This version of the form is not currently in use and is provided for reference only. Download this version of

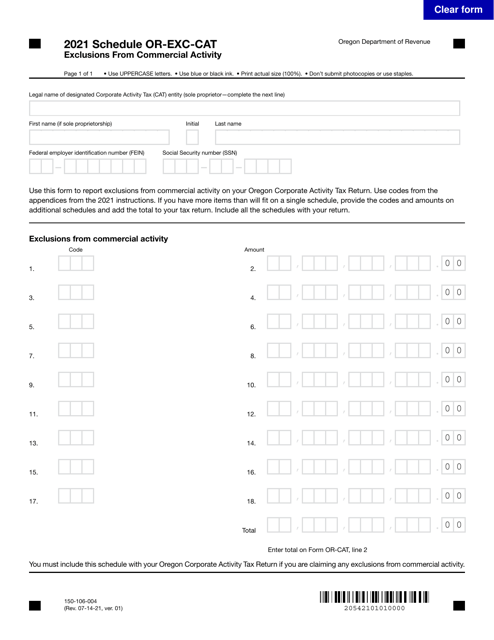

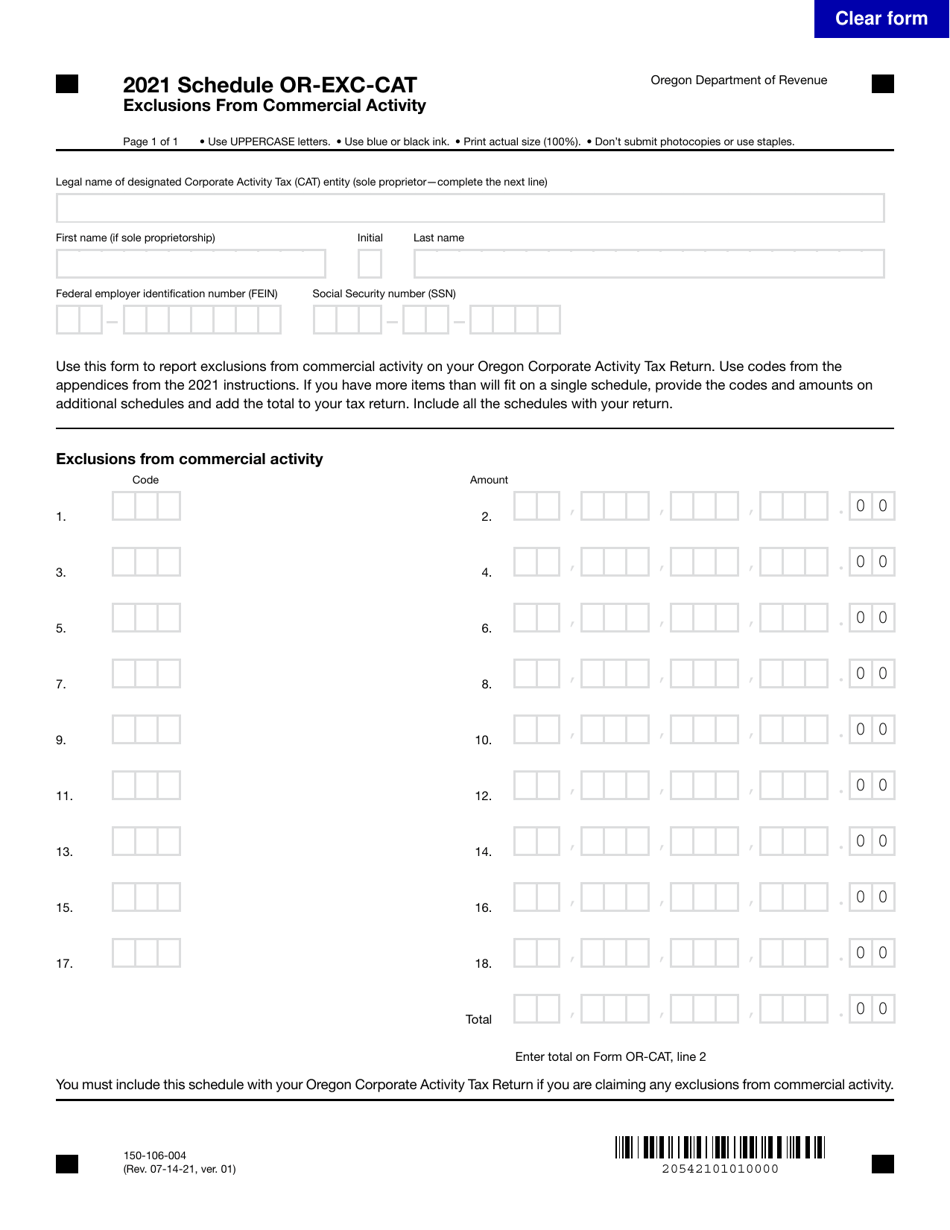

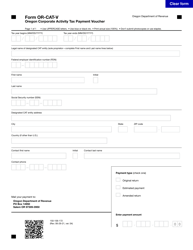

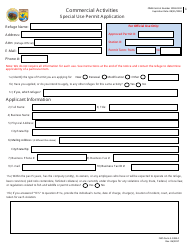

Form 150-106-004 Schedule OR-EXC-CAT

for the current year.

Form 150-106-004 Schedule OR-EXC-CAT Exclusions From Commercial Activity - Oregon

What Is Form 150-106-004 Schedule OR-EXC-CAT?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

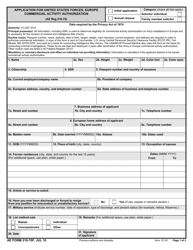

Q: What is Form 150-106-004 Schedule OR-EXC-CAT?

A: Form 150-106-004 Schedule OR-EXC-CAT is a form used to report exclusions from commercial activity in the state of Oregon.

Q: What does the form cover?

A: The form covers reporting exclusions from commercial activity in Oregon.

Q: Who is required to file Form 150-106-004 Schedule OR-EXC-CAT?

A: Any individual or business that has exclusions from commercial activity in Oregon is required to file this form.

Q: Is this form only for residents of Oregon?

A: No, this form is for anyone who has exclusions from commercial activity in Oregon, regardless of residency.

Q: What information do I need to complete the form?

A: You will need to provide details about the exclusions from commercial activity, including the type of activity and the amount of exclusion.

Q: When is the deadline to file Form 150-106-004 Schedule OR-EXC-CAT?

A: The deadline to file the form is typically April 15th of each year.

Q: Are there any penalties for not filing this form?

A: Yes, failure to file or filing late may result in penalties imposed by the Oregon Department of Revenue.

Q: I have more questions about this form, who should I contact?

A: For any further questions or assistance, you should contact the Oregon Department of Revenue.

Form Details:

- Released on July 14, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-106-004 Schedule OR-EXC-CAT by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.