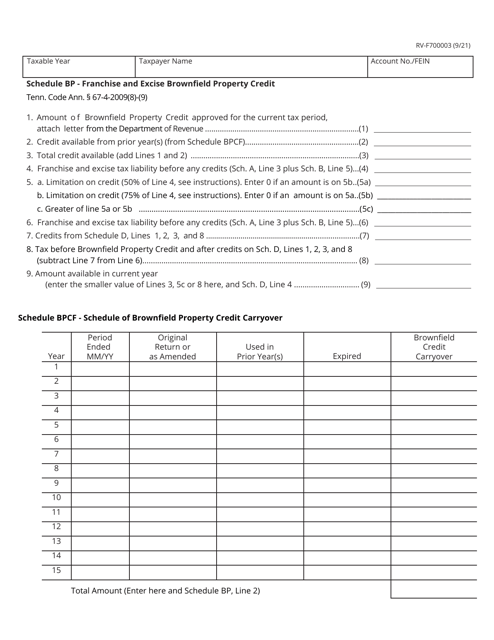

Form RV-F700003 Schedule BP, BPCF Franchise and Excise Brownfield Property Credit, Brownfield Property Credit Carryover - Tennessee

What Is Form RV-F700003 Schedule BP, BPCF?

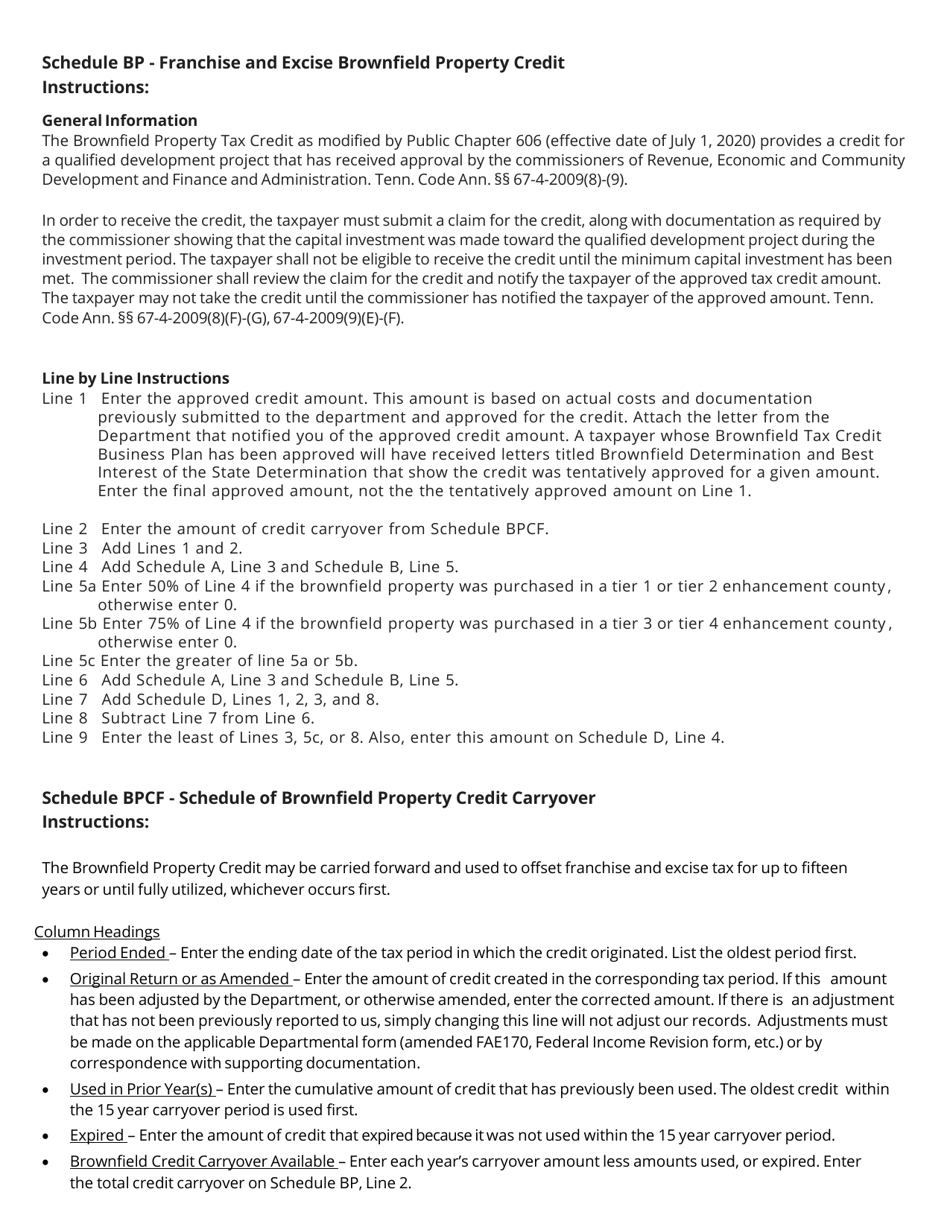

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F700003?

