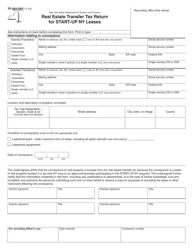

This version of the form is not currently in use and is provided for reference only. Download this version of

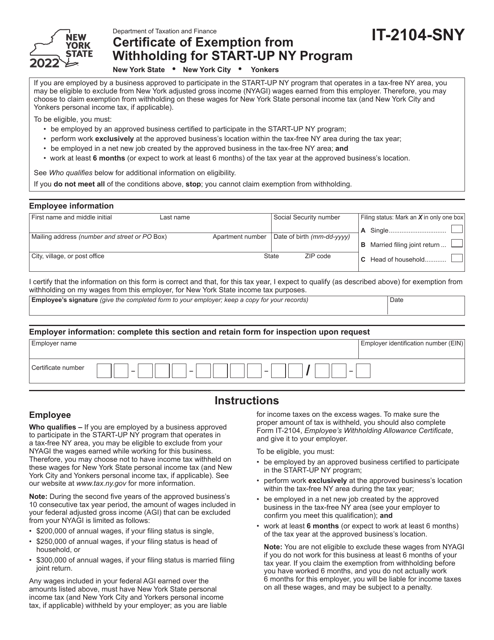

Form IT-2104-SNY

for the current year.

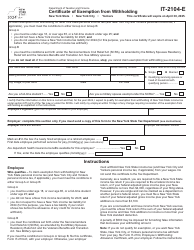

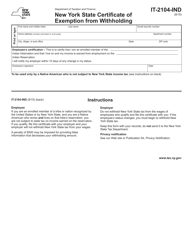

Form IT-2104-SNY Certificate of Exemption From Withholding for Start-Up Ny Program - New York

What Is Form IT-2104-SNY?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2104-SNY?

A: Form IT-2104-SNY is the Certificate of Exemption From Withholding for Start-Up NY Program in New York.

Q: What is the purpose of Form IT-2104-SNY?

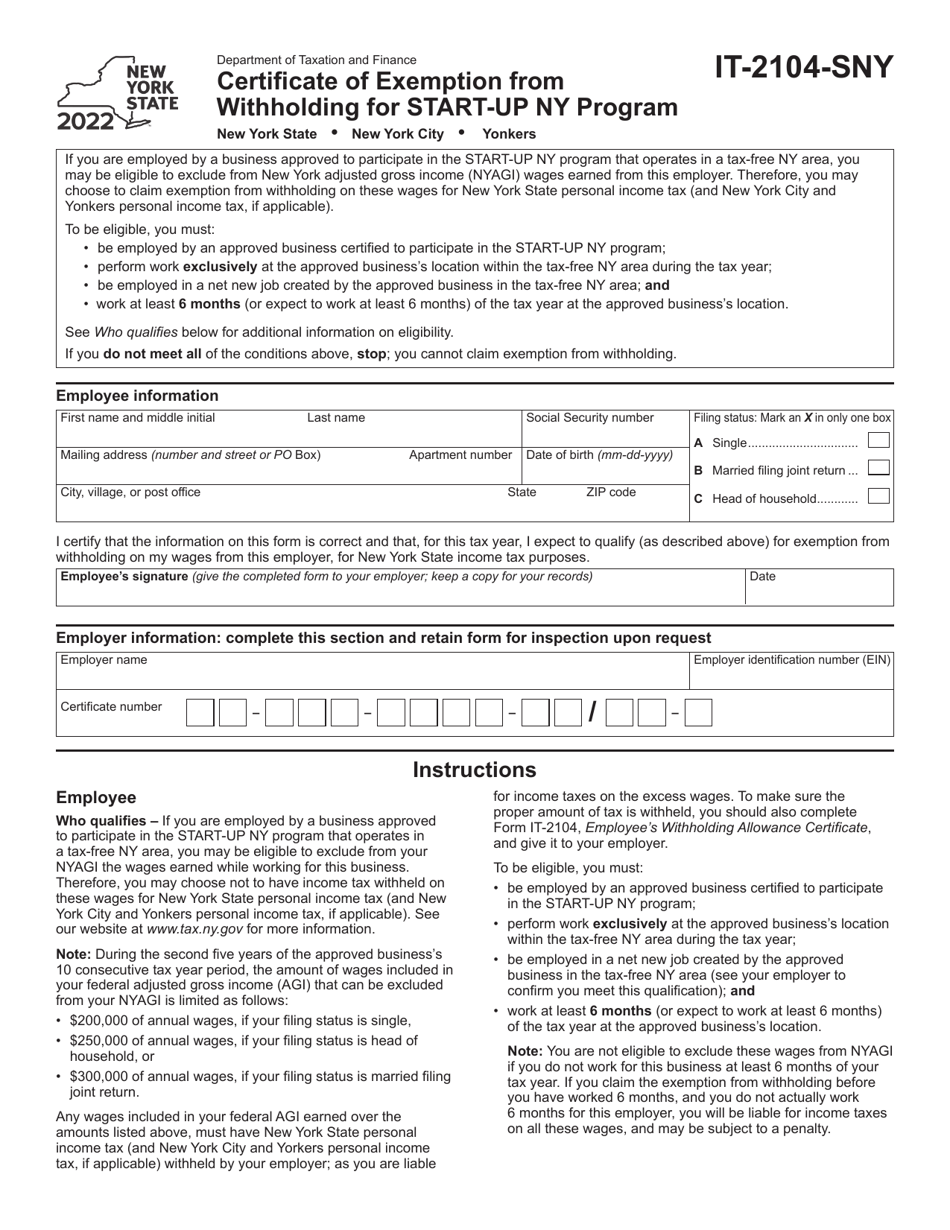

A: The purpose of Form IT-2104-SNY is to claim exemption from withholding taxes for participants in the Start-Up NY Program in New York.

