This version of the form is not currently in use and is provided for reference only. Download this version of

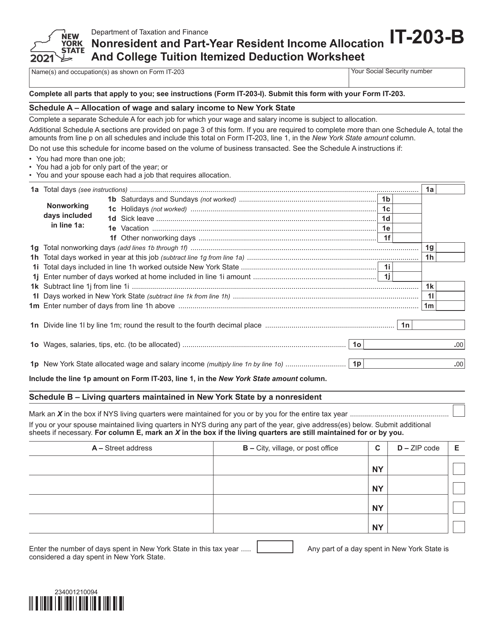

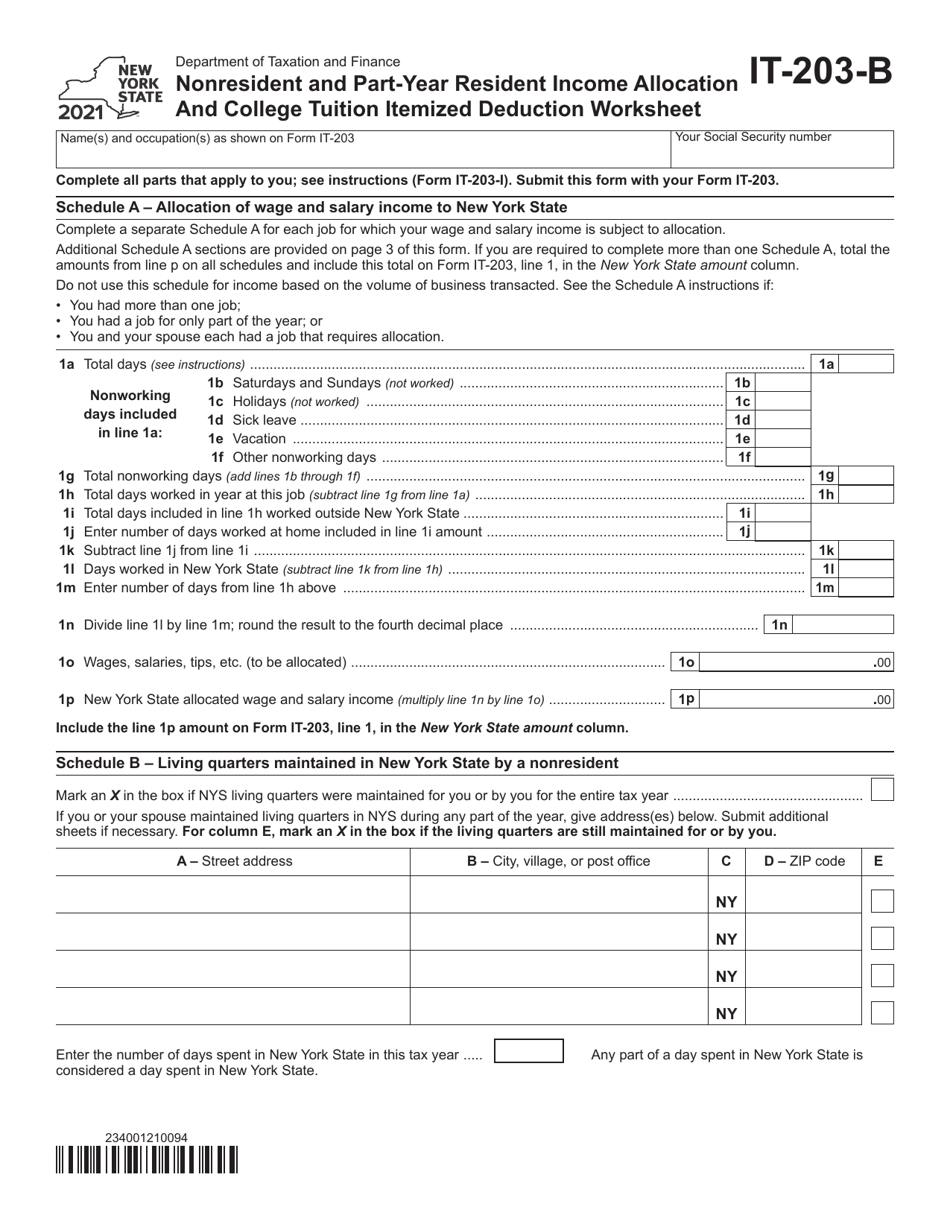

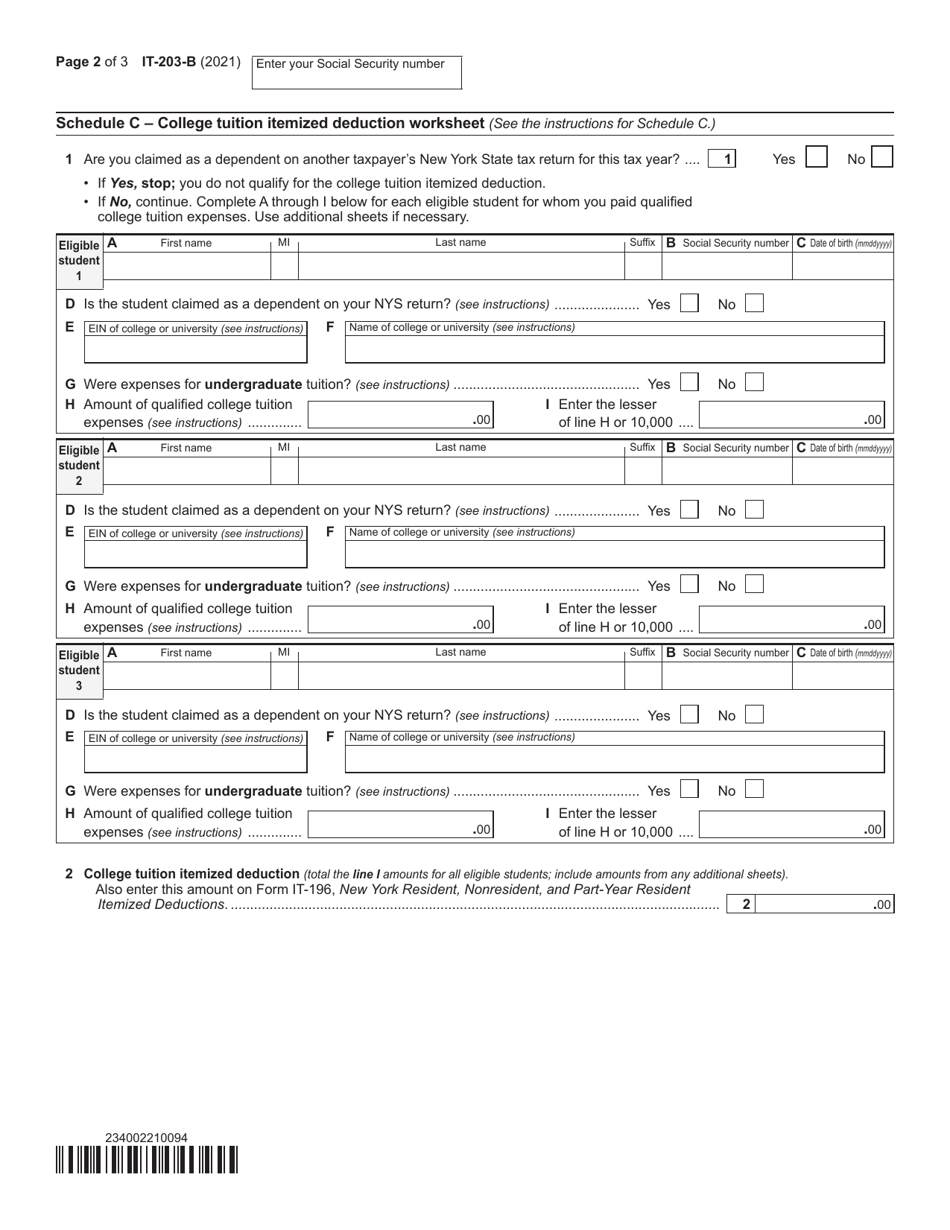

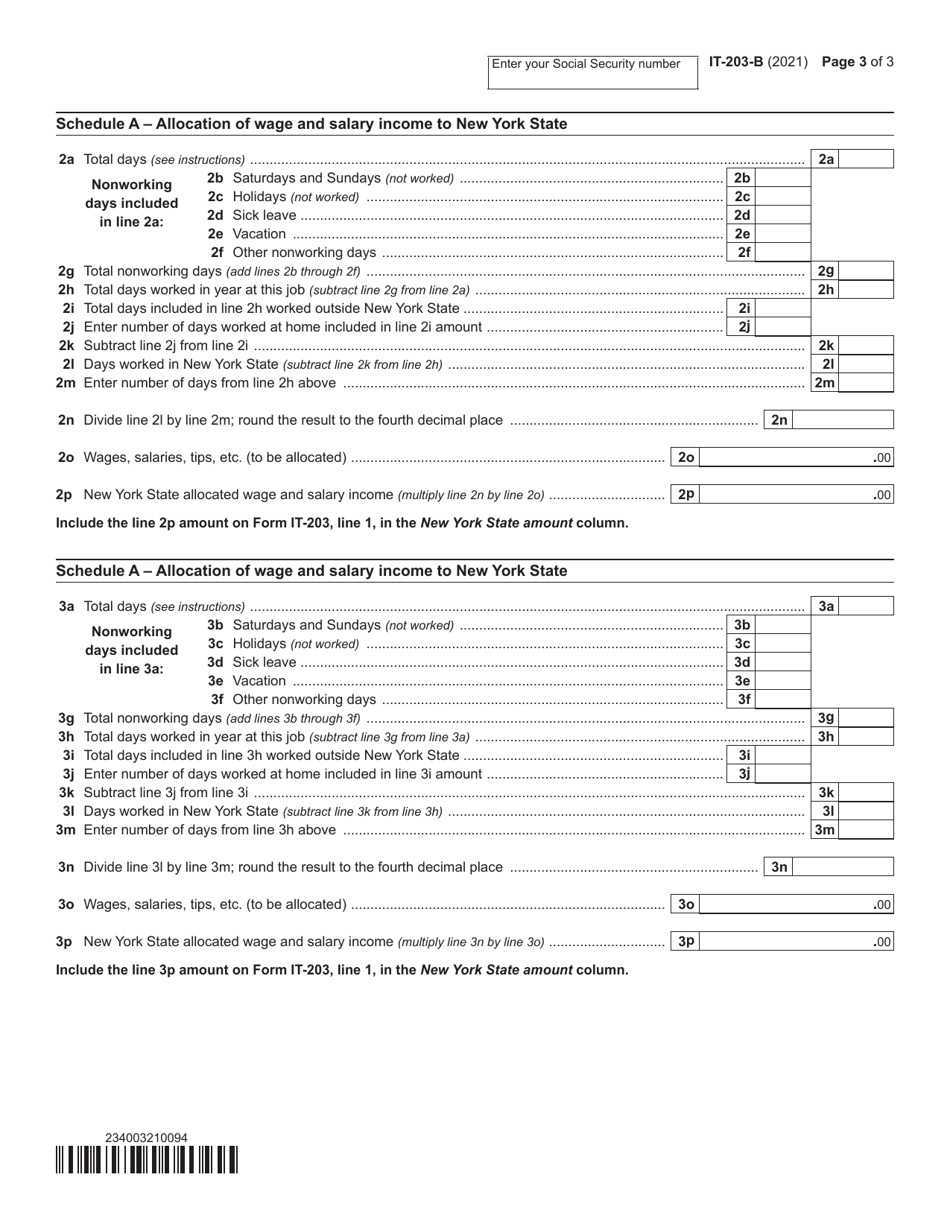

Form IT-203-B

for the current year.

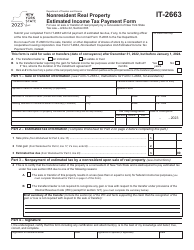

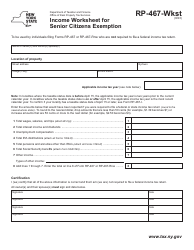

Form IT-203-B Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet - New York

What Is Form IT-203-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-B?

A: Form IT-203-B is a worksheet used in New York to allocate income between nonresident and part-year resident taxpayers.

Q: Who needs to use Form IT-203-B?

A: Nonresident and part-year resident taxpayers in New York need to use Form IT-203-B.

Q: What is the purpose of Form IT-203-B?

A: Form IT-203-B is used to determine the amount of income that should be allocated to New York State for tax purposes.

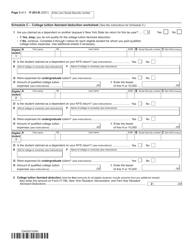

Q: What does the Form IT-203-B worksheet include?

A: The Form IT-203-B worksheet includes calculations for allocating income and determining the college tuitionitemized deduction.

Q: When should Form IT-203-B be filed?

A: Form IT-203-B should be filed along with Form IT-203 or IT-203-B, depending on the taxpayer's residency status.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.