This version of the form is not currently in use and is provided for reference only. Download this version of

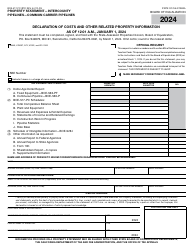

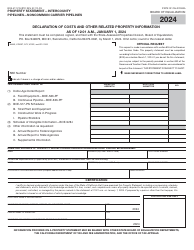

Form BOE-517-PG

for the current year.

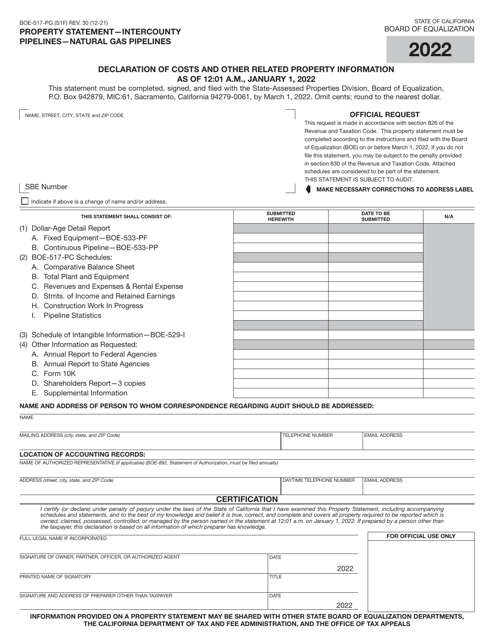

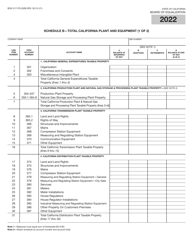

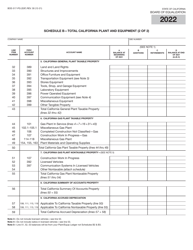

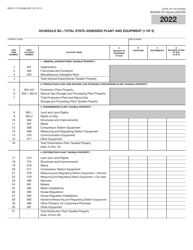

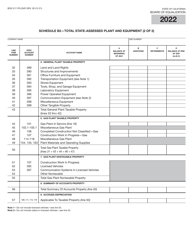

