This version of the form is not currently in use and is provided for reference only. Download this version of

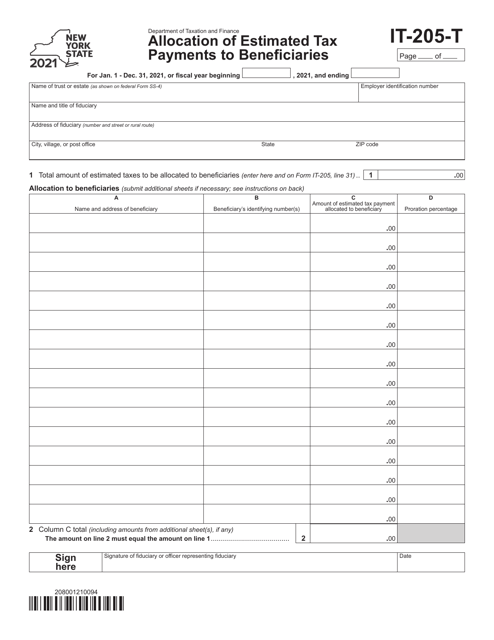

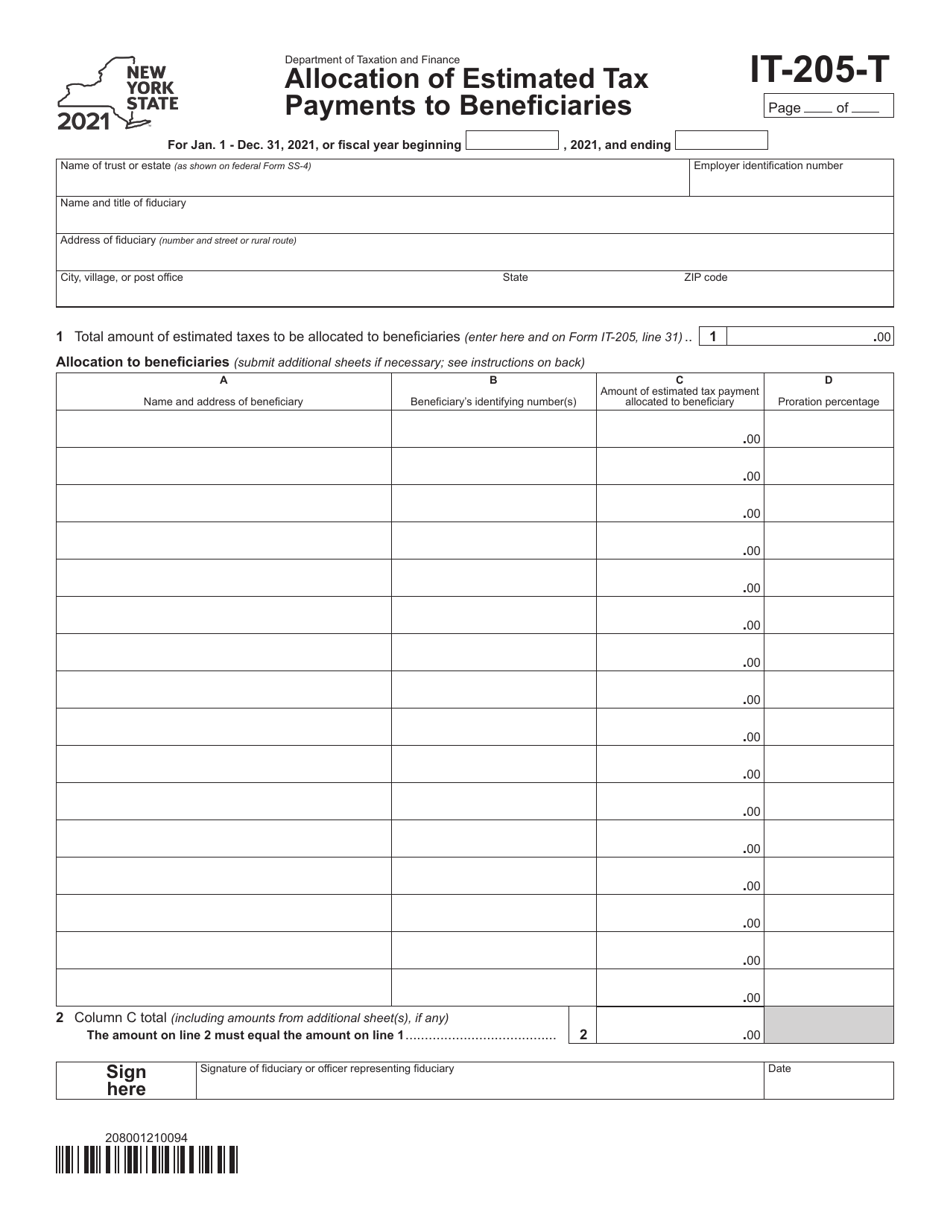

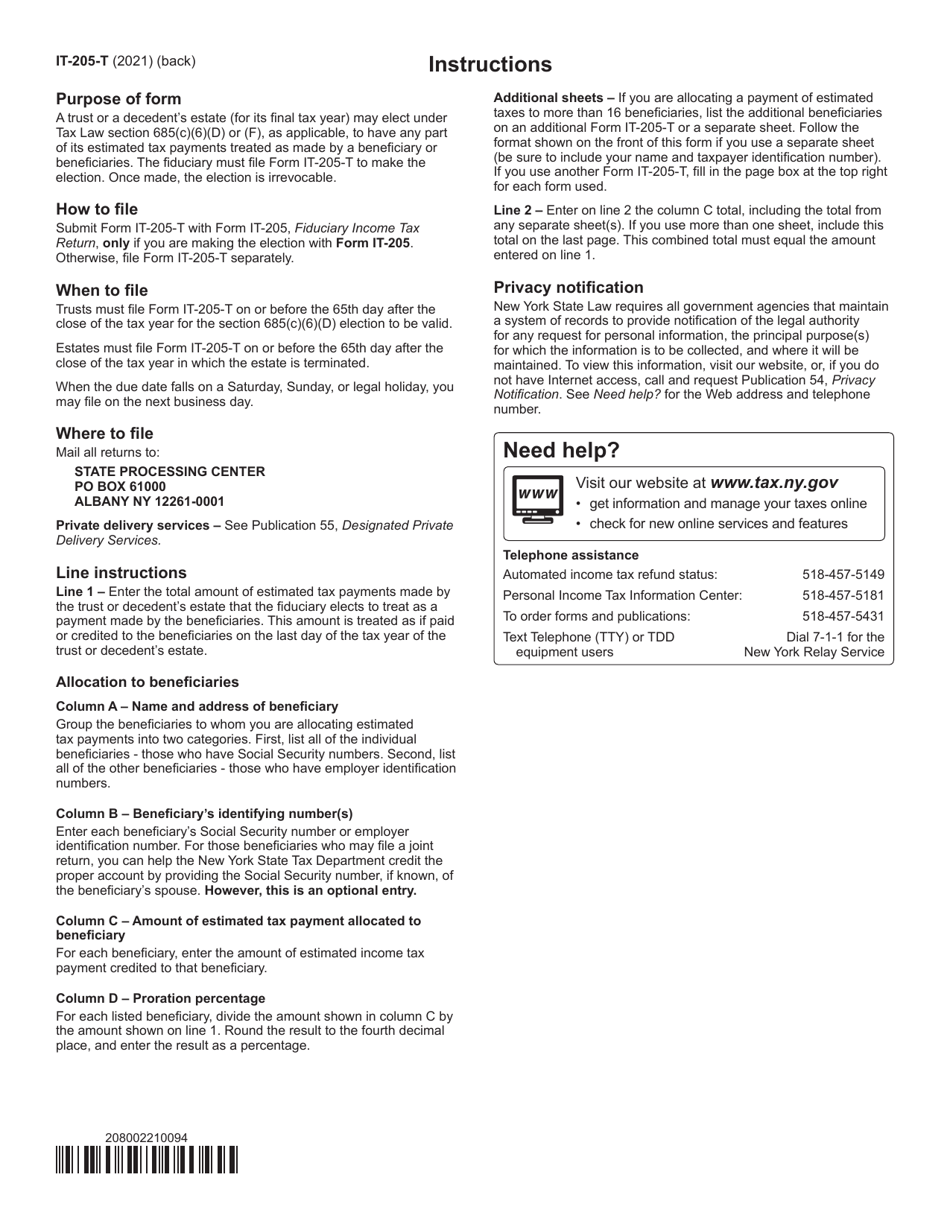

Form IT-205-T

for the current year.

Form IT-205-T Allocation of Estimated Tax Payments to Beneficiaries - New York

What Is Form IT-205-T?

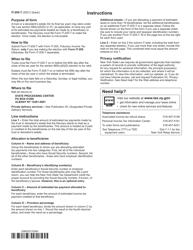

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-205-T?

A: Form IT-205-T is the Allocation of Estimated Tax Payments to Beneficiaries form for New York.

Q: Who needs to file Form IT-205-T?

A: Individuals who are beneficiaries of certain trusts and estates in New York may need to file Form IT-205-T.

Q: What is the purpose of Form IT-205-T?

A: Form IT-205-T is used to allocate estimated tax payments made by a trust or estate to its beneficiaries.

Q: When is Form IT-205-T due?

A: Form IT-205-T is due by April 15th of the year following the tax year.

Q: Is there a penalty for not filing Form IT-205-T?

A: Yes, there may be penalties for not filing Form IT-205-T or for filing it late. It is important to file the form and pay any required taxes on time.

Q: Can I file Form IT-205-T electronically?

A: Yes, Form IT-205-T can be filed electronically using approved e-file software.

Q: Is Form IT-205-T applicable in Canada?

A: No, Form IT-205-T is specific to New York and does not apply to Canada.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-T by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.