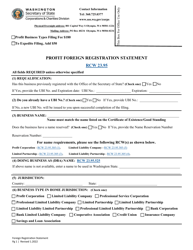

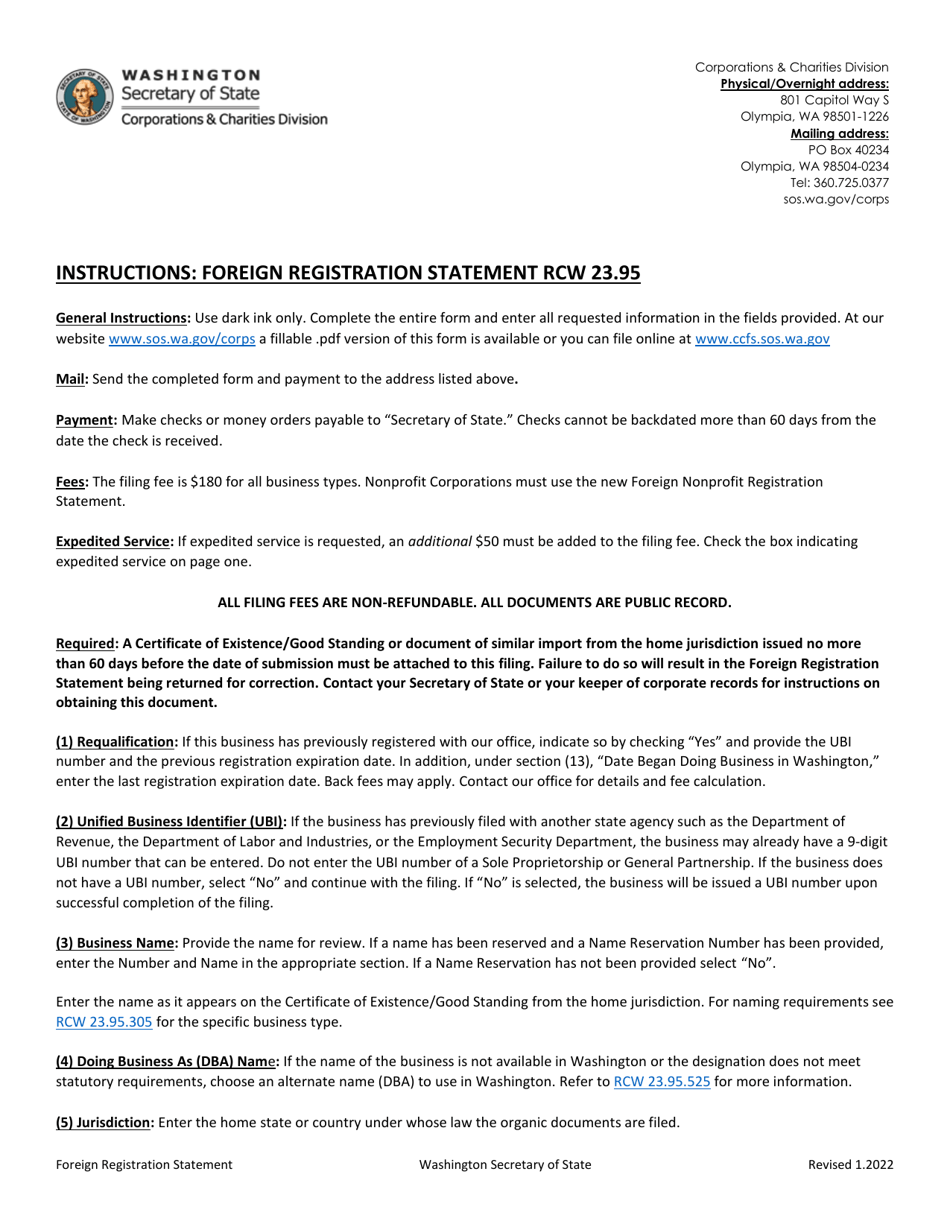

Profit Foreign Registration Statement - Washington

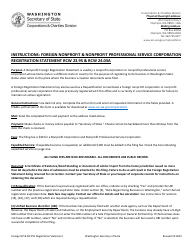

Profit Foreign Registration Statement is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is a Profit Foreign Registration Statement?