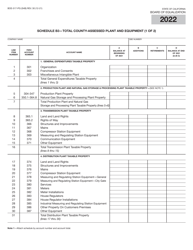

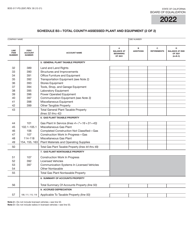

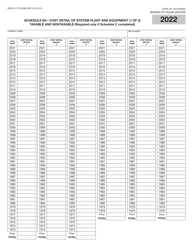

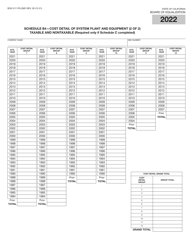

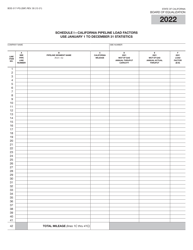

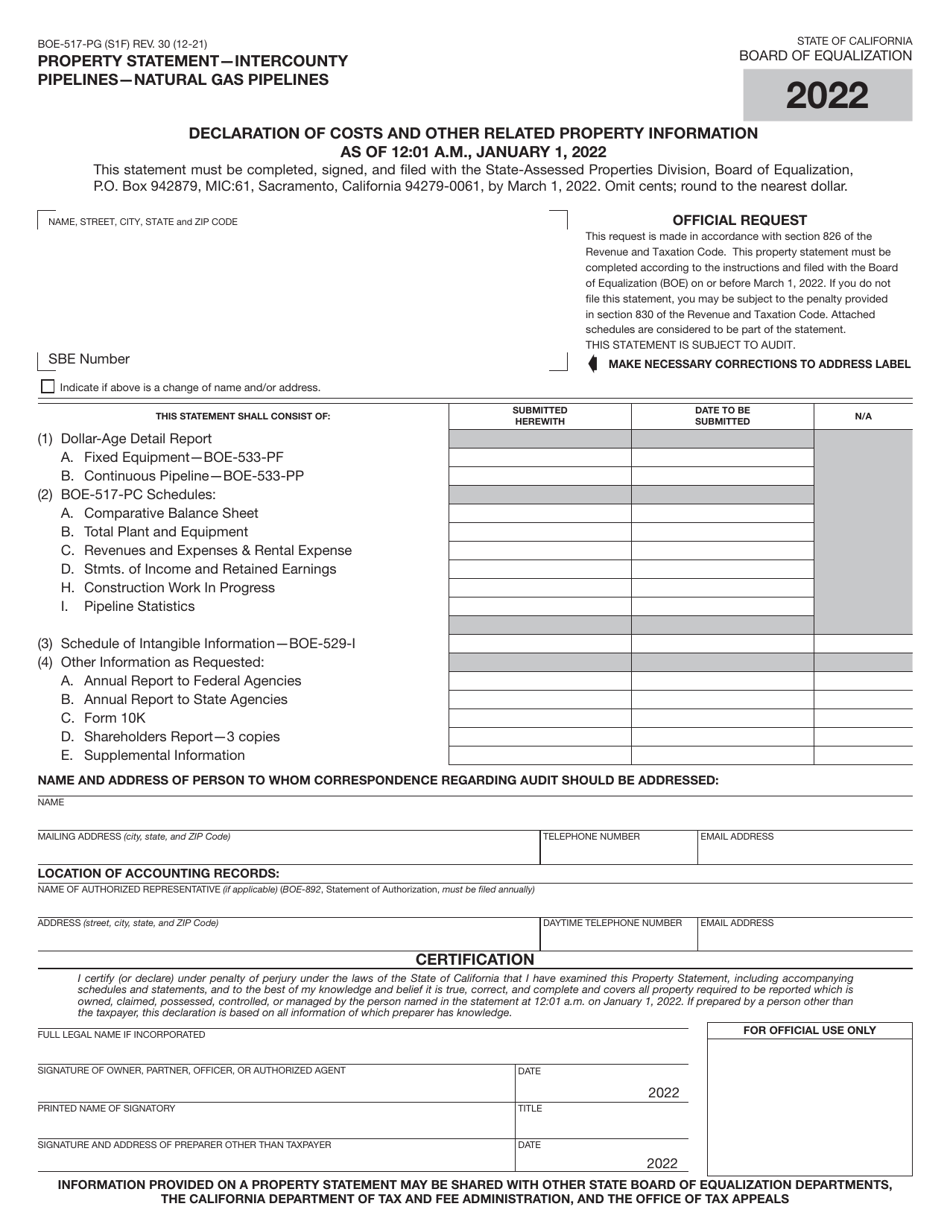

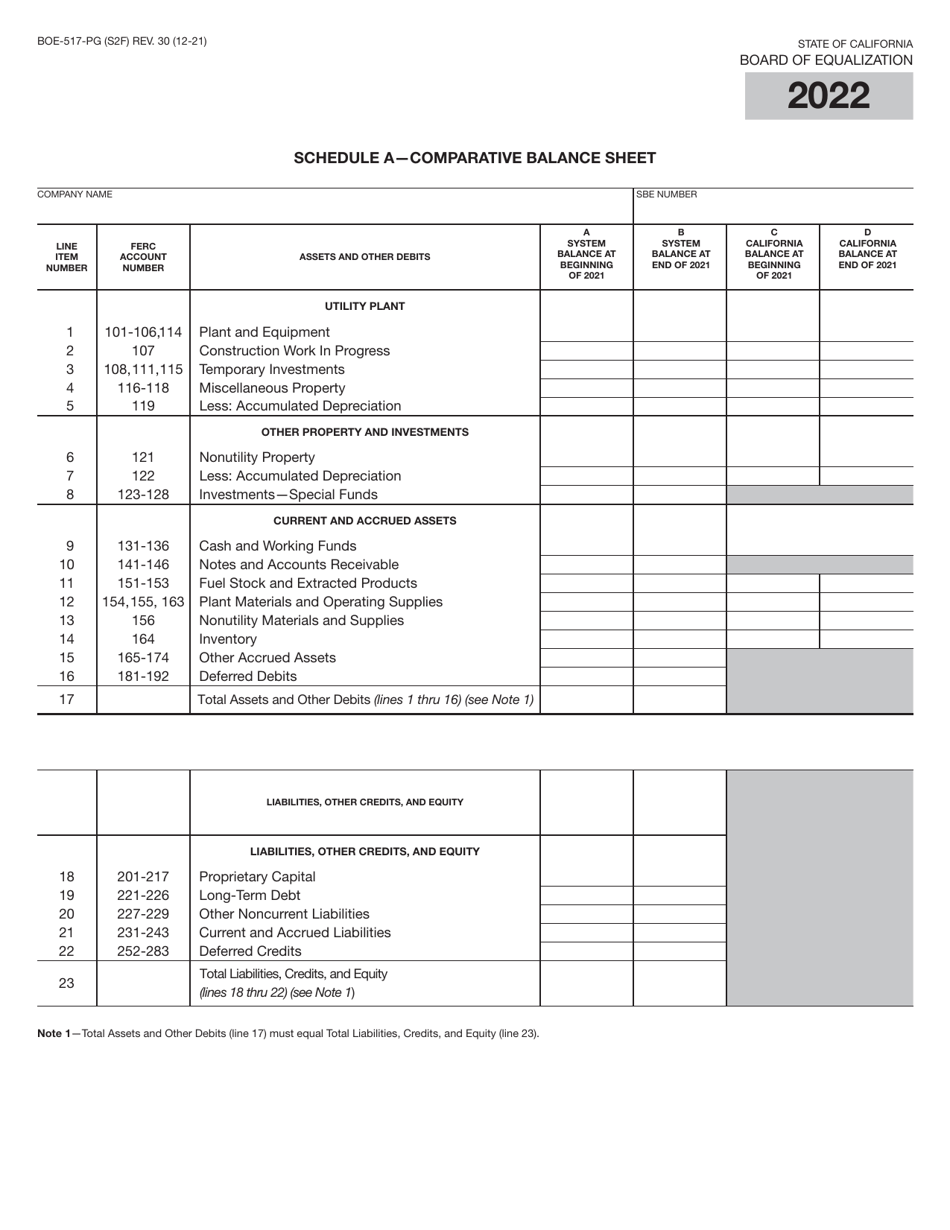

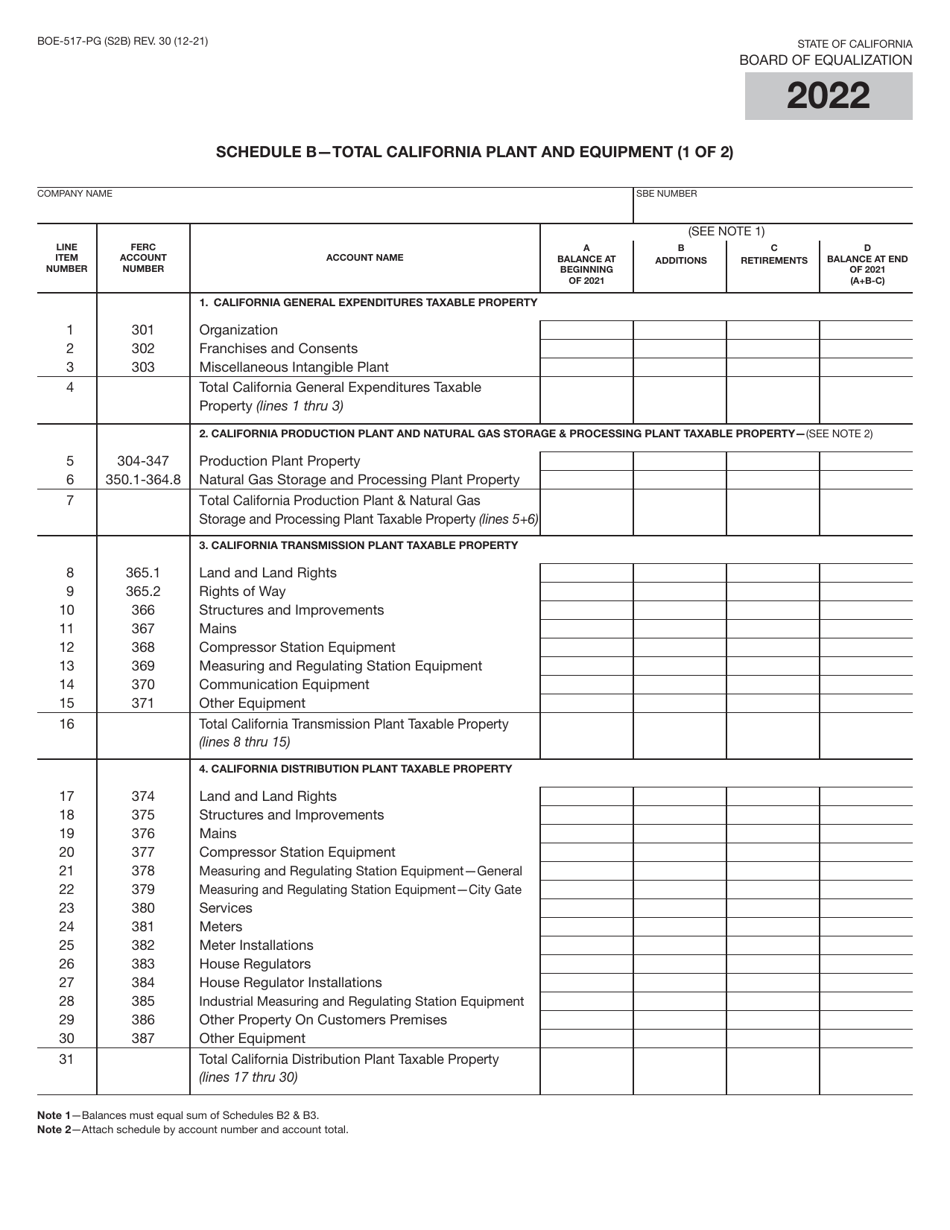

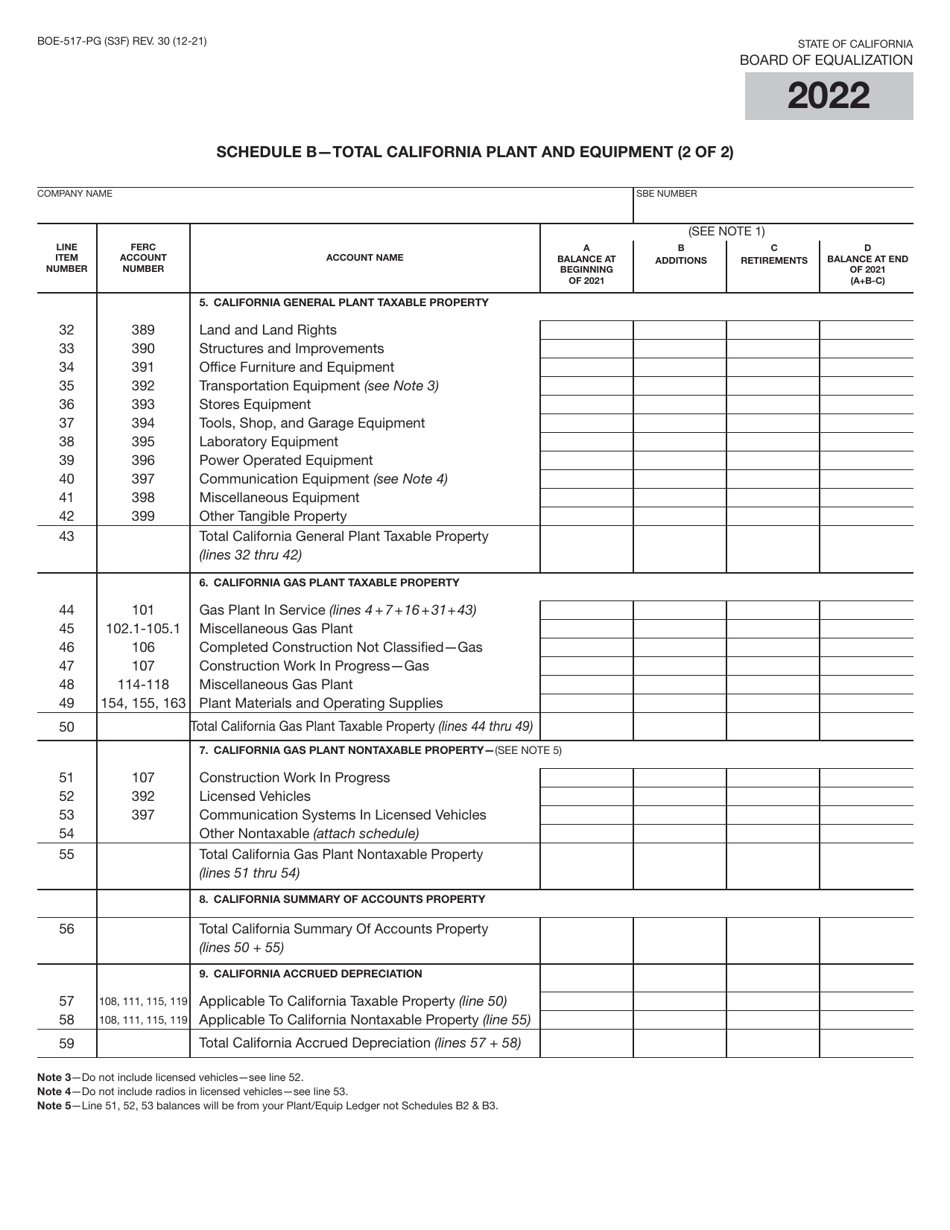

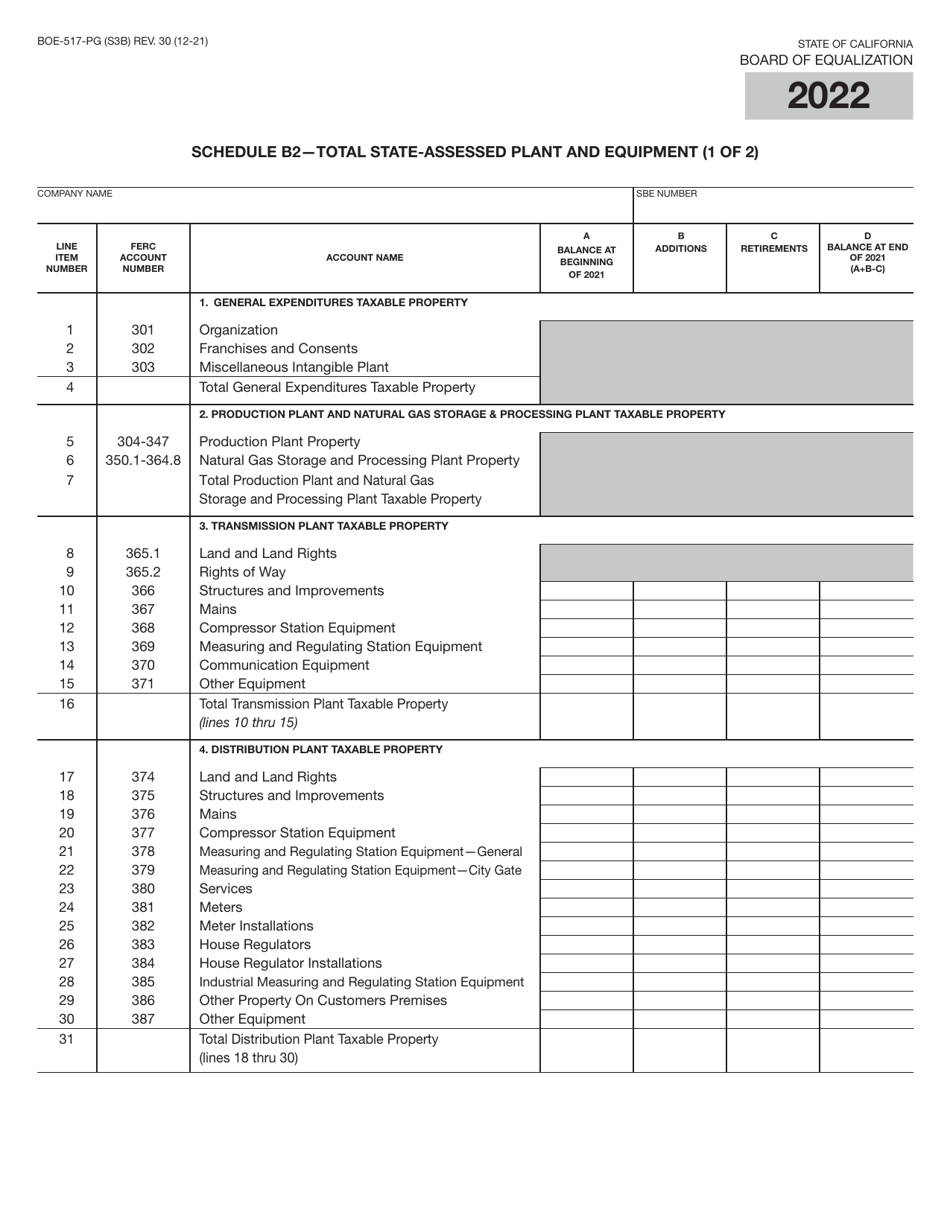

