This version of the form is not currently in use and is provided for reference only. Download this version of

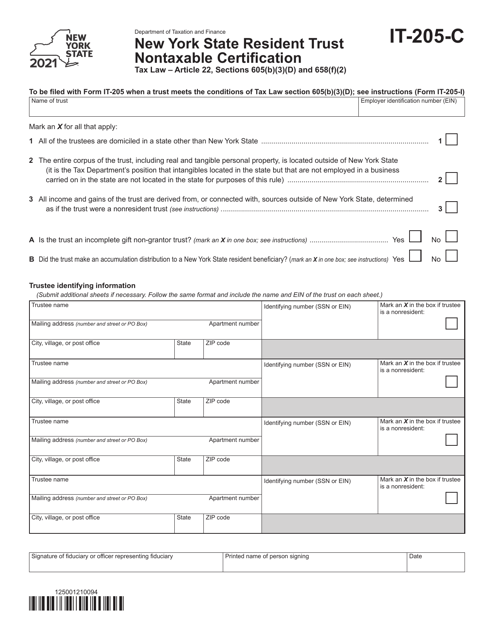

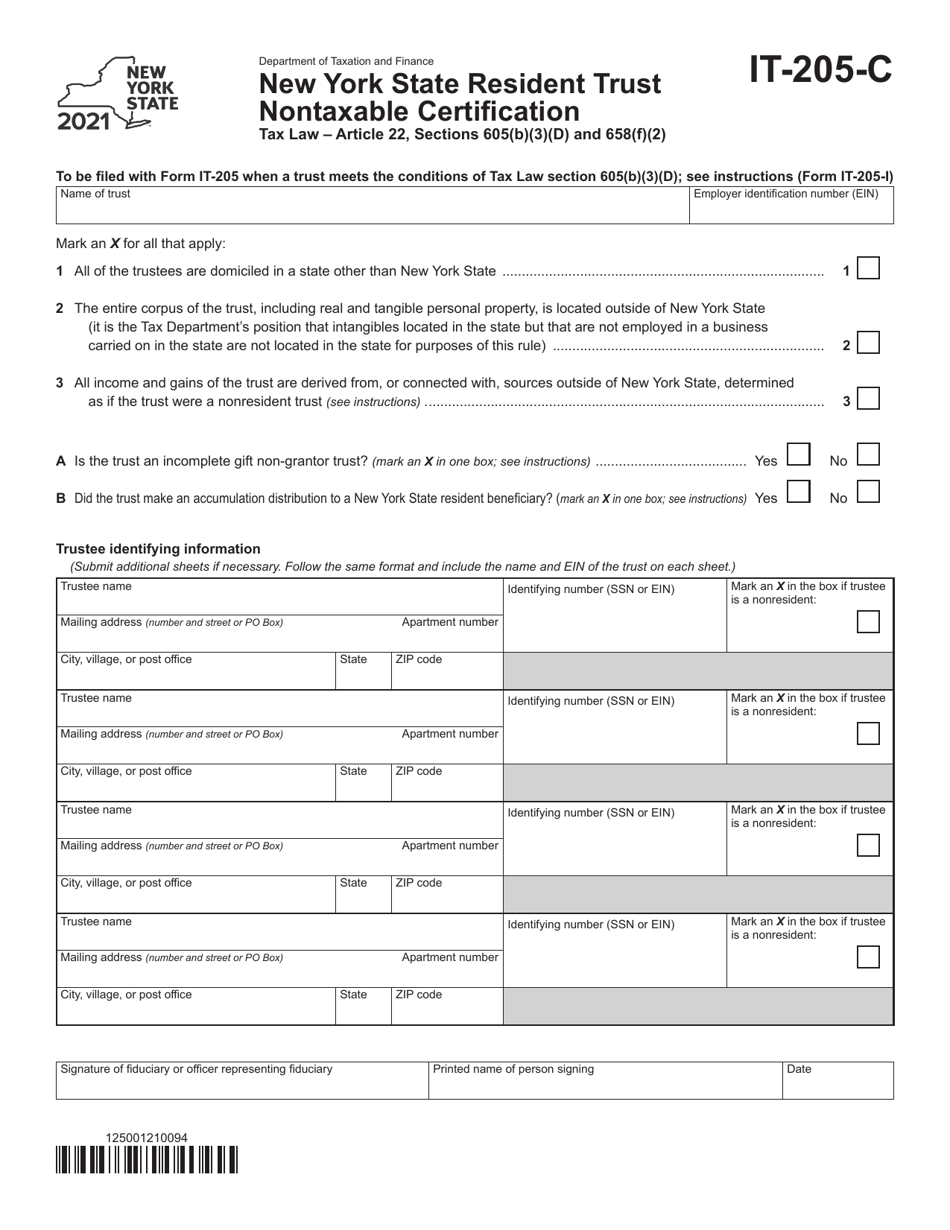

Form IT-205-C

for the current year.

Form IT-205-C New York State Resident Trust Nontaxable Certification - New York

What Is Form IT-205-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-205-C?

A: Form IT-205-C is the New York State Resident Trust Nontaxable Certification.

Q: Who needs to file Form IT-205-C?

A: Residents of New York State who have a trust that qualifies as a nontaxable entity for state tax purposes.

Q: What is the purpose of Form IT-205-C?

A: The purpose of Form IT-205-C is to certify that a trust is nontaxable in New York State.

Q: When is Form IT-205-C due?

A: Form IT-205-C is due on the same date as the New York State income tax return for the trust.

Q: Are there any penalties for not filing Form IT-205-C?

A: Yes, there may be penalties for failing to file or filing an incomplete or inaccurate Form IT-205-C. It is important to fulfill all tax filing requirements.

Q: Can I e-file Form IT-205-C?

A: No, Form IT-205-C is not eligible for e-filing. It must be filed by mail.

Q: Are there any fees associated with filing Form IT-205-C?

A: No, there are no fees for filing Form IT-205-C.

Q: Is Form IT-205-C only for residents of New York State?

A: Yes, Form IT-205-C is specifically for residents of New York State.

Q: What supporting documents should be attached to Form IT-205-C?

A: There are no specific supporting documents required to be attached to Form IT-205-C.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.