This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule J

for the current year.

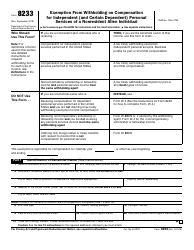

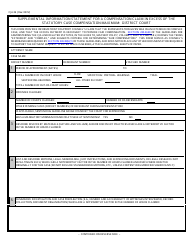

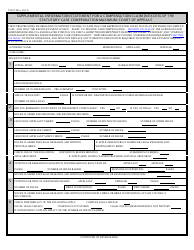

Instructions for IRS Form 990 Schedule J Compensation Information

This document contains official instructions for IRS Form 990 Schedule J, Compensation Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule J is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule J?

A: IRS Form 990 Schedule J is a form used to report compensation information for certain employees of tax-exempt organizations.

Q: Who needs to file IRS Form 990 Schedule J?

A: Tax-exempt organizations that pay certain employees more than a specified threshold need to file IRS Form 990 Schedule J.

Q: What type of compensation information is reported on Schedule J?

A: Schedule J reports details of compensation, including salaries, bonuses, retirement benefits, and other types of compensation.

Q: Is Form 990 Schedule J required for all tax-exempt organizations?

A: No, Form 990 Schedule J is only required for tax-exempt organizations that pay certain employees above a specified threshold.

Q: When is the deadline for filing IRS Form 990 Schedule J?

A: The deadline for filing IRS Form 990 Schedule J is typically the same as the deadline for filing Form 990, which is the 15th day of the 5th month after the end of the organization's accounting period.

Q: What happens if a tax-exempt organization fails to file Schedule J?

A: Failing to file IRS Form 990 Schedule J or providing incomplete or inaccurate information may result in penalties or other enforcement actions by the IRS.

Q: Are there any exceptions or special rules for filing Schedule J?

A: There may be exceptions or special rules for certain types of organizations or specific situations, so it is advisable to consult with a tax professional or refer to IRS guidance for more information.

Q: Can an organization amend Form 990 Schedule J after filing?

A: Yes, an organization can file an amended Form 990 Schedule J if they discover errors or omissions in the original filing.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.