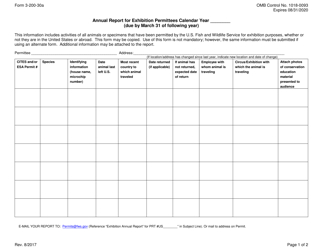

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

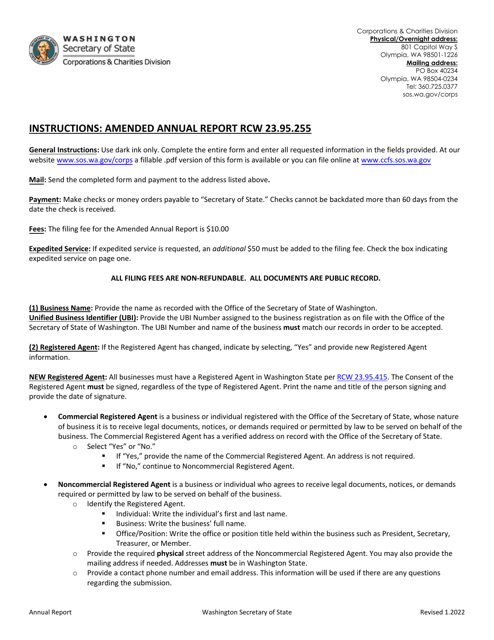

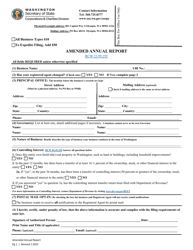

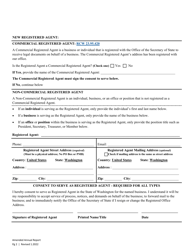

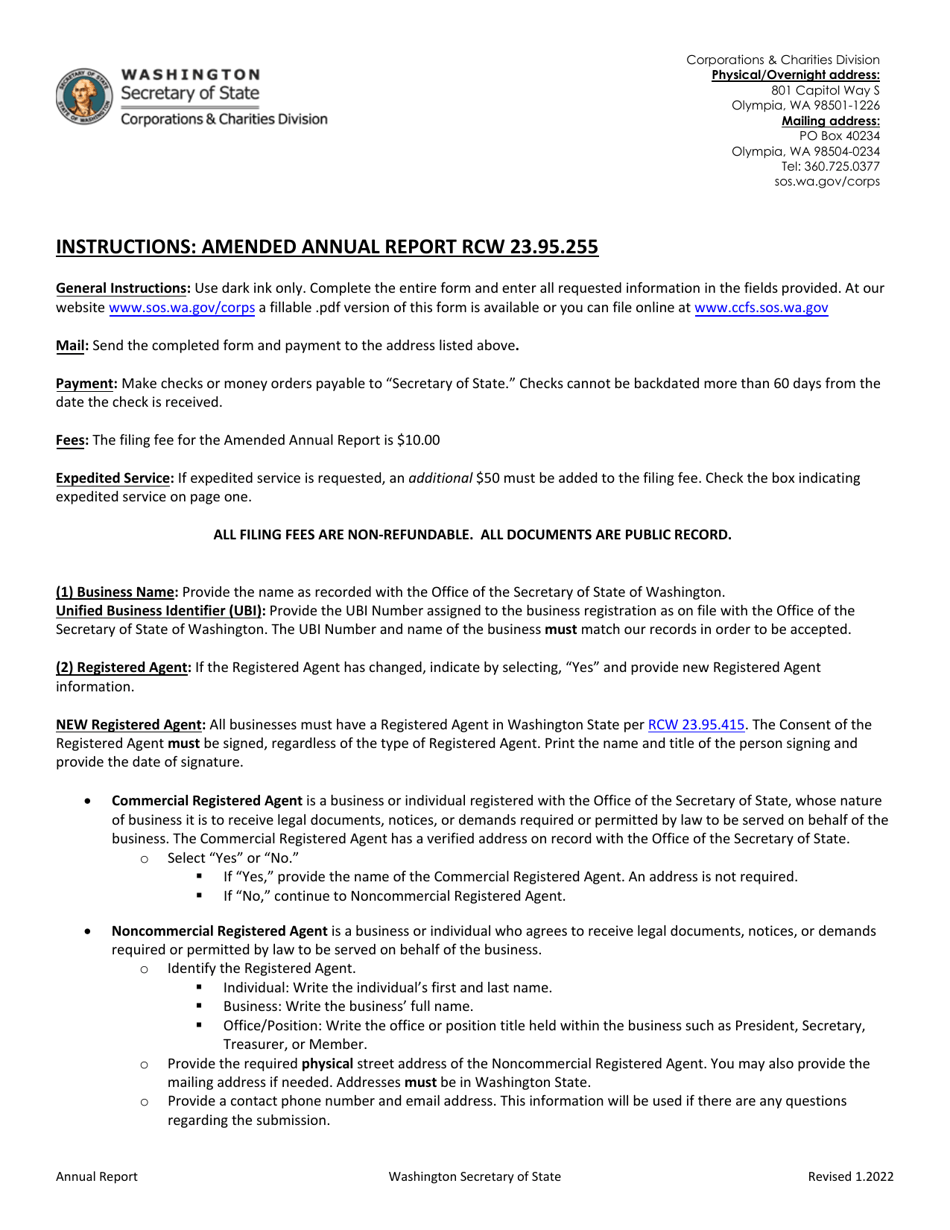

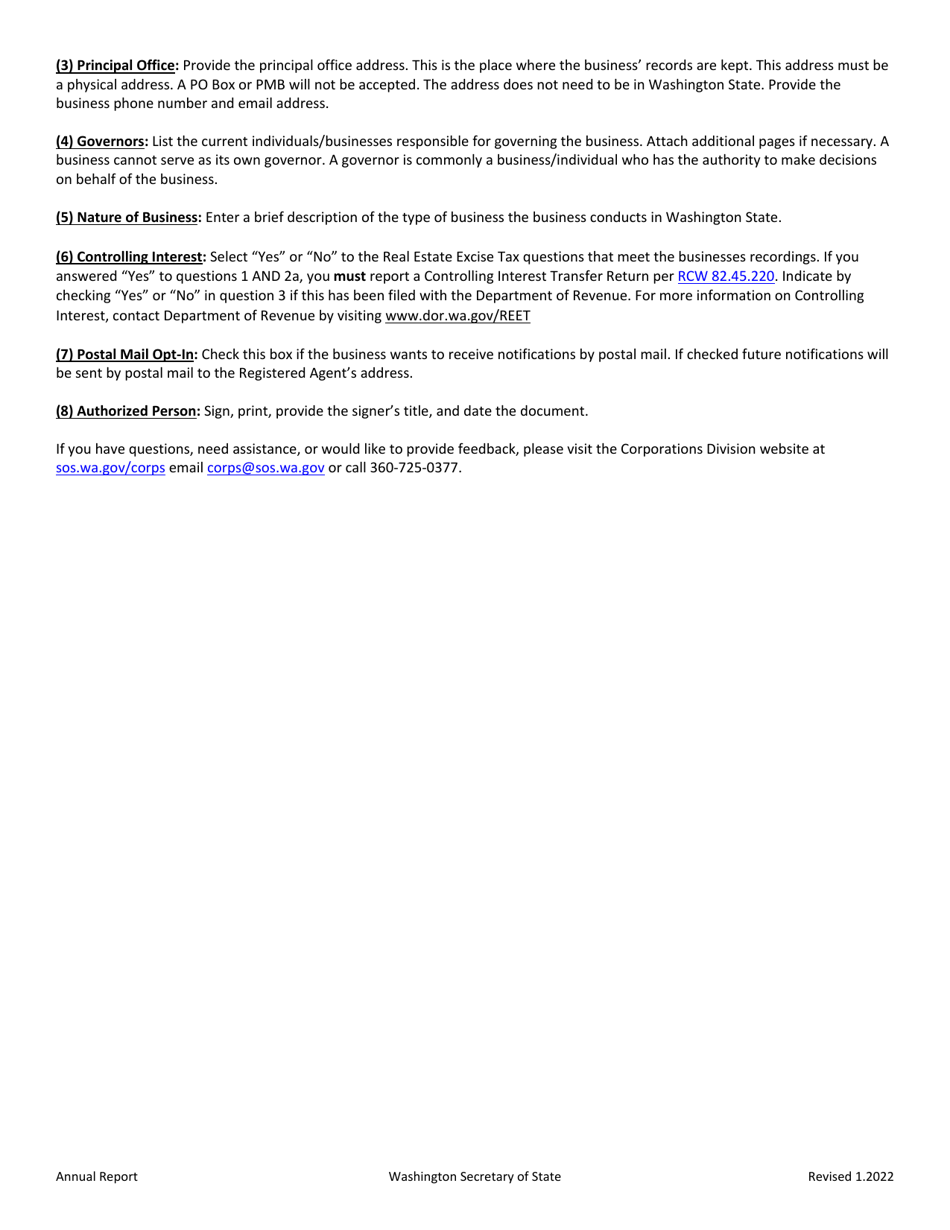

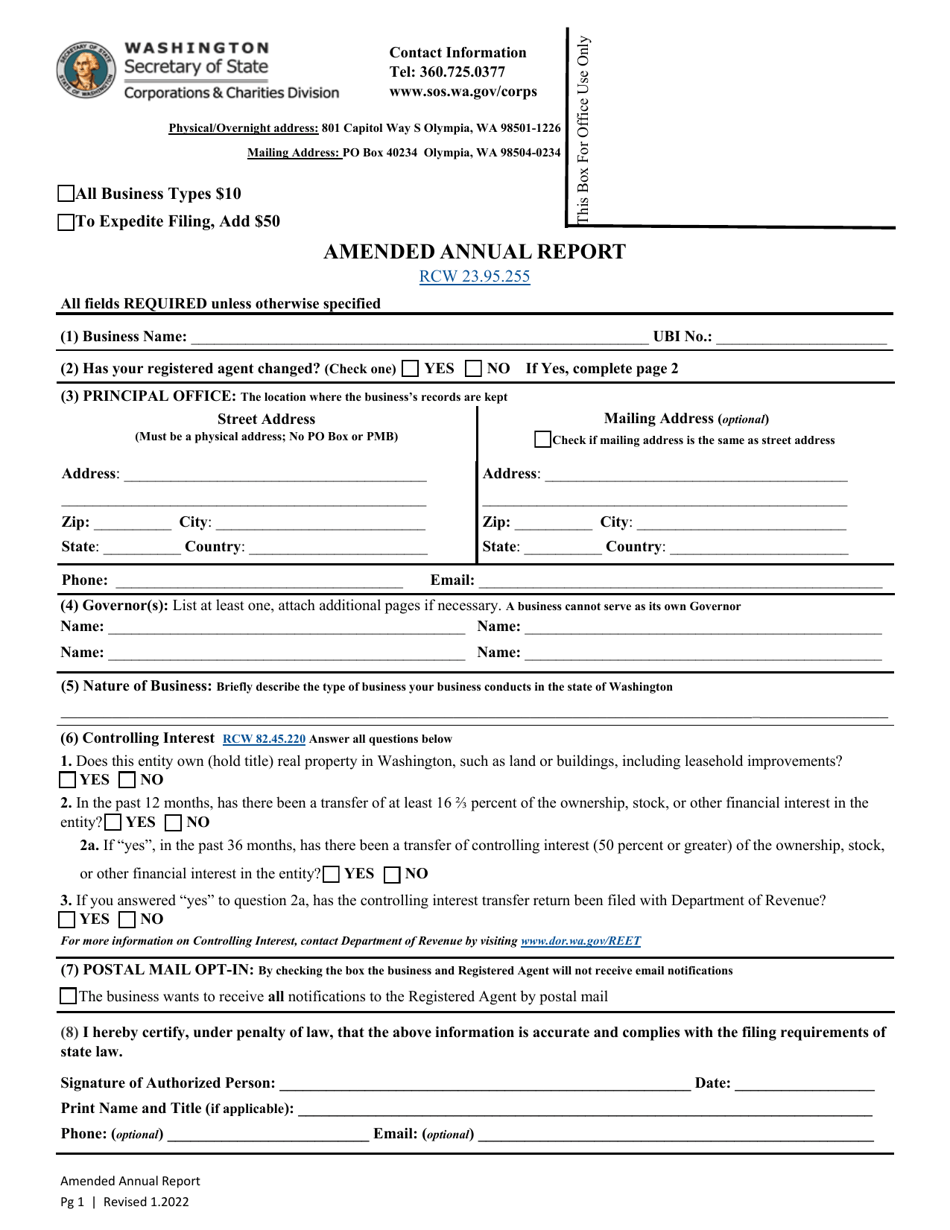

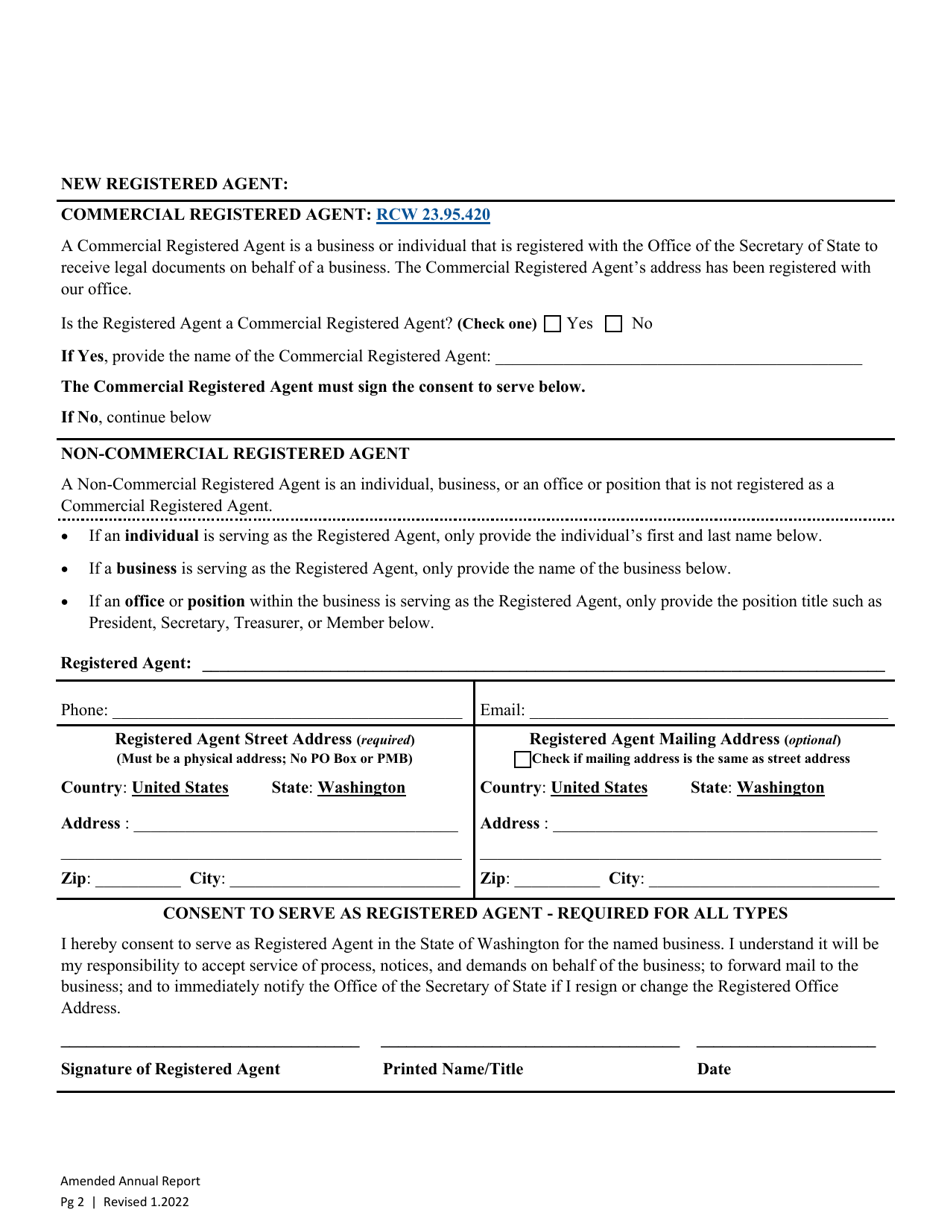

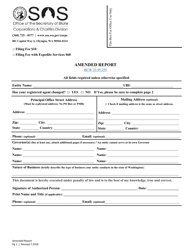

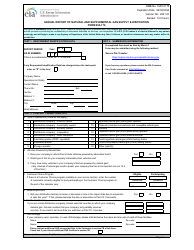

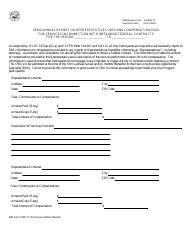

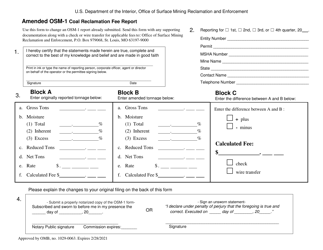

Amended Annual Report - Washington

