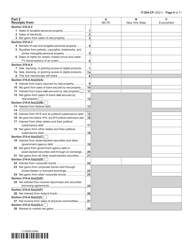

This version of the form is not currently in use and is provided for reference only. Download this version of

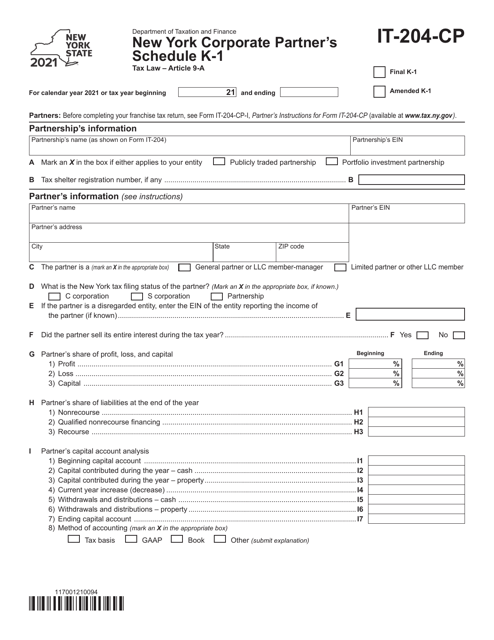

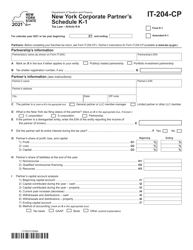

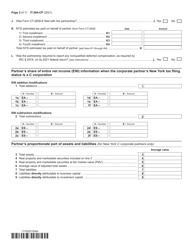

