This version of the form is not currently in use and is provided for reference only. Download this version of

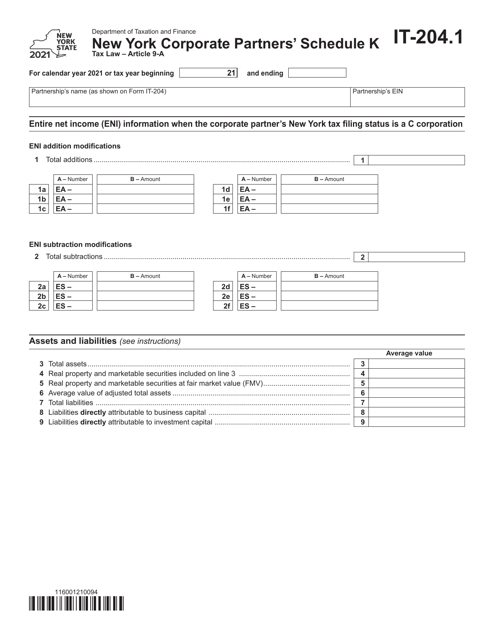

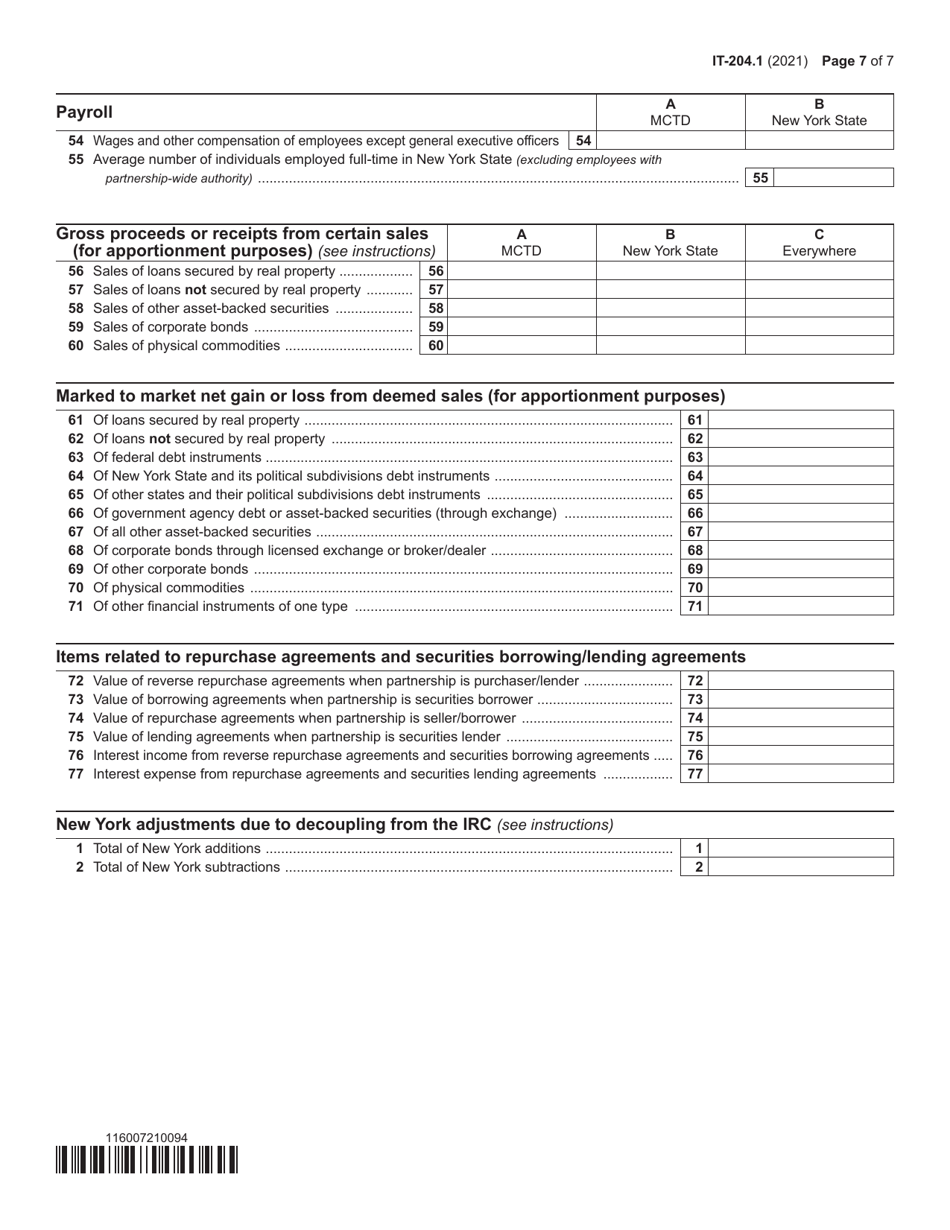

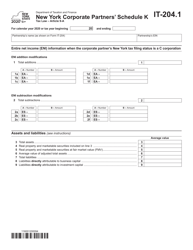

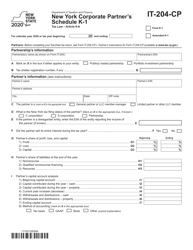

Form IT-204.1 Schedule K

for the current year.

