This version of the form is not currently in use and is provided for reference only. Download this version of

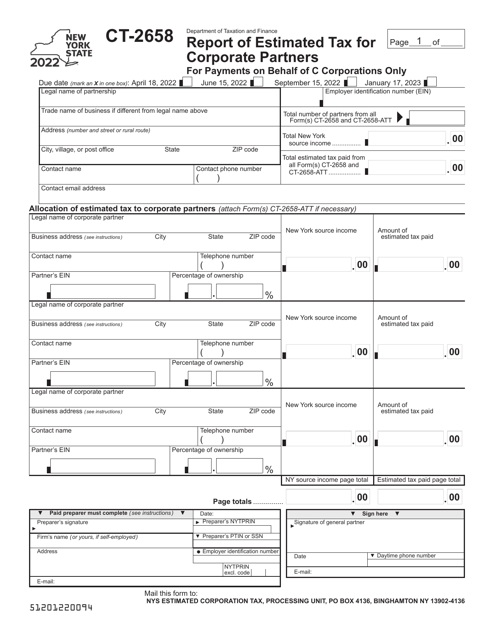

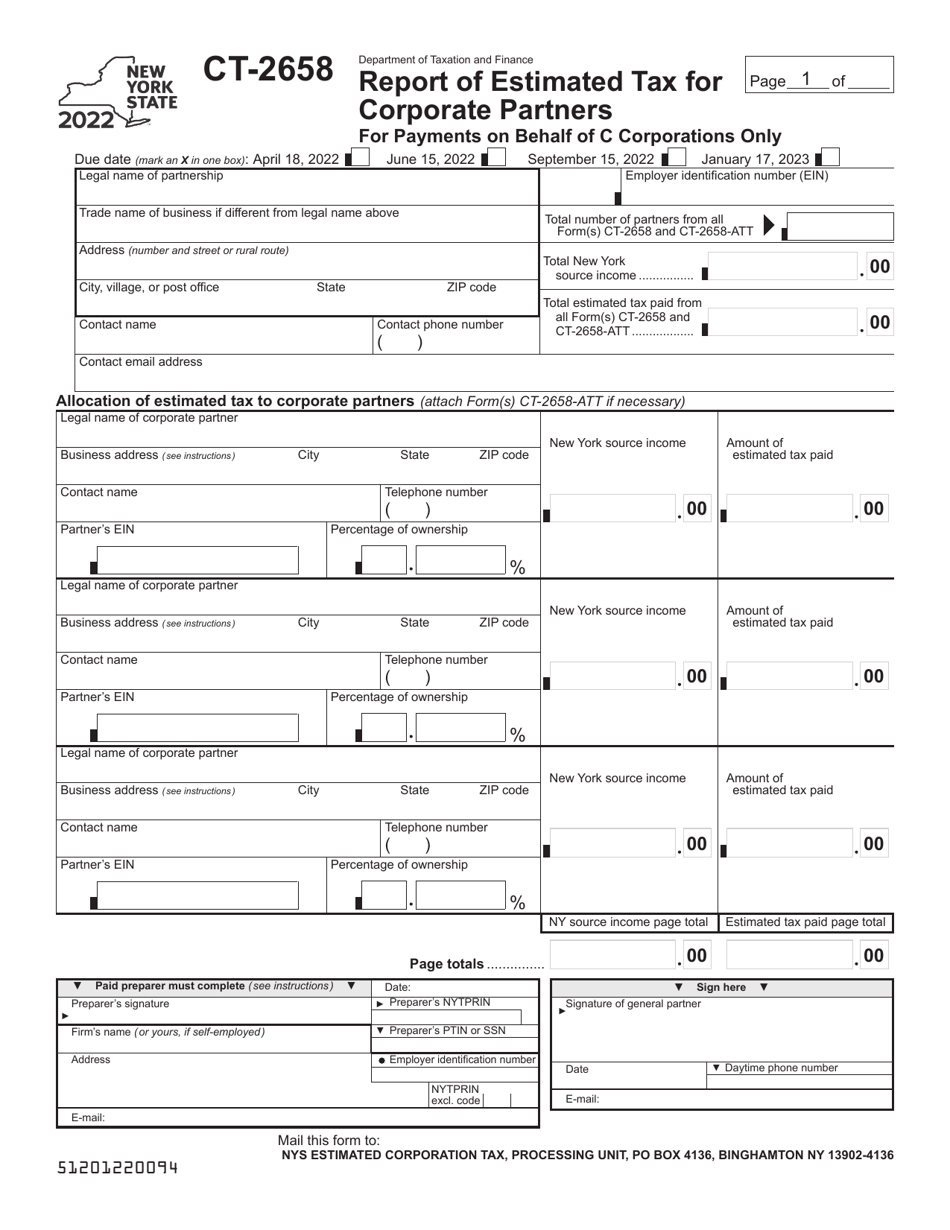

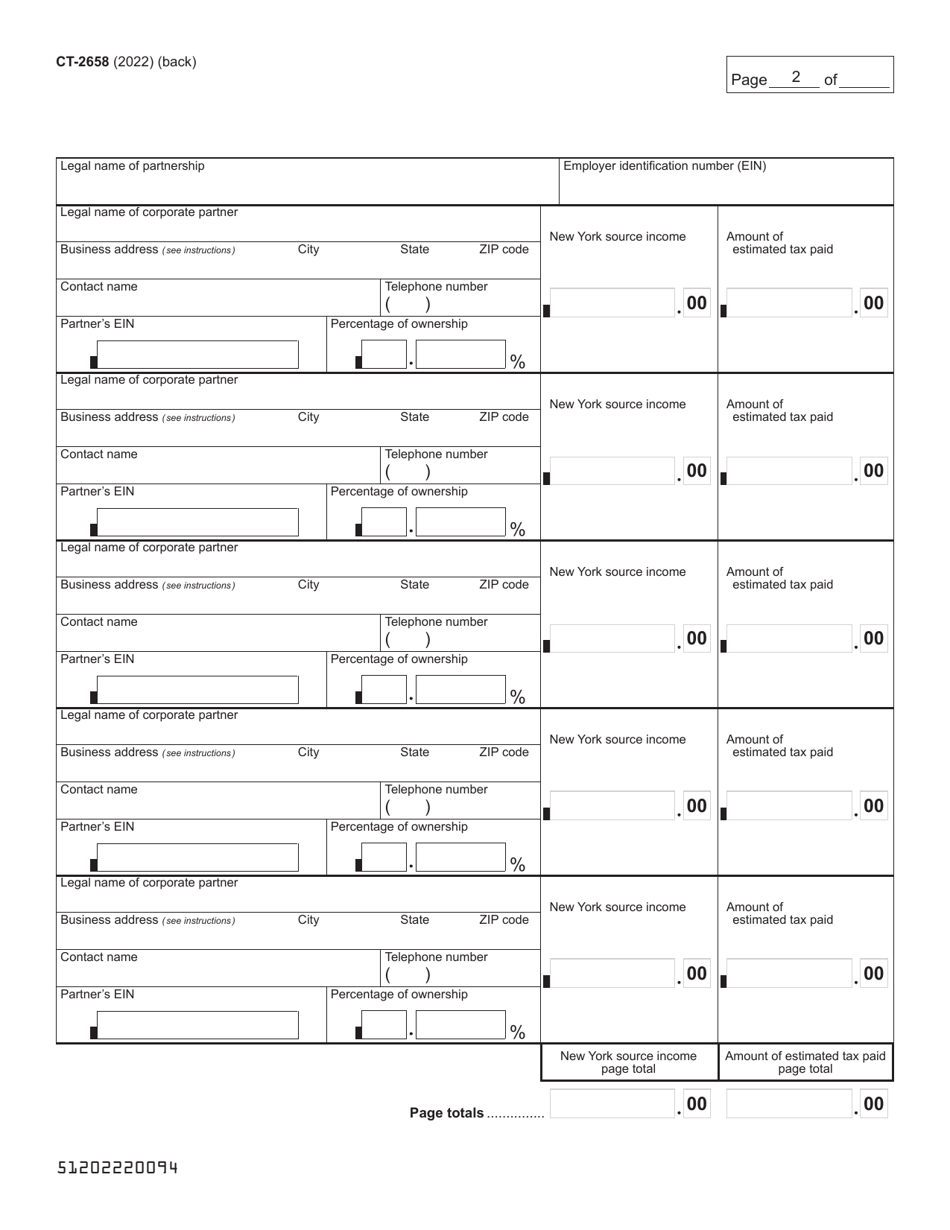

Form CT-2658

for the current year.

Form CT-2658 Report of Estimated Tax for Corporate Partners for Payments on Behalf of C Corporations Only - New York

What Is Form CT-2658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-2658?

A: Form CT-2658 is a report of estimated tax for corporate partners for payments on behalf of C corporations only in the state of New York.

Q: Who needs to file Form CT-2658?

A: Corporate partners who are making estimated tax payments on behalf of C corporations in New York need to file Form CT-2658.

Q: What is the purpose of Form CT-2658?

A: The purpose of Form CT-2658 is to report and remit estimated tax payments on behalf of C corporations in New York.

Q: Are there any specific requirements for filing Form CT-2658?

A: Yes, there are specific requirements for filing Form CT-2658, including providing information on the estimated tax payments made on behalf of C corporations in New York.

Q: Is there a deadline for filing Form CT-2658?

A: Yes, Form CT-2658 must be filed and the estimated tax payments must be remitted on a quarterly basis, following the schedule provided by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-2658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.