This version of the form is not currently in use and is provided for reference only. Download this version of

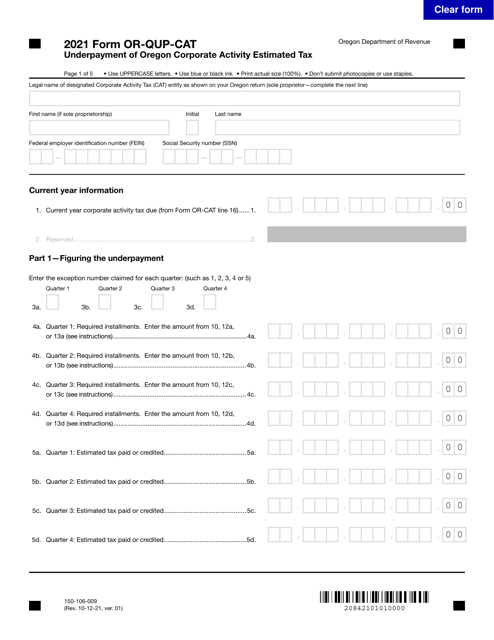

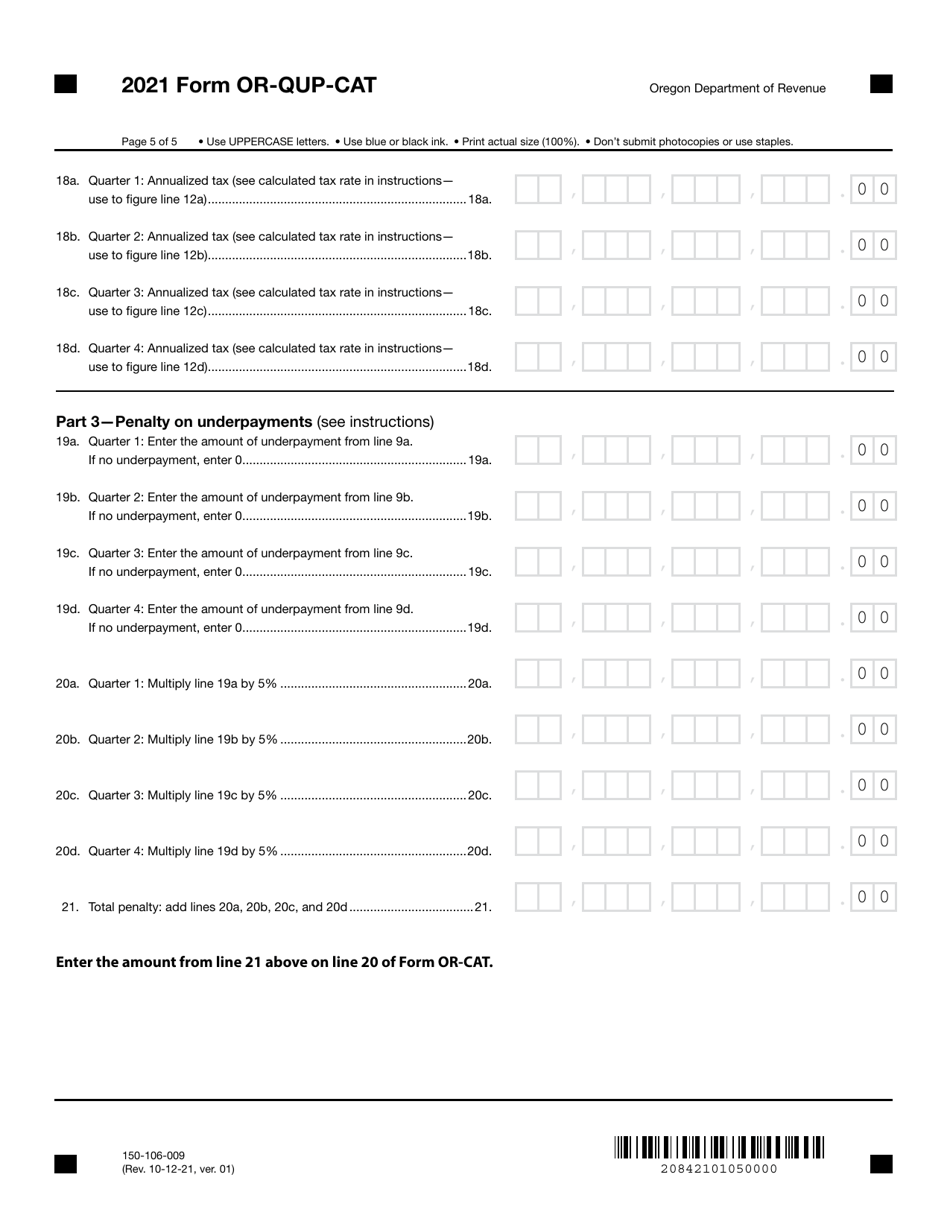

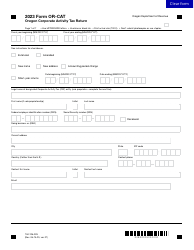

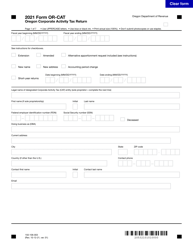

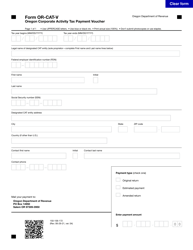

Form OR-QUP-CAT (150-106-009)

for the current year.