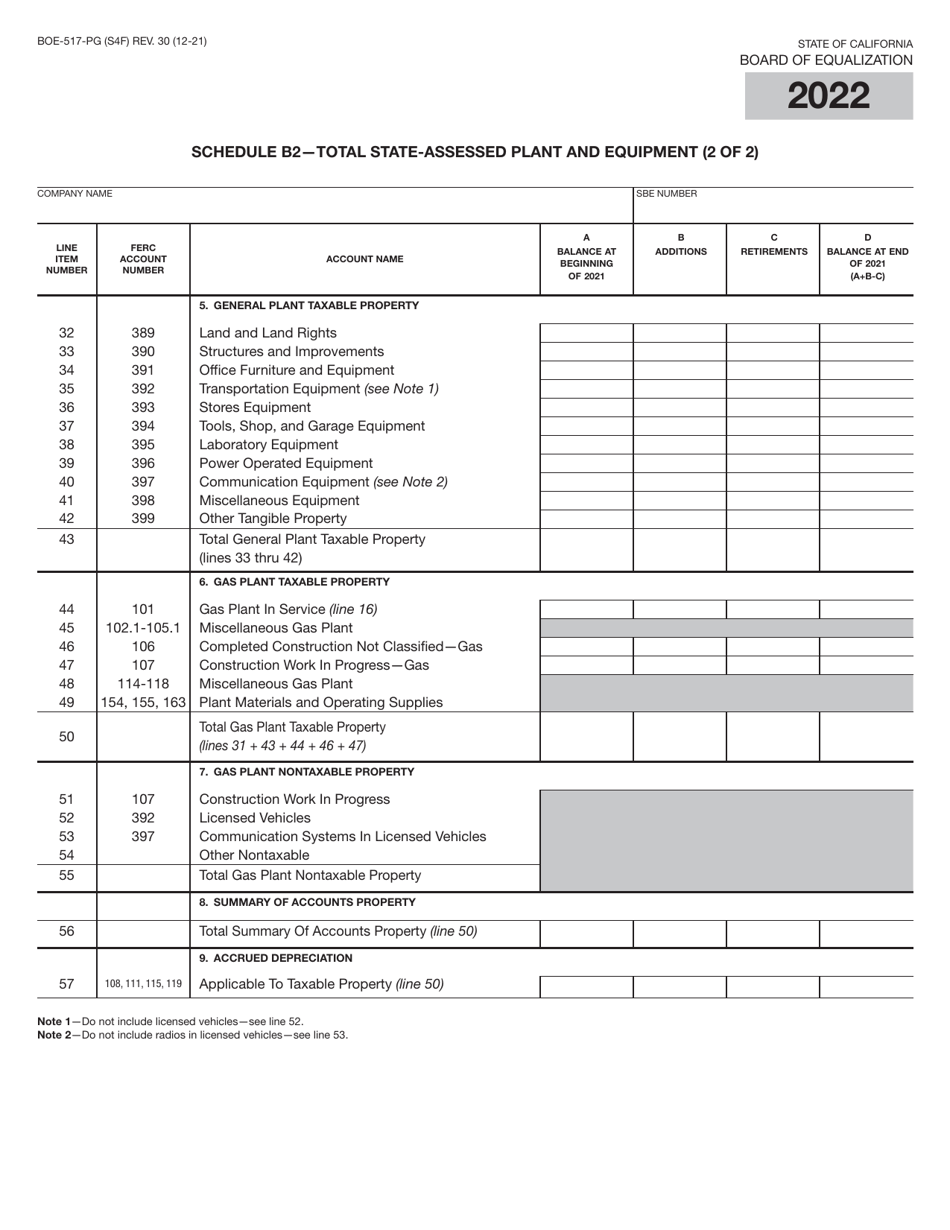

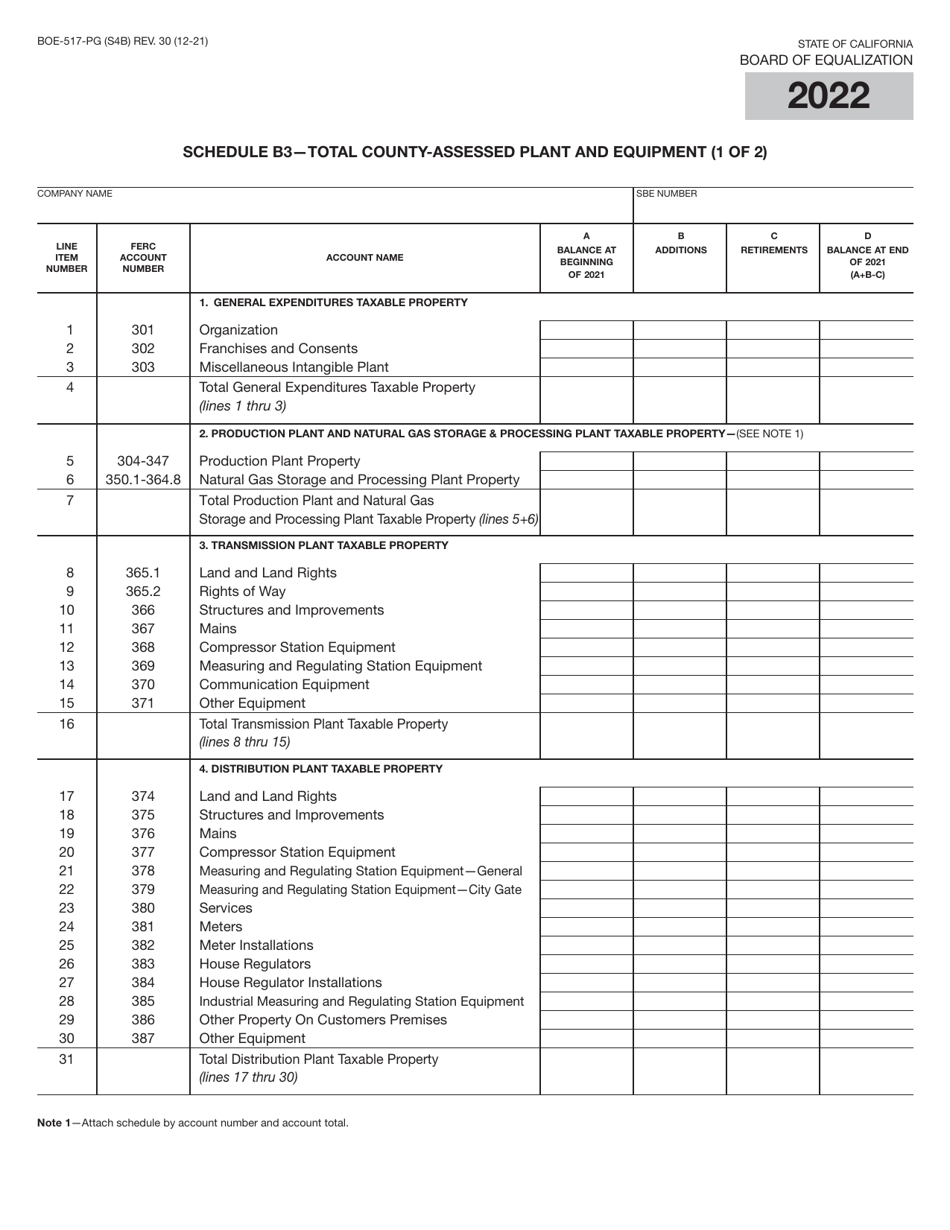

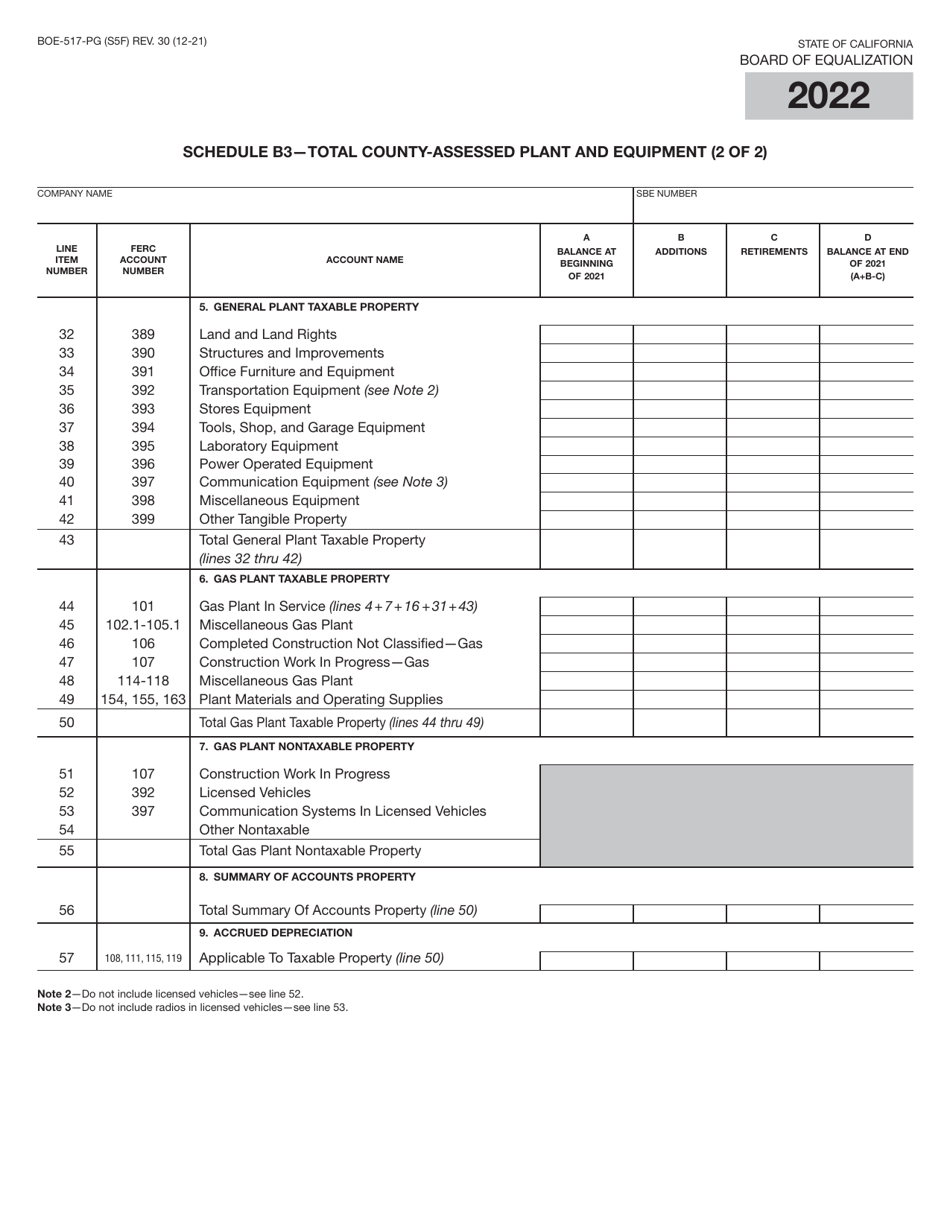

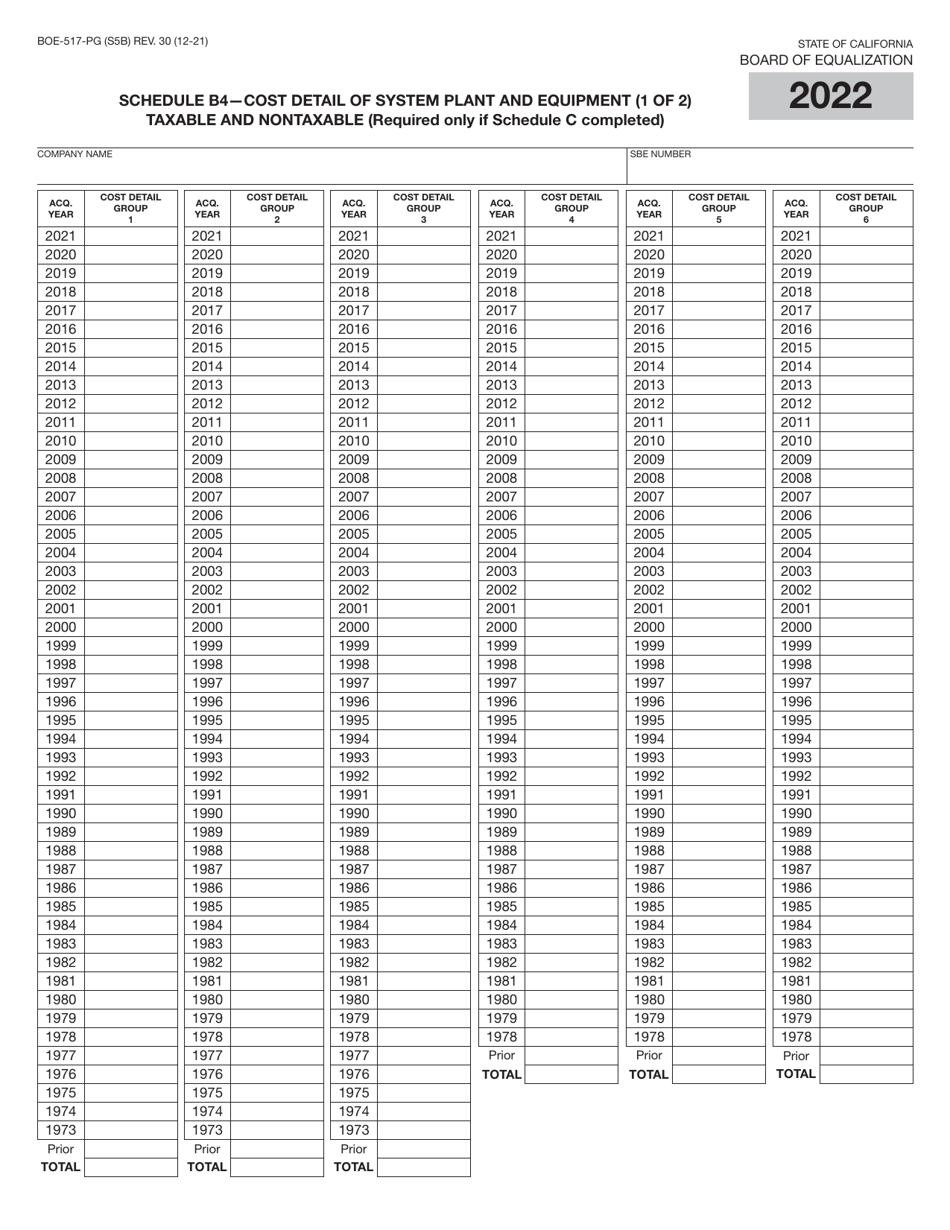

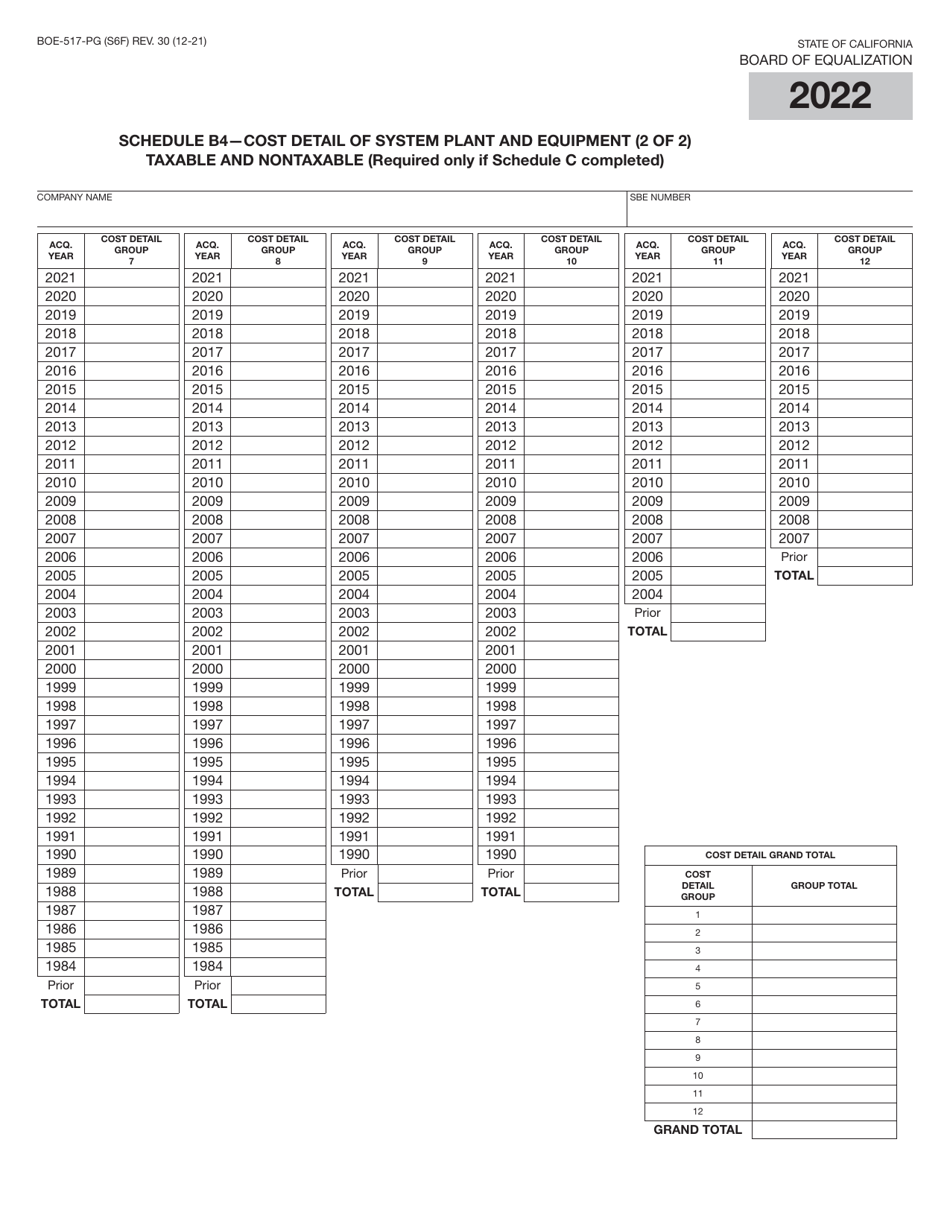

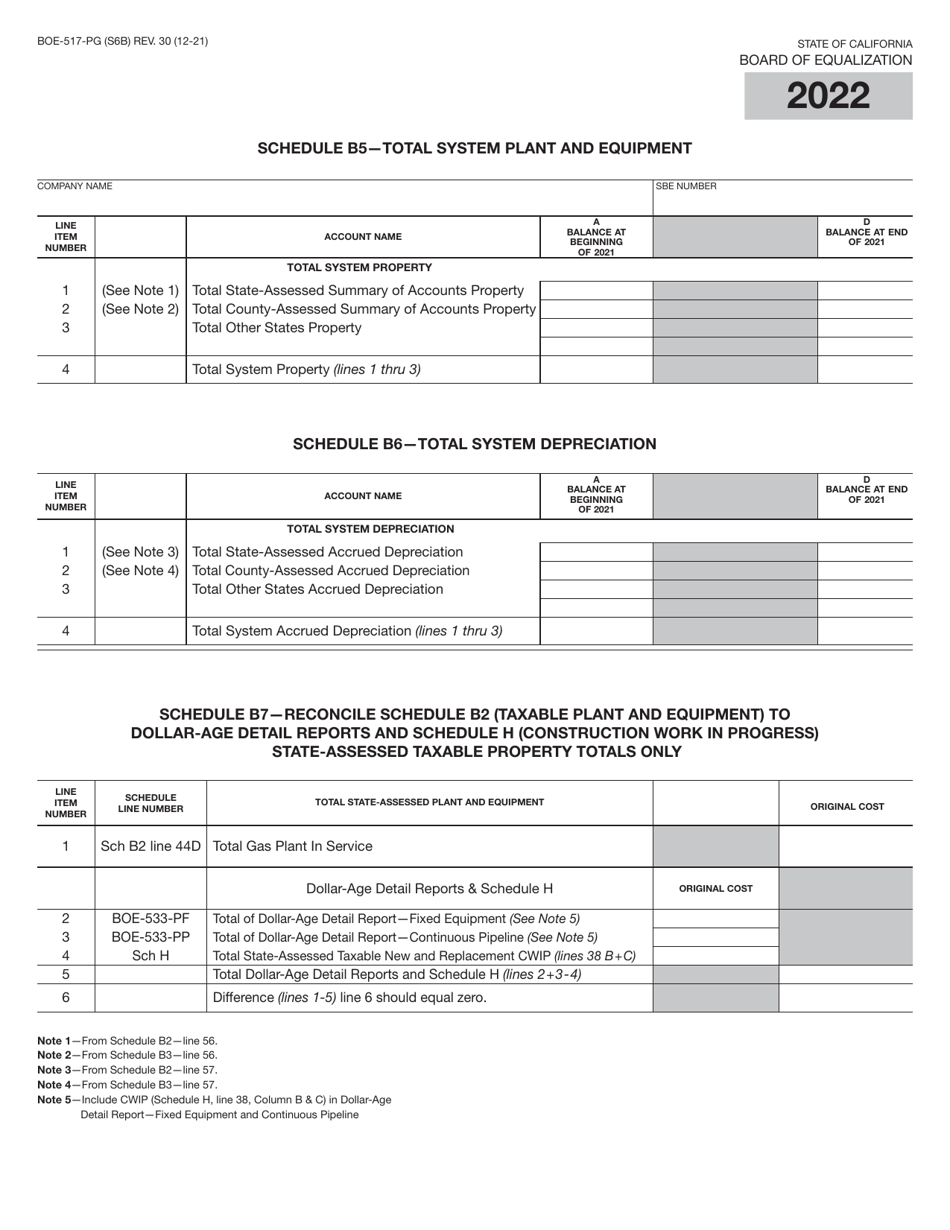

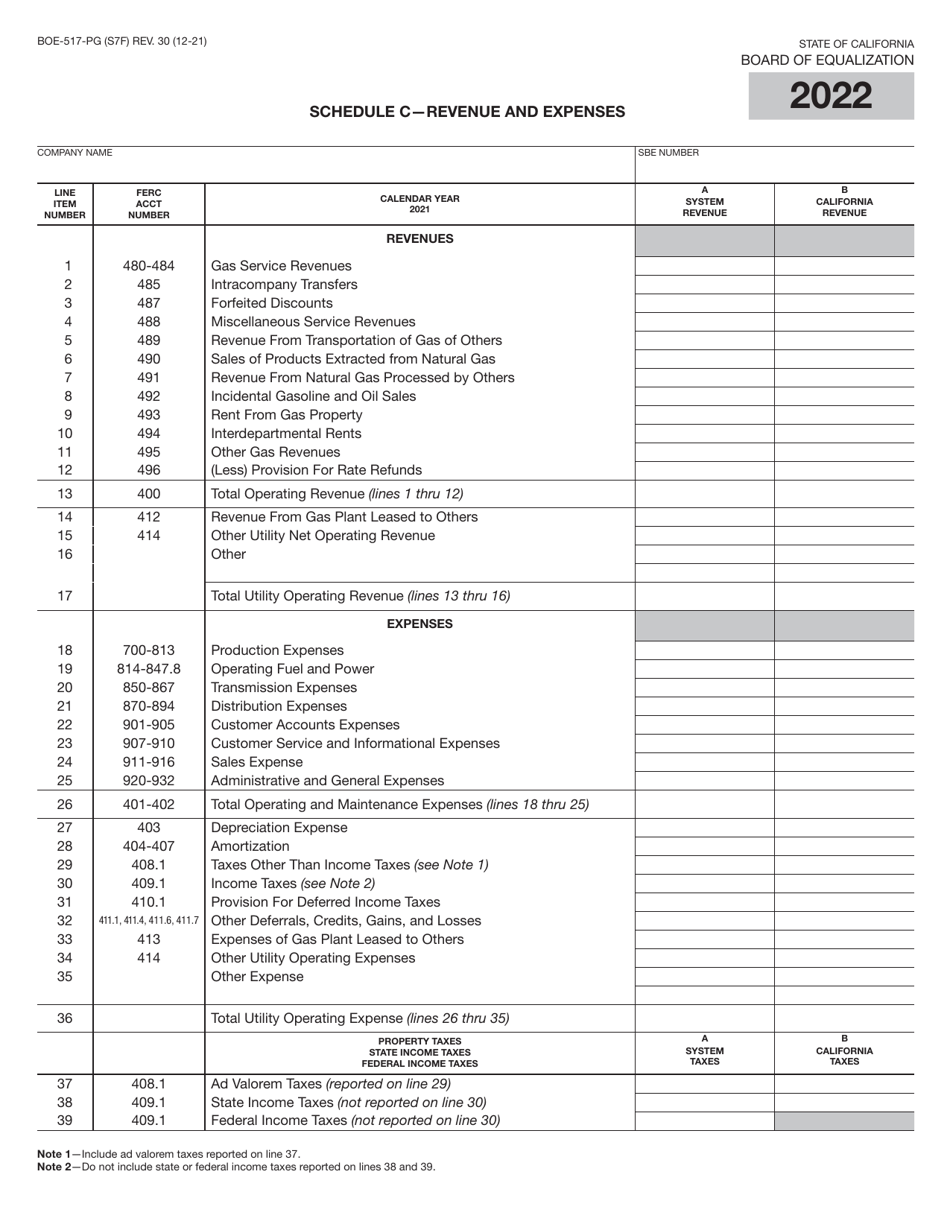

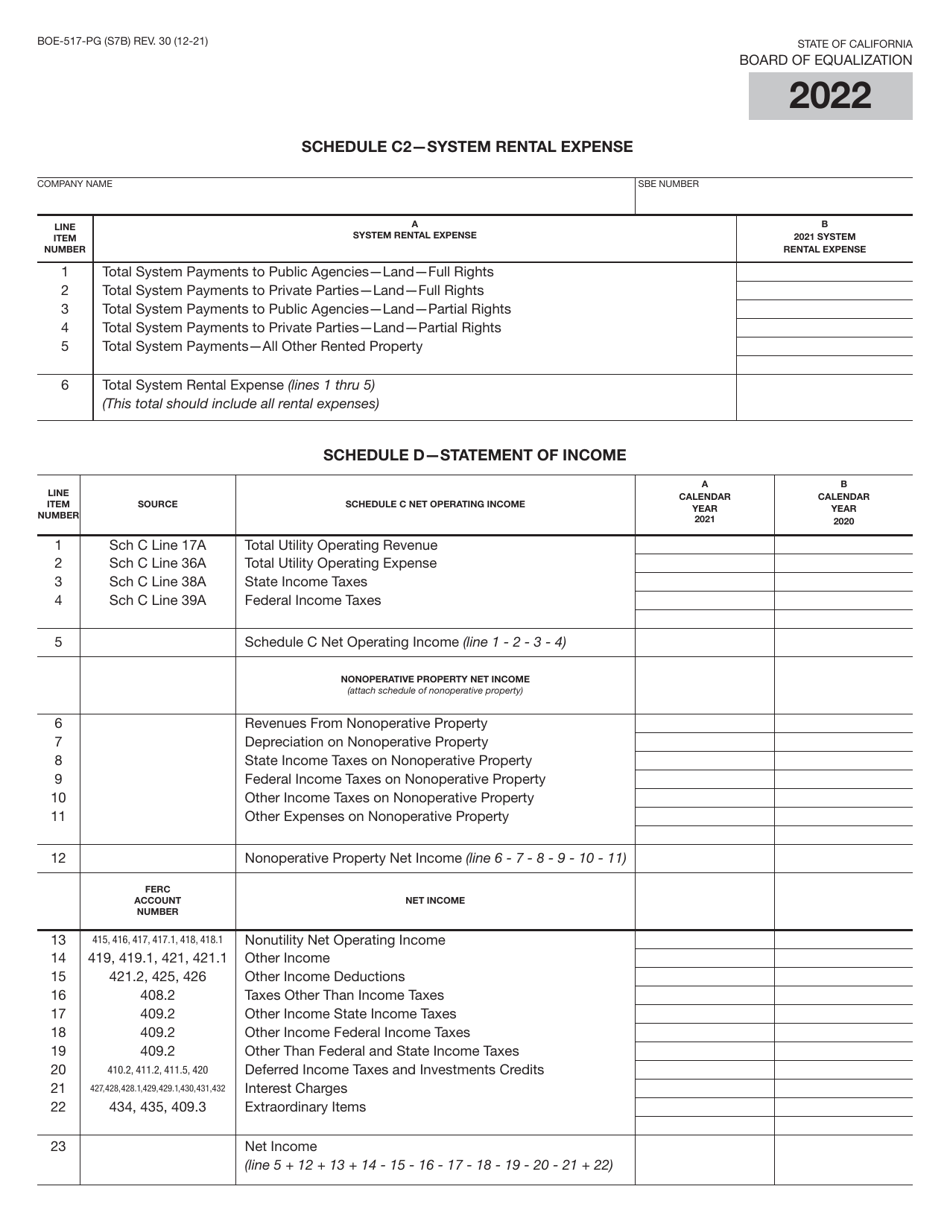

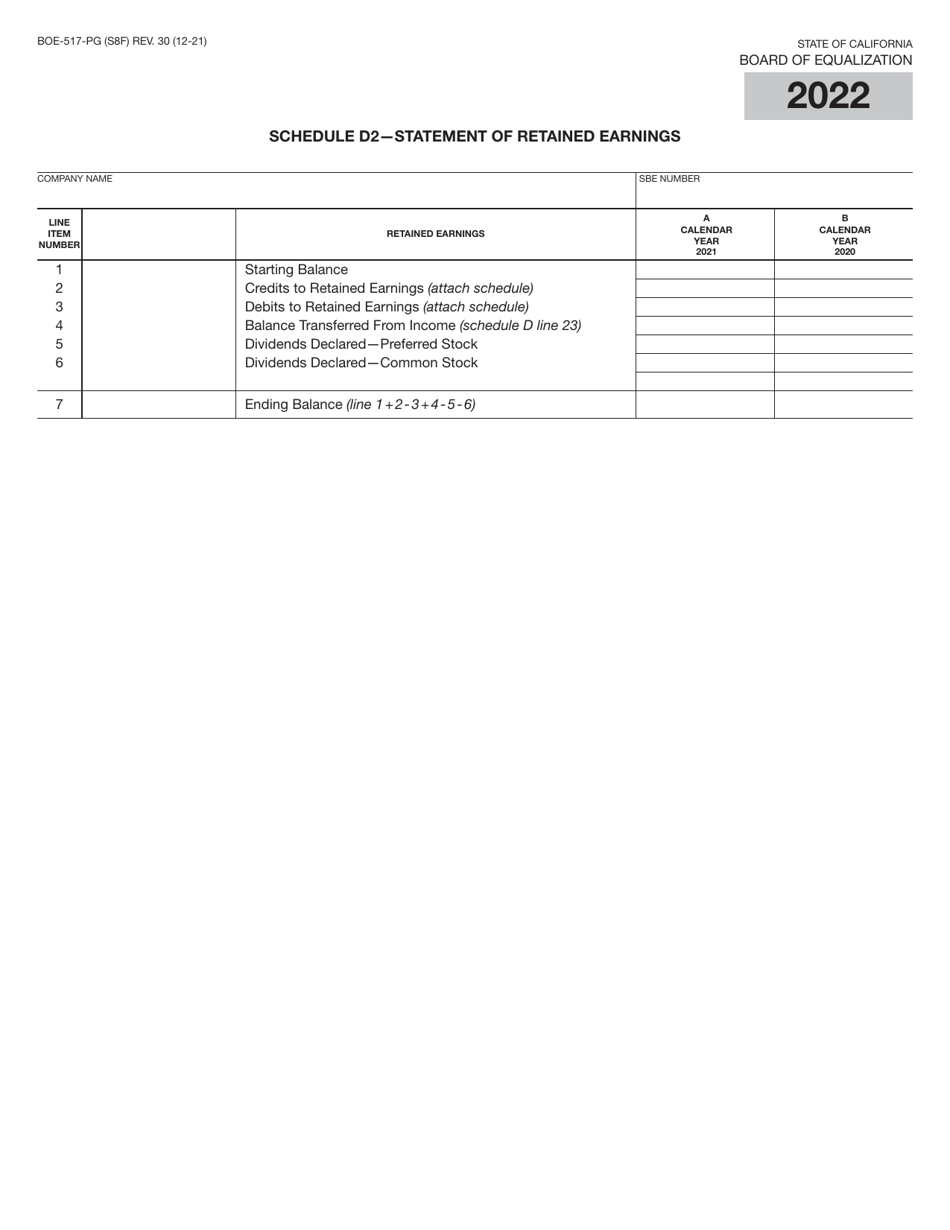

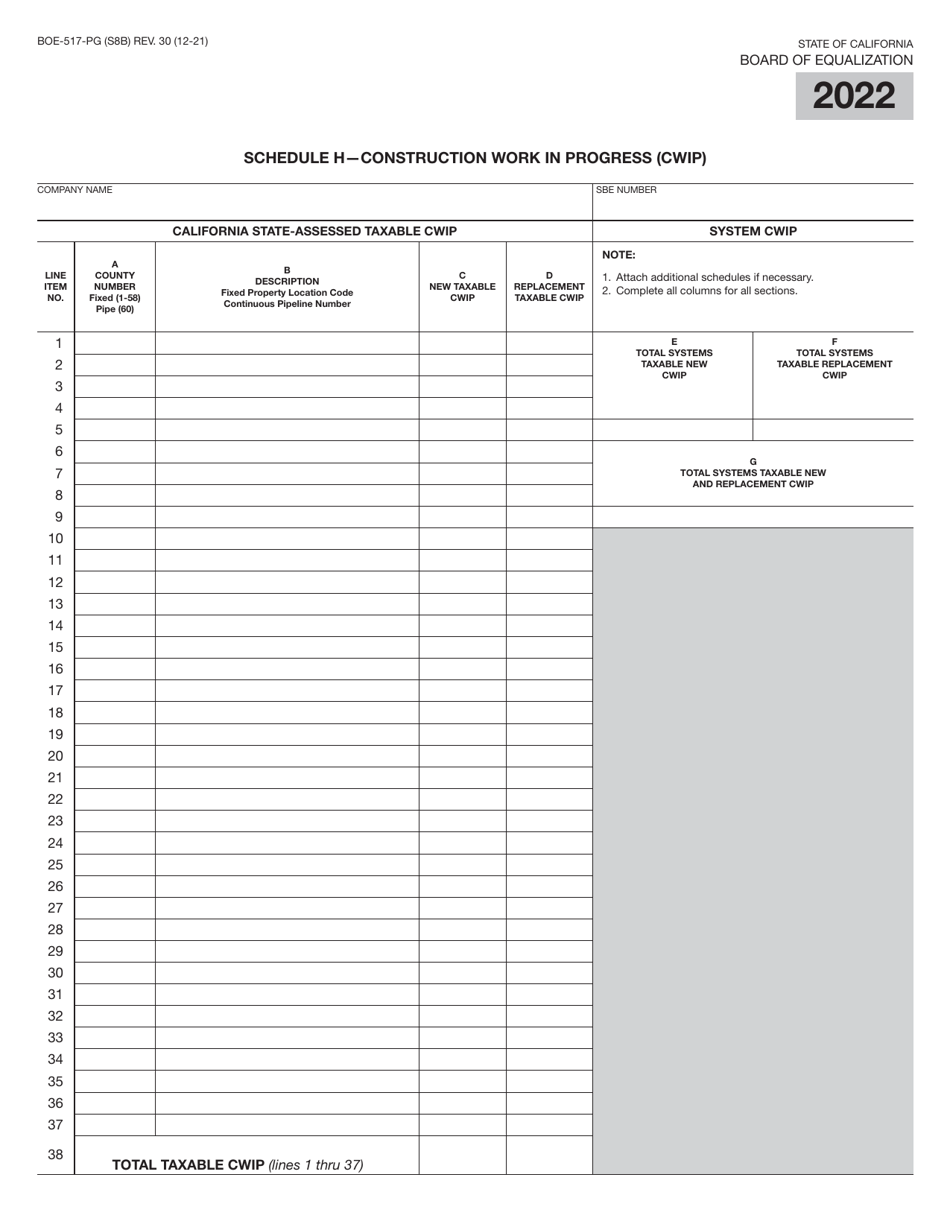

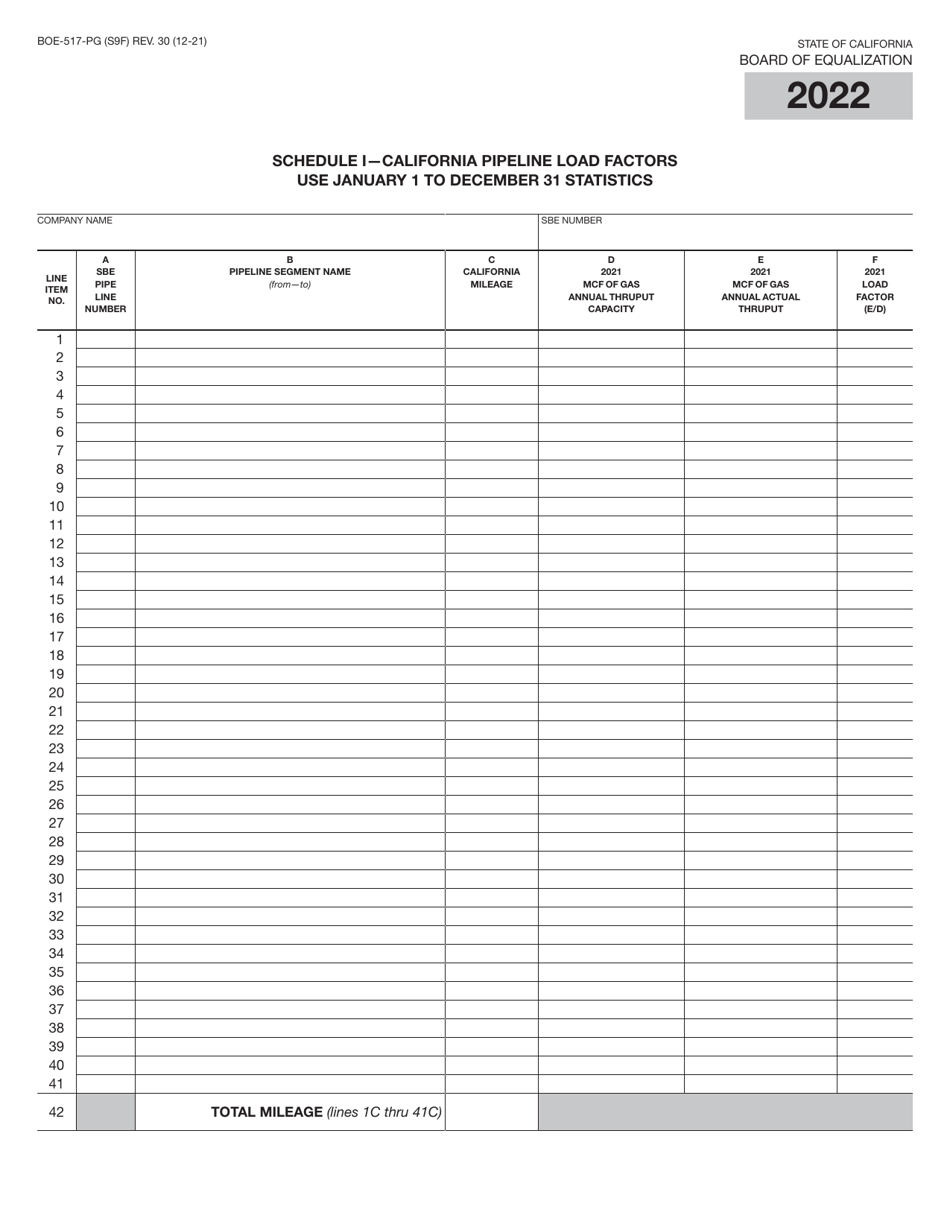

