This version of the form is not currently in use and is provided for reference only. Download this version of

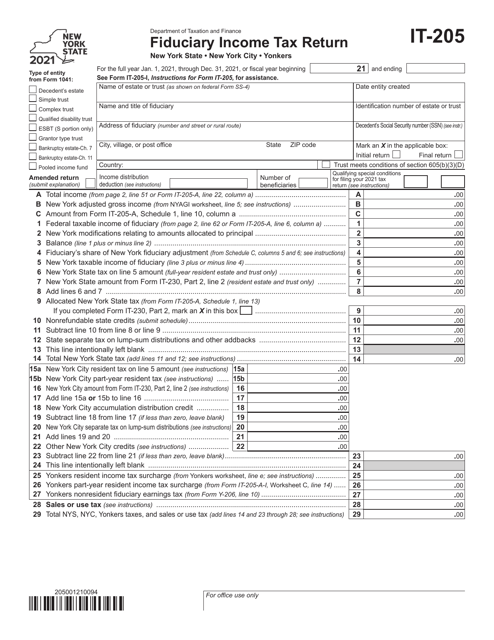

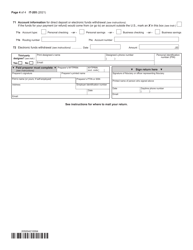

Form IT-205

for the current year.

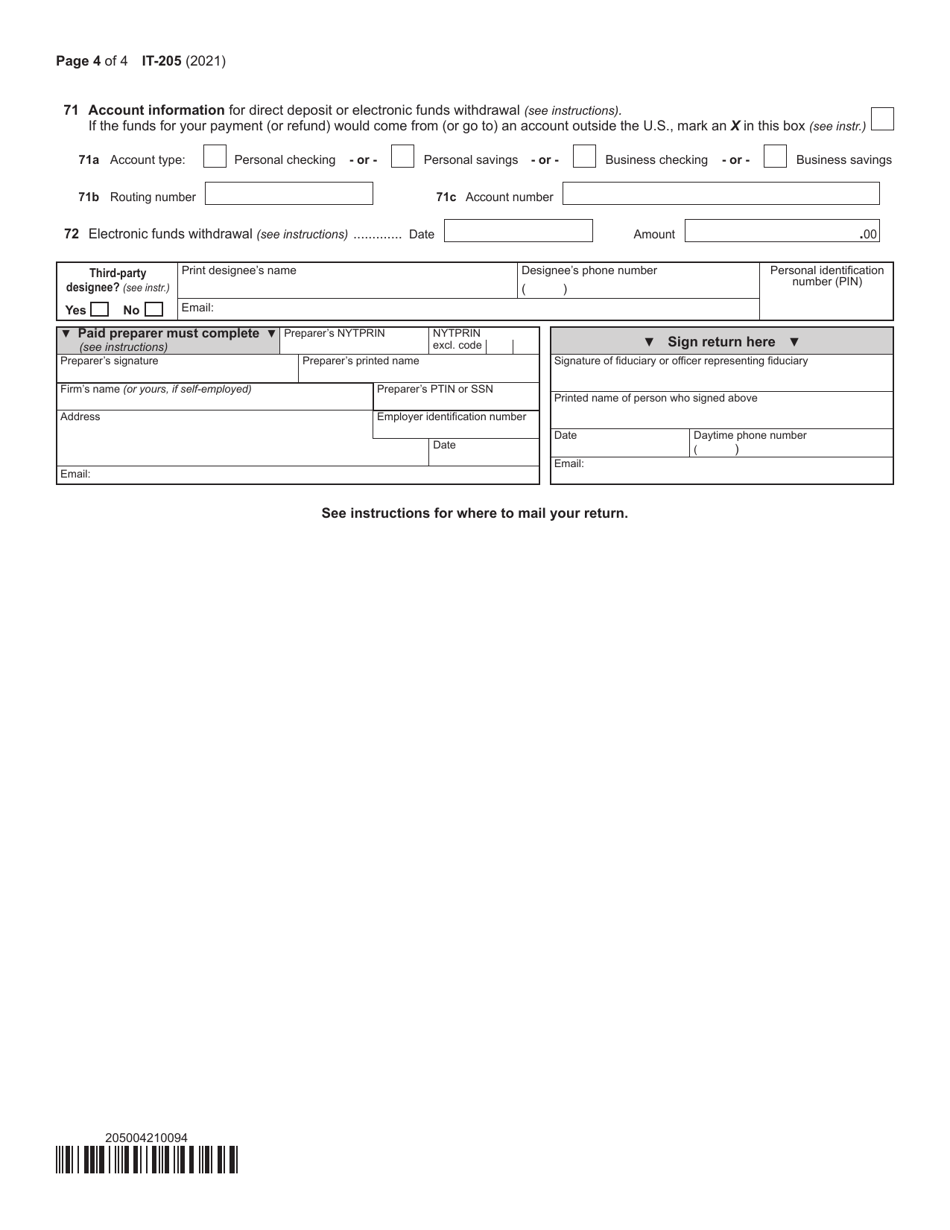

Form IT-205 Fiduciary Income Tax Return - New York

What Is Form IT-205?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205?

