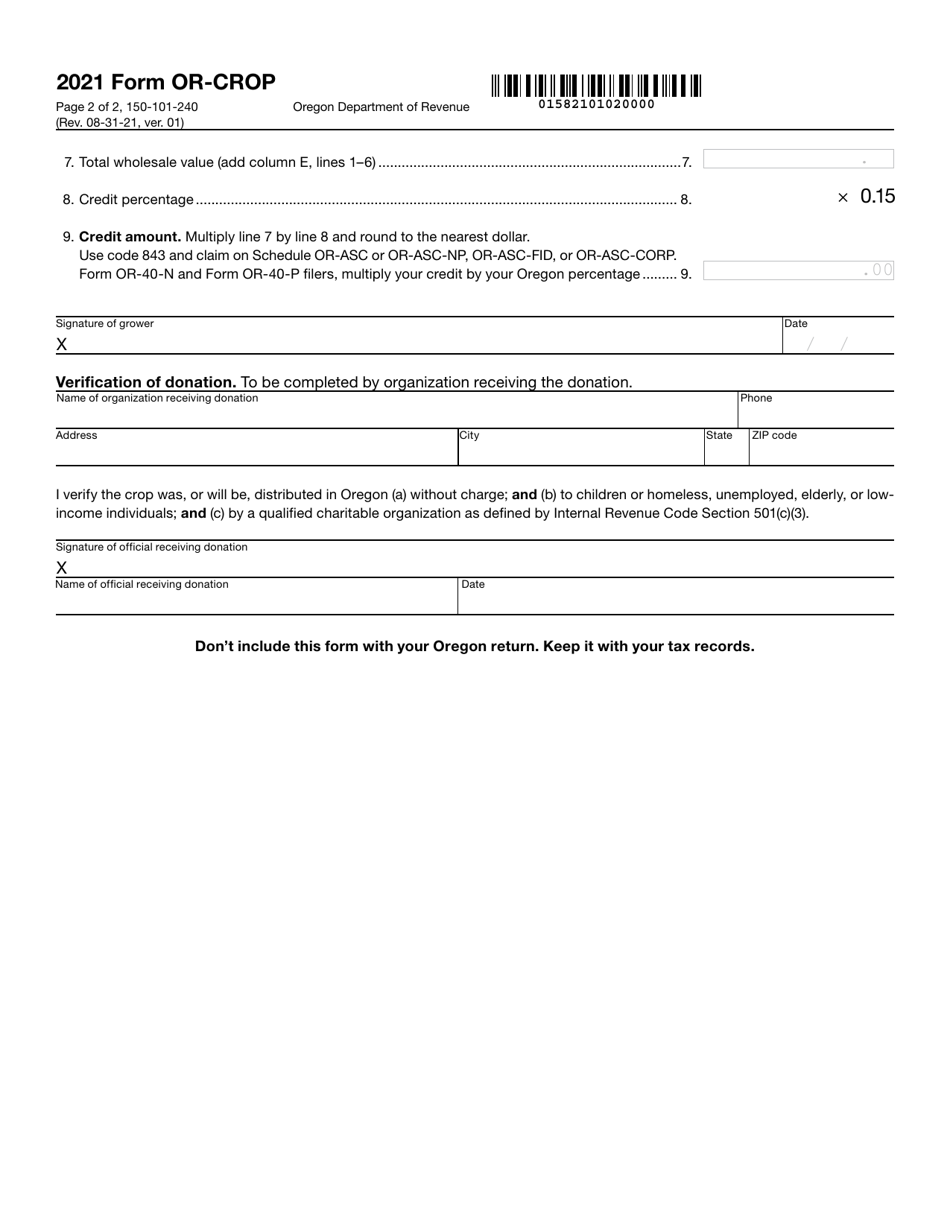

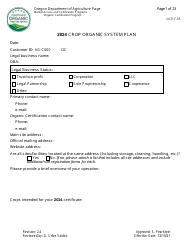

This version of the form is not currently in use and is provided for reference only. Download this version of