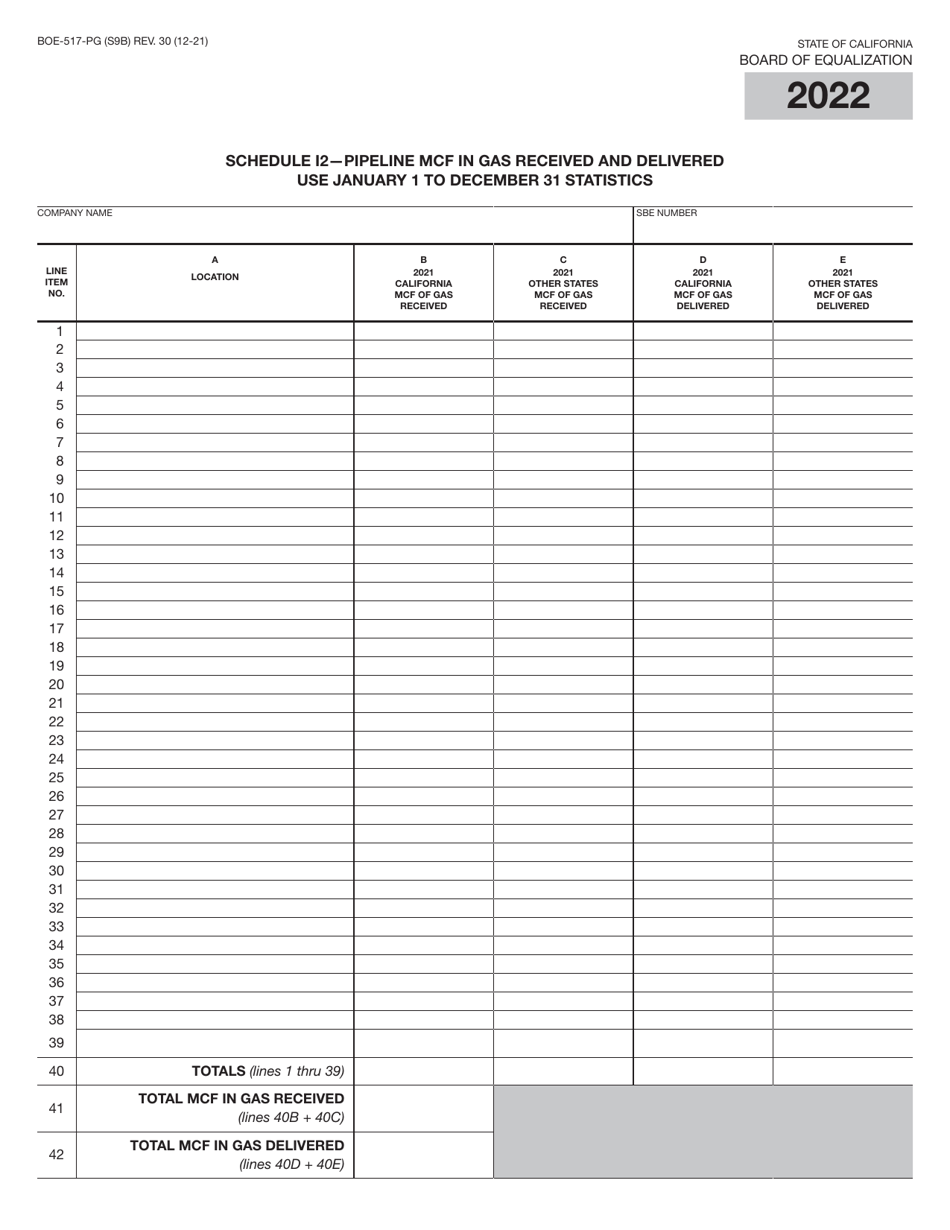

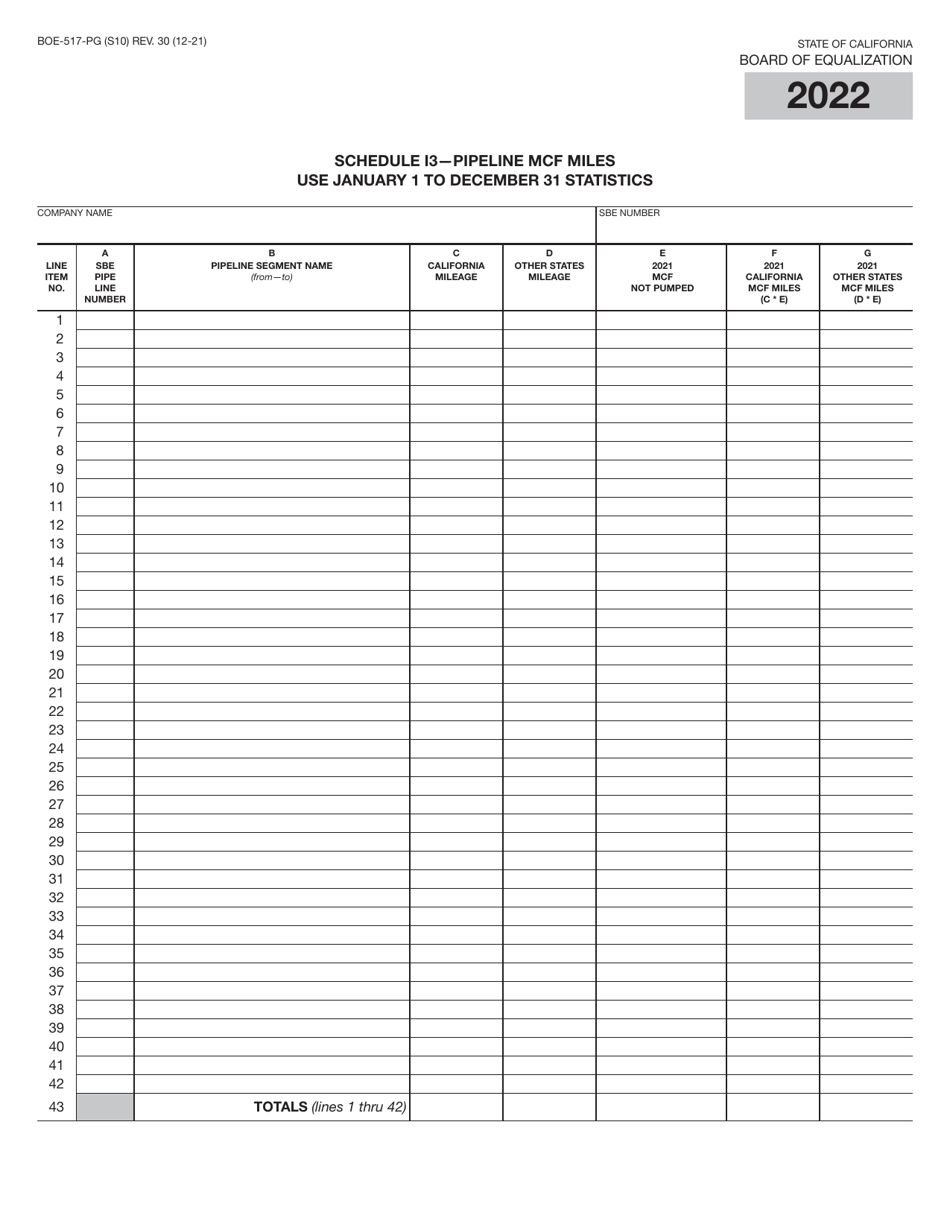

Form BOE-517-PG Property Statement - Intercounty Pipelines - Natural Gas Pipelines - California

What Is Form BOE-517-PG?

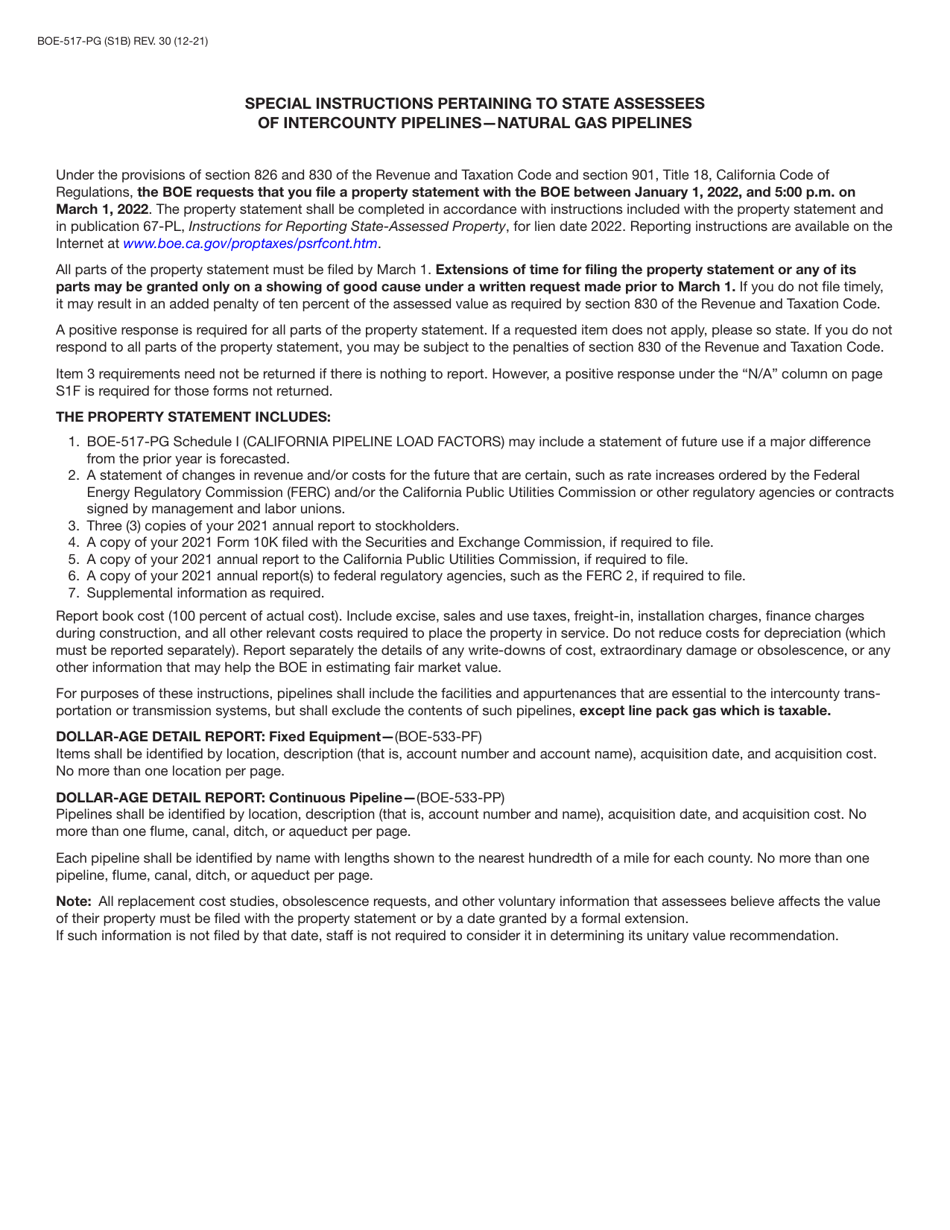

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-517-PG Property Statement?

A: BOE-517-PG Property Statement is a form used to report property information related to Intercounty Pipelines - Natural Gas Pipelines in California.

