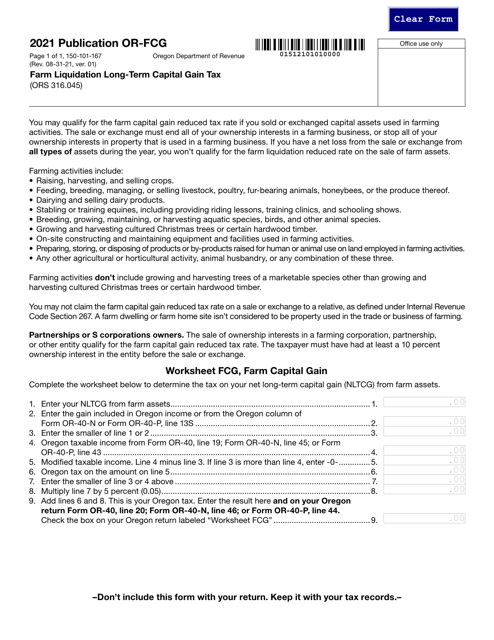

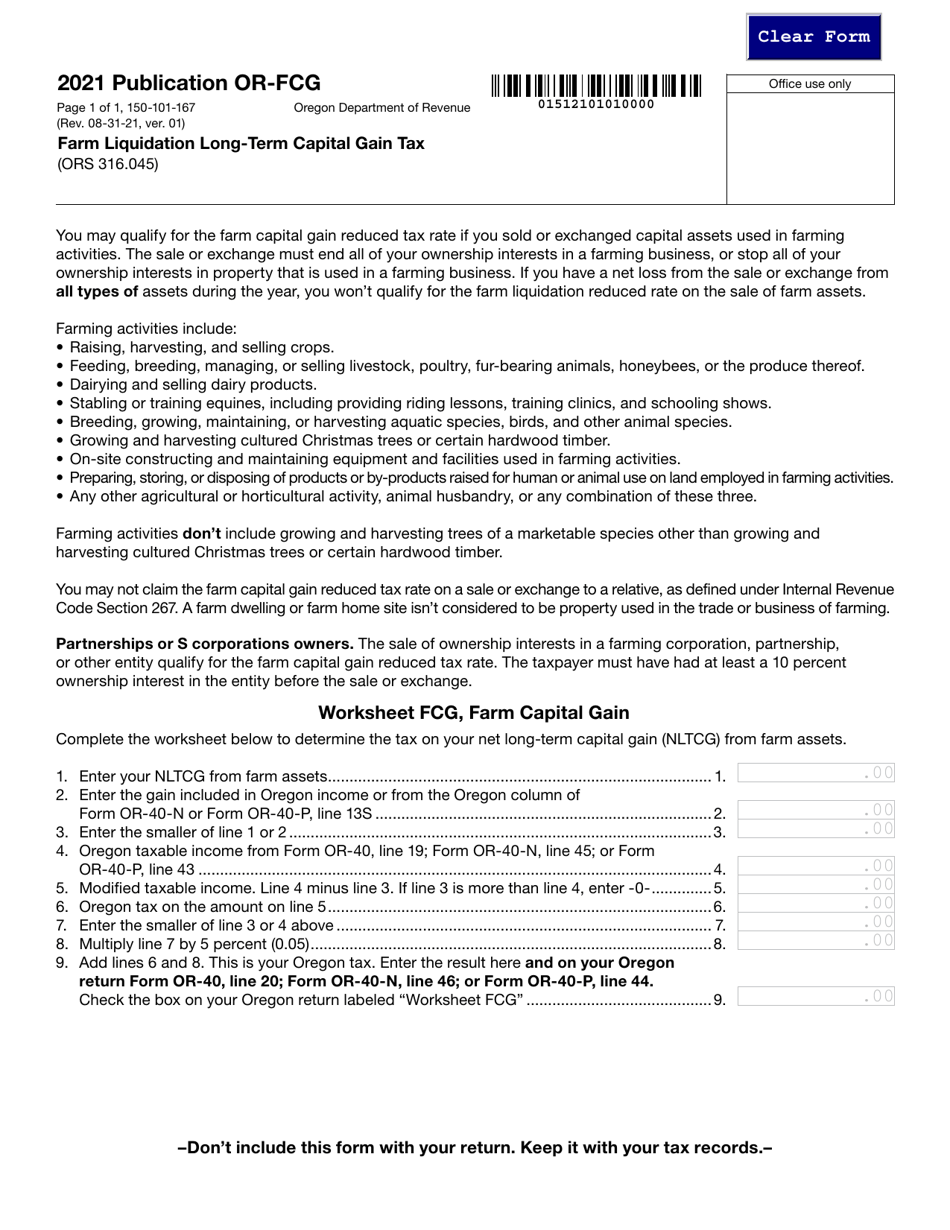

Form OR-FCG (150-101-167) Worksheet FCG Farm Liquidation Long-Term Capital Gain Tax - Oregon

What Is Form OR-FCG (150-101-167) Worksheet FCG?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-FCG (150-101-167)?

A: Form OR-FCG (150-101-167) is a worksheet used in Oregon to calculate the Farm Liquidation Long-Term Capital Gain Tax.

Q: What is the purpose of Form OR-FCG?

A: The purpose of Form OR-FCG is to determine the amount of long-term capital gain tax owed on the liquidation of a farm in Oregon.

Q: Who should use Form OR-FCG?

A: Farmers in Oregon who are liquidating their farm and have long-term capital gains should use Form OR-FCG.

Q: What is a long-term capital gain?

A: A long-term capital gain is a taxable profit that occurs when an asset is sold after being held for more than one year.

Q: How is the Farm Liquidation Long-Term Capital Gain Tax calculated?

A: The Farm Liquidation Long-Term Capital Gain Tax is calculated using the information provided on Form OR-FCG, including the sale proceeds, basis, and adjustments.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-FCG (150-101-167) Worksheet FCG by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.