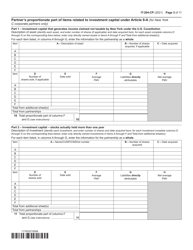

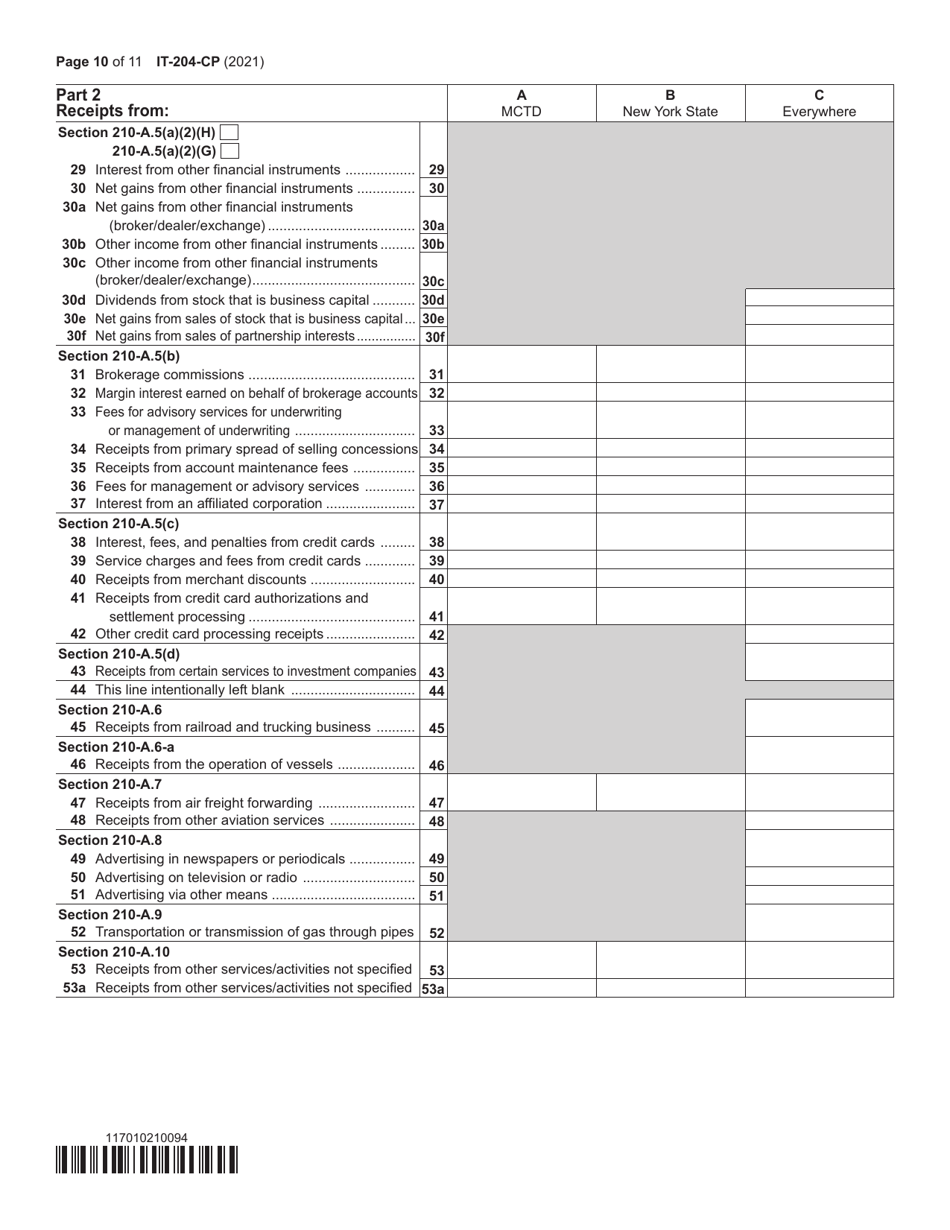

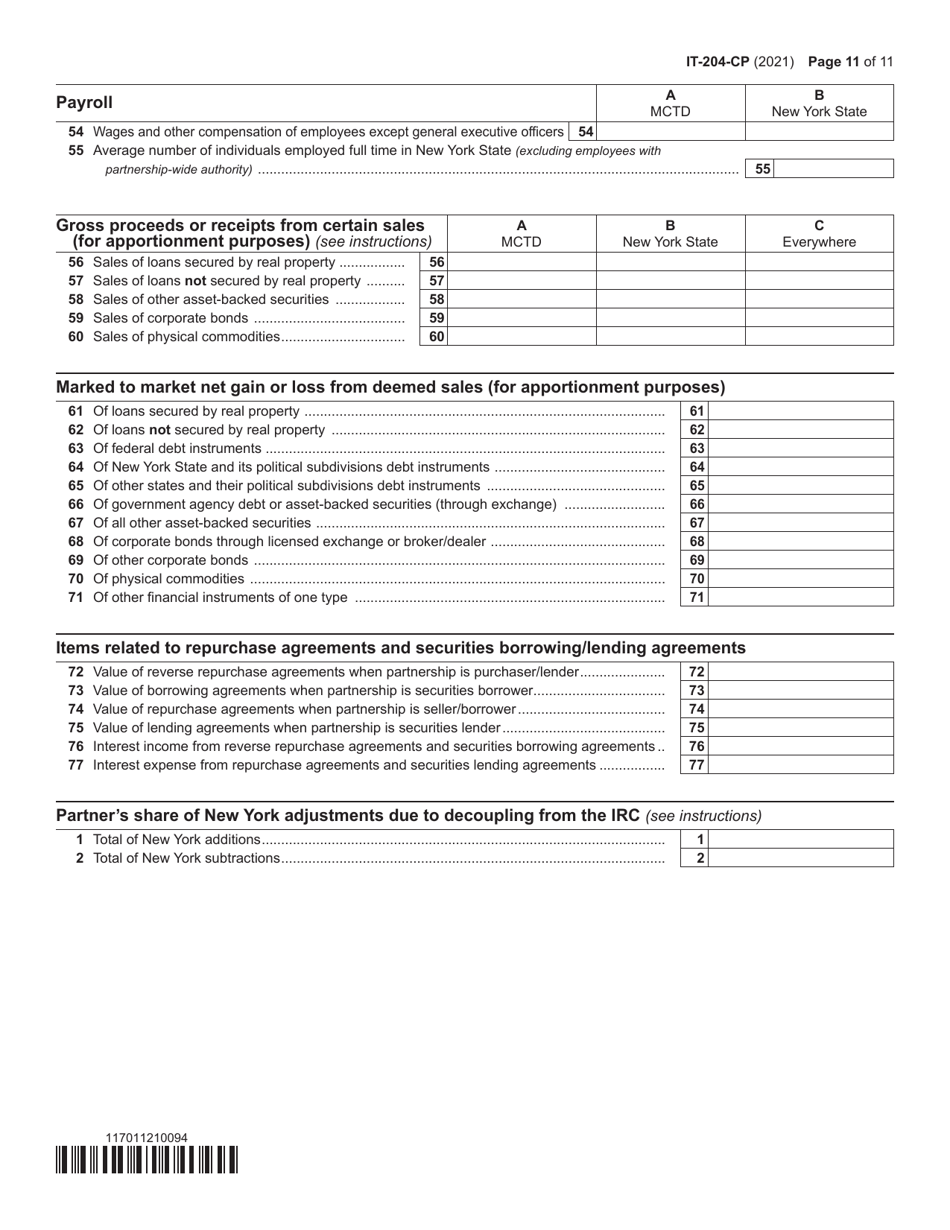

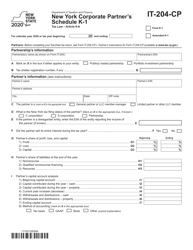

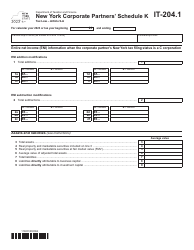

Form IT-204-CP Schedule K-1

for the current year.