Amended Annual Report is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is an amended annual report?

A: An amended annual report is a revised version of the original annual report that a company or organization in Washington has previously filed.

Q: When should an amended annual report be filed?

A: An amended annual report should be filed if there are any errors or omissions in the original annual report that need to be corrected.

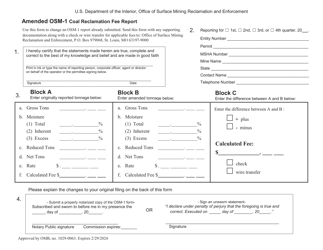

Q: Are there any fees associated with filing an amended annual report?

A: Yes, there may be fees associated with filing an amended annual report in Washington. The specific fees can vary depending on the type of entity and the filing method.

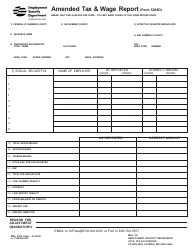

Q: What information is typically included in an amended annual report?

A: An amended annual report typically includes the corrected information from the original report, such as financial details, changes in ownership or management, and any other necessary updates.

Q: Why is it important to file an amended annual report?

A: It is important to file an amended annual report to ensure that the information on record with the Secretary of State's office is accurate and up to date. Failure to file an amended annual report when necessary may result in penalties or other legal consequences.

Q: Can I file an amended annual report for a previous year?

A: Yes, you can file an amended annual report for a previous year if there are errors or omissions in the original report for that year. However, it is generally recommended to file amended reports as soon as possible to avoid complications.

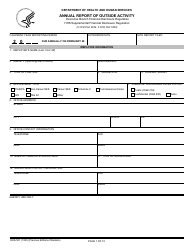

Q: What happens after I file an amended annual report?

A: After you file an amended annual report, it will be reviewed by the Secretary of State's office. If everything is in order, the amended report will be accepted and the corrected information will be updated in the official records.

Q: Can I file an amended annual report for a dissolved company?

A: Yes, you can still file an amended annual report for a dissolved company in Washington if there are errors or omissions in the original report. However, the process may be different and you should consult with the Secretary of State's office for guidance.

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.