A: A Profit Foreign Registration Statement is a legal document that a foreign corporation files with the state of Washington in order to register and do business in the state.

Q: Who needs to file a Profit Foreign Registration Statement in Washington?

A: Any foreign corporation that wants to conduct business in Washington needs to file a Profit Foreign Registration Statement.

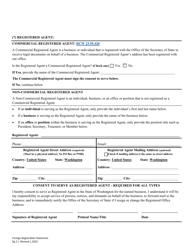

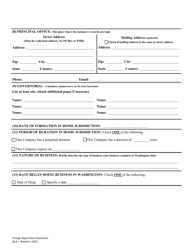

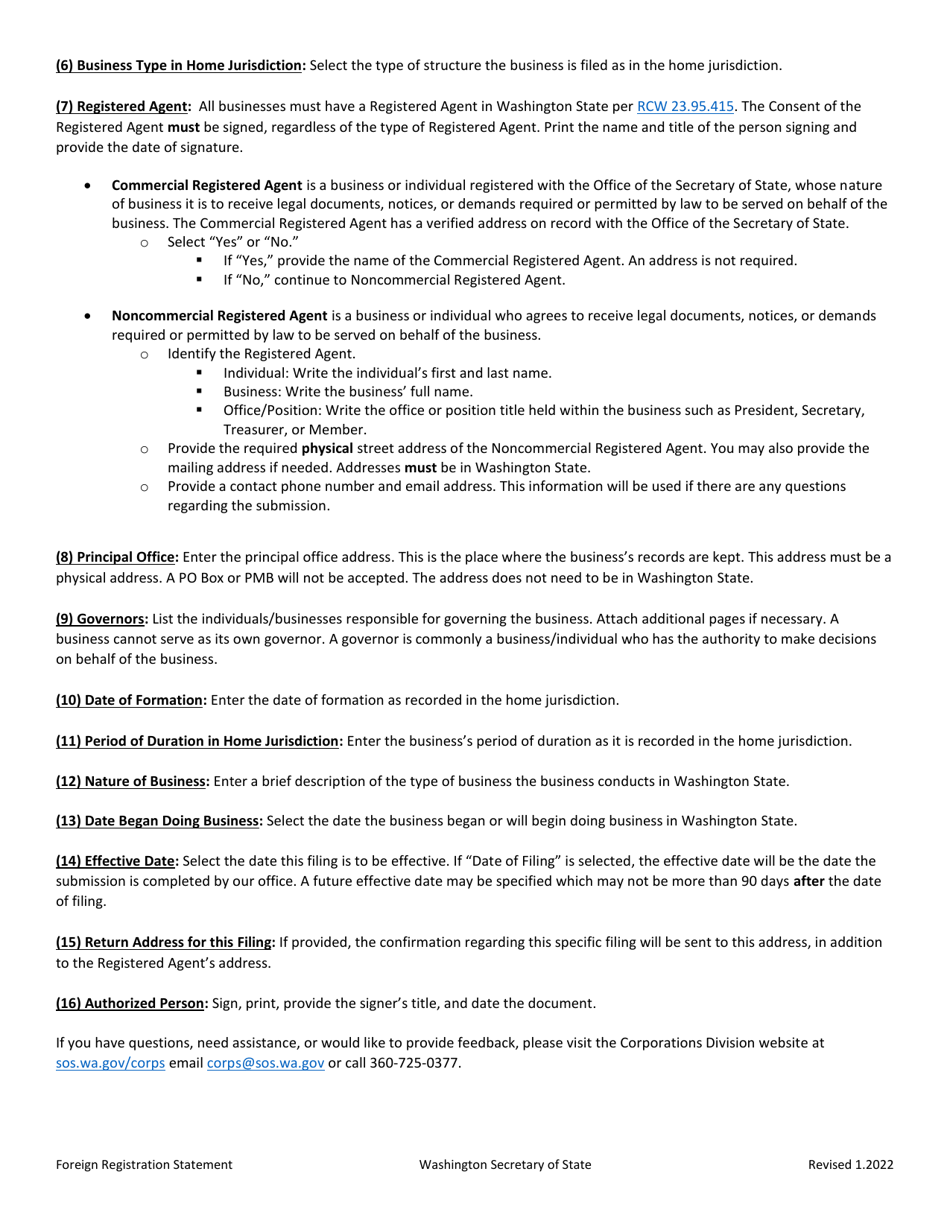

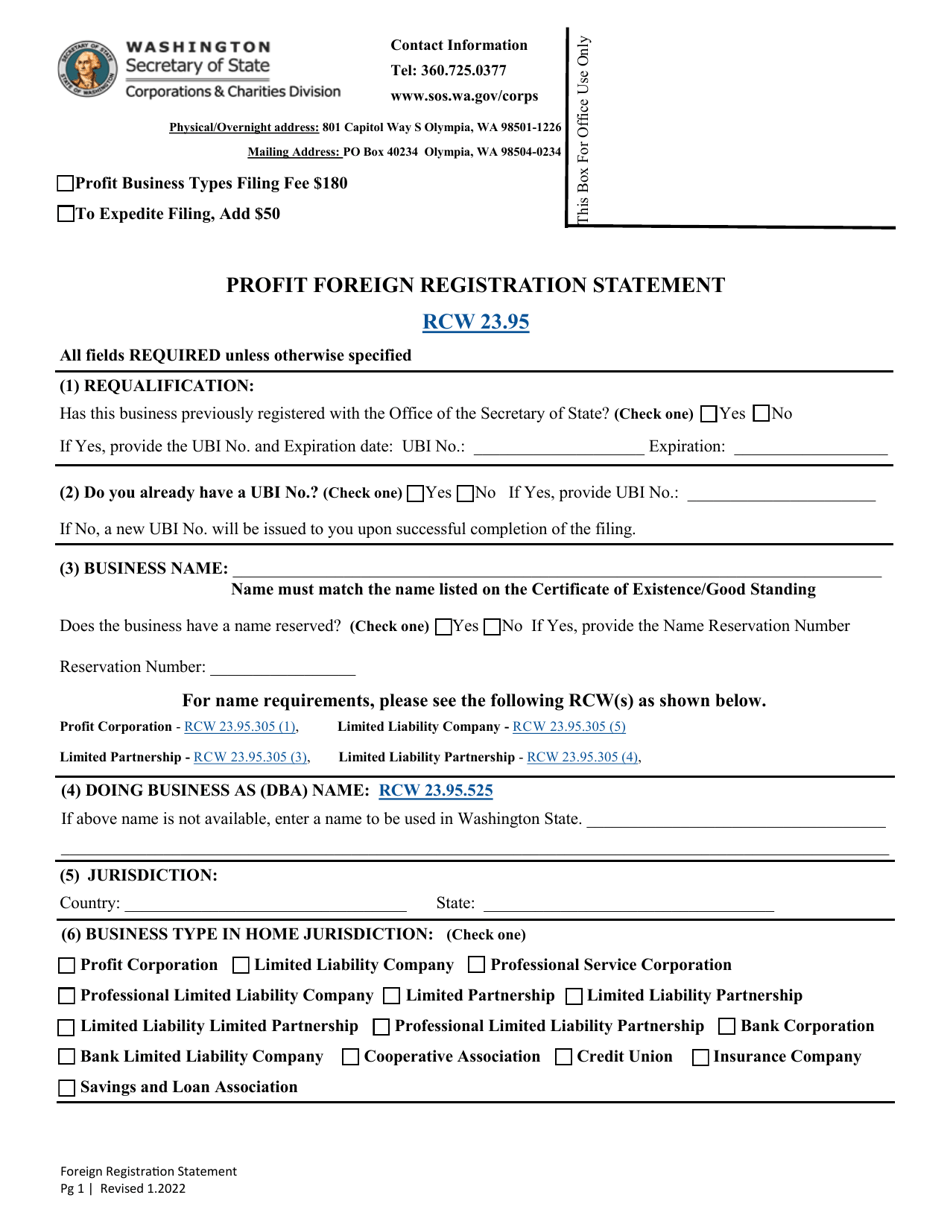

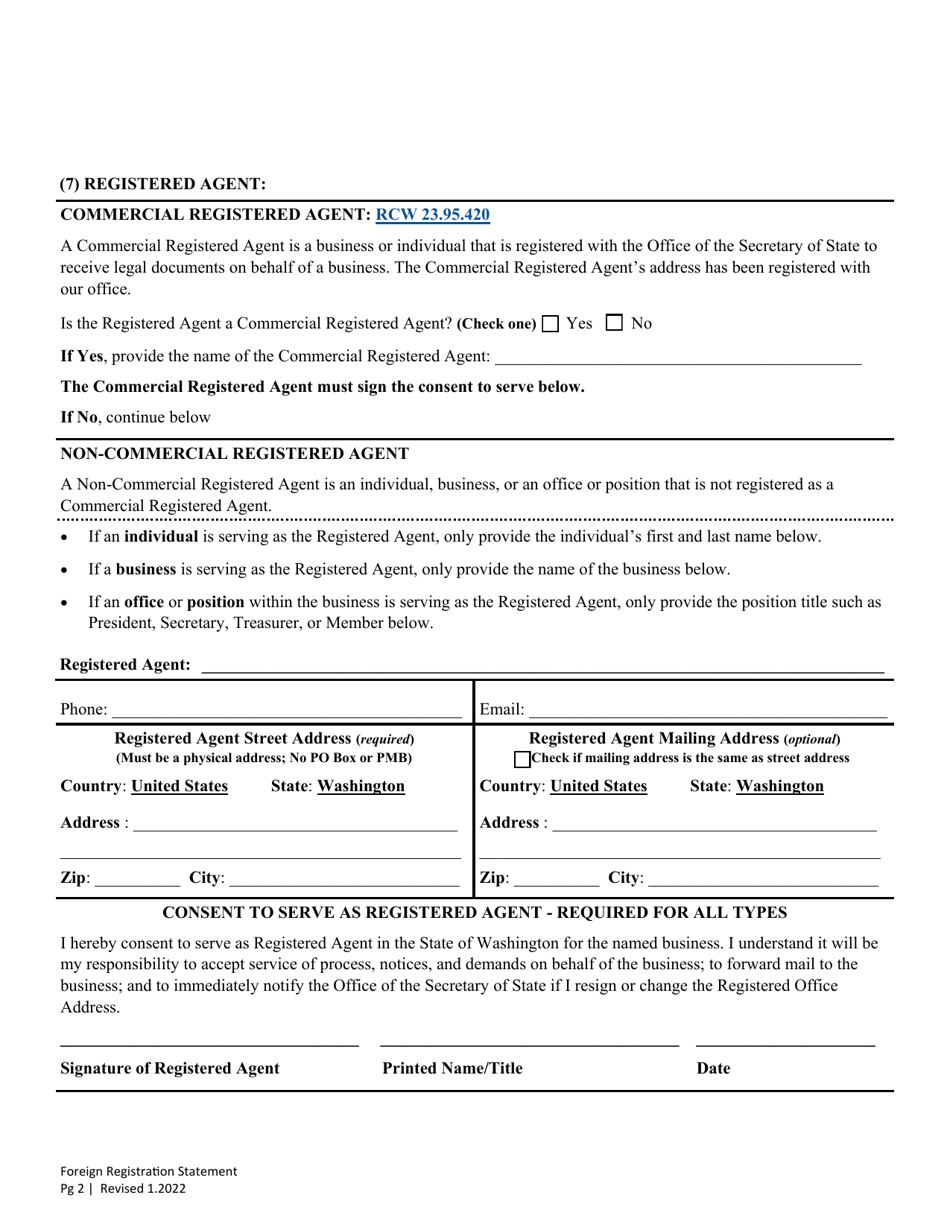

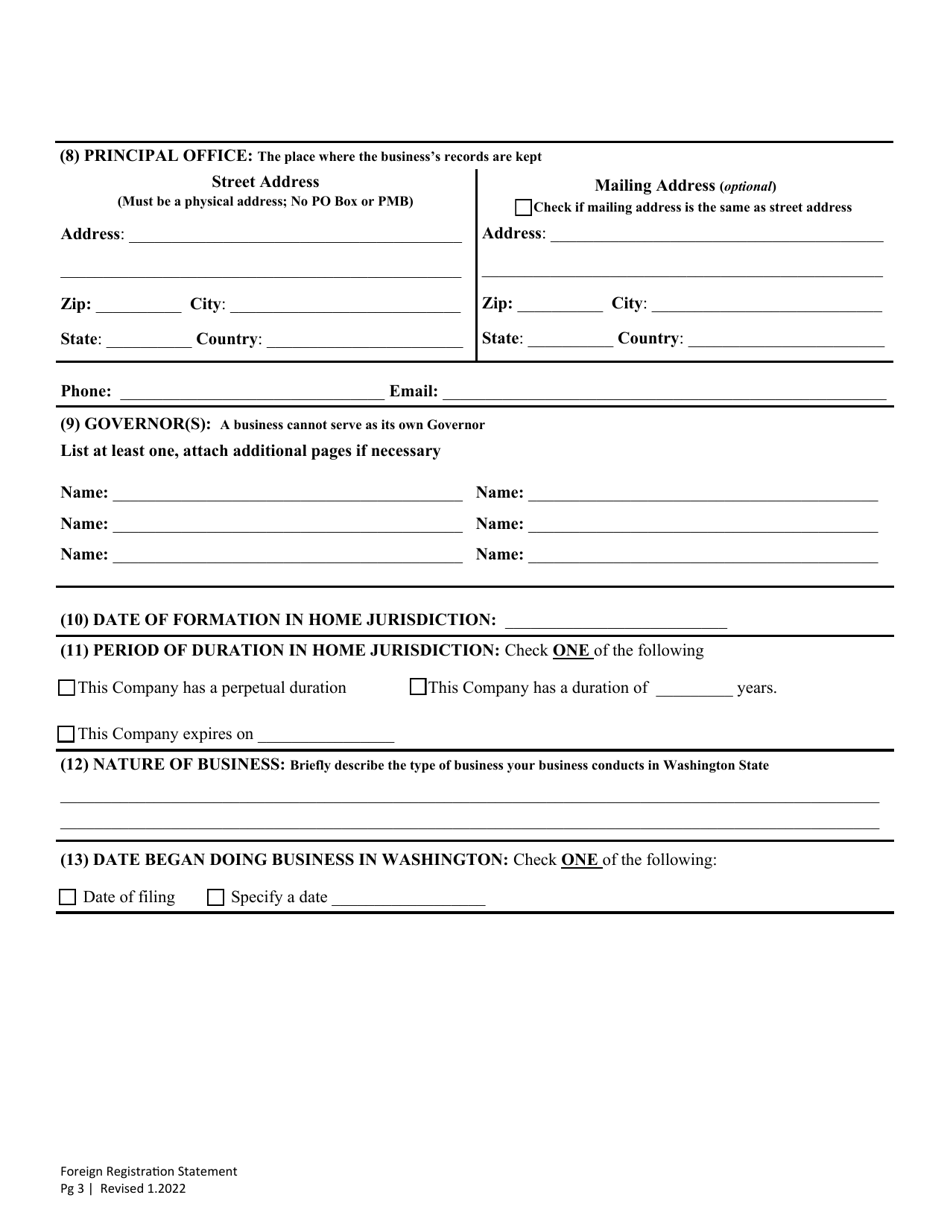