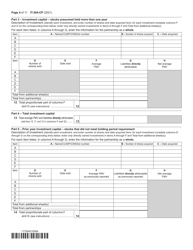

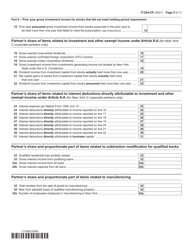

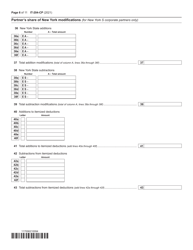

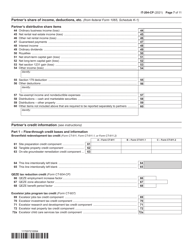

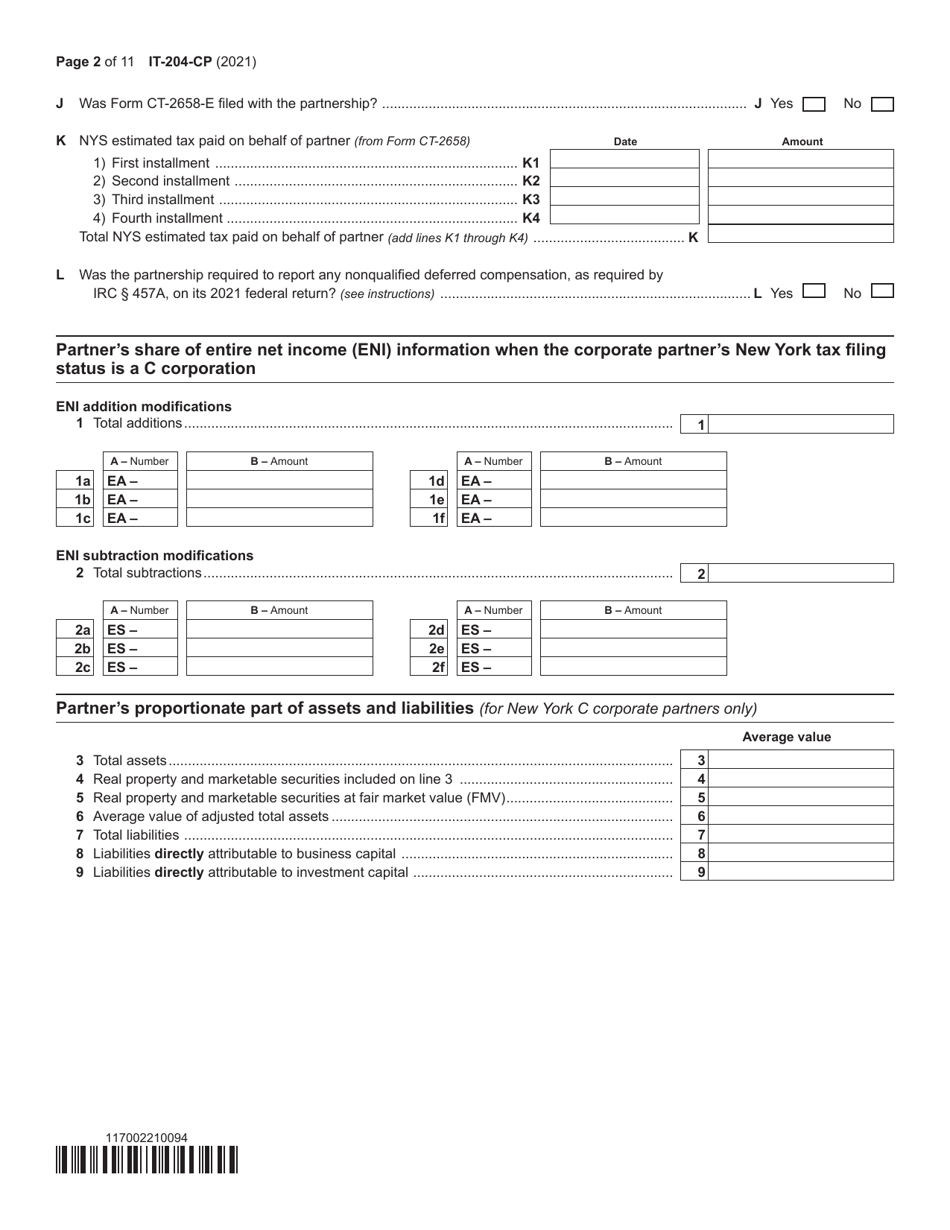

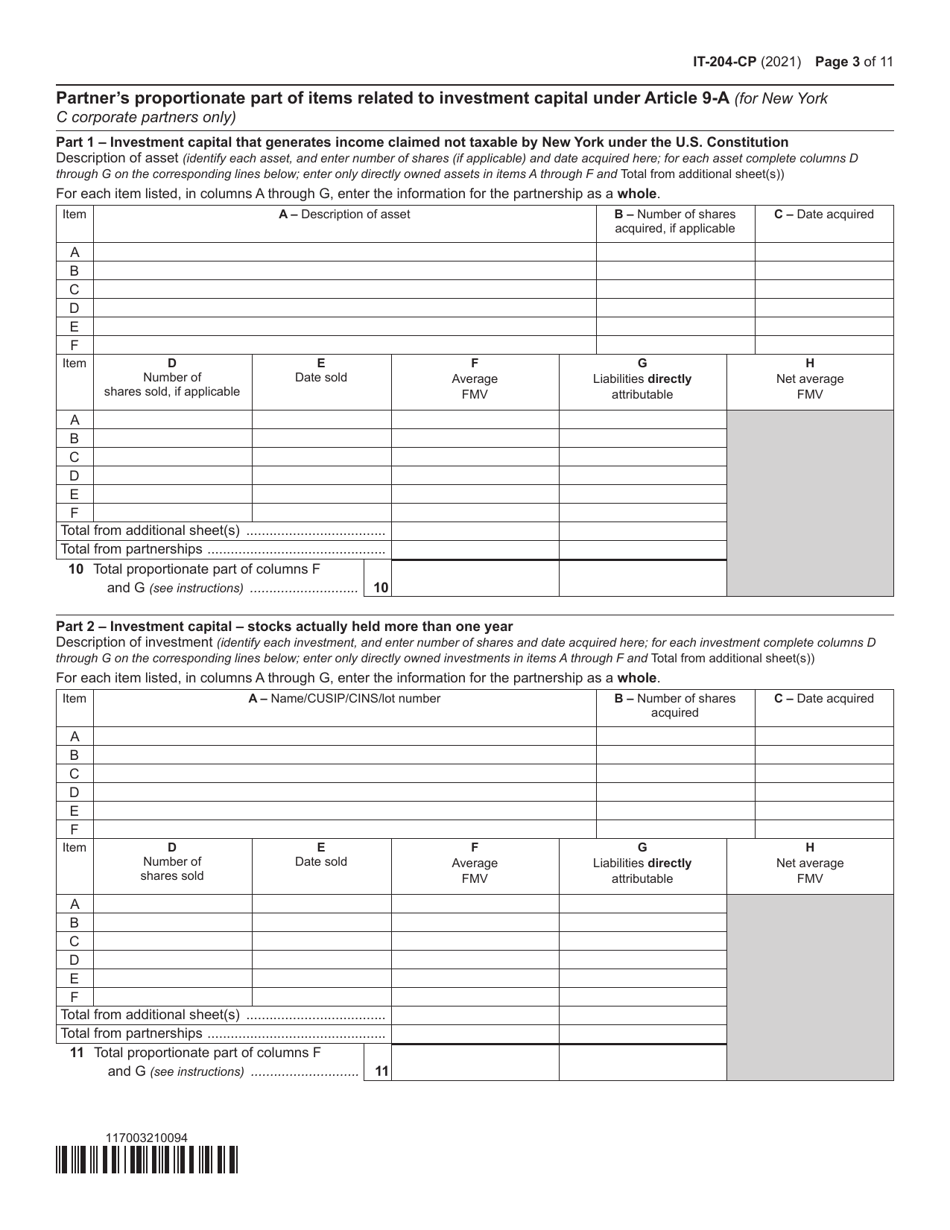

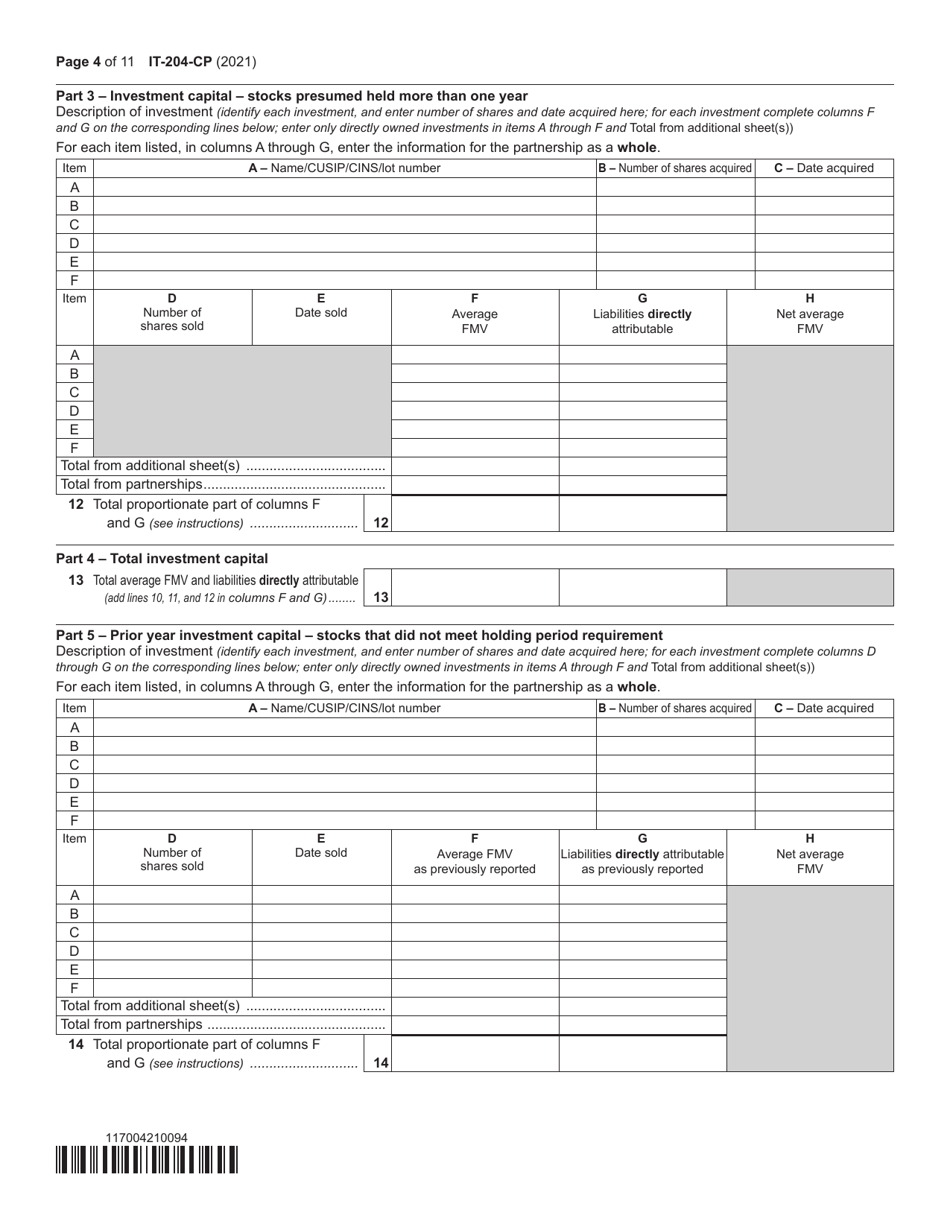

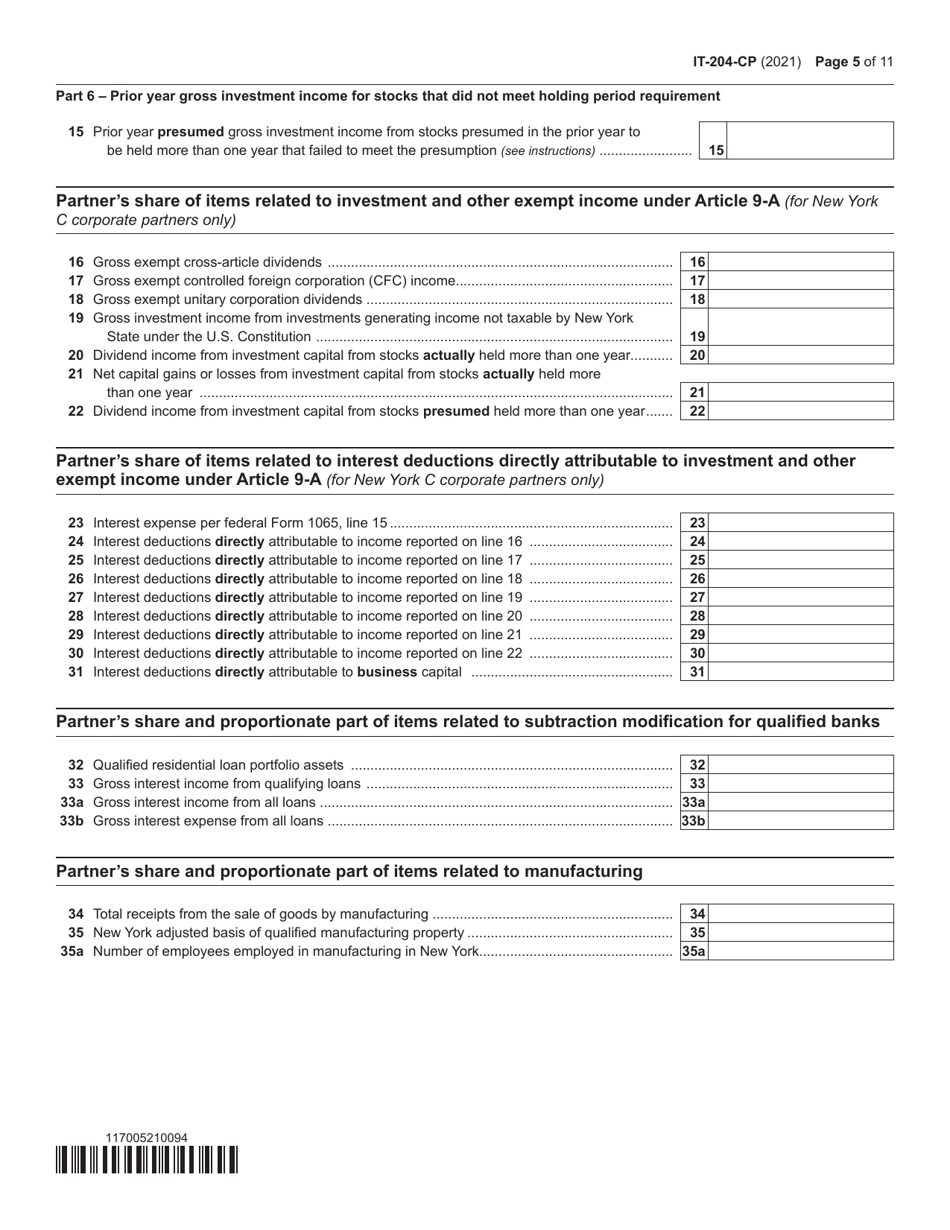

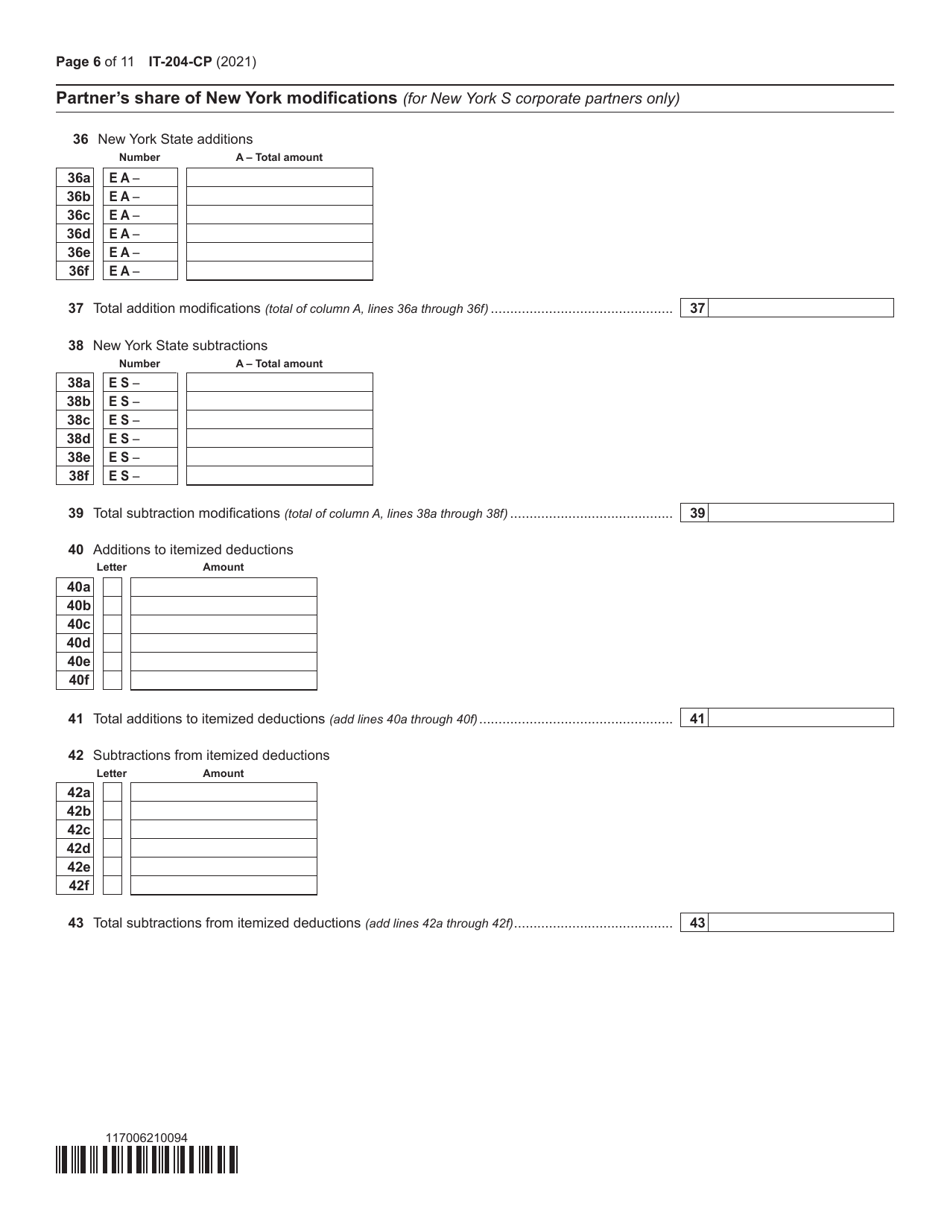

Form IT-204-CP Schedule K-1 New York Corporate Partner's Schedule - New York

What Is Form IT-204-CP Schedule K-1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-CP?

