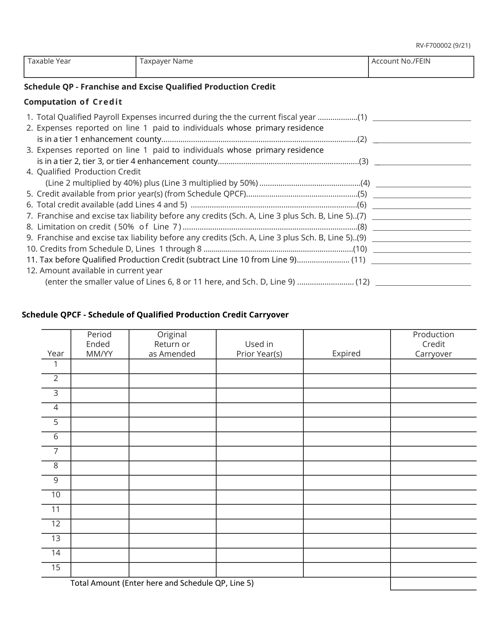

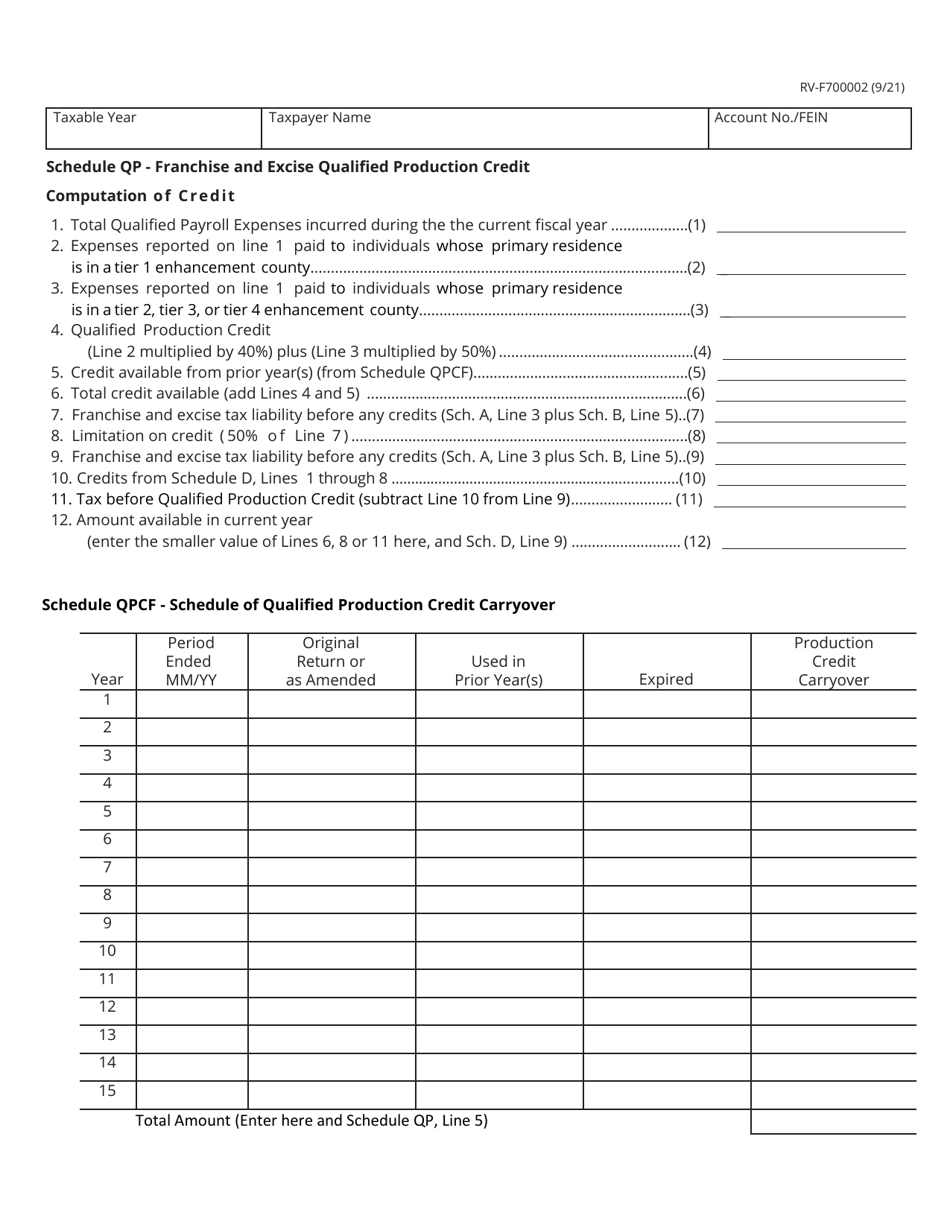

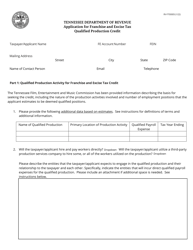

Form RV-F700002 Schedule QP, QPCF Franchise and Excise Qualified Production Credit, Qualified Production Credit Carryover - Tennessee

What Is Form RV-F700002 Schedule QP, QPCF?

