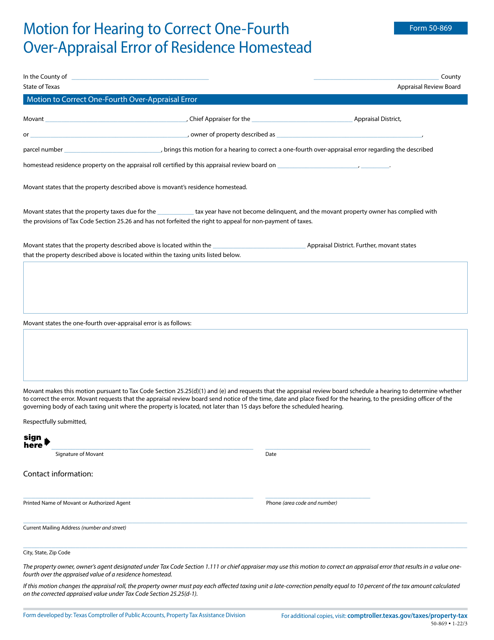

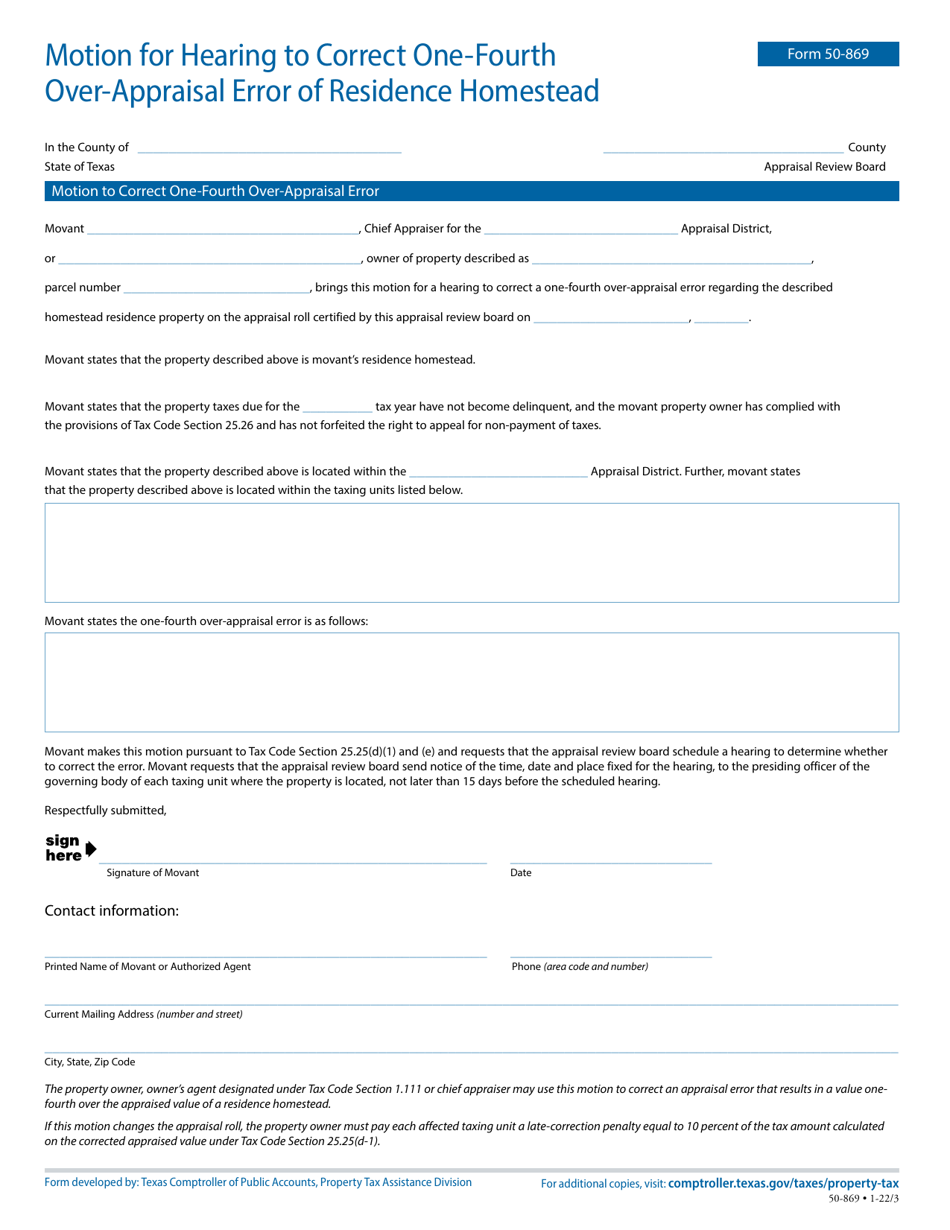

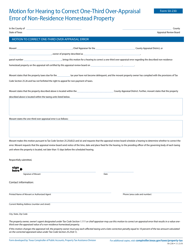

Form 50-869 Motion for Hearing to Correct One-Fourth Over-appraisal Error of Residence Homestead - Texas

What Is Form 50-869?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-869?

A: Form 50-869 is a legal document used in Texas for filing a motion for a hearing to correct an over-appraisal error of a residence homestead.

Q: Why would someone need to use Form 50-869?

A: Someone would need to use Form 50-869 if they believe their residence homestead has been over-appraised and they want to request a hearing to correct the error.

Q: What is considered an over-appraisal error?

A: An over-appraisal error occurs when a property is valued higher than its actual market value.

Q: Can Form 50-869 be used for other types of properties?

A: No, Form 50-869 is specifically for correcting over-appraisal errors of residence homesteads in Texas.

Q: How should Form 50-869 be filled out?

A: Form 50-869 should be filled out with accurate information regarding the property, the reasons for the over-appraisal error, and the requested correction.

Q: What is the purpose of a hearing for Form 50-869?

A: The purpose of the hearing is to present evidence and arguments to support the requested correction of the over-appraisal error.

Q: Is there a deadline for filing Form 50-869?

A: Yes, Form 50-869 should be filed within the specified deadline determined by the local appraisal district.

Q: What happens after filing Form 50-869?

A: After filing Form 50-869, the appraisal review board will review the request and schedule a hearing if deemed necessary.

Q: Can an attorney be hired for assistance with Form 50-869?

A: Yes, an attorney can be hired to provide legal advice and assistance with Form 50-869 if needed.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-869 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.