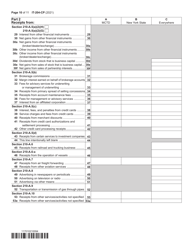

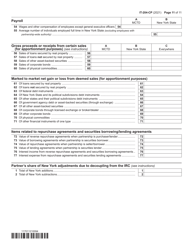

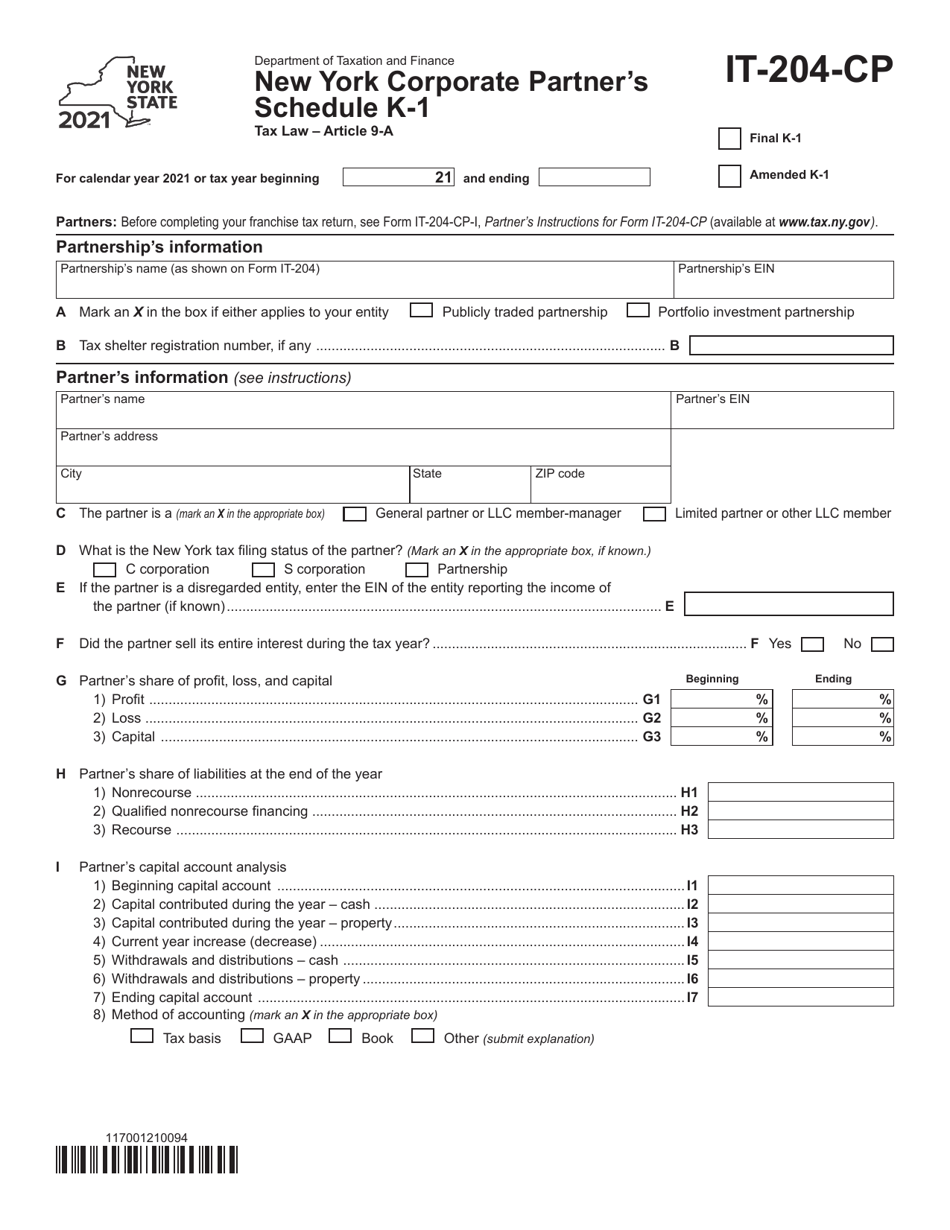

A: Form IT-204-CP is the New York Corporate Partner's Schedule.

Q: What is Schedule K-1?