A: Form IT-205 is the Fiduciary Income Tax Return for New York State.

Q: Who needs to file Form IT-205?

A: Form IT-205 must be filed by fiduciaries who are responsible for filing income taxes on behalf of a decedent's estate, a trust, or certain other entities in New York State.

Q: What is the purpose of Form IT-205?

A: The purpose of Form IT-205 is to report and calculate the income, deductions, and taxes owed by a fiduciary entity in New York State.

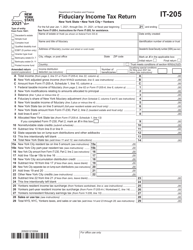

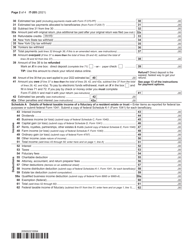

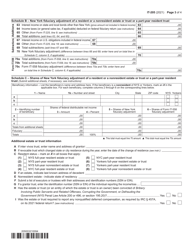

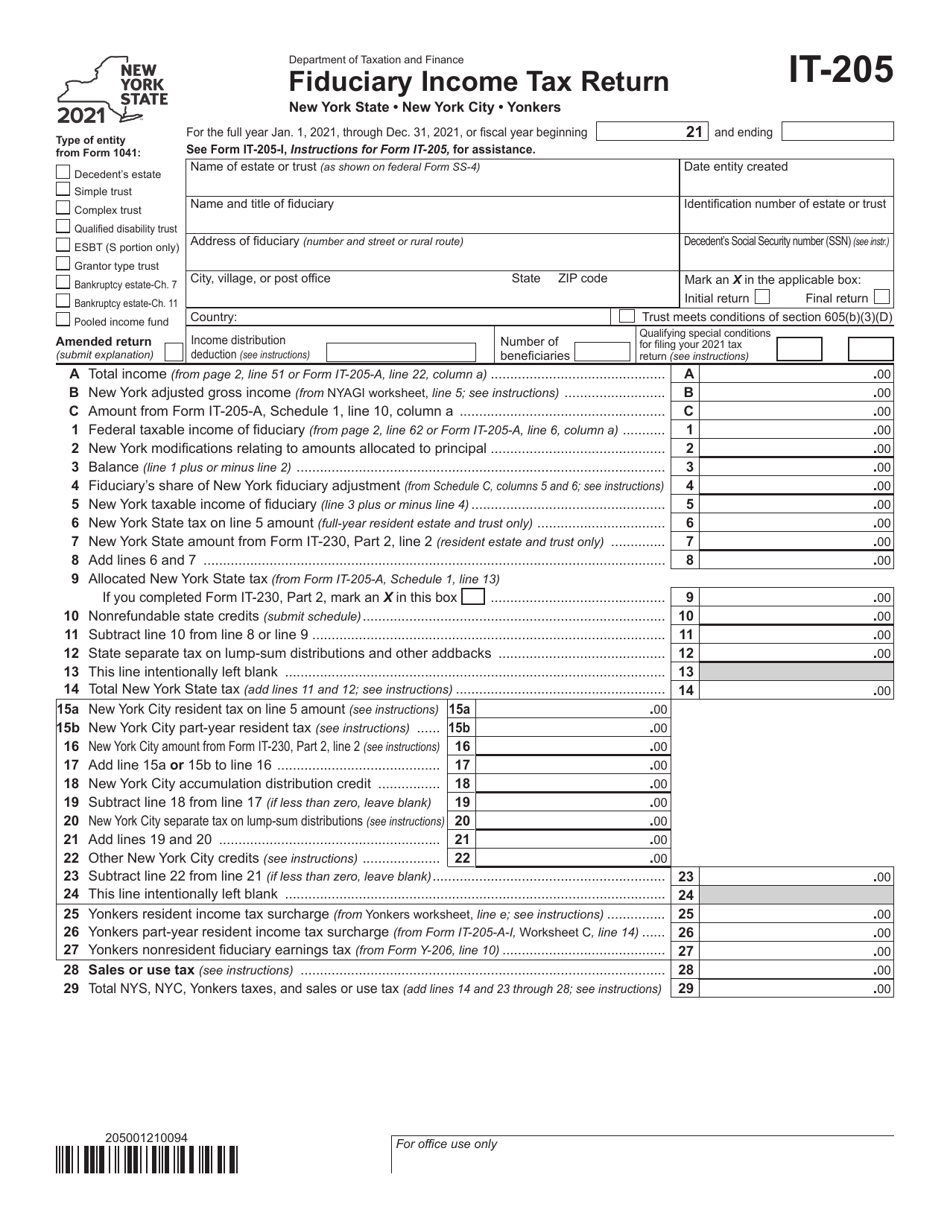

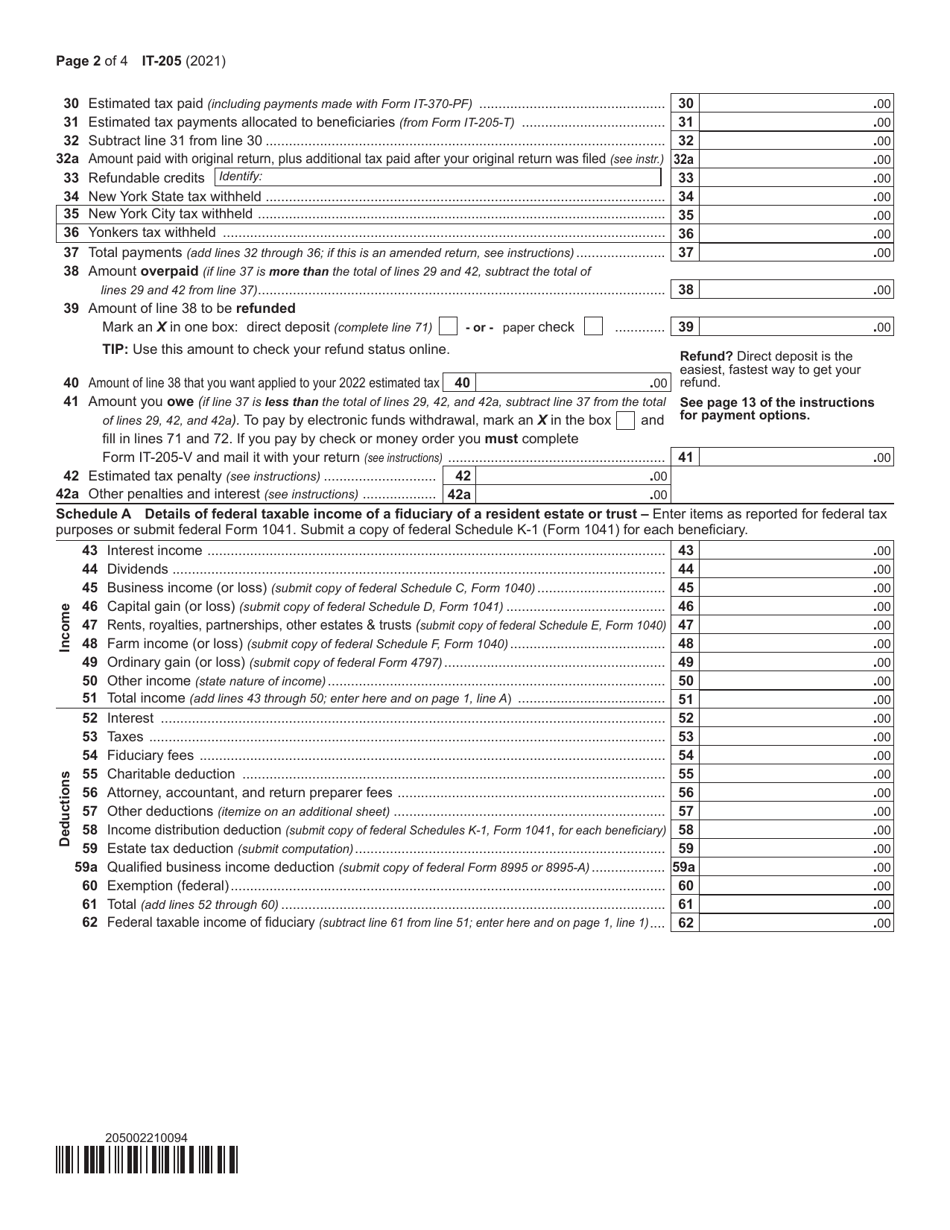

Q: What are some common attachments to Form IT-205?

