This version of the form is not currently in use and is provided for reference only. Download this version of

Form IE (RV-F1406701)

for the current year.

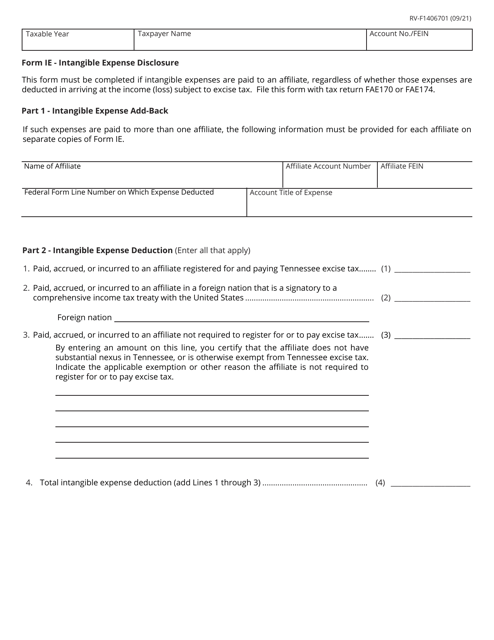

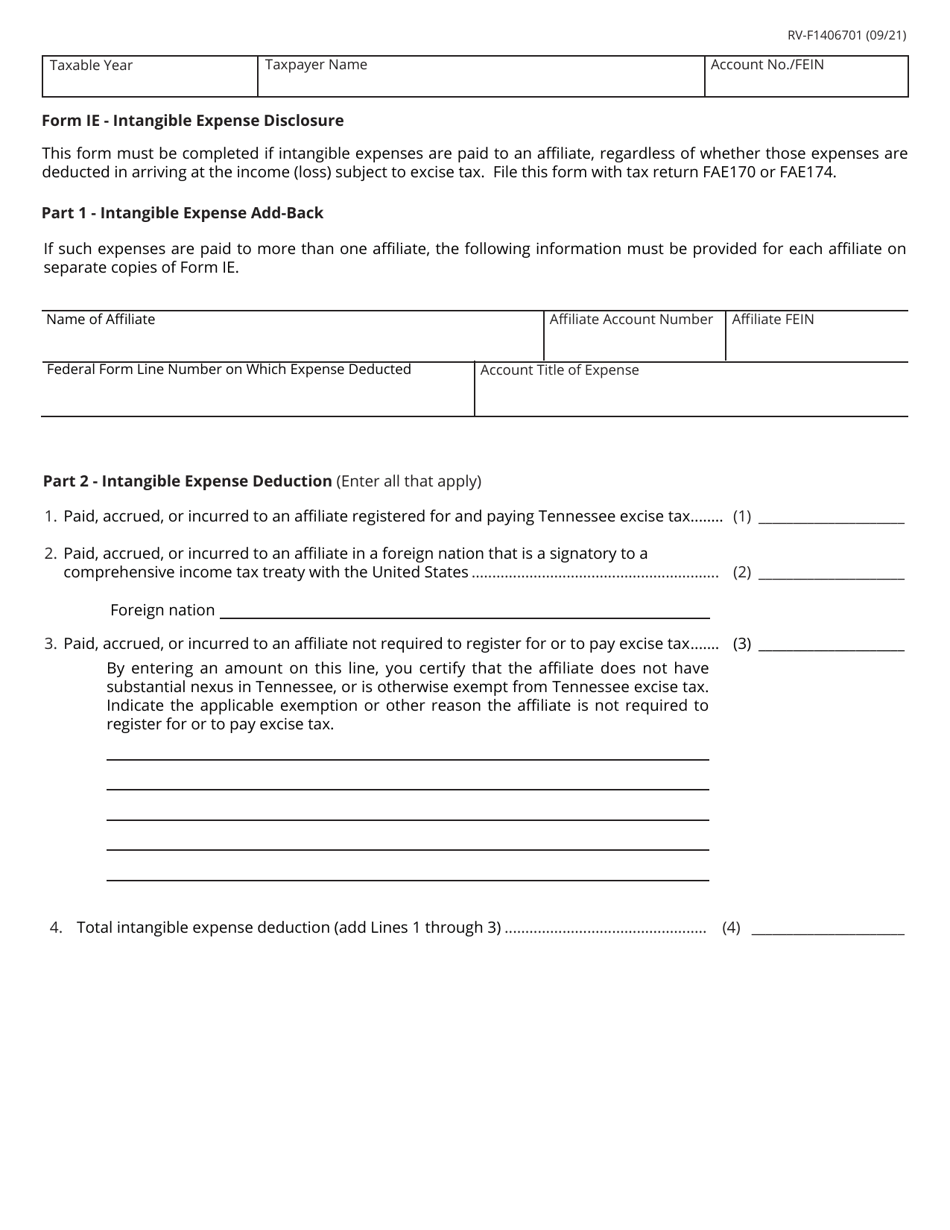

Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee

What Is Form IE (RV-F1406701)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IE (RV-F1406701)?