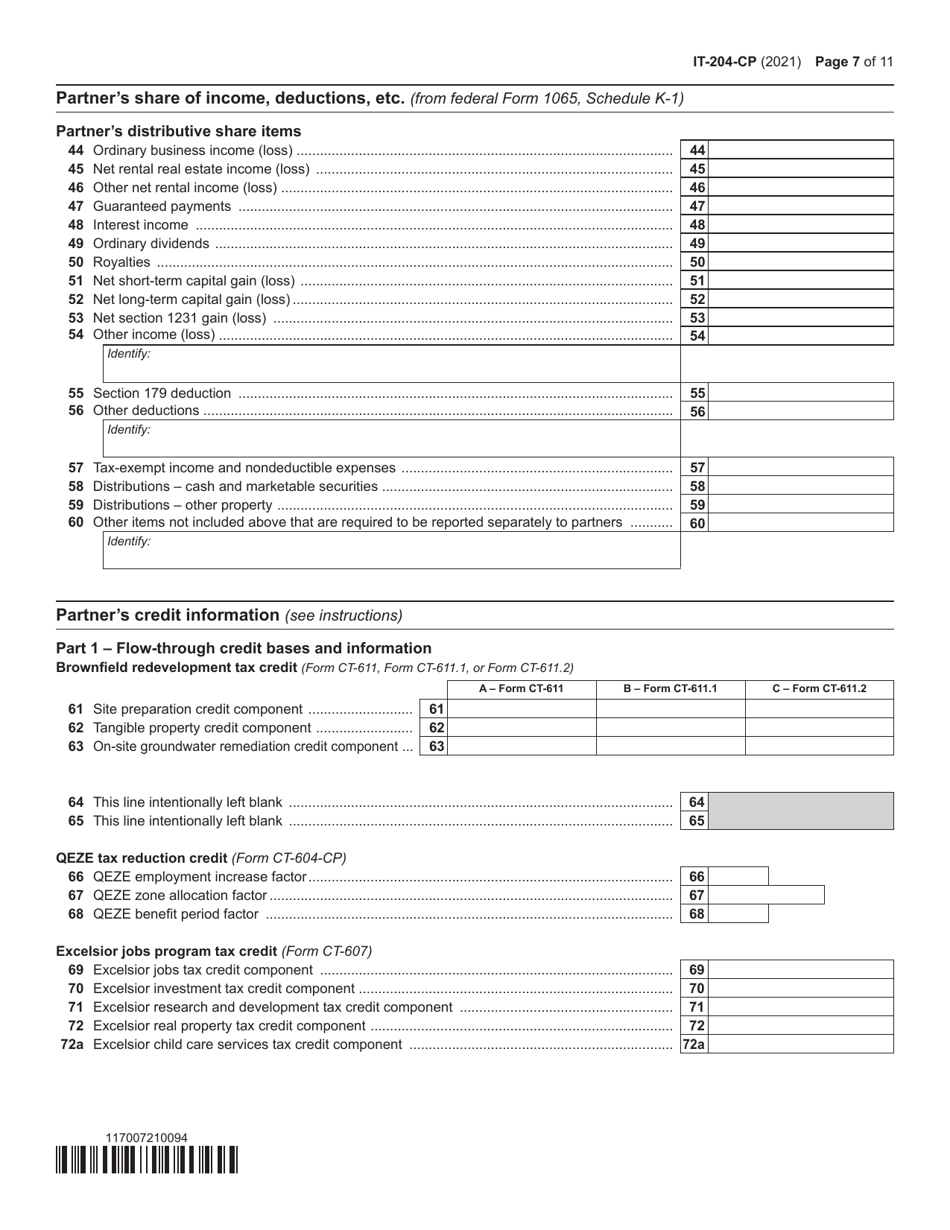

A: Schedule K-1 is a tax form used to report a partner's share of income, deductions, and credits from a partnership.

Q: What is the purpose of Form IT-204-CP?