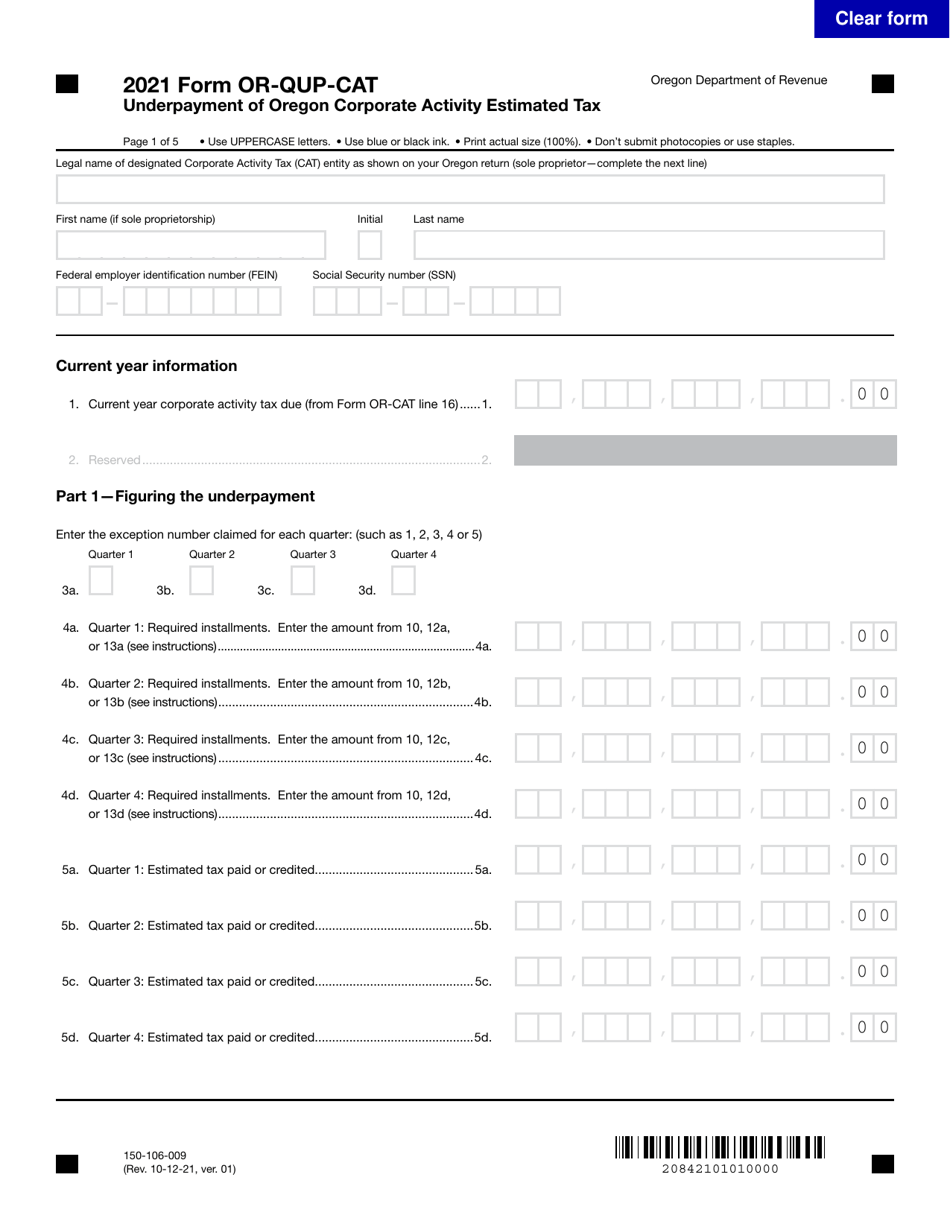

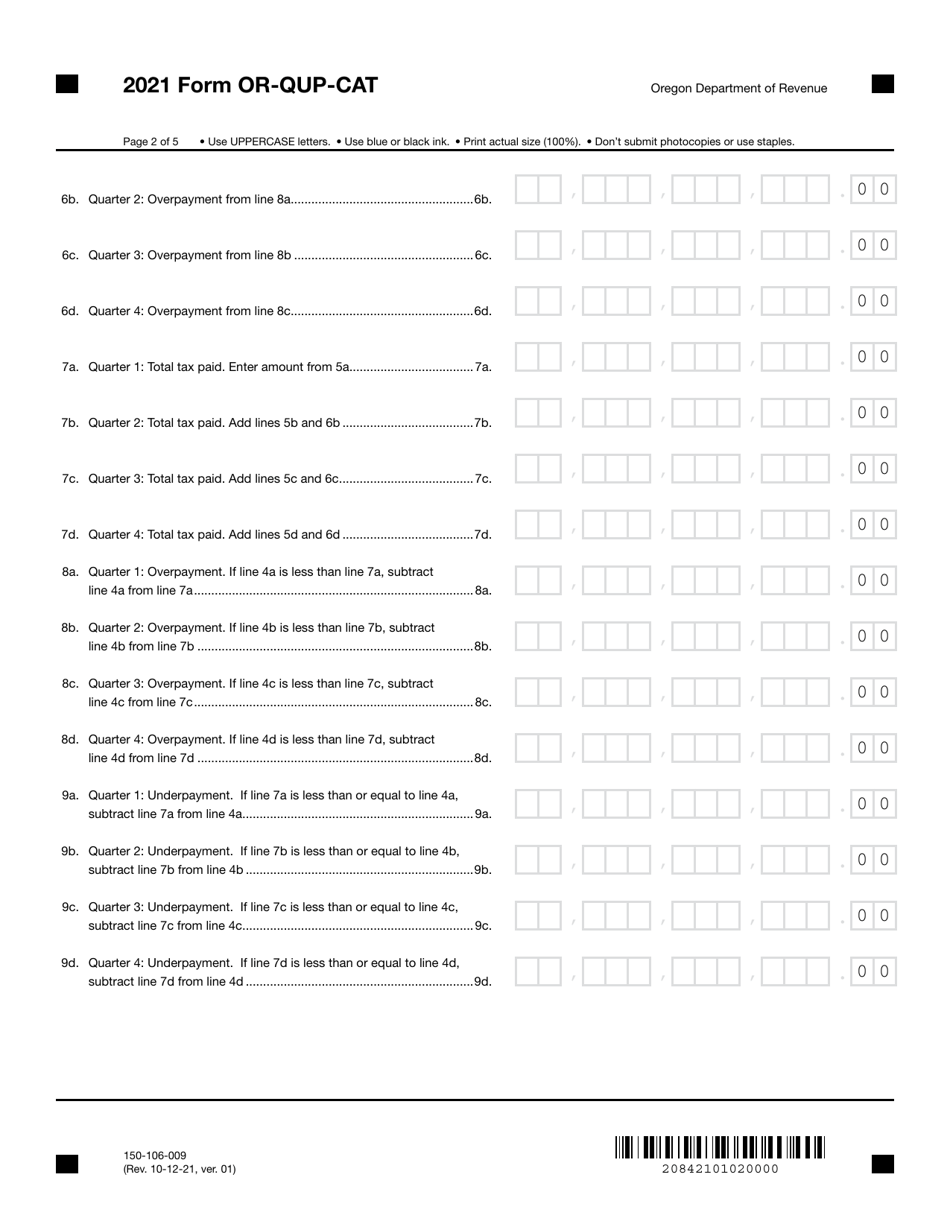

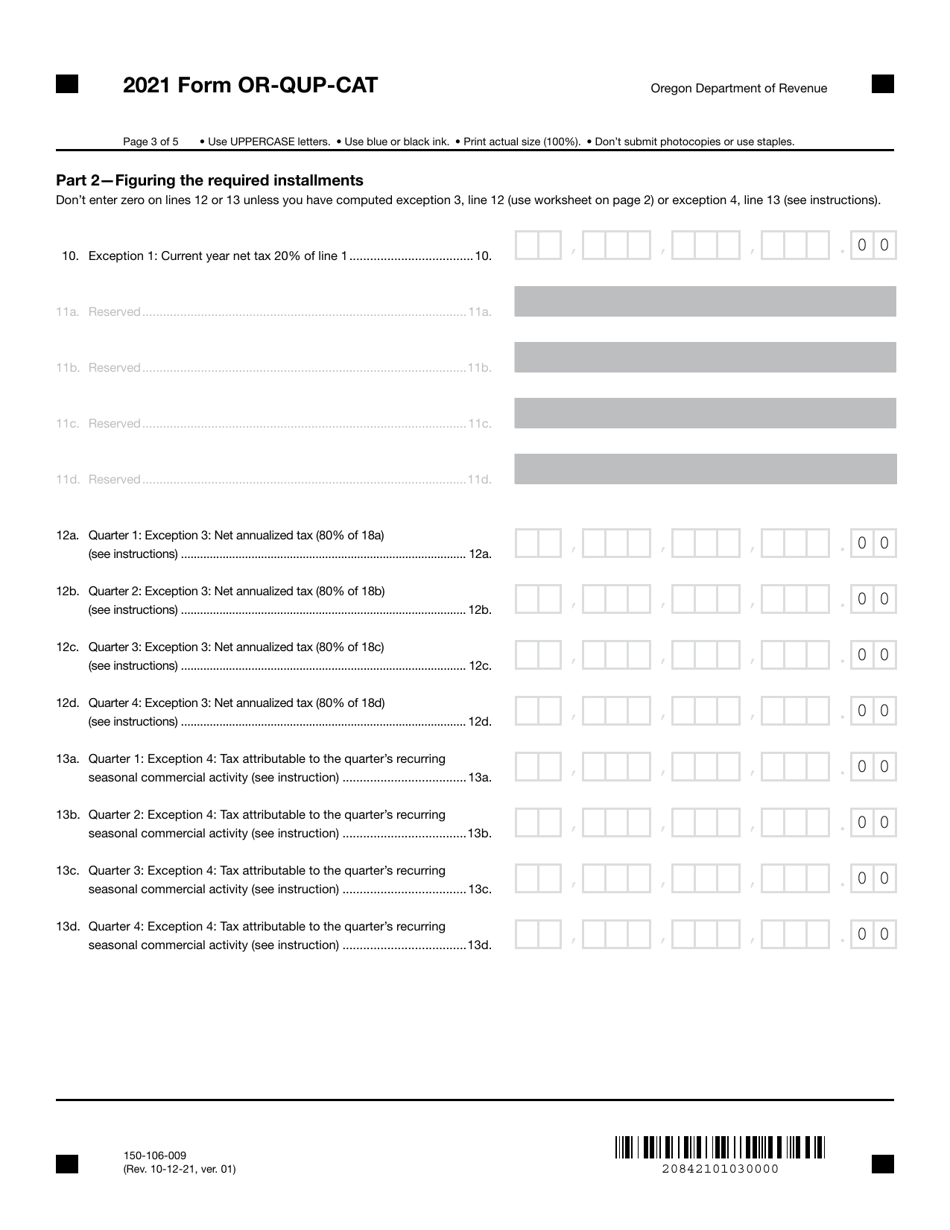

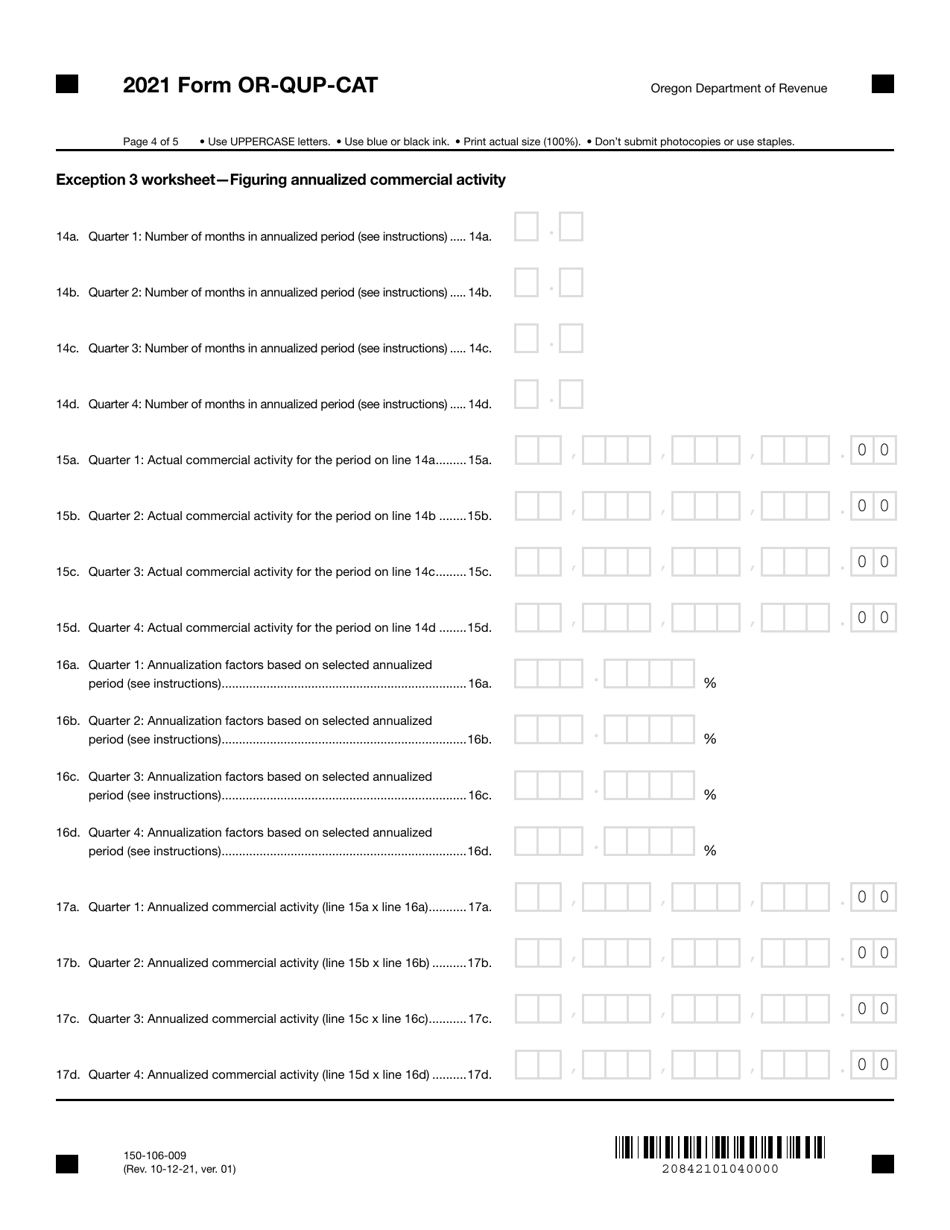

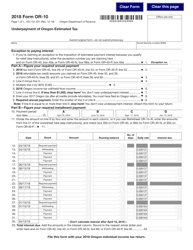

Form OR-QUP-CAT (150-106-009) Underpayment of Oregon Corporate Activity Estimated Tax - Oregon

What Is Form OR-QUP-CAT (150-106-009)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-QUP-CAT (150-106-009)?

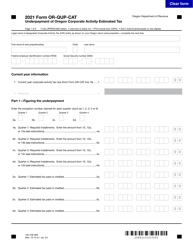

