This version of the form is not currently in use and is provided for reference only. Download this version of

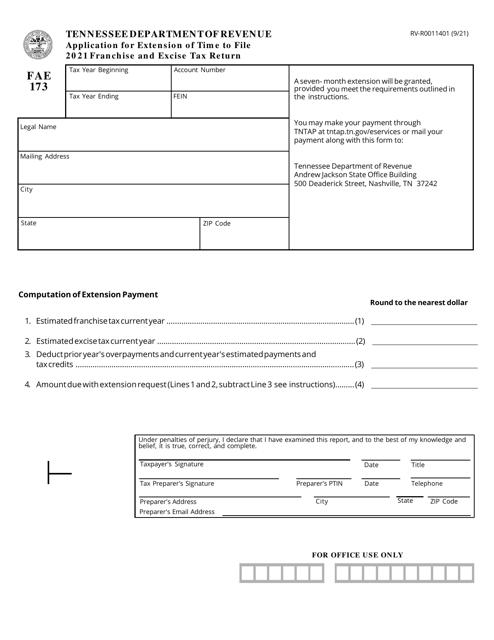

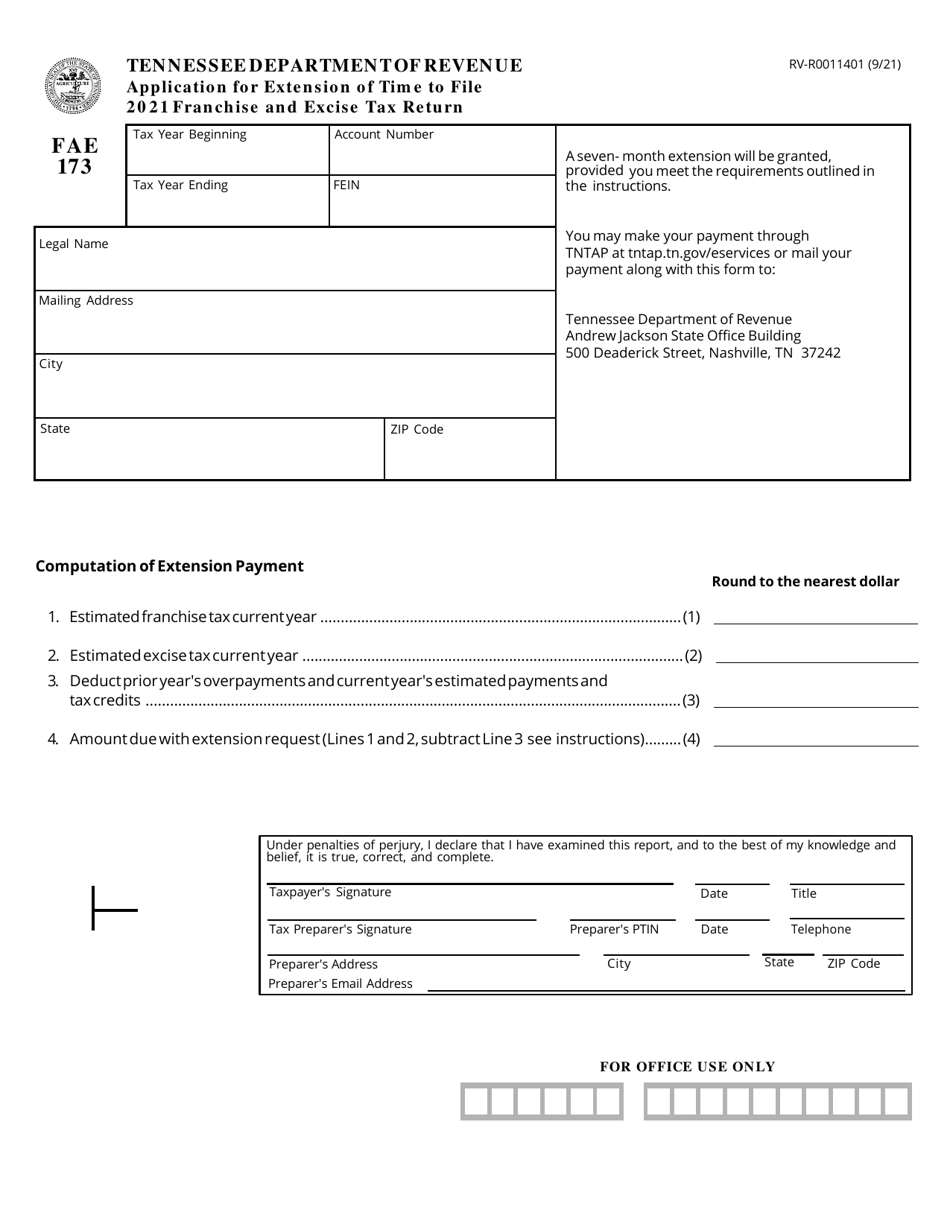

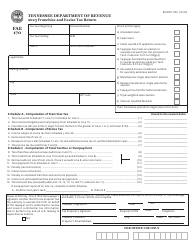

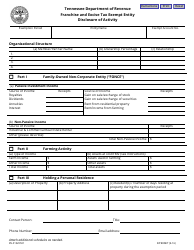

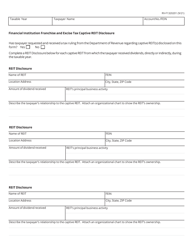

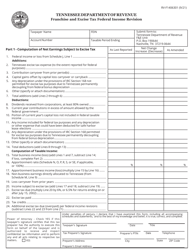

Form FAE173 (RV-R0011401)

for the current year.

