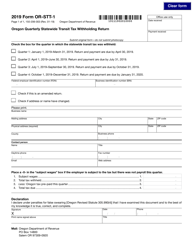

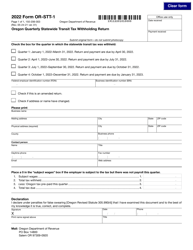

This version of the form is not currently in use and is provided for reference only. Download this version of

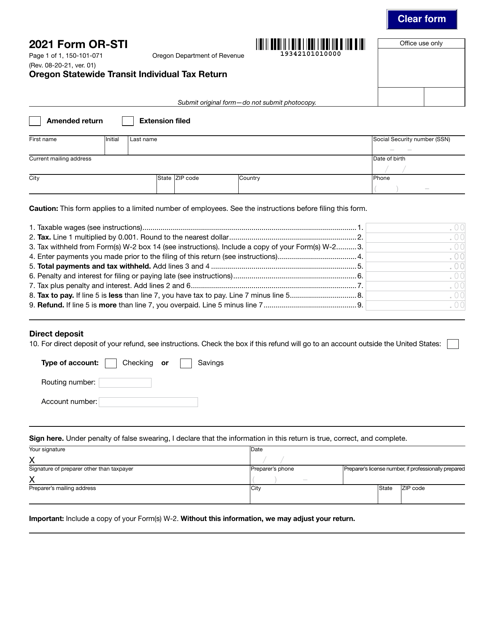

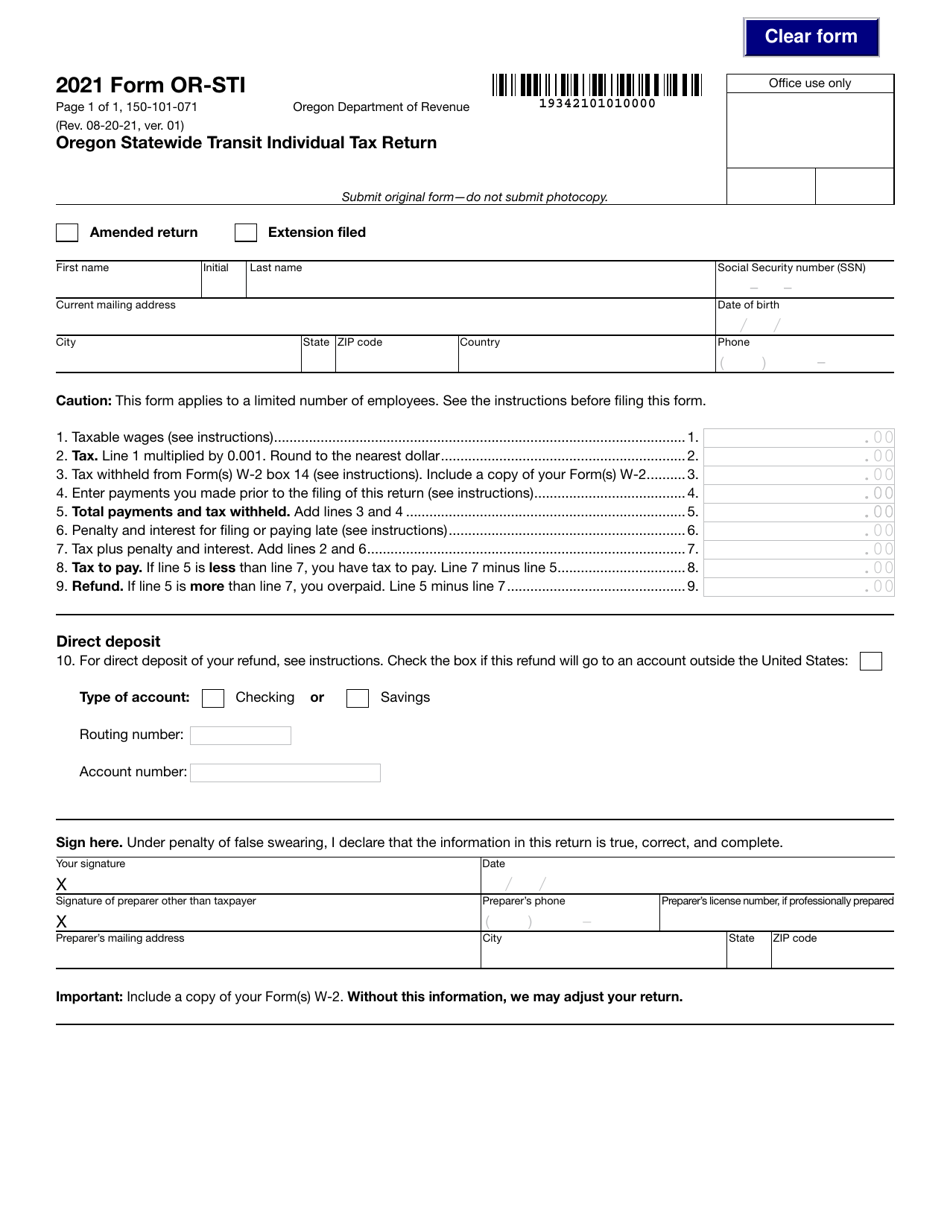

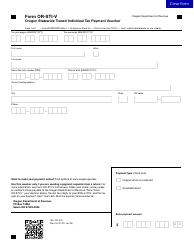

Form OR-STI (150-101-071)

for the current year.

Form OR-STI (150-101-071) Oregon Statewide Transit Individual Tax Return - Oregon

What Is Form OR-STI (150-101-071)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the OR-STI form?

A: The OR-STI form is the Oregon Statewide Transit Individual Tax Return.

Q: What is the purpose of the OR-STI form?

A: The purpose of the OR-STI form is to report and pay the statewide transit tax.

Q: Who needs to file the OR-STI form?

A: Any individual who is an Oregon resident or has Oregon source income and meets certain income thresholds needs to file the OR-STI form.

Q: What is the statewide transit tax?

A: The statewide transit tax is a tax imposed on wages, self-employment income, and certain other types of income to fund public transportation in Oregon.

Q: When is the deadline to file the OR-STI form?

A: The deadline to file the OR-STI form is generally April 15th of each year, unless that date falls on a weekend or holiday.

Q: Are there any penalties for not filing the OR-STI form?

A: Yes, there can be penalties for failing to file the OR-STI form or for filing late.

Q: What should I do if I can't pay the amount due on the OR-STI form?

A: If you can't pay the amount due, you should still file the OR-STI form on time and contact the Oregon Department of Revenue to discuss payment options.

Q: Can I e-file the OR-STI form?

A: Yes, you can e-file the OR-STI form using approved tax preparation software or through a tax professional.

Q: Do I need to attach any additional documents when filing the OR-STI form?

A: In general, you do not need to attach any additional documents when filing the OR-STI form unless specifically requested by the Oregon Department of Revenue.

Form Details:

- Released on August 20, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-STI (150-101-071) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.