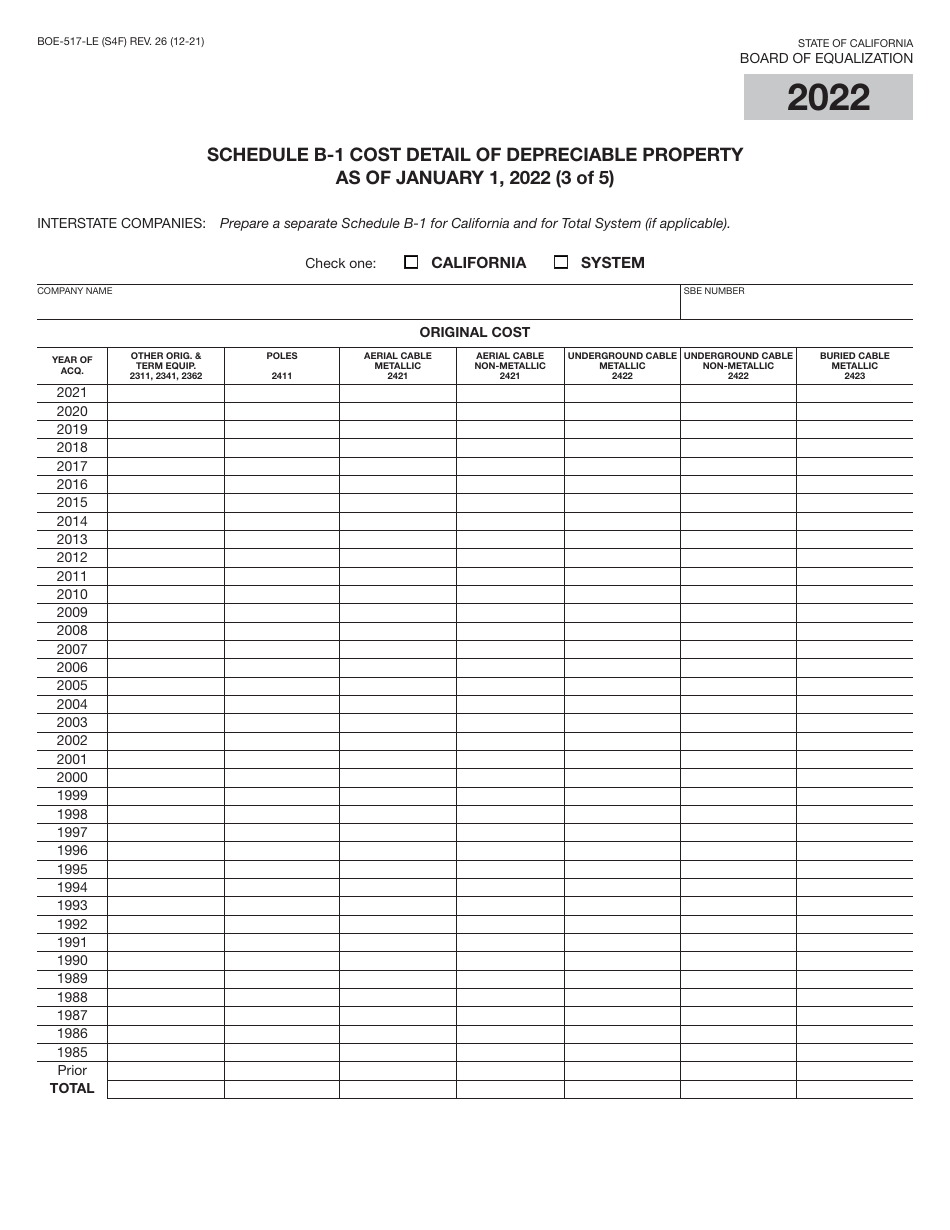

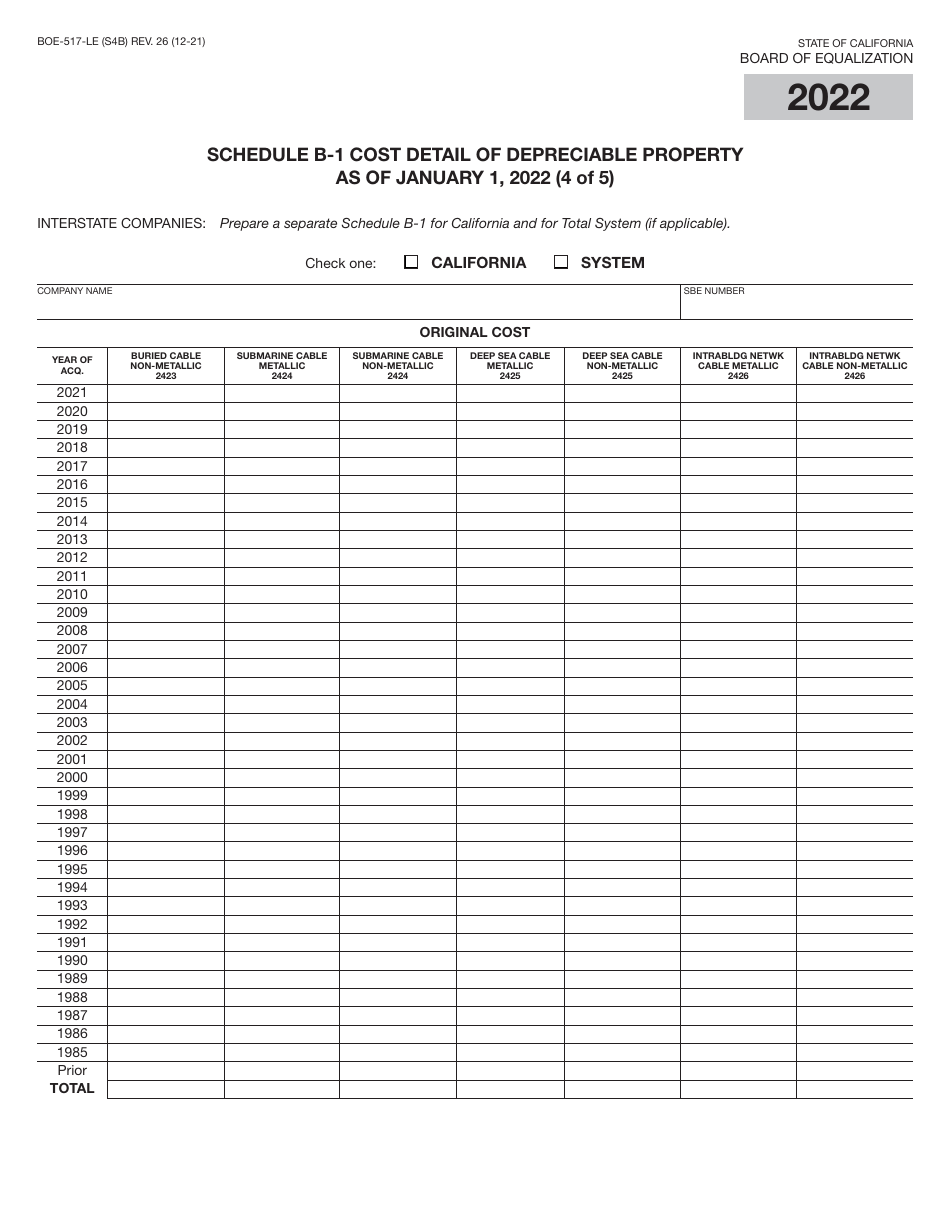

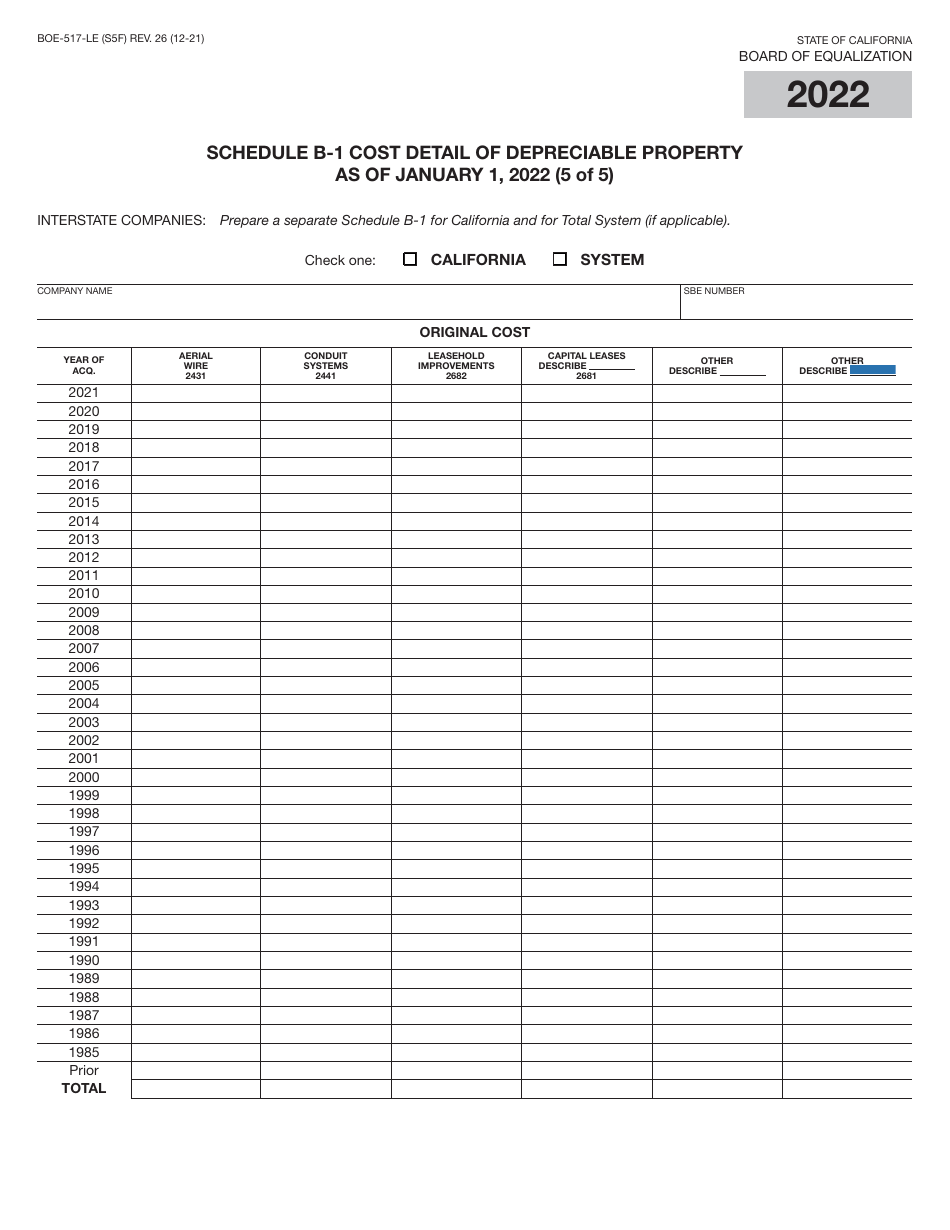

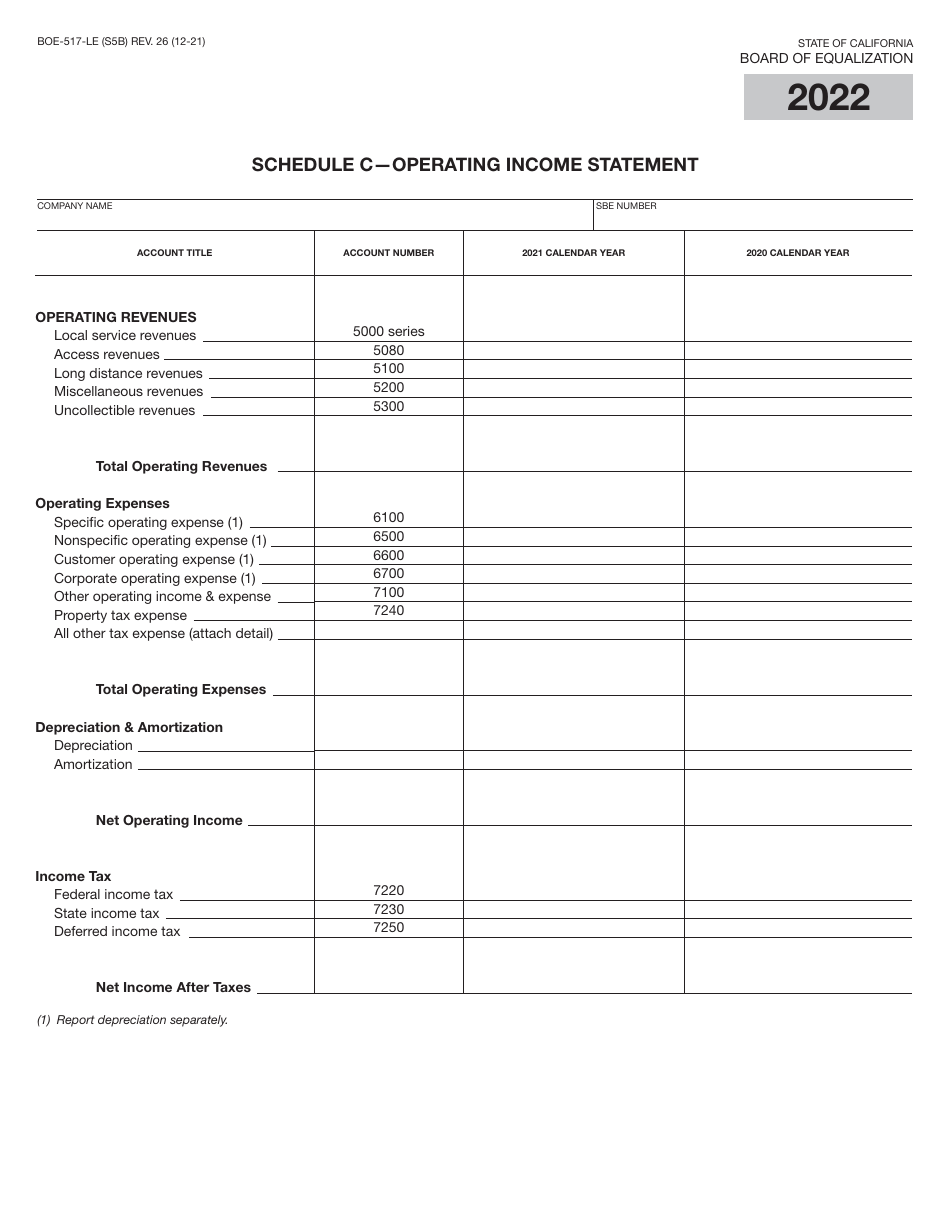

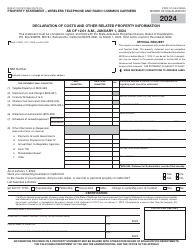

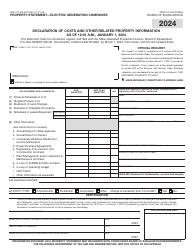

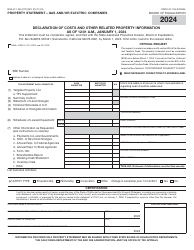

Form BOE-517-LE Property Statement - Local Exchange Telephone Companies - California

What Is Form BOE-517-LE?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-517-LE?

A: Form BOE-517-LE is the Property Statement for Local Exchange Telephone Companies in California.

Q: Who needs to file Form BOE-517-LE?

A: Local Exchange Telephone Companies operating in California need to file Form BOE-517-LE.

Q: What is the purpose of Form BOE-517-LE?

A: The purpose of Form BOE-517-LE is to report the property details of Local Exchange Telephone Companies for assessment and taxation purposes in California.

Q: When is the deadline for filing Form BOE-517-LE?

A: The deadline for filing Form BOE-517-LE is annually by April 1st.

