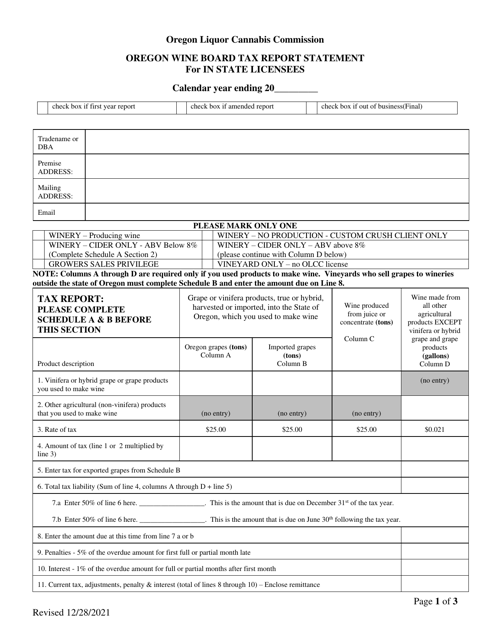

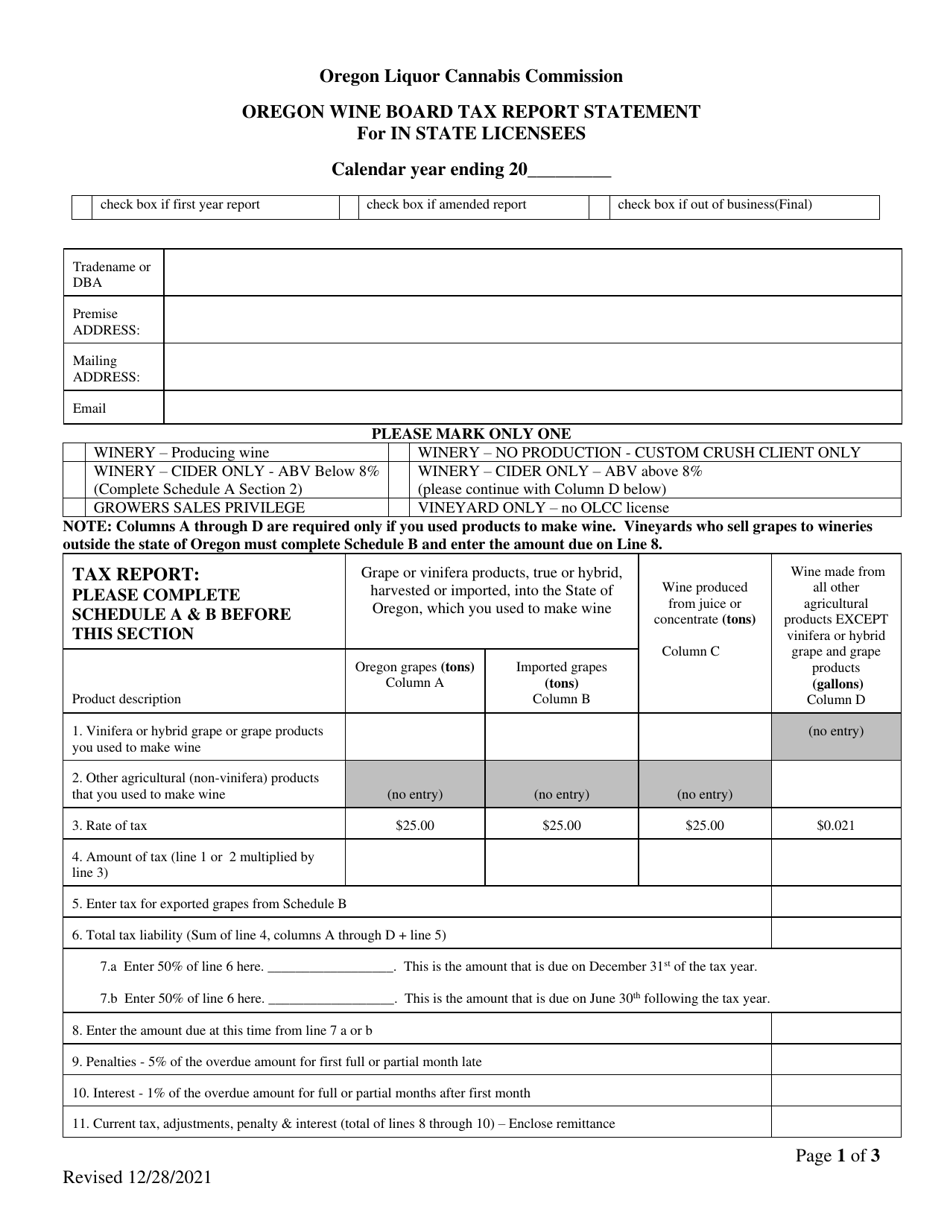

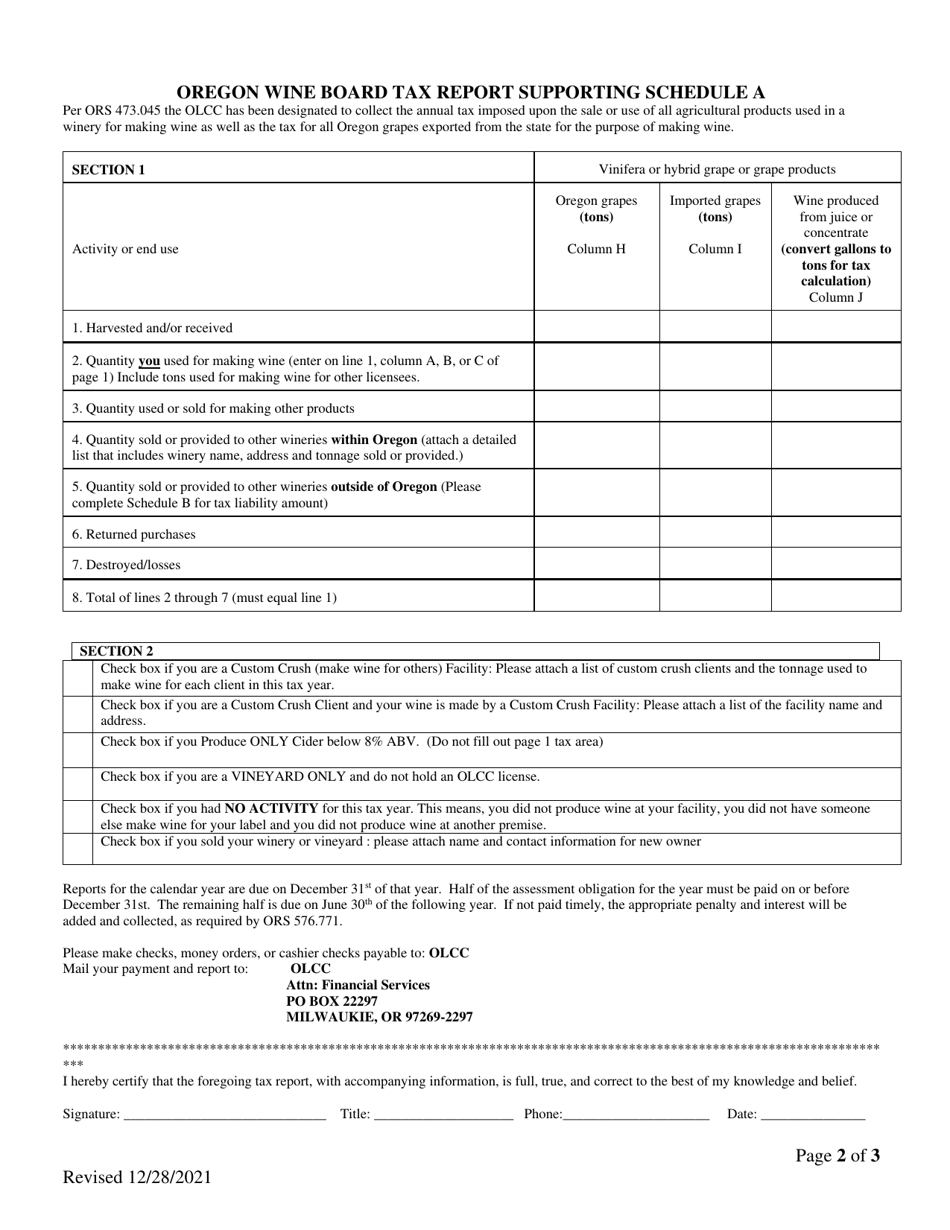

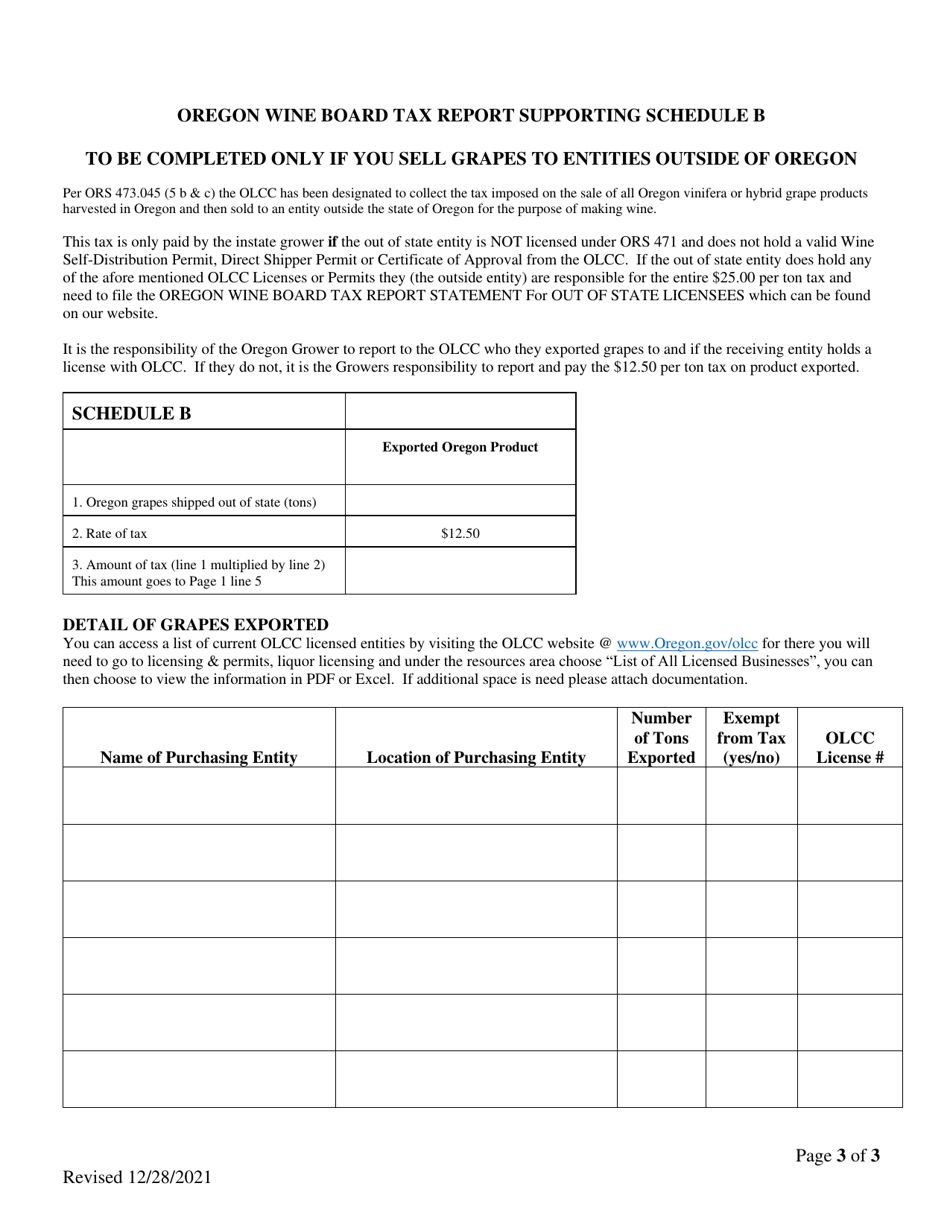

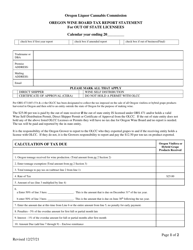

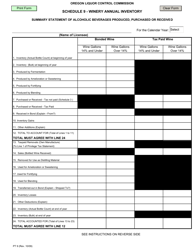

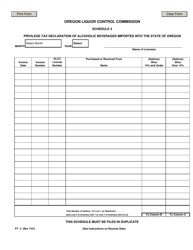

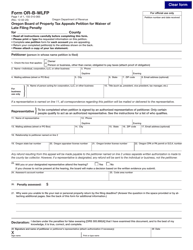

Oregon Wine Board Tax Report Statement for in State Licensees - Oregon

Oregon Wine Board Tax Report Statement for in State Licensees is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the Oregon Wine Board Tax Report?