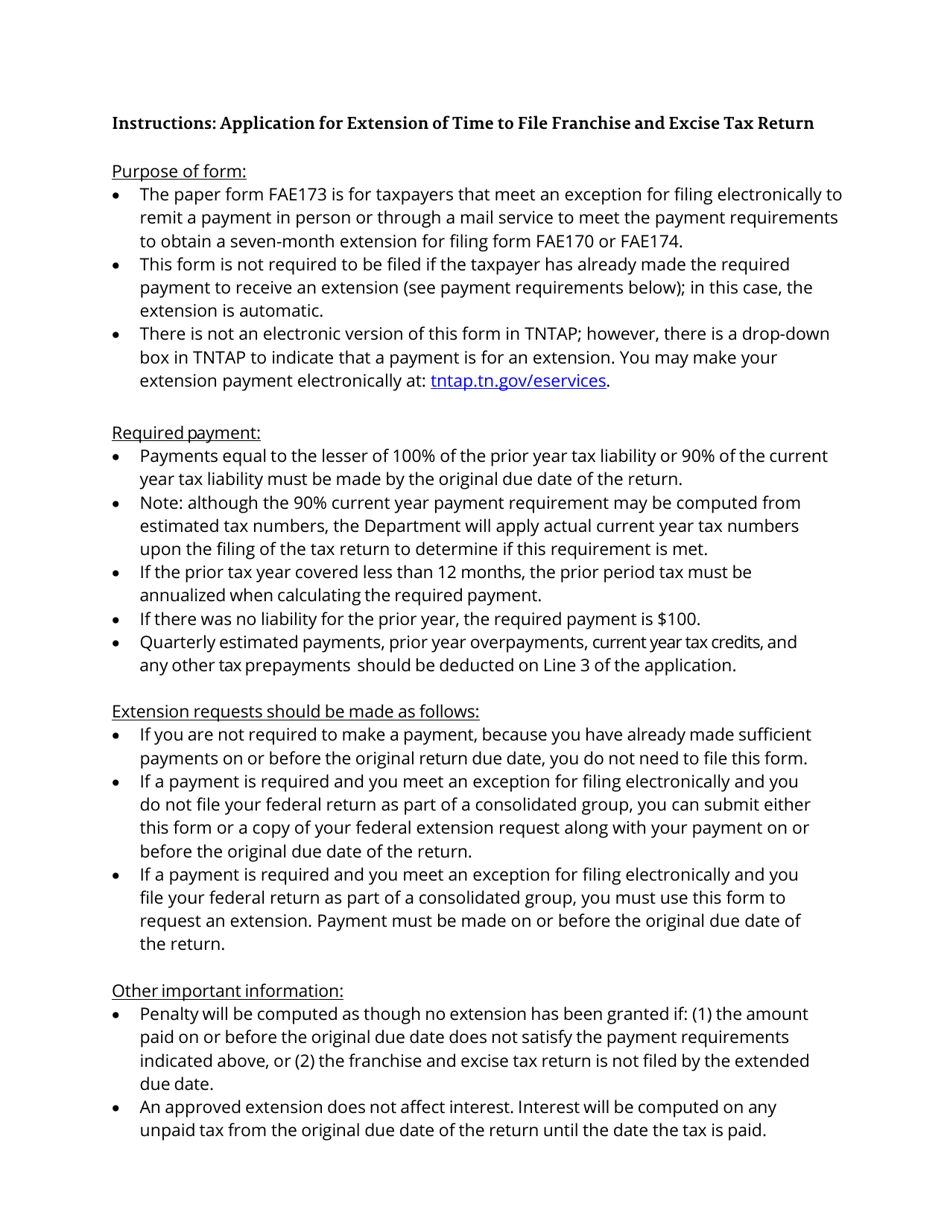

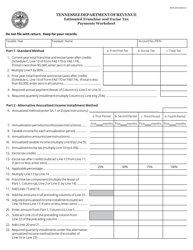

Form FAE173 (RV-R0011401) Application for Extension of Time to File Franchise and Excise Tax Return - Tennessee

What Is Form FAE173 (RV-R0011401)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAE173?

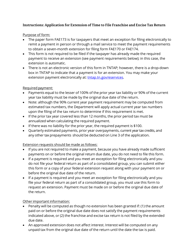

A: Form FAE173 is the Application for Extension of Time to File Franchise and Excise Tax Return for the state of Tennessee.

Q: Who needs to file Form FAE173?

A: Any taxpayer in Tennessee who needs additional time to file their Franchise and Excise Tax Return can file Form FAE173.

Q: What is the purpose of Form FAE173?

A: The purpose of Form FAE173 is to request an extension of time to file the Franchise and Excise Tax Return in Tennessee.

Q: What information is required on Form FAE173?

A: Form FAE173 requires basic taxpayer information, including name, address, tax identification number, and the reason for requesting the extension.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE173 (RV-R0011401) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.