This version of the form is not currently in use and is provided for reference only. Download this version of

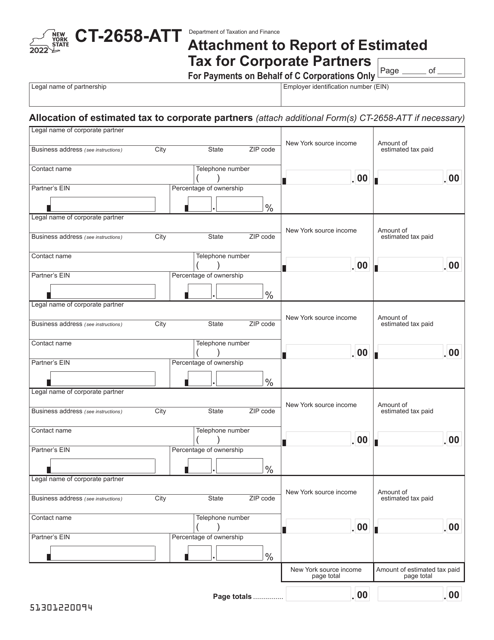

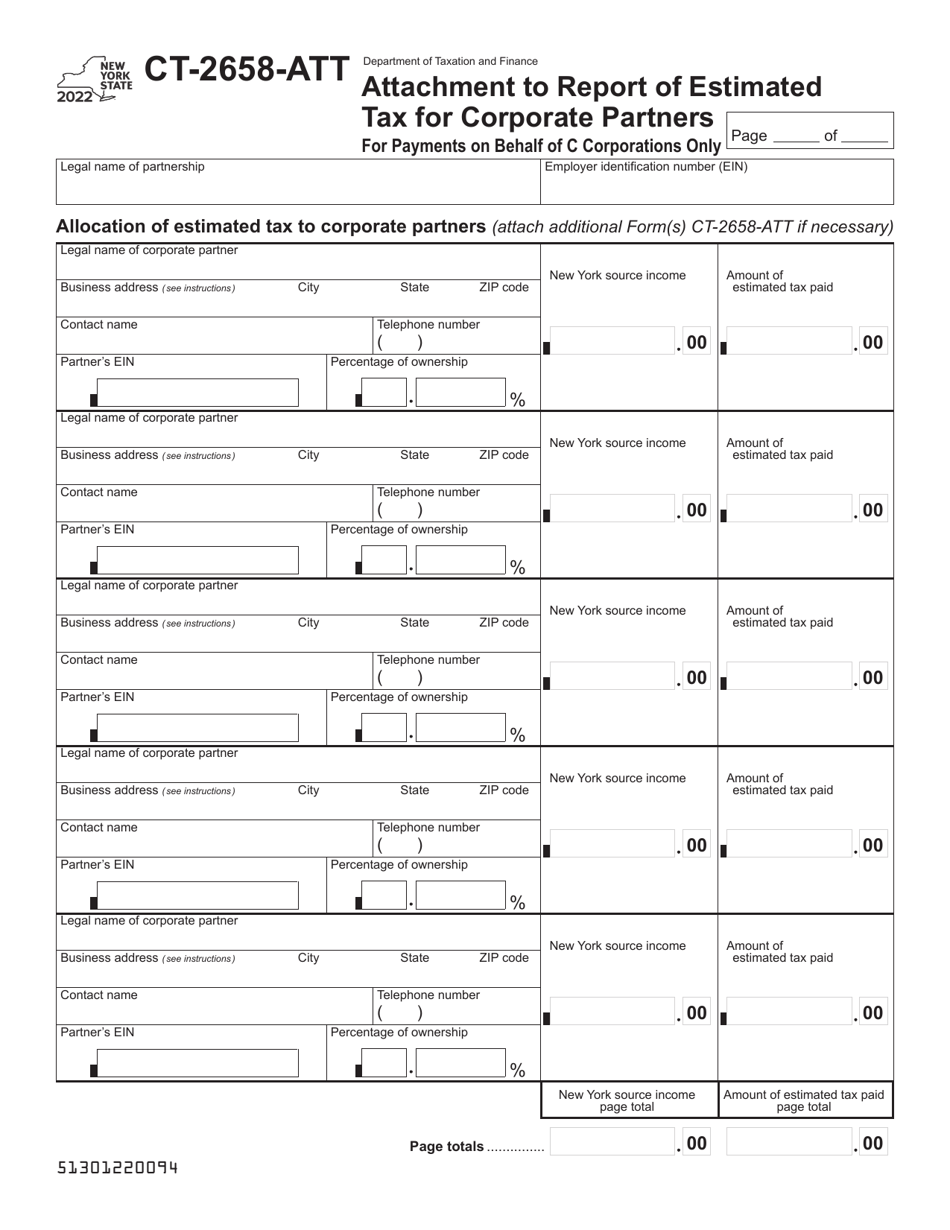

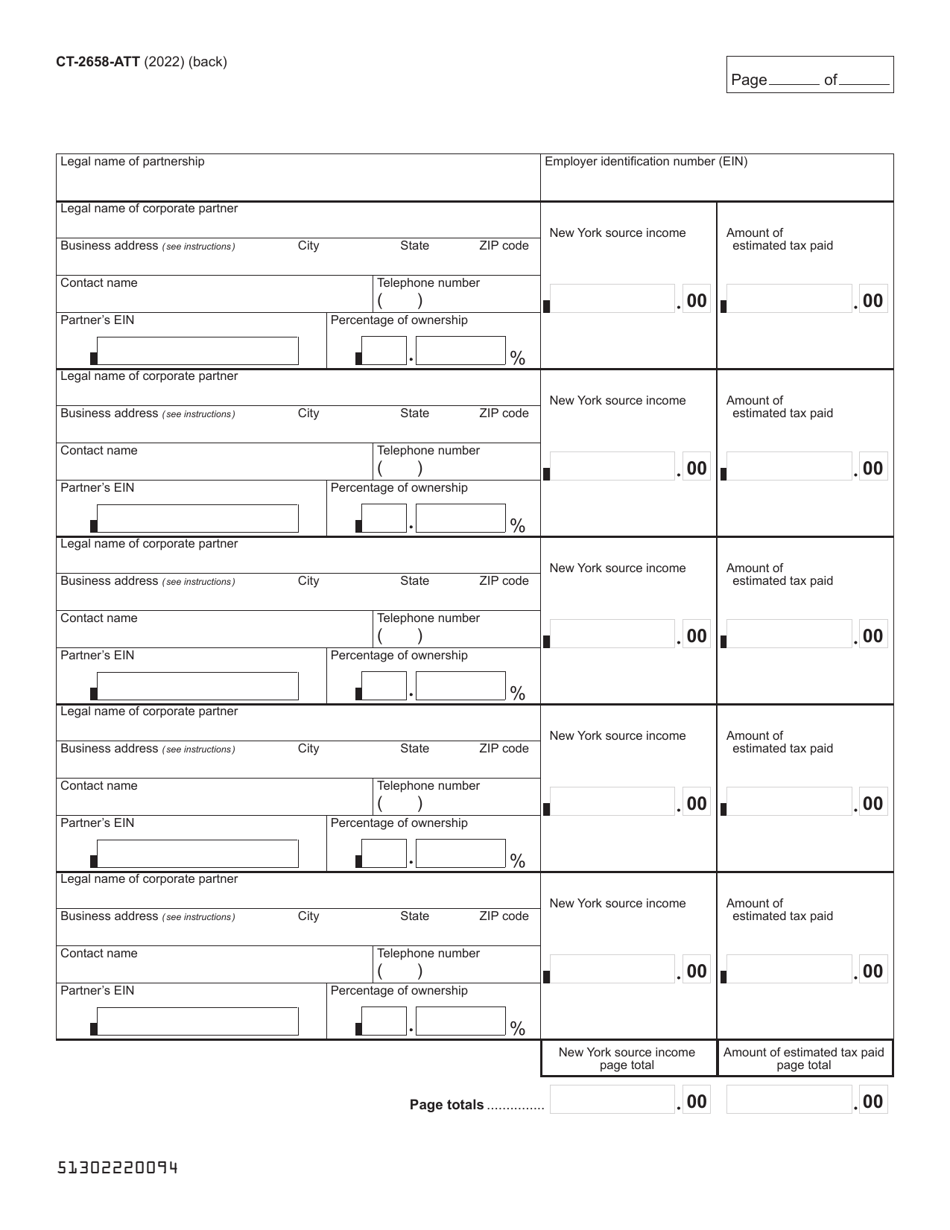

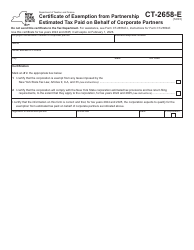

Form CT-2658-ATT

for the current year.

Form CT-2658-ATT Attachment to Report of Estimated Tax for Corporate Partners for Payments on Behalf of C Corporations Only - New York

What Is Form CT-2658-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-2658-ATT?

A: Form CT-2658-ATT is an attachment to the Report of Estimated Tax for Corporate Partners for Payments on Behalf of C Corporations Only in New York.

Q: Who needs to file Form CT-2658-ATT?

A: Only corporate partners making payments on behalf of C corporations in New York need to file Form CT-2658-ATT.

Q: What is the purpose of Form CT-2658-ATT?

A: The purpose of Form CT-2658-ATT is to report estimated tax payments made by corporate partners on behalf of C corporations in New York.

Q: Is Form CT-2658-ATT for individuals or corporations?

A: Form CT-2658-ATT is specifically for corporate partners making payments on behalf of C corporations in New York.

Q: Are there any other forms required to be filed along with Form CT-2658-ATT?

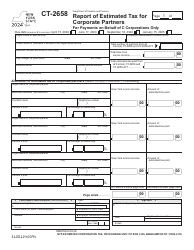

A: Yes, Form CT-2658, Report of Estimated Tax for Corporate Partners, is also required to be filed along with Form CT-2658-ATT.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2658-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.