Q: Who needs to file the BOE-517-PG Property Statement?

A: Property owners, operators, or tenants who own, operate, or possess Intercounty Pipelines - Natural Gas Pipelines in California need to file the BOE-517-PG Property Statement.

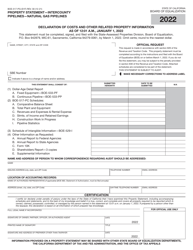

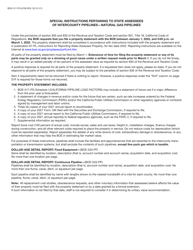

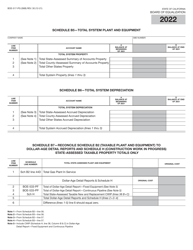

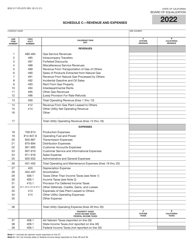

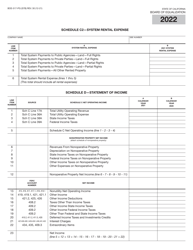

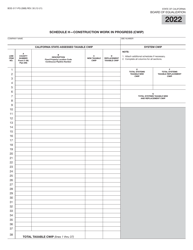

Q: What information is required in the BOE-517-PG Property Statement?

A: The BOE-517-PG Property Statement requires information such as property location, property characteristics, acquisition, and disposition information, as well as cost and income information.

Q: When is the deadline to file the BOE-517-PG Property Statement?

A: The deadline to file the BOE-517-PG Property Statement is April 1st of each year.

Q: What are the consequences of not filing the BOE-517-PG Property Statement?

A: Failing to file the BOE-517-PG Property Statement may result in penalties, interest, or other enforcement actions by the California Department of Tax and Fee Administration.

Q: Are there any exemptions or exclusions from filing the BOE-517-PG Property Statement?

A: Yes, there are certain exemptions and exclusions from filing the BOE-517-PG Property Statement. It is recommended to refer to the instructions provided with the form for more information.

Q: Is there a fee for filing the BOE-517-PG Property Statement?

A: No, there is no fee for filing the BOE-517-PG Property Statement.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-517-PG by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.