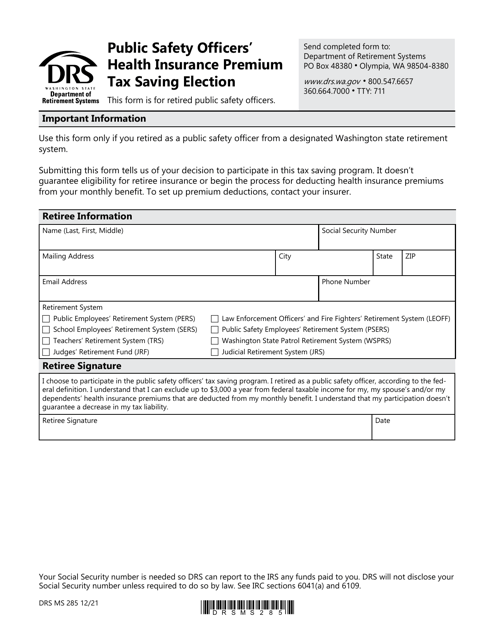

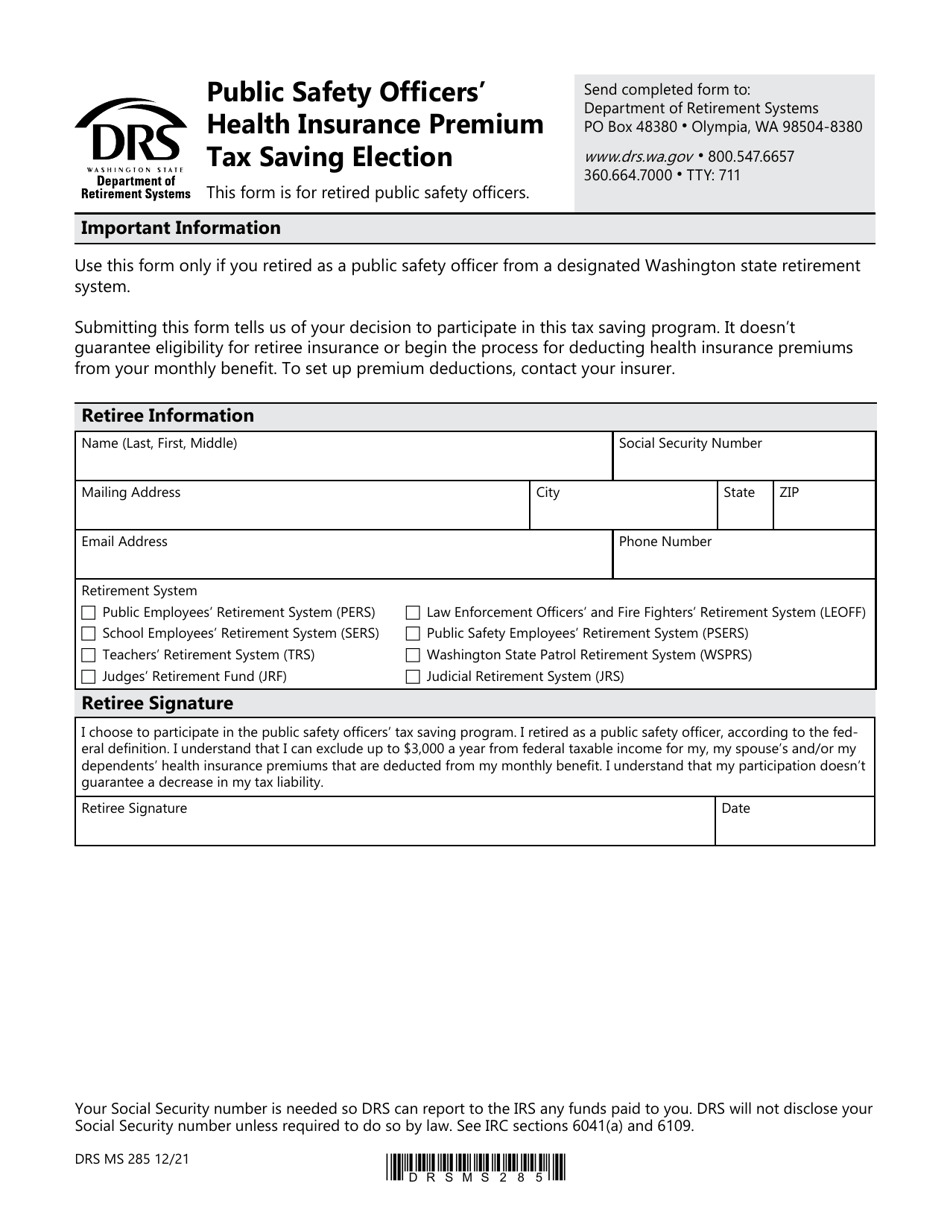

Form DRS MS285 Public Safety Officers' Health Insurance Premium Tax Saving Election - Washington

What Is Form DRS MS285?

This is a legal form that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DRS MS285 form?

A: The DRS MS285 form is the tax saving election form for public safety officers' health insurance premiums in Washington.

Q: Who can use the DRS MS285 form?

A: The DRS MS285 form is specifically for public safety officers in Washington who want to save on their health insurance premiums through tax deductions.

Q: How does the DRS MS285 form work?

A: By completing this form, public safety officers can elect to have a portion of their health insurance premiums excluded from their taxable income, thereby reducing their overall tax liability.

Q: Are all health insurance premiums eligible for tax savings through the DRS MS285 form?

A: No, only health insurance premiums paid by public safety officers, as defined by Washington state law, are eligible for tax savings through this form.

Q: When should I submit the DRS MS285 form?

A: You should submit the DRS MS285 form to your employer within 90 days after your insurance provider first bills you for eligible premiums.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Washington State Department of Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DRS MS285 by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.