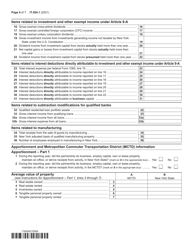

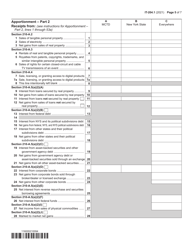

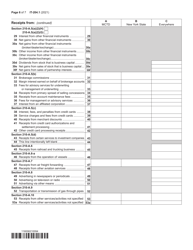

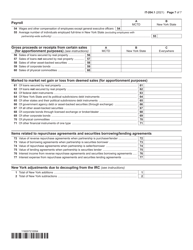

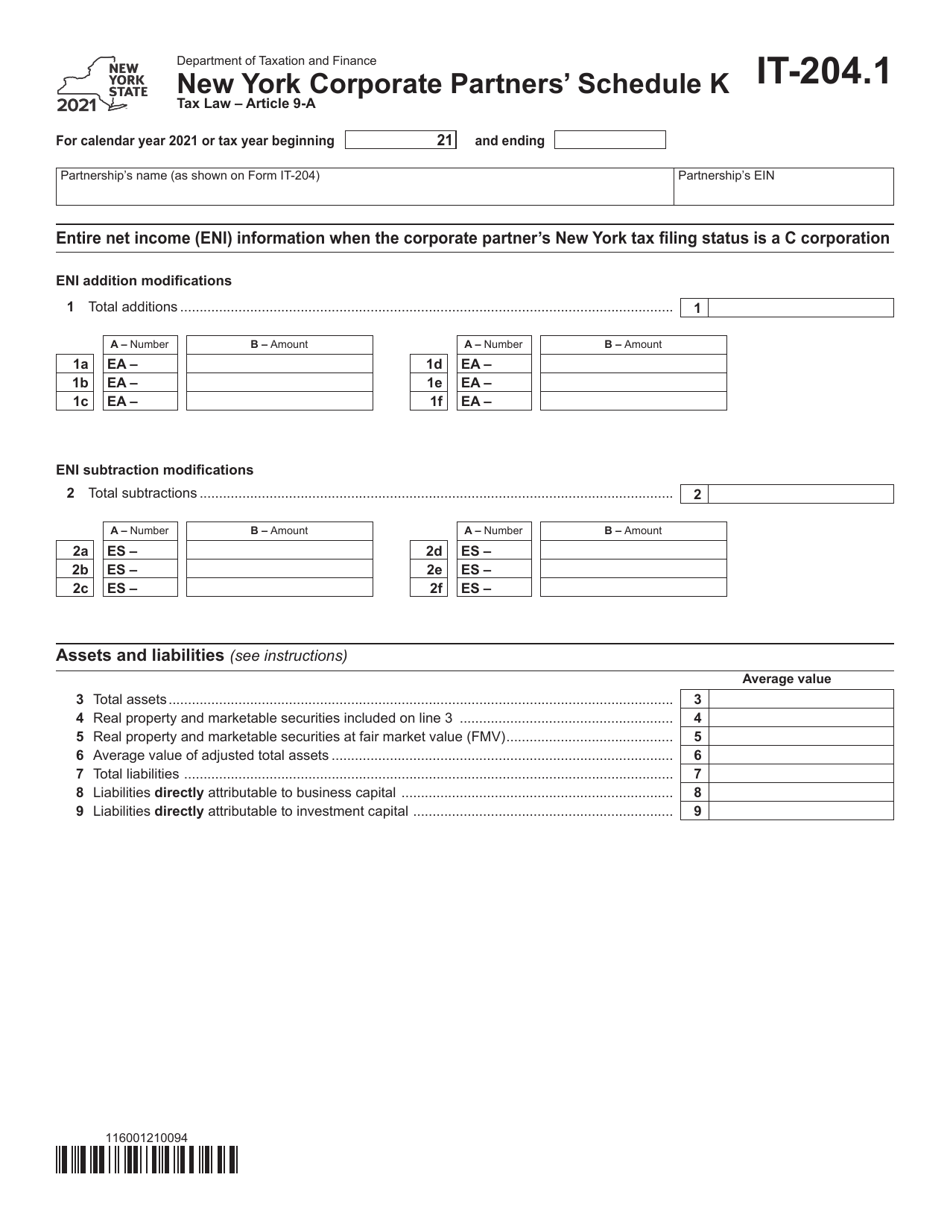

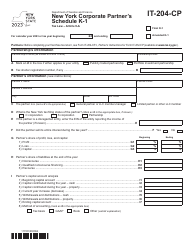

Form IT-204.1 Schedule K New York Corporate Partners' Schedule - New York

What Is Form IT-204.1 Schedule K?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204.1 Schedule K?

A: Form IT-204.1 Schedule K is a schedule used by New York corporations to report information about their partners who are also subject to New York taxes.

Q: Who needs to file Form IT-204.1 Schedule K?

A: New York corporations that have partners who are subject to New York taxes need to file Form IT-204.1 Schedule K.

