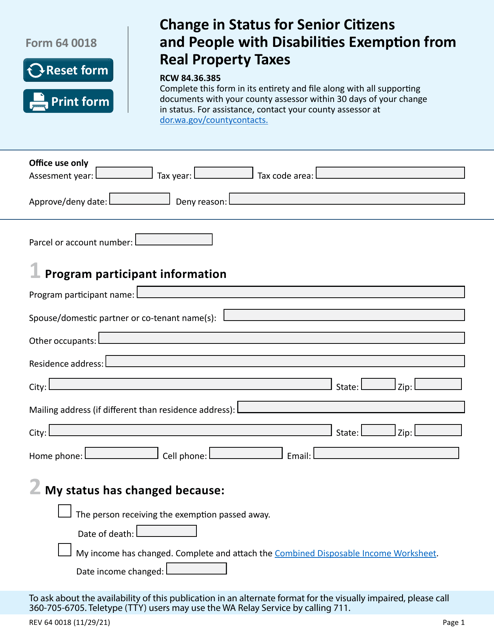

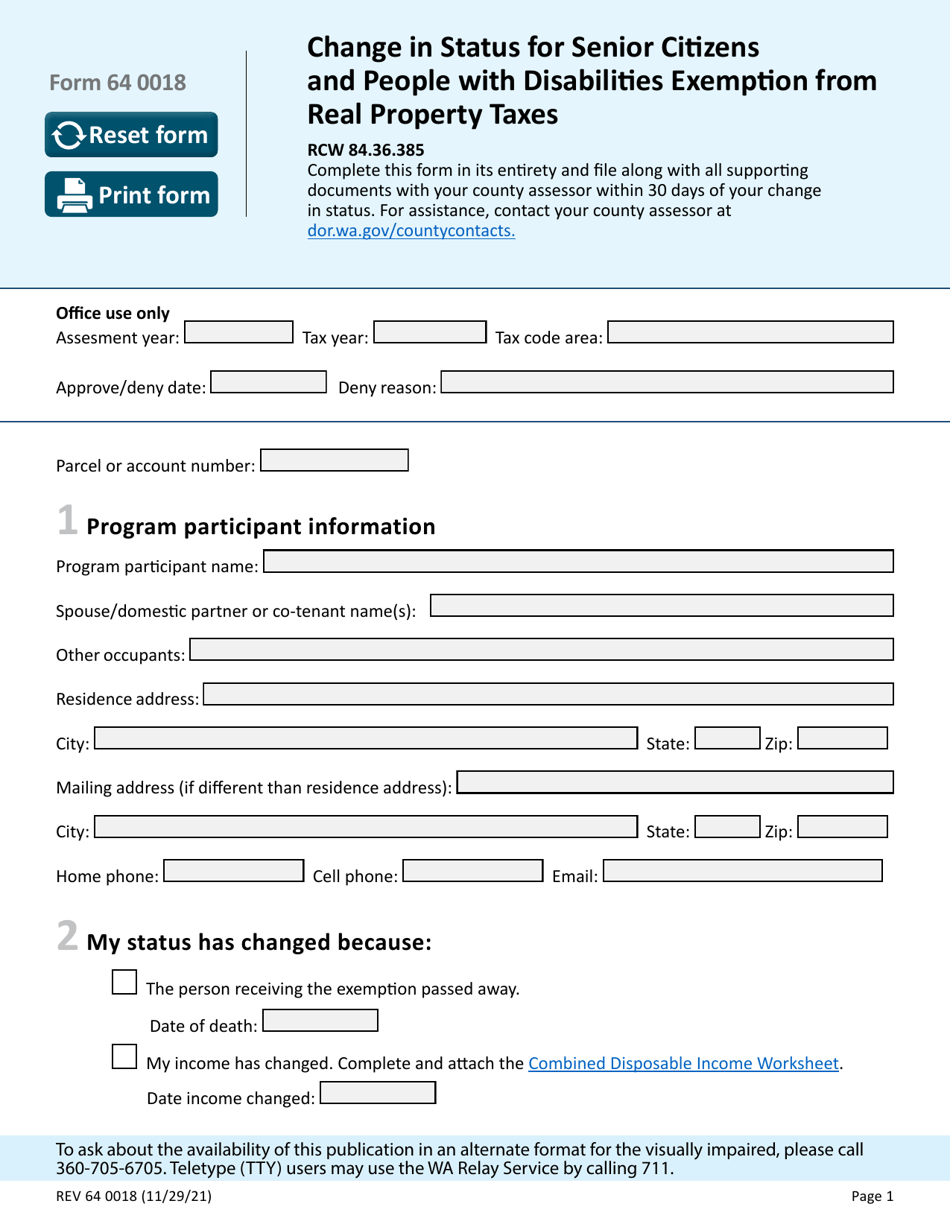

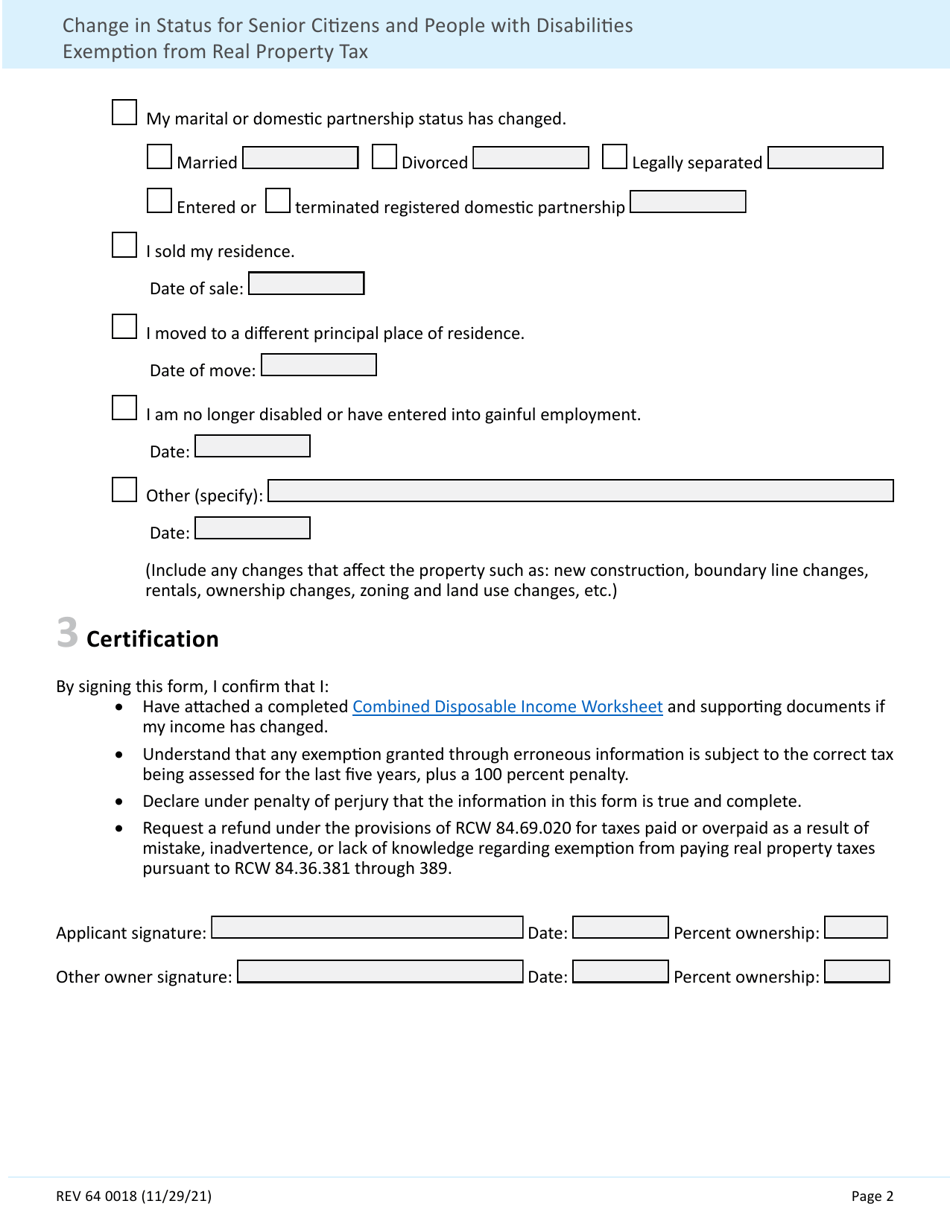

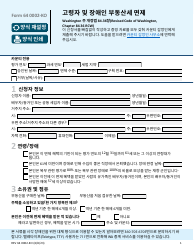

Form REV64 0018 Change in Status for Senior Citizens and People With Disabilities Exemption From Real Property Taxes - Washington

What Is Form REV64 0018?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV64 0018?

A: Form REV64 0018 is a Change in Status for Senior Citizens and People With Disabilities Exemption From Real Property Taxes form in Washington.

Q: Who is eligible for the exemption?

A: Senior citizens and people with disabilities are eligible for the exemption.

Q: What is the purpose of this form?

A: The purpose of this form is to apply for an exemption from real property taxes for senior citizens and people with disabilities in Washington.

Q: Are there any eligibility requirements?

A: Yes, there are eligibility requirements. The applicant must be a senior citizen or a person with disabilities, meet the income requirement, and own and occupy the property as their primary residence.