A: Form IE (RV-F1406701) is the Intangible Expense Disclosure form for the state of Tennessee.

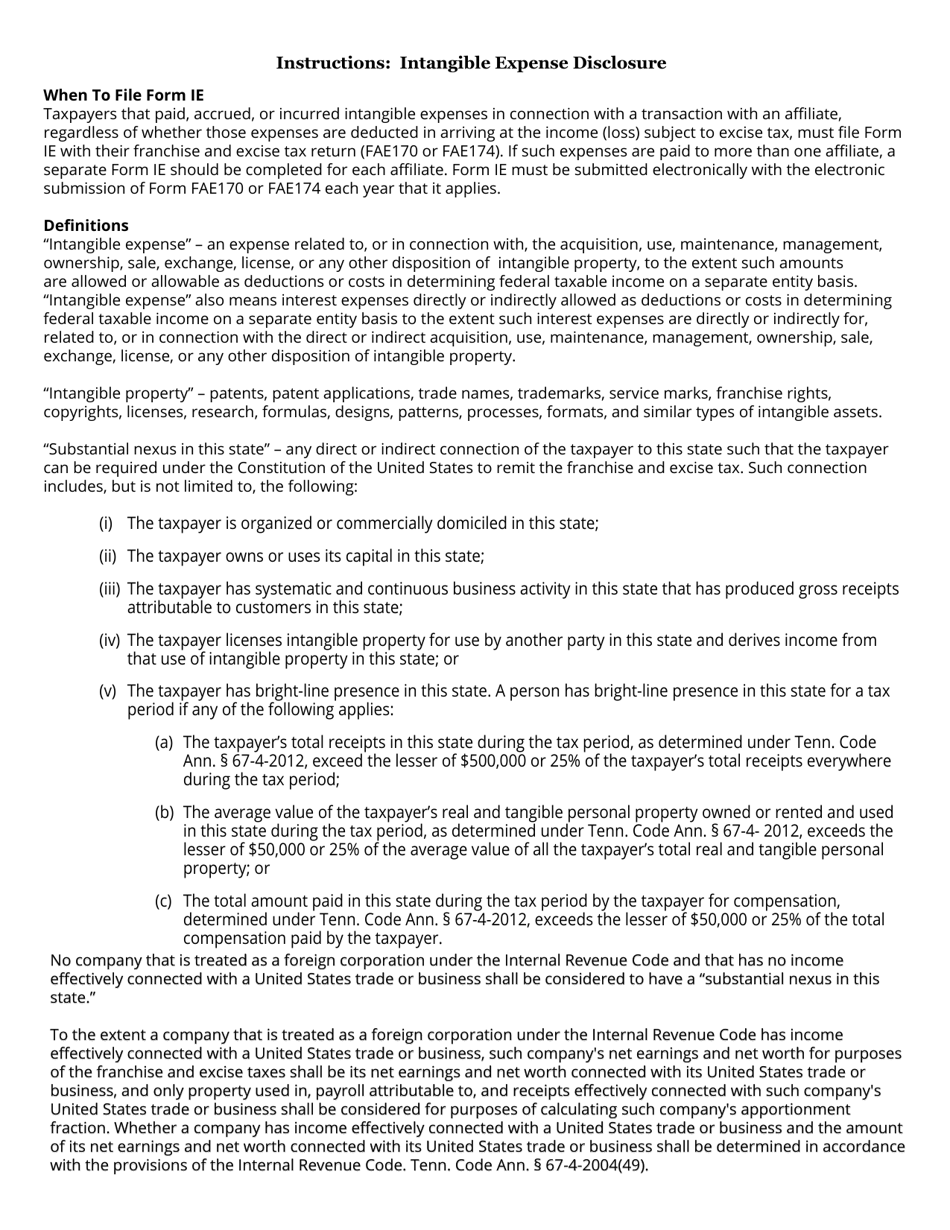

Q: What is an intangible expense?

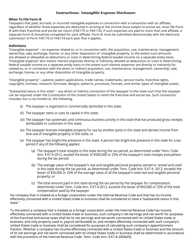

A: An intangible expense refers to a cost incurred in relation to intangible assets such as patents, copyrights, trademarks, or franchise rights.

Q: Who is required to file the Form IE (RV-F1406701)?

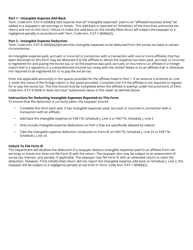

A: Businesses that have claimed deductions for intangible expenses on their Tennessee franchise and excise tax returns are required to file the Form IE (RV-F1406701).

