This version of the form is not currently in use and is provided for reference only. Download this version of

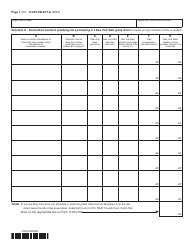

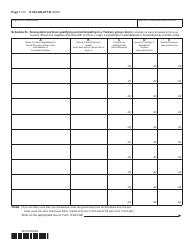

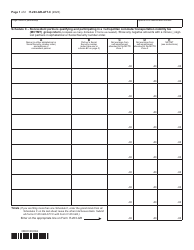

Form IT-203-S-ATT

for the current year.

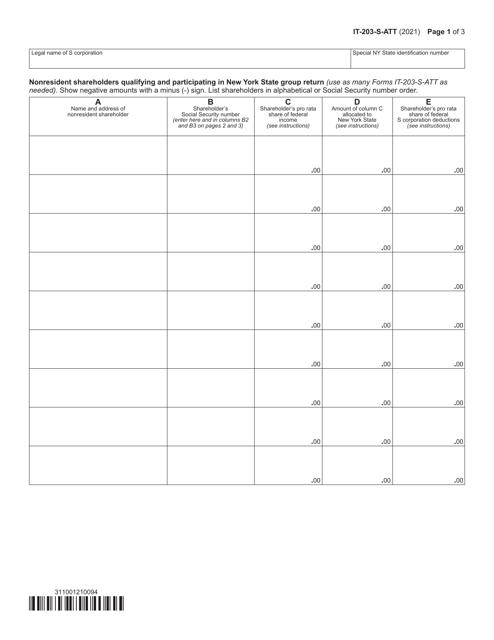

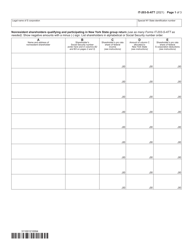

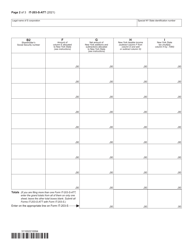