A: Form RV-F700003 is a form used in Tennessee to claim the Brownfield Property Credit.

Q: What is Schedule BP?

A: Schedule BP is a part of Form RV-F700003 that specifically deals with the Brownfield Property Credit.

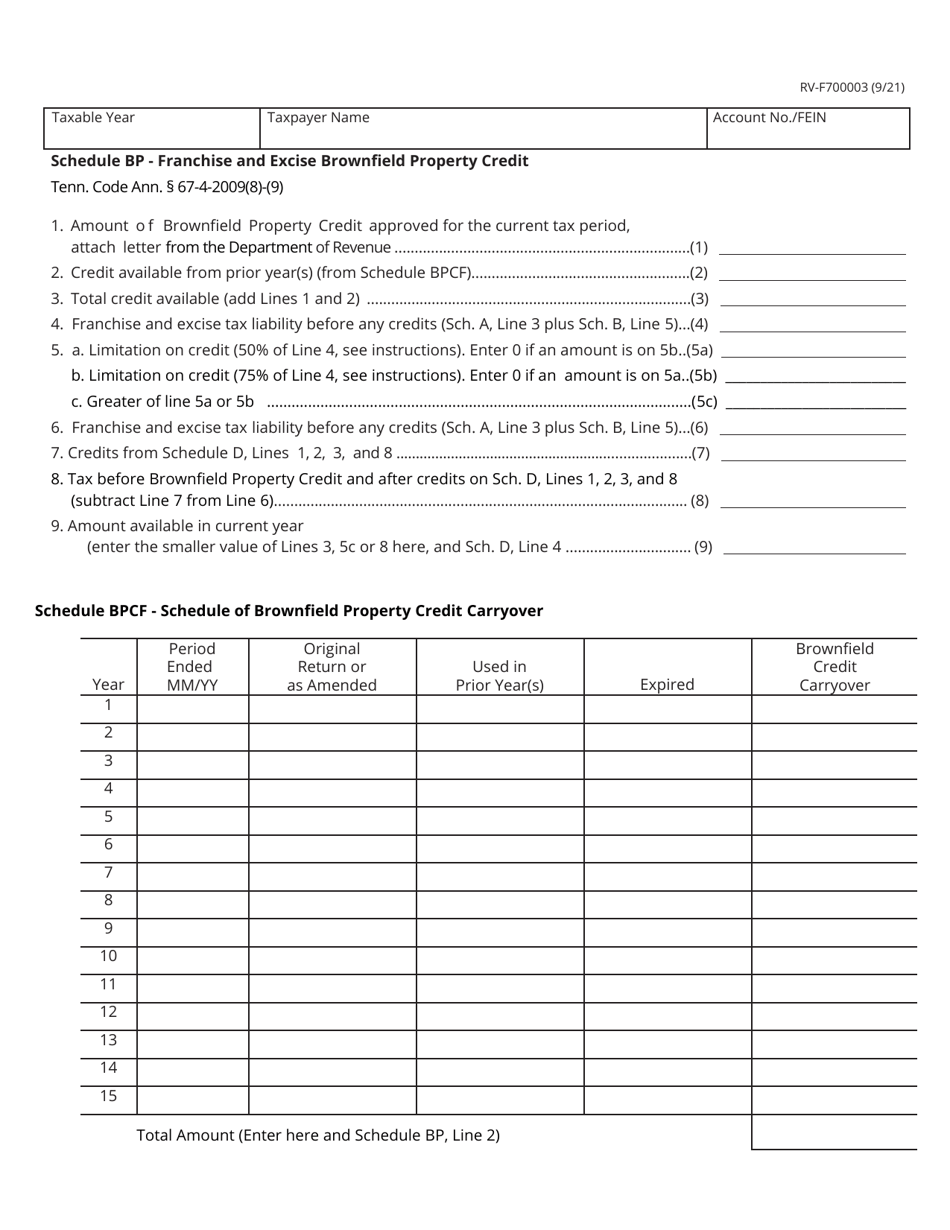

Q: What is BPCF?

A: BPCF stands for Brownfield Property Credit Franchise.

Q: What is the Franchise and Excise Brownfield Property Credit?

A: The Franchise and Excise Brownfield Property Credit is a tax credit available in Tennessee for the remediation and redevelopment of brownfield properties.

Q: What is the Brownfield Property Credit Carryover?

A: The Brownfield Property Credit Carryover refers to any unused Brownfield Property Credit that can be carried forward to future tax years.

Q: What is Tennessee?

A: Tennessee is a state in the United States, located in the southeastern region.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F700003 Schedule BP, BPCF by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.