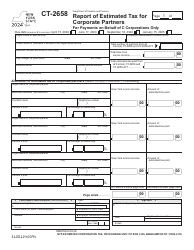

This version of the form is not currently in use and is provided for reference only. Download this version of

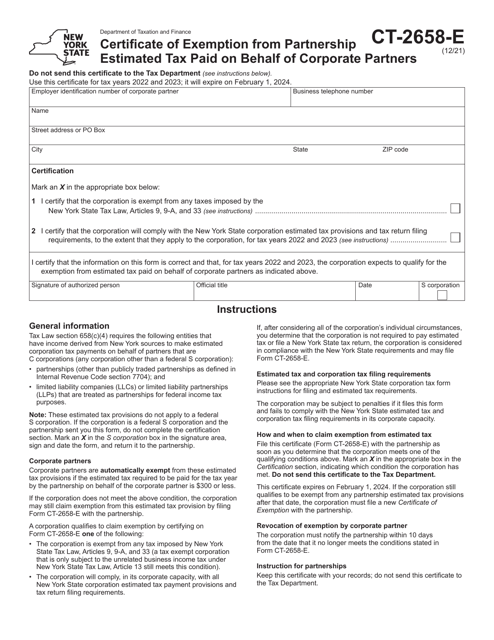

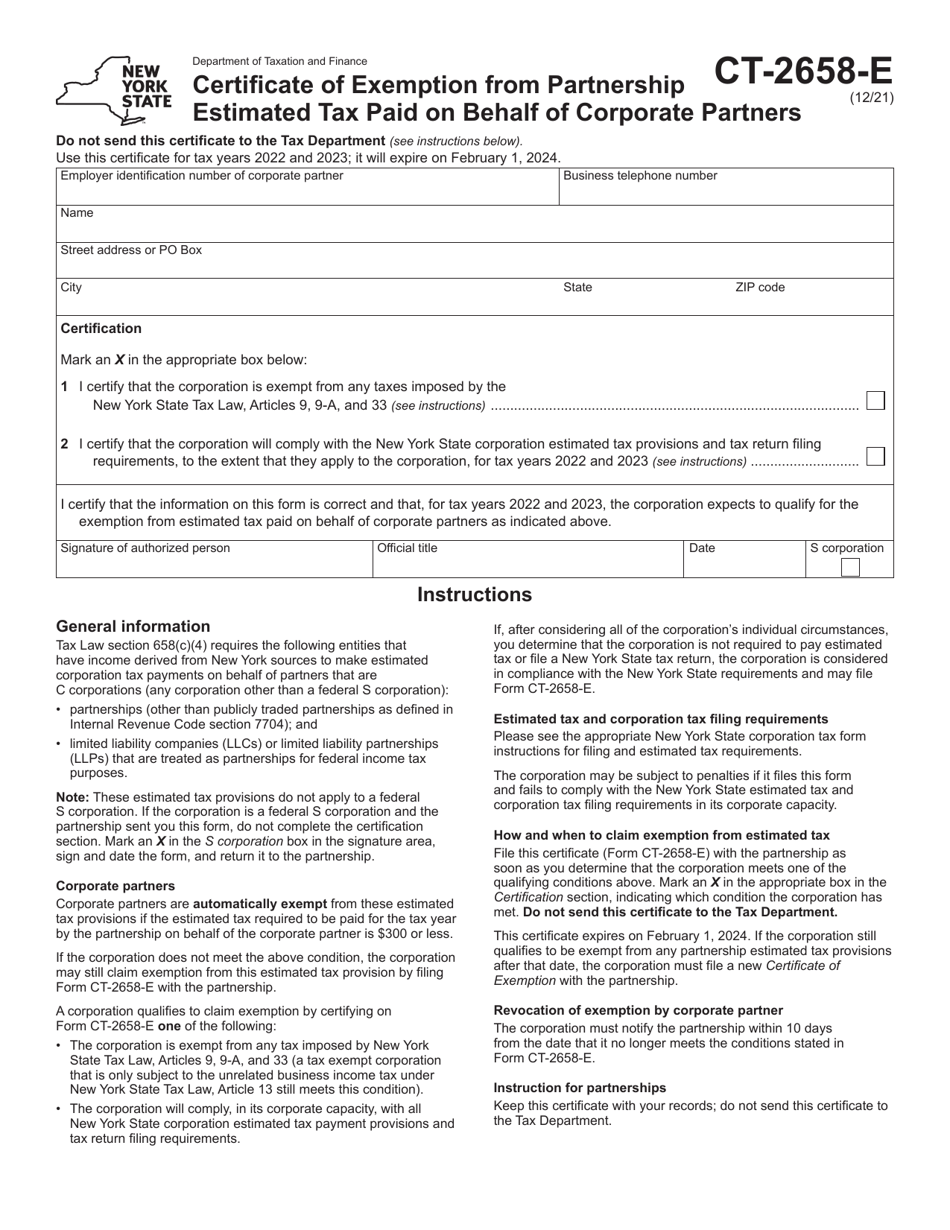

Form CT-2658-E

for the current year.

Form CT-2658-E Certificate of Exemption From Partnership Estimated Tax Paid on Behalf of Corporate Partners - New York

What Is Form CT-2658-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-2658-E?

A: Form CT-2658-E is a certificate of exemption from partnership estimated tax paid on behalf of corporate partners in the state of New York.

Q: Who needs to file Form CT-2658-E?

A: Partnerships in New York that have corporate partners and meet certain criteria may need to file Form CT-2658-E.

Q: What is the purpose of Form CT-2658-E?

A: The purpose of Form CT-2658-E is to claim exemption from paying partnership estimated tax on behalf of corporate partners in New York.

Q: What information is required on Form CT-2658-E?

A: Form CT-2658-E requires information such as the partnership's name, address, federal employer identification number (FEIN), and details about each corporate partner.

Q: When is Form CT-2658-E due?

A: Form CT-2658-E is typically due on or before the fifteenth day of the third month following the end of the partnership's tax year.

Q: Are there any penalties for late filing of Form CT-2658-E?

A: Yes, there may be penalties for late filing of Form CT-2658-E, so it's important to submit the form by the due date.

Q: Are there any exemptions or special considerations for filing Form CT-2658-E?

A: Yes, there are exemptions and special considerations outlined in the instructions for Form CT-2658-E. It is important to review the instructions or consult a tax professional for specific guidance.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2658-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.