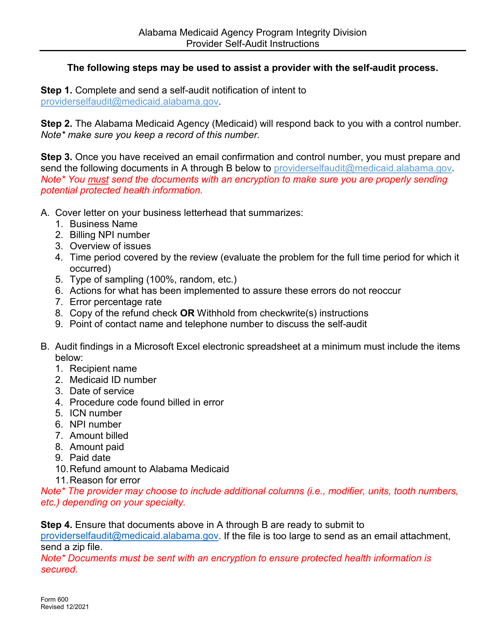

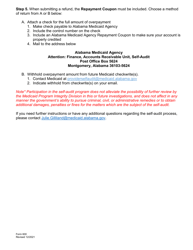

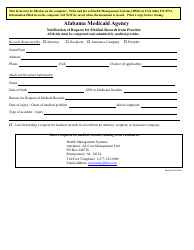

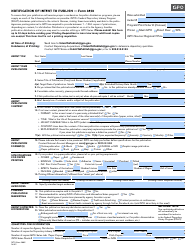

Form 600 Provider Self-audit Notification of Intent - Alabama

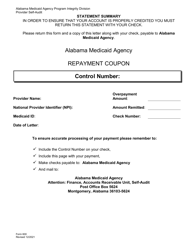

What Is Form 600?

This is a legal form that was released by the Alabama Medicaid Agency - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

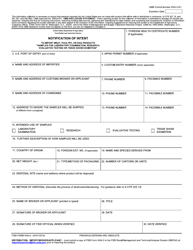

Q: What is Form 600 Provider Self-audit Notification of Intent?

A: Form 600 is a notification of intent for provider self-audit in Alabama.

Q: Who needs to file Form 600?

A: Providers in Alabama who want to conduct a self-audit need to file Form 600.

Q: What is the purpose of Form 600?

A: Form 600 is used to notify the Alabama Medicaid Agency of the provider's intent to conduct a self-audit.

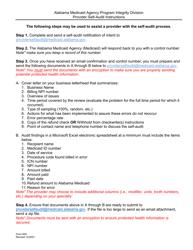

Q: What information is required in Form 600?

A: Form 600 requires the provider's name, address, NPI number, Medicaid provider number, and a brief description of the audit.

Q: When should Form 600 be filed?

A: Form 600 should be filed at least 30 days prior to the start of the self-audit.

Q: Is there a fee to file Form 600?

A: No, there is no fee to file Form 600.

Q: What happens after filing Form 600?

A: After filing Form 600, the Alabama Medicaid Agency will review the notification and may request additional information or documentation.

Q: Is Form 600 required for all self-audits in Alabama?

A: Yes, providers must file Form 600 for all self-audits conducted in Alabama.

Q: Are there any penalties for not filing Form 600?

A: Failure to file Form 600 may result in penalties or other enforcement actions by the Alabama Medicaid Agency.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Alabama Medicaid Agency;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 600 by clicking the link below or browse more documents and templates provided by the Alabama Medicaid Agency.