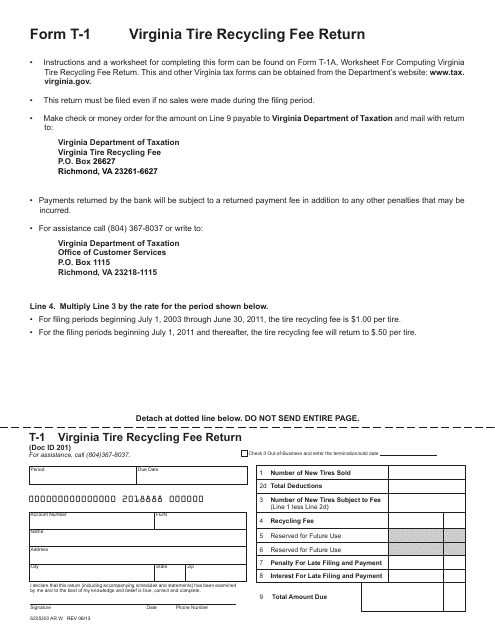

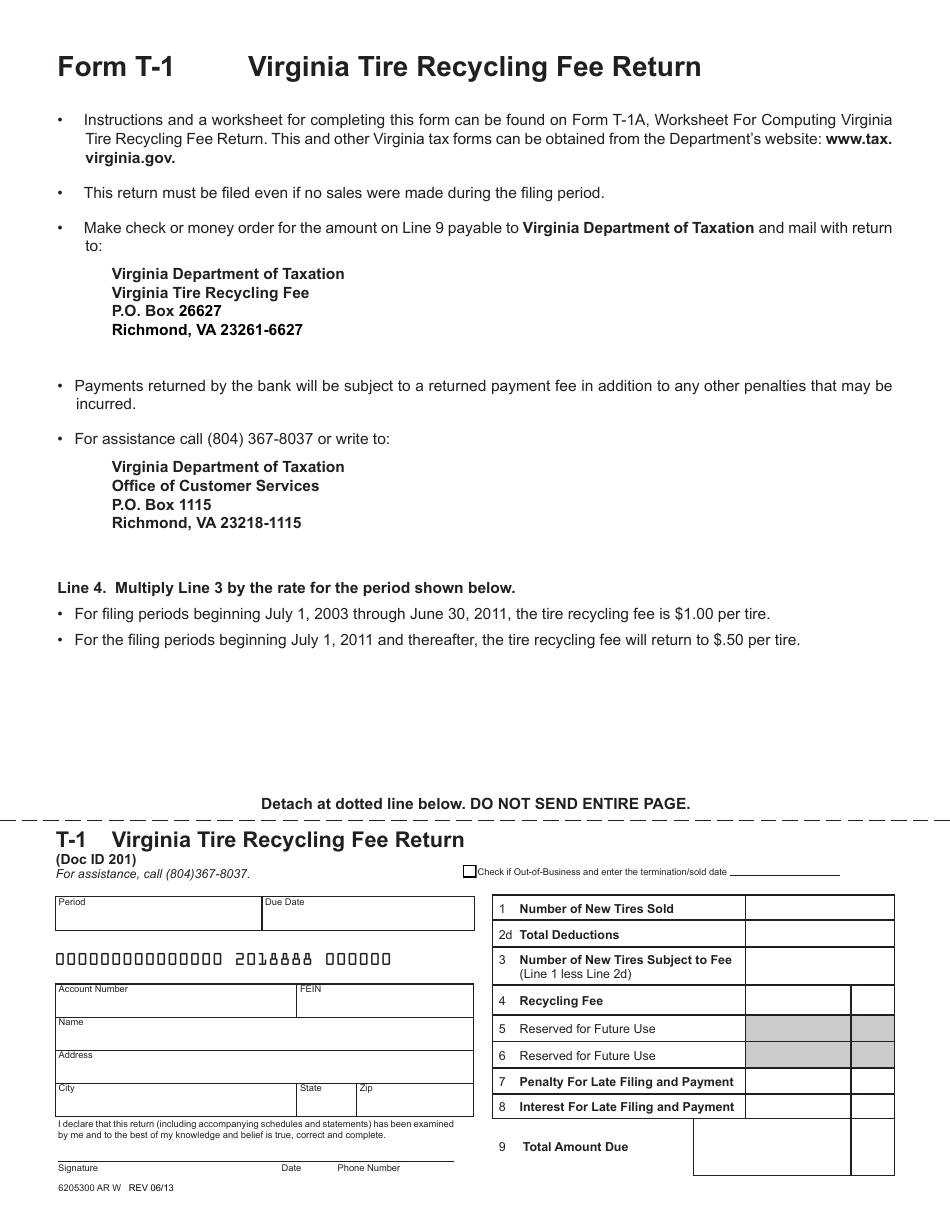

Form T-1 Virginia Tire Recycling Fee Return - Virginia

What Is Form T-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-1?

A: Form T-1 is the Virginia Tire Recycling Fee Return.

Q: What is the Virginia Tire Recycling Fee?

A: The Virginia Tire Recycling Fee is a fee imposed on the purchase of new tires in Virginia.

Q: Who needs to file Form T-1?

A: Any business that sells new tires in Virginia needs to file Form T-1.

Q: How often do I need to file Form T-1?

A: Form T-1 needs to be filed quarterly.

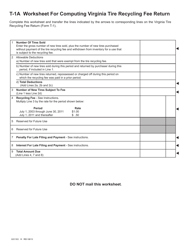

Q: What information is required on Form T-1?

A: Form T-1 requires information about the number and cost of tires sold in Virginia.

Q: Are there any penalties for not filing Form T-1?

A: Yes, failure to file Form T-1 or paying the required fees can result in penalties and interest.

Q: Is Form T-1 only applicable in Virginia?

A: Yes, Form T-1 is specific to Virginia and its tire recycling program.

Q: What is the deadline for filing Form T-1?

A: Form T-1 is due by the last day of the month following the end of each quarter.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.