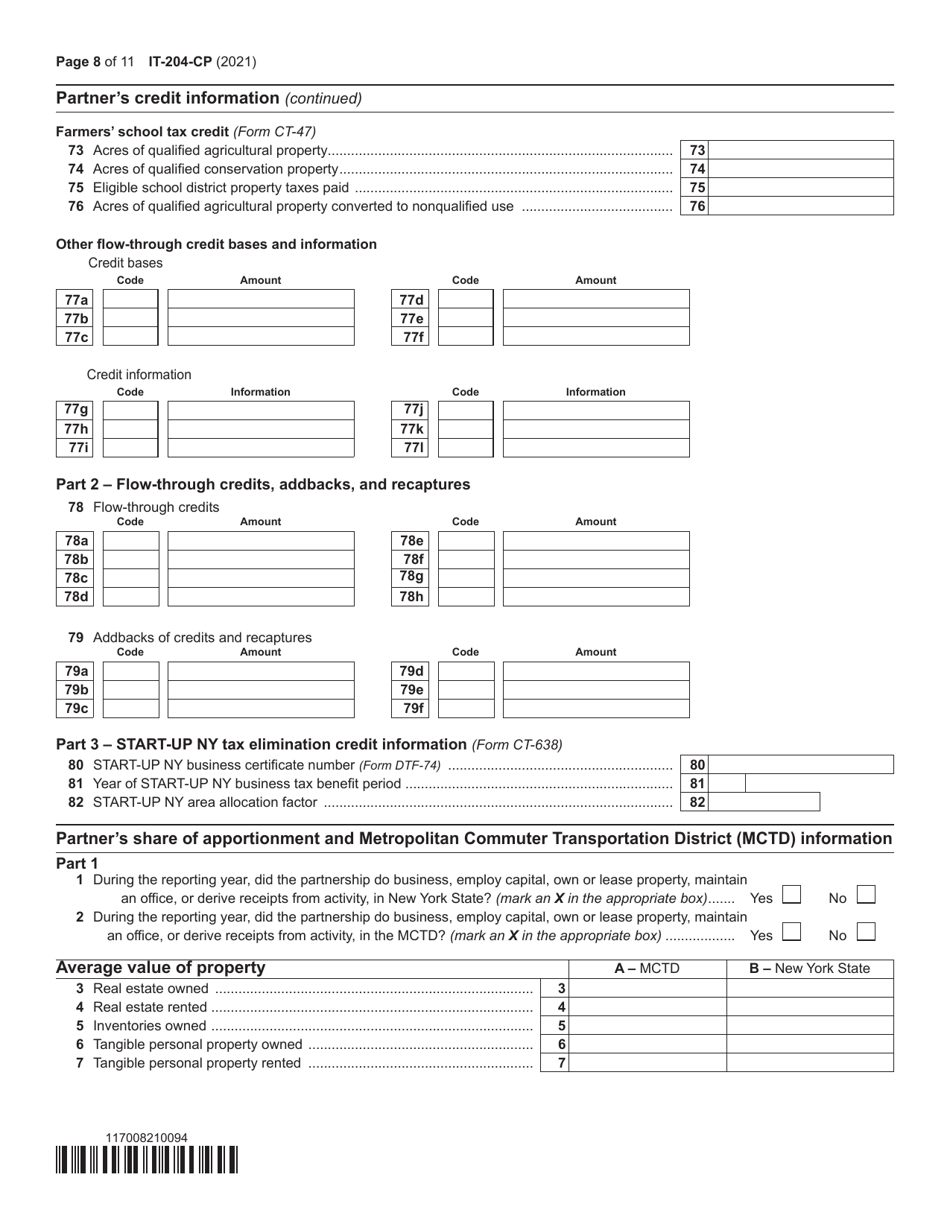

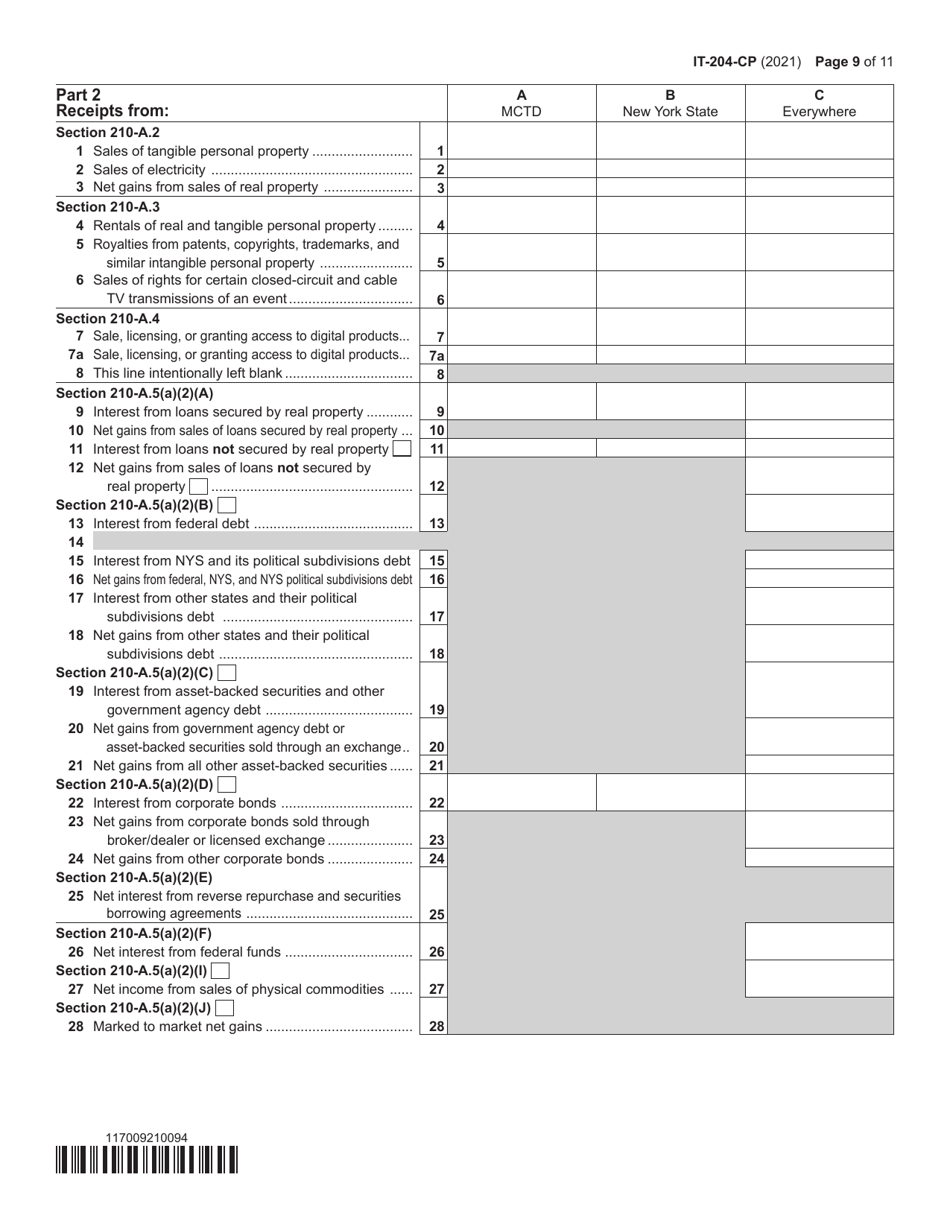

A: The purpose of Form IT-204-CP is to report the partner's distributive share of New York source income, modifications, and credits.

Q: Who is required to file Form IT-204-CP?

A: Form IT-204-CP must be filed by corporate partners who have a distributive share of New York source income from a partnership.

Q: What information is required on Form IT-204-CP?

A: Form IT-204-CP requires information such as the partner's name, address, Social Security number or EIN, and the partner's share of various income, deductions, modifications, and credits.

Q: When is the deadline to file Form IT-204-CP?

A: The deadline to file Form IT-204-CP is generally the fifteenth day of the fourth month following the close of the partnership's tax year.

Q: Are there any penalties for late filing of Form IT-204-CP?

A: Yes, there may be penalties for late filing of Form IT-204-CP, including potential interest charges on any unpaid tax liabilities.

Q: Can Form IT-204-CP be e-filed?

A: Yes, Form IT-204-CP can be e-filed using approved tax software or through a tax professional.

Q: Is it necessary to include a copy of Form IT-204-CP with the partner's personal income tax return?

A: Generally, it is not required to include a copy of Form IT-204-CP with the partner's personal income tax return. However, it is advisable to keep a copy for record-keeping purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-CP Schedule K-1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.