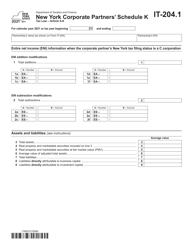

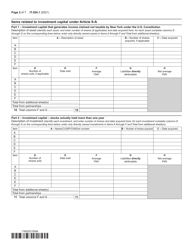

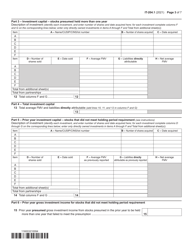

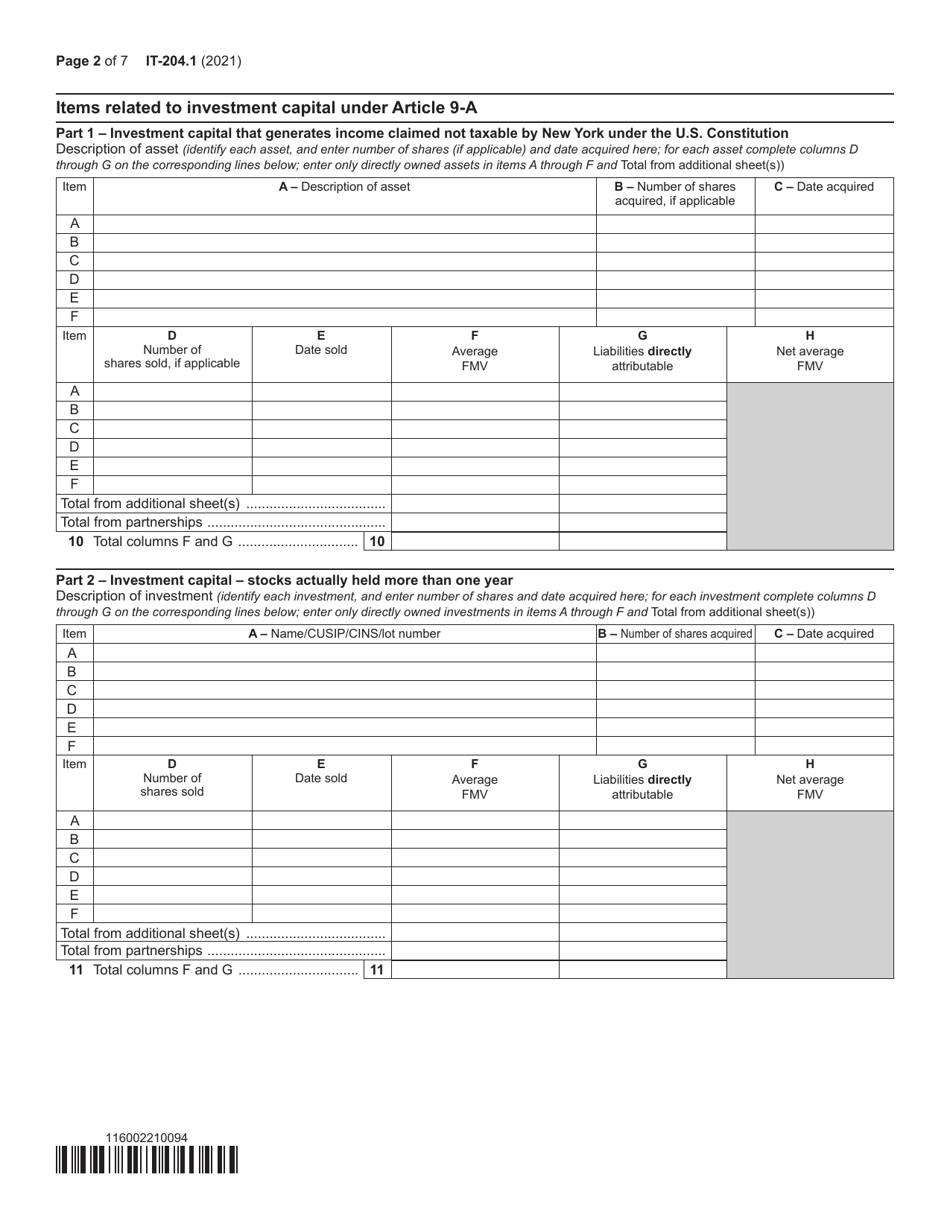

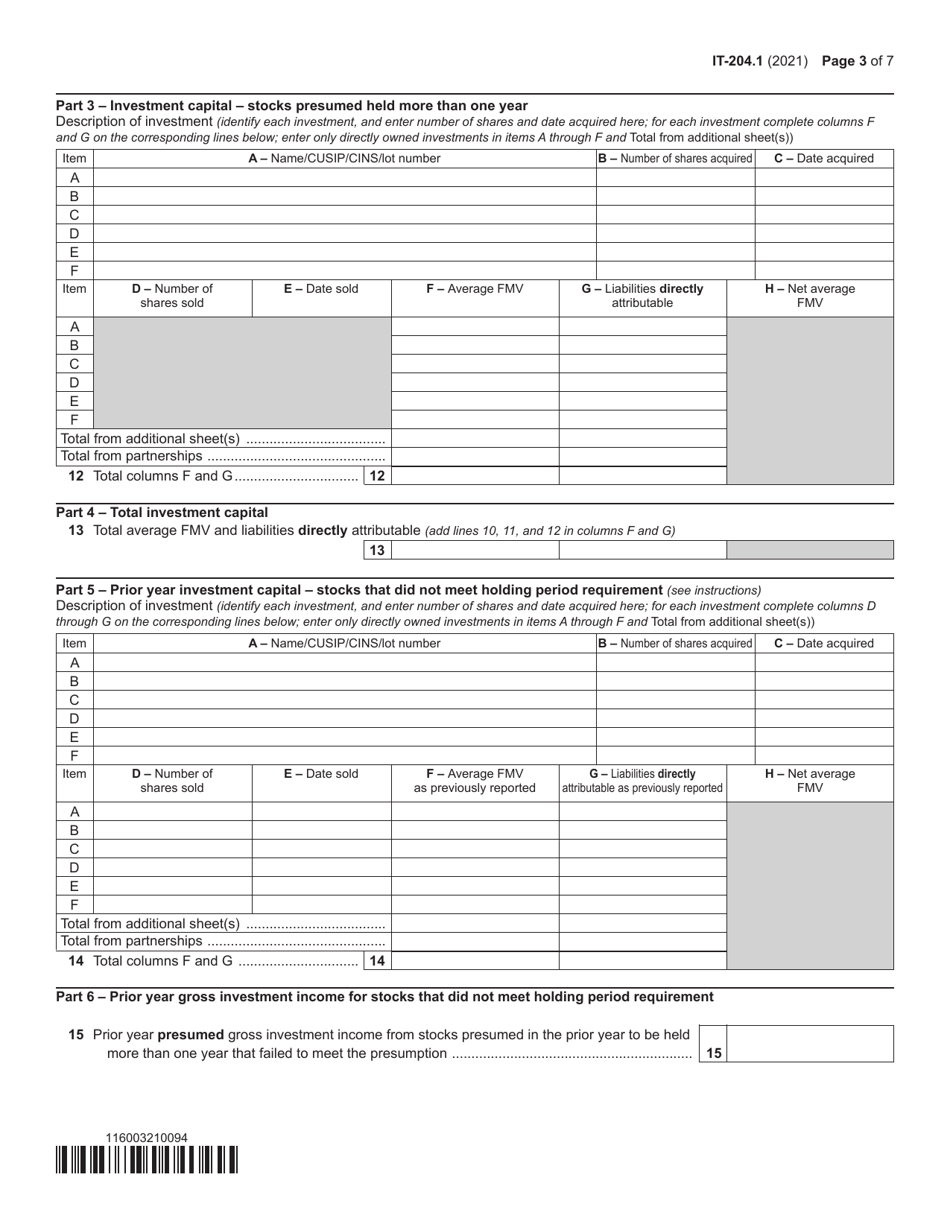

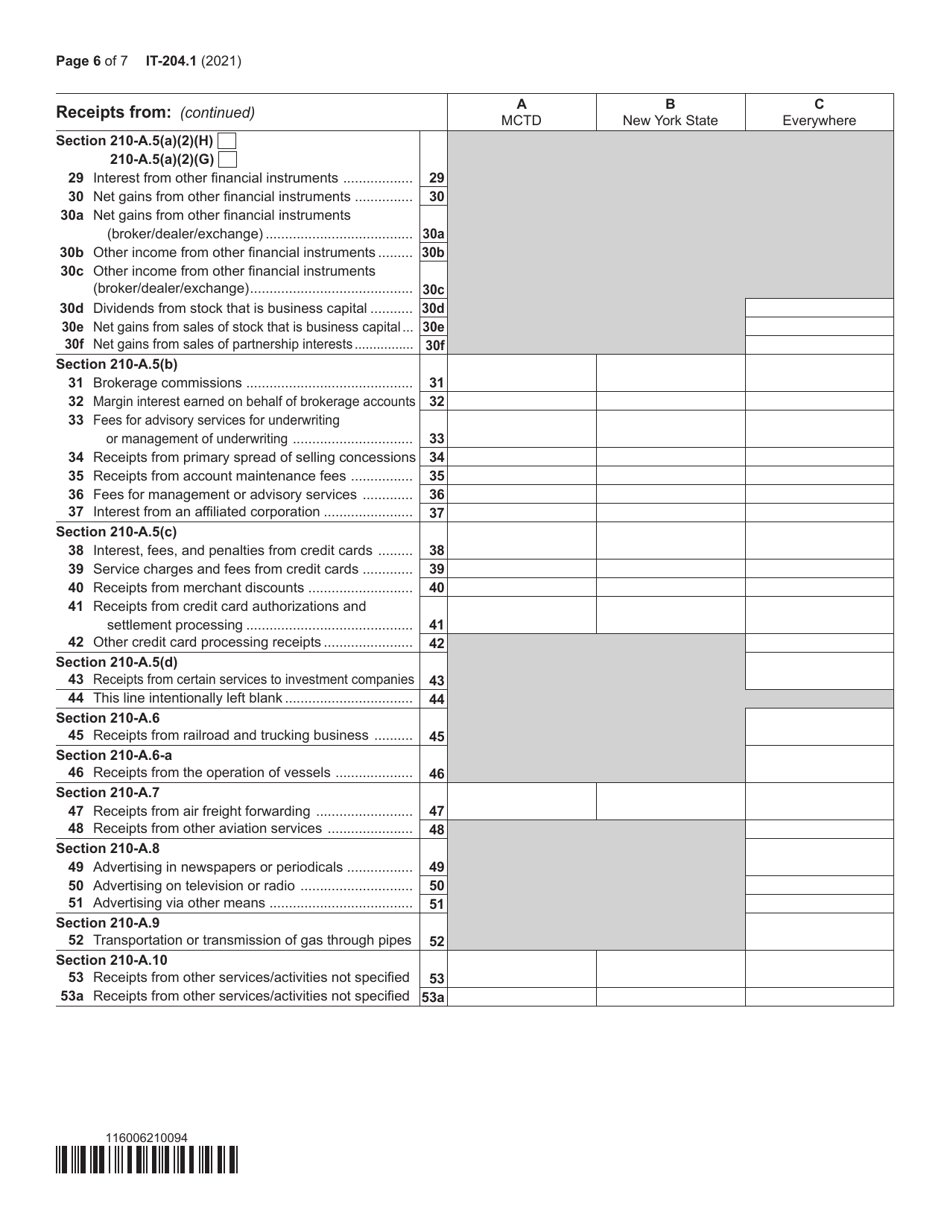

Q: What information does Form IT-204.1 Schedule K require?

A: Form IT-204.1 Schedule K requires information about the corporate partners, such as their names, addresses, federal employer identification numbers (EINs), and their distributive share of income or loss.

Q: When is Form IT-204.1 Schedule K due?

A: Form IT-204.1 Schedule K is due on the same date as the New York corporation's tax return, which is generally March 15th for calendar year filers.

Q: Are there any penalties for not filing Form IT-204.1 Schedule K?

A: Yes, there can be penalties for not filing Form IT-204.1 Schedule K or for filing it late. It is important to meet the filing deadline to avoid these penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204.1 Schedule K by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.