Q: What is the deadline for submitting the form?

A: The deadline for submitting the form is on or before December 31st of the assessment year in which the exemption is being claimed.

Q: Is there an income limit for this exemption?

A: Yes, there is an income limit for this exemption. The applicant must meet the income requirement set by the Washington State Department of Revenue.

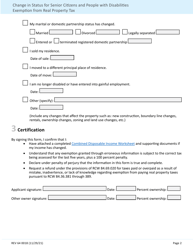

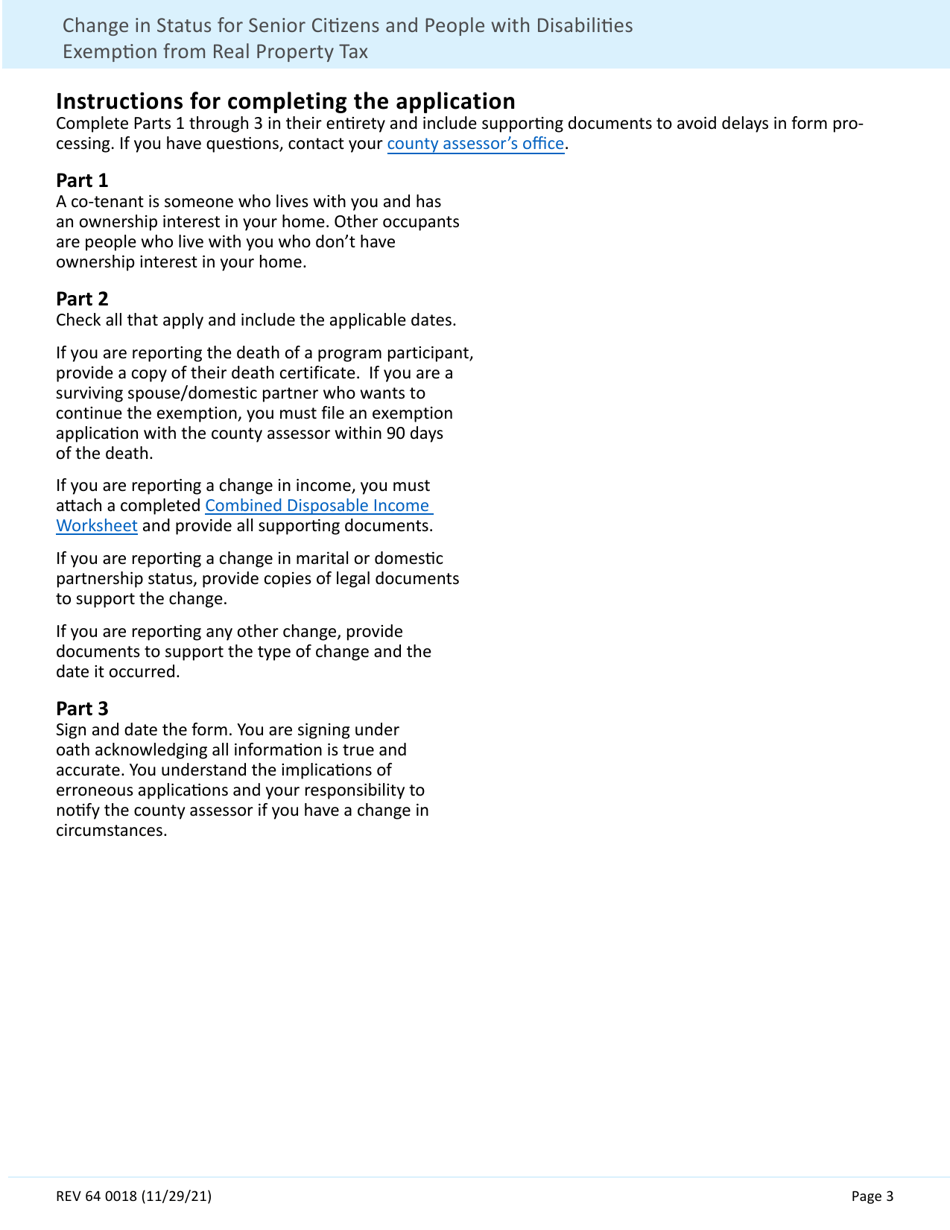

Q: What documents do I need to submit with the form?

A: You may need to submit proof of age, proof of disability, proof of income, and other supporting documents as requested by the Washington State Department of Revenue.

Q: How long does the exemption last?

A: The exemption lasts for the assessment year in which it is claimed and subsequent assessment years, as long as the applicant continues to meet the eligibility requirements.

Form Details:

- Released on November 29, 2021;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV64 0018 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.