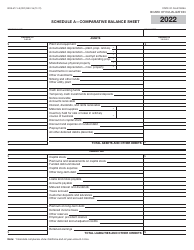

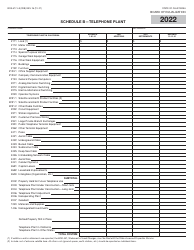

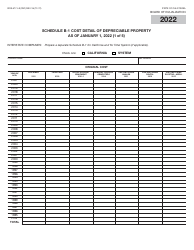

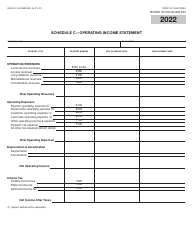

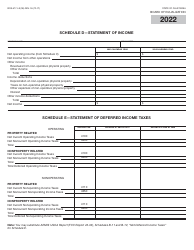

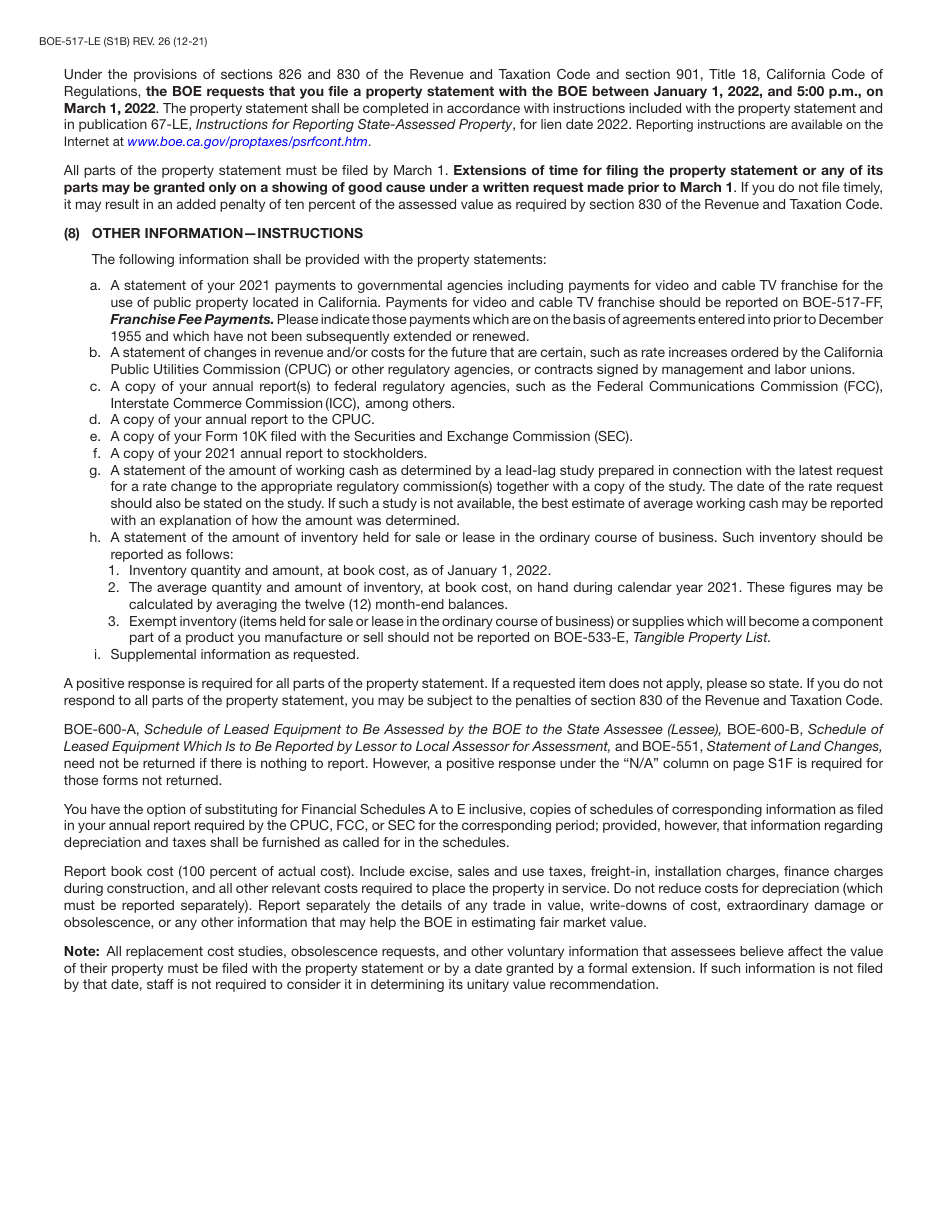

Q: What information needs to be provided in Form BOE-517-LE?

A: Form BOE-517-LE requires information about the company's property, including its location, description, and value.

Q: Are there any penalties for late filing of Form BOE-517-LE?

A: Yes, there can be penalties for late filing of Form BOE-517-LE, including potential assessment of a 10% penalty on the assessed value of the property.

Q: Are there any exemptions or exclusions for filing Form BOE-517-LE?

A: Exemptions or exclusions may apply for specific types of property owned by Local Exchange Telephone Companies, but they must be claimed on the form if applicable.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-517-LE by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.