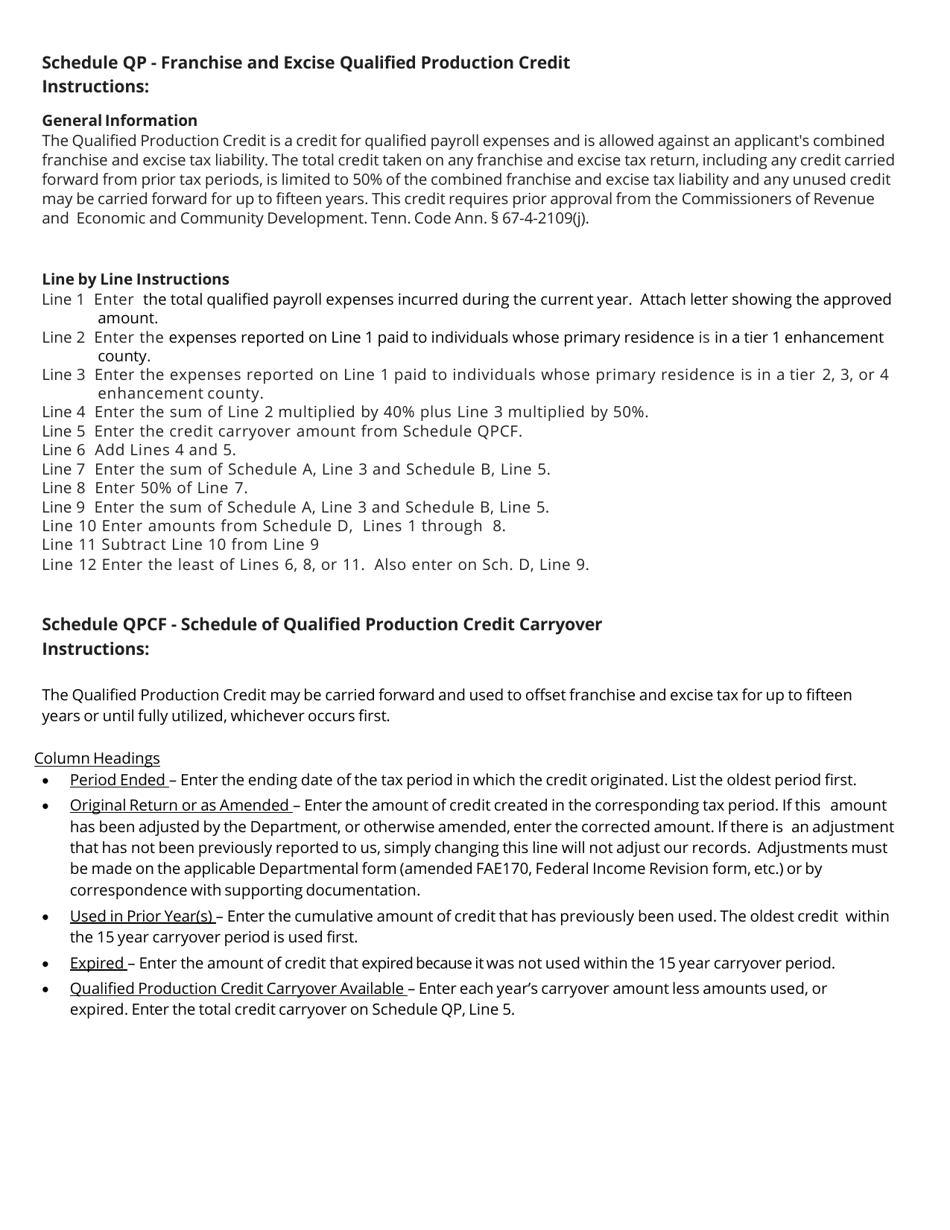

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F700002 Schedule QP?

A: Form RV-F700002 Schedule QP is a tax form used in Tennessee to claim the Qualified Production Credit (QPCF) and Qualified Production Credit Carryover.

Q: What is the Qualified Production Credit (QPCF)?

A: The Qualified Production Credit (QPCF) is a tax credit available in Tennessee for qualified production activities.

Q: What is the Qualified Production Credit Carryover?

A: The Qualified Production Credit Carryover allows taxpayers to carry forward any unused QPCF to future tax years.

Q: Who can use Form RV-F700002 Schedule QP?

A: Taxpayers in Tennessee who qualify for the Qualified Production Credit or have unused QPCF from previous years can use Form RV-F700002 Schedule QP.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F700002 Schedule QP, QPCF by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.