A: The Oregon Wine Board Tax Report is a statement that in-state licensees must submit to report their wine sales and pay the required taxes.

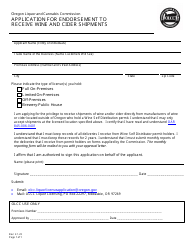

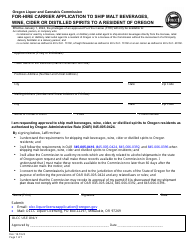

Q: Who needs to submit the Oregon Wine Board Tax Report?

A: In-state licensees, such as wineries or wine distributors operating in Oregon, need to submit the tax report.

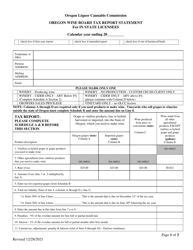

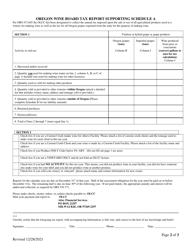

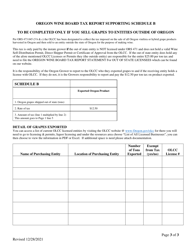

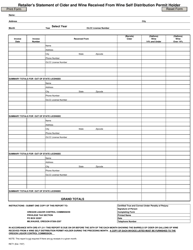

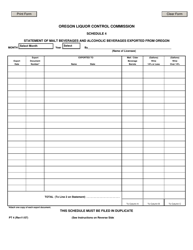

Q: What information is required on the Oregon Wine Board Tax Report?

A: The report typically requires information on wine sales, including the quantity and value of wine sold, and any applicable taxes due.

Q: When is the Oregon Wine Board Tax Report due?

A: The tax report is typically due on a quarterly basis, with specific due dates provided by the Oregon Wine Board.

Q: Are there any penalties for not submitting the Oregon Wine Board Tax Report?

A: Yes, failure to submit the tax report or pay the required taxes on time can result in penalties, including fines and potential license revocation.

Form Details:

- Released on December 28, 2021;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.