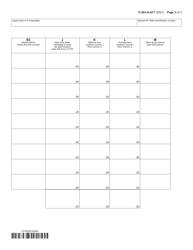

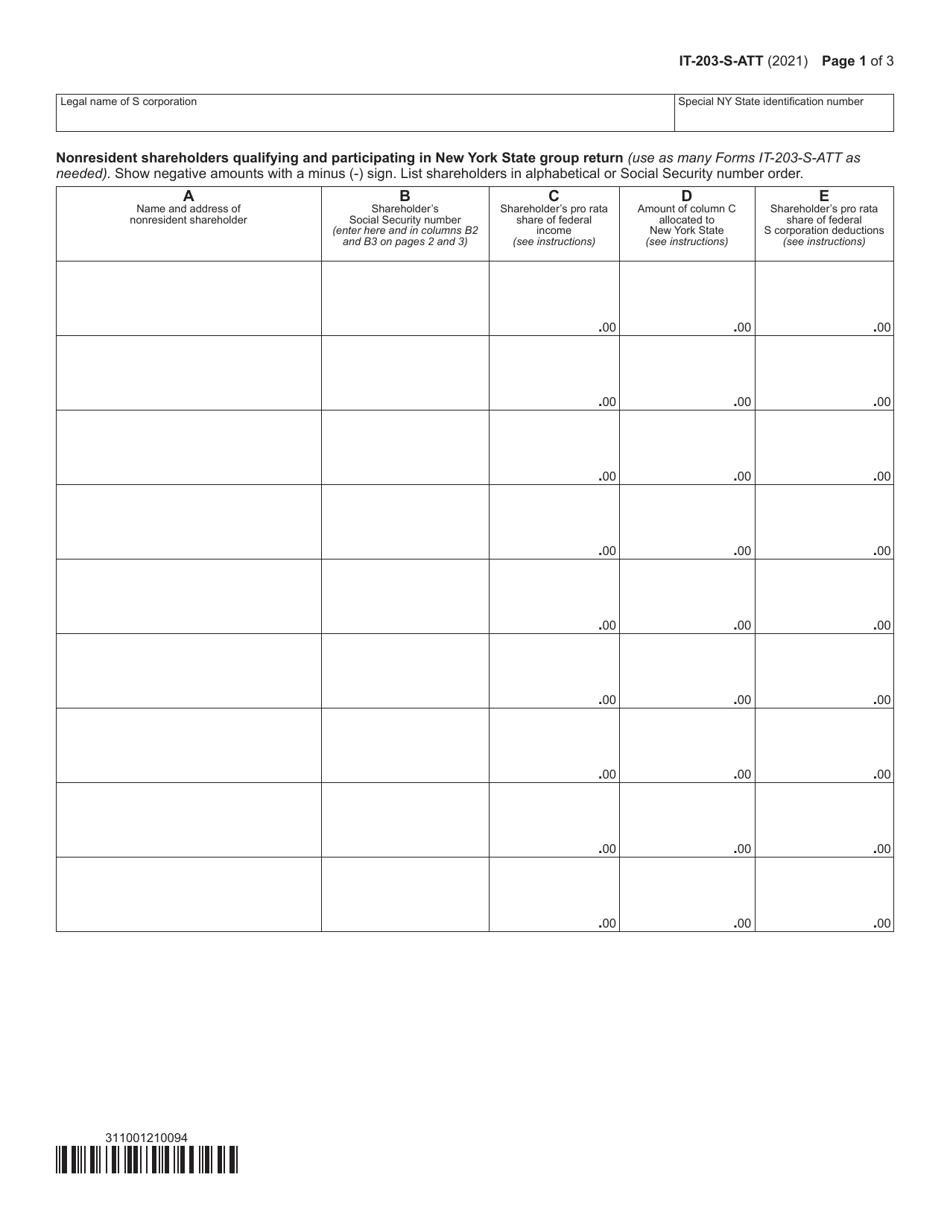

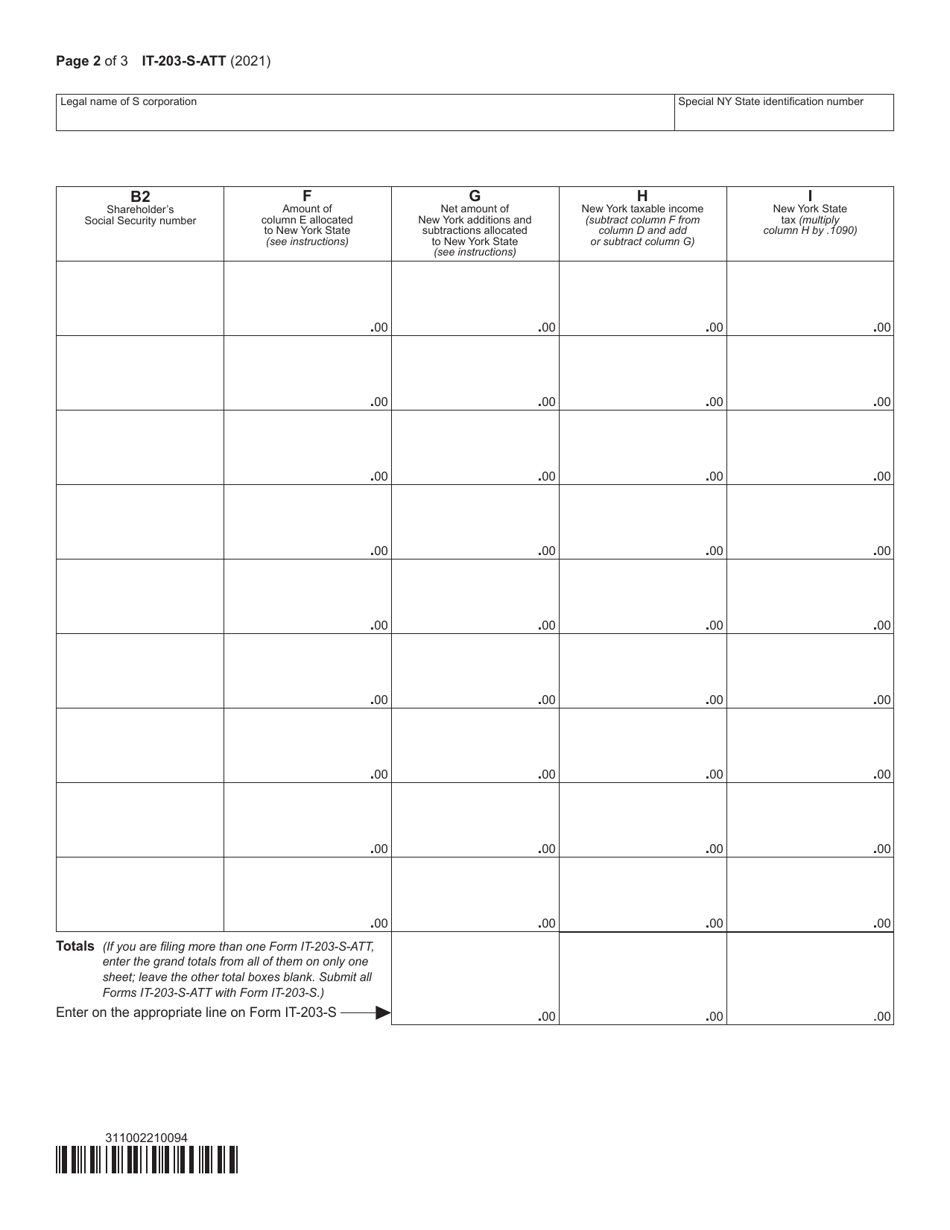

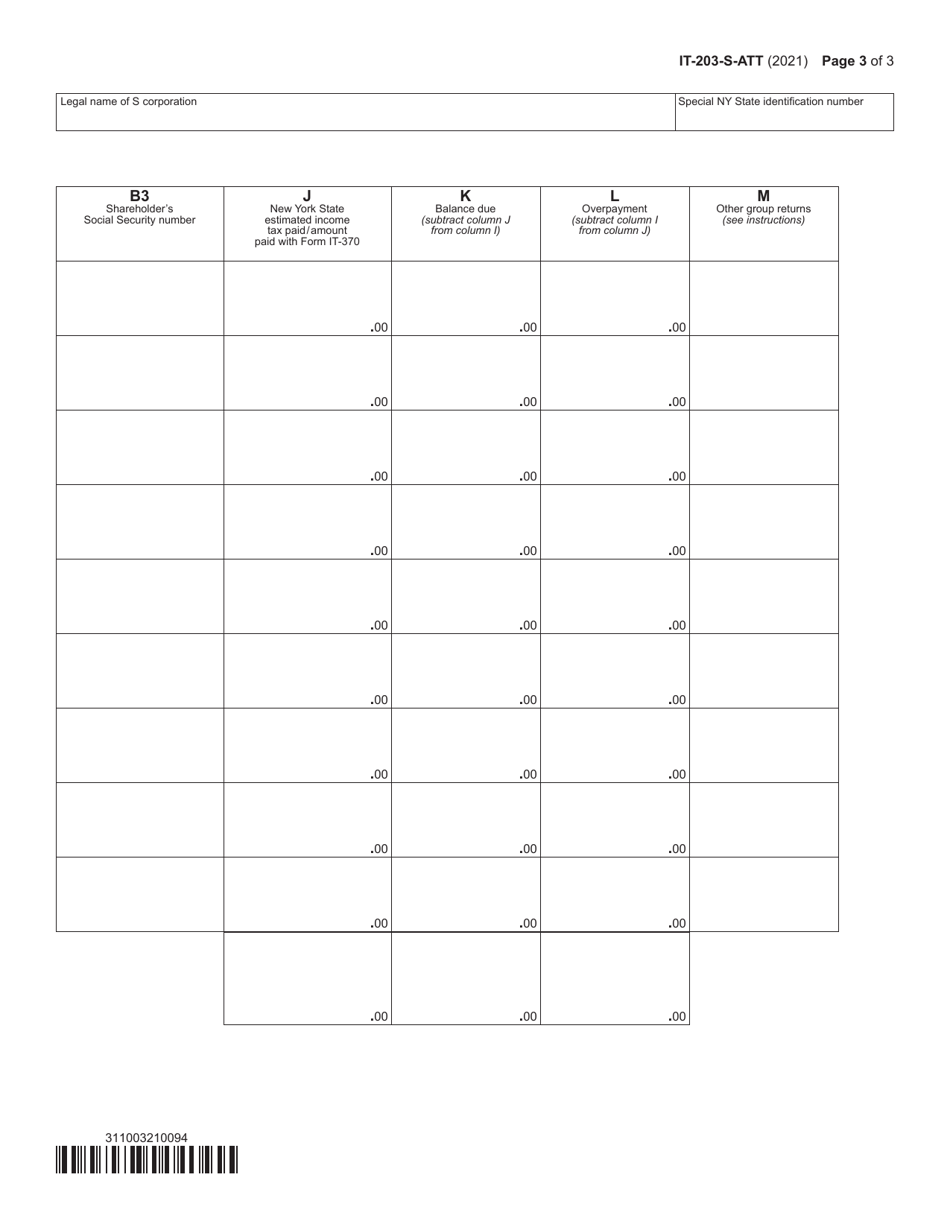

Form IT-203-S-ATT Nonresident Shareholders Qualifying and Participating in New York State Group Return - New York

What Is Form IT-203-S-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-S-ATT?

A: Form IT-203-S-ATT is a form used by nonresident shareholders to qualify and participate in a New York State group return.

Q: Who should use Form IT-203-S-ATT?

A: Nonresident shareholders who want to qualify and participate in a New York State group return should use Form IT-203-S-ATT.

Q: What does it mean to qualify and participate in a New York State group return?

A: Qualifying and participating in a New York State group return means that nonresident shareholders