A: Some common attachments to Form IT-205 include Schedules A, B, C, and D, which report specific types of income, deductions, and taxes.

Q: When is Form IT-205 due?

A: Form IT-205 is due on the 15th day of the 4th month following the close of the fiduciary entity's tax year.

Q: Are there any penalties for late filing of Form IT-205?

A: Yes, there are penalties for late filing of Form IT-205. It is important to file the return and pay any taxes owed by the due date to avoid penalties and interest.

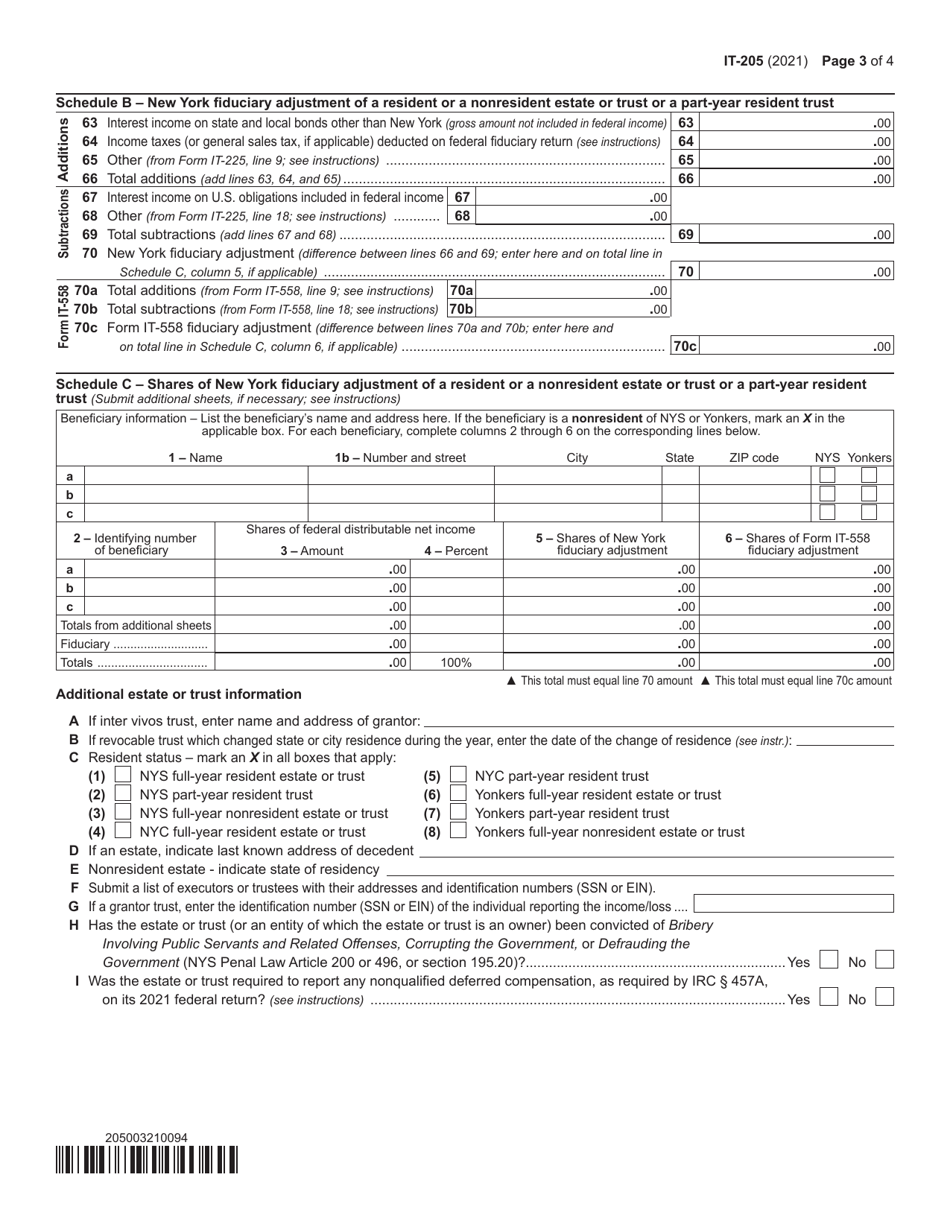

Q: Can Form IT-205 be e-filed?

A: No, Form IT-205 cannot be e-filed. It must be printed and mailed to the New York State Department of Taxation and Finance.

Q: Is Form IT-205 required for federal income tax purposes?

A: No, Form IT-205 is specific to New York State and is not required for federal incometax purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.