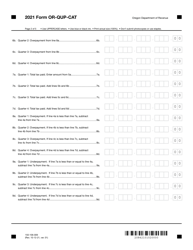

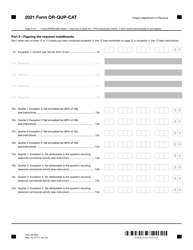

A: OR-QUP-CAT (150-106-009) is a form used for reporting and paying underpayment of the Oregon Corporate Activity Estimated Tax in Oregon.

Q: What is the purpose of OR-QUP-CAT (150-106-009)?

A: The purpose of OR-QUP-CAT (150-106-009) is to report and pay any underpayment of the Oregon Corporate Activity Estimated Tax.

Q: Who needs to file OR-QUP-CAT (150-106-009)?

A: Businesses or corporations that have underpaid the Oregon Corporate Activity Estimated Tax need to file OR-QUP-CAT (150-106-009).

Q: How do I file OR-QUP-CAT (150-106-009)?

A: OR-QUP-CAT (150-106-009) can be filed by completing the form and sending it to the Oregon Department of Revenue along with the payment for the underpaid tax.

Q: When is the deadline for filing OR-QUP-CAT (150-106-009)?

A: The deadline for filing OR-QUP-CAT (150-106-009) is usually the same as the deadline for filing Oregon Corporate Activity Estimated Tax, which is generally the 15th day of the month following the end of the tax year.

Q: What happens if I don't file OR-QUP-CAT (150-106-009)?

A: If you don't file OR-QUP-CAT (150-106-009) or pay the underpaid tax, you may be subject to penalties and interest charges by the Oregon Department of Revenue.

Form Details:

- Released on October 12, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-QUP-CAT (150-106-009) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.