Q: Who should use Form IT-2104-SNY?

A: Participants in the Start-Up NY Program in New York should use Form IT-2104-SNY to claim exemption from withholding taxes.

Q: Is Form IT-2104-SNY only for residents of New York?

A: No, Form IT-2104-SNY can be used by both residents and non-residents of New York who are participating in the Start-Up NY Program.

Q: What information do I need to fill out Form IT-2104-SNY?

A: You will need to provide your personal information, including your name, address, social security number, and information about your participation in the Start-Up NY Program.

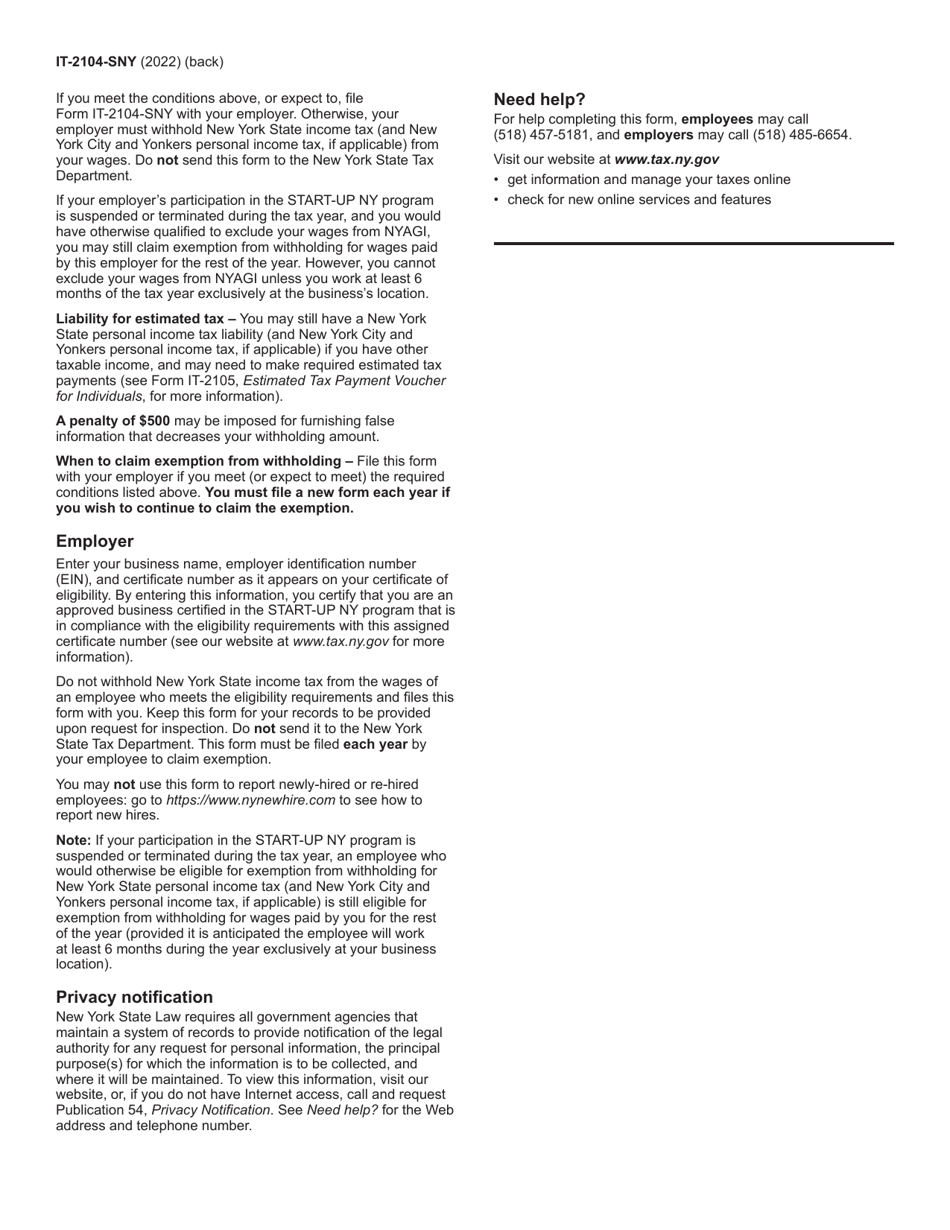

Q: When should I submit Form IT-2104-SNY?

A: You should submit Form IT-2104-SNY to your employer as soon as possible, preferably before the first payment of wages subject to withholding.

Q: Can I claim exemption from withholding for other reasons?

A: No, Form IT-2104-SNY is specifically for claiming exemption from withholding for participants in the Start-Up NY Program.

Q: What happens if I don't submit Form IT-2104-SNY?

A: If you don't submit Form IT-2104-SNY, your employer will withhold taxes from your wages as required by law.

Q: Can I change my withholding status after submitting Form IT-2104-SNY?

A: Yes, you can change your withholding status by submitting a new Form IT-2104-SNY to your employer.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-SNY by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.