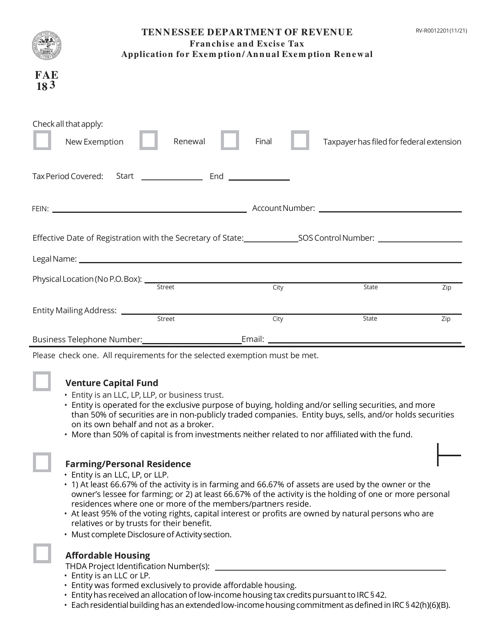

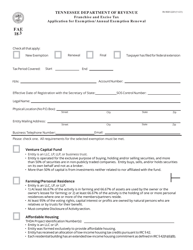

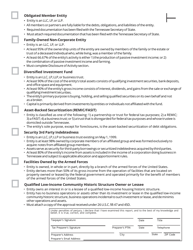

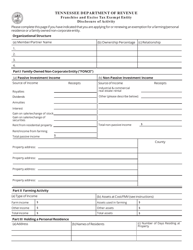

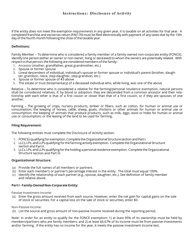

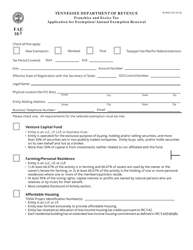

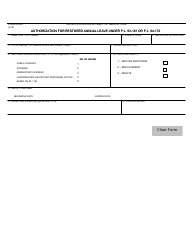

Form FAE183 (RV-R0012201) Application for Exemption / Annual Exemption Renewal - Tennessee

What Is Form FAE183 (RV-R0012201)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAE183?

A: Form FAE183 is the application for exemption or annual exemption renewal in Tennessee.

Q: What is the purpose of Form FAE183?

A: Form FAE183 is used to request exemption from property taxes or renew an existing exemption in Tennessee.

Q: Who needs to fill out Form FAE183?

A: Property owners in Tennessee who are seeking exemption from property taxes or need to renew their existing exemption must fill out Form FAE183.

Q: What information is required on Form FAE183?

A: Form FAE183 requires property owners to provide details about the property, ownership information, and supporting documentation for the exemption.

Q: Is there a deadline for submitting Form FAE183?

A: Yes, Form FAE183 must be submitted by the designated deadline specified by the Tennessee Department of Revenue.

Q: Are there any fees associated with submitting Form FAE183?

A: There are usually no fees associated with submitting Form FAE183, but certain exemptions may require payment of a filing fee.

Q: What happens after submitting Form FAE183?

A: After submitting Form FAE183, the Tennessee Department of Revenue will review the application and determine eligibility for the exemption.

Q: Can I apply for multiple exemptions using Form FAE183?

A: Yes, you can apply for multiple exemptions on a single Form FAE183 if you meet the eligibility requirements for each exemption.

Q: Can I renew my exemption using Form FAE183?

A: Yes, Form FAE183 can be used for both initial exemption applications and annual exemption renewals in Tennessee.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE183 (RV-R0012201) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.