Q: When is the deadline to file the Form IE (RV-F1406701)?

A: The Form IE (RV-F1406701) must be filed by the due date of the Tennessee franchise and excise tax return, which is the 15th day of the fourth month following the close of the taxable year.

Q: What information is required to complete the Form IE (RV-F1406701)?

A: The Form IE (RV-F1406701) requires details on the amount of intangible expenses claimed, the taxpayer's name, address, and tax identification number, as well as supporting documentation.

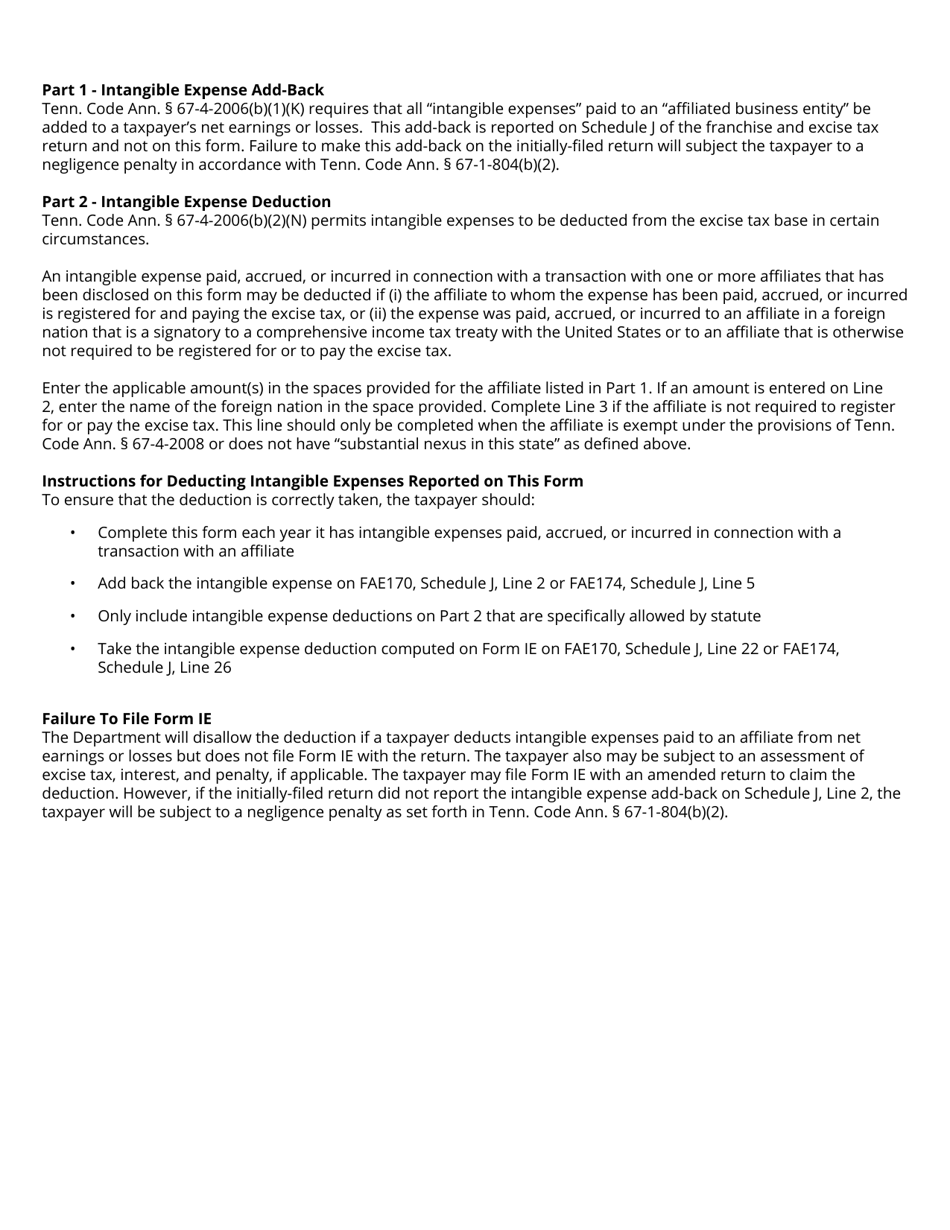

Q: Is there a penalty for not filing the Form IE (RV-F1406701)?

A: Yes, failure to file the Form IE (RV-F1406701) or filing a false or incomplete form may result in penalties and interest.

Q: Can I file the Form IE (RV-F1406701) electronically?

A: Yes, the Tennessee Department of Revenue allows electronic filing of the Form IE (RV-F1406701).

Q: Are there any exemptions to filing the Form IE (RV-F1406701)?

A: There are exemptions available for certain entities, such as tax-exempt organizations and small businesses with total assets of less than $10 million.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IE (RV-F1406701) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.