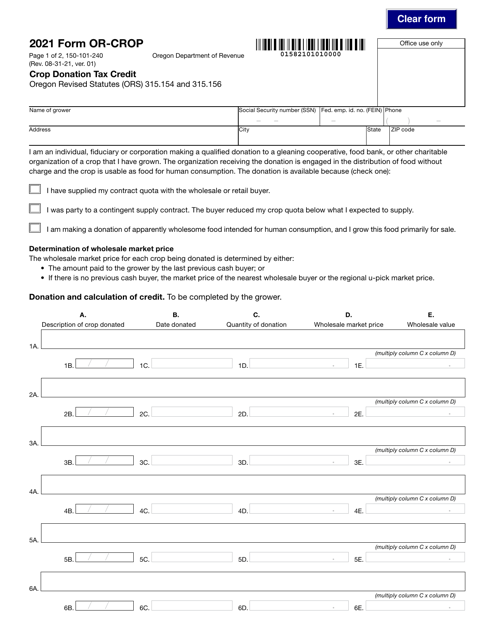

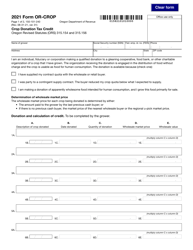

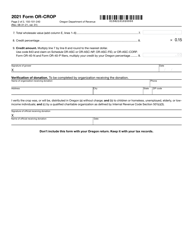

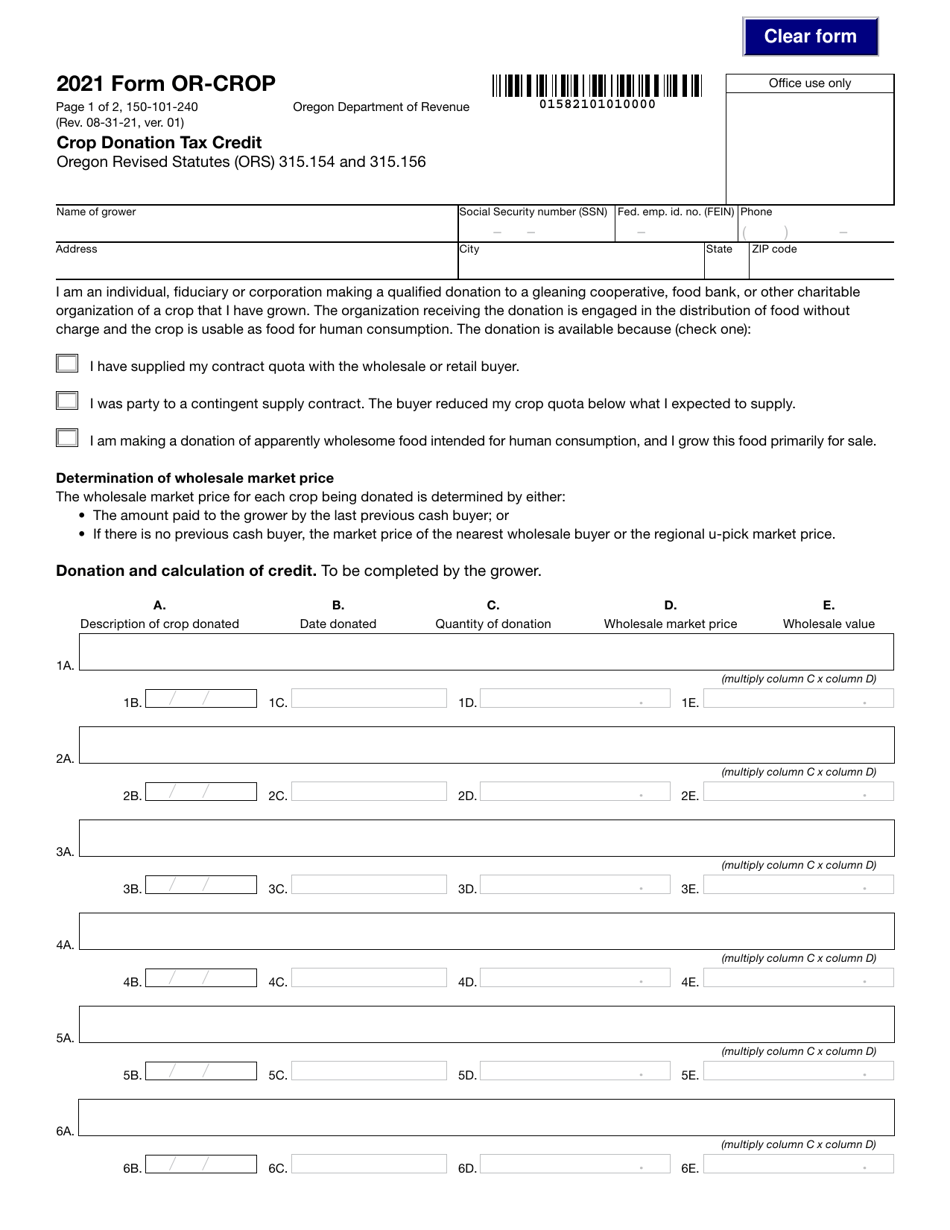

Form OR-CROP (150-101-240)

for the current year.

Form OR-CROP (150-101-240) Crop Donation Tax Credit - Oregon

What Is Form OR-CROP (150-101-240)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-CROP?

A: OR-CROP is an abbreviation for Oregon Crop Donation Tax Credit.

Q: What is the purpose of OR-CROP?

A: The purpose of OR-CROP is to provide a tax credit for individuals or businesses that donate crops to a charitable organization.

Q: What is the tax credit amount for OR-CROP?

A: The tax credit amount for OR-CROP is 10% of the fair market value of the donated crops.

Q: Who is eligible for OR-CROP?

A: Any individual or business that donates crops to a charitable organization in Oregon is eligible for OR-CROP.

Q: How do I claim the OR-CROP tax credit?

A: To claim the OR-CROP tax credit, you need to complete and submit Form OR-CROP (150-101-240) with your annual state tax return.

Q: Can the OR-CROP tax credit be carried forward?

A: No, the OR-CROP tax credit cannot be carried forward to future years.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-CROP (150-101-240) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.