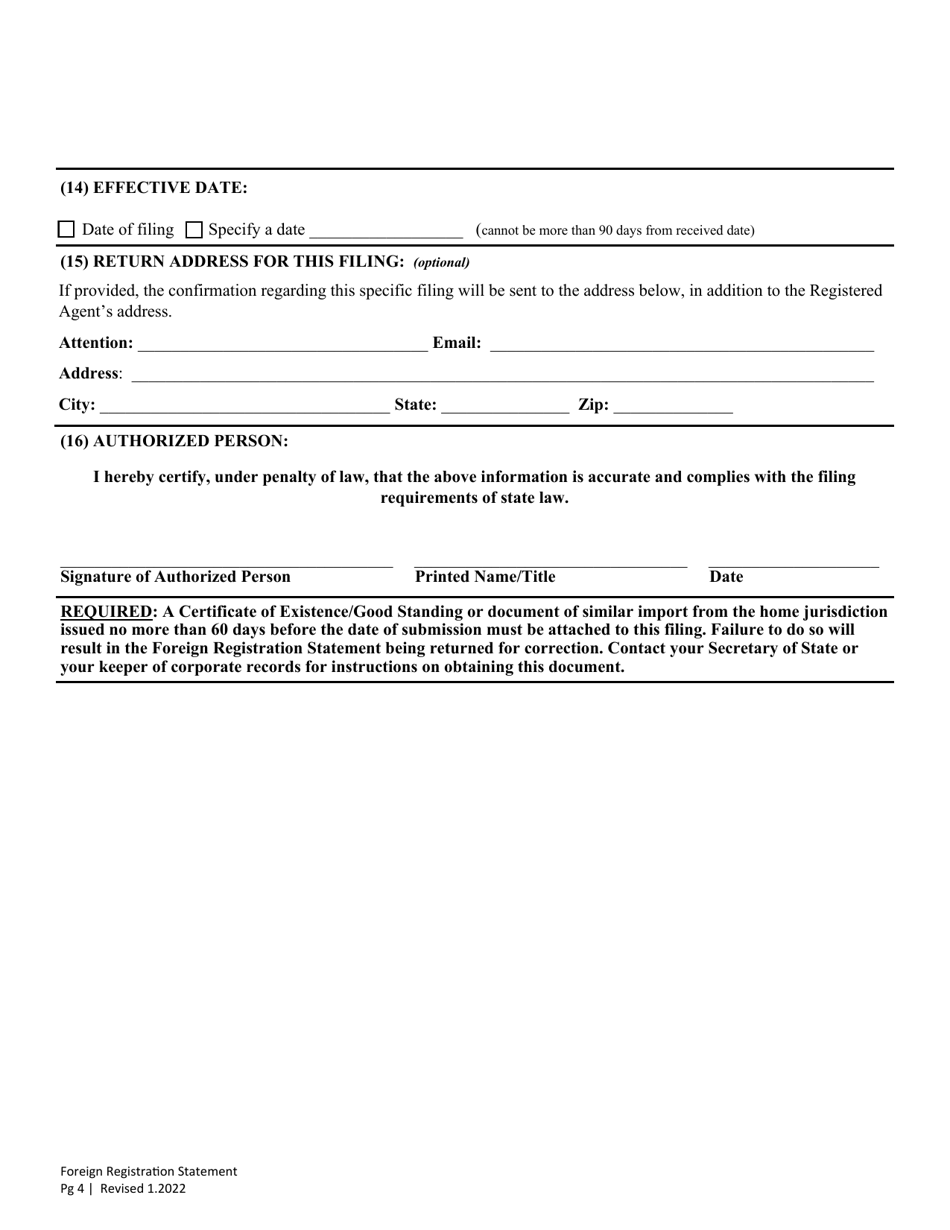

Q: What information is required in a Profit Foreign Registration Statement?

A: The Profit Foreign Registration Statement requires information such as the name of the corporation, its principal office address, the names and addresses of its officers and directors, and a registered agent.

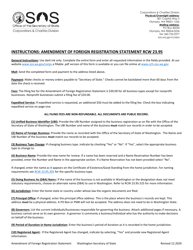

Q: What happens after I file a Profit Foreign Registration Statement?

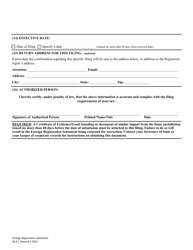

A: After you file a Profit Foreign Registration Statement, the state of Washington will review the document and if everything is in order, your corporation will be registered to do business in the state.

Q: Do I need to file an annual report for a foreign corporation registered in Washington?

A: Yes, foreign corporations registered in Washington are required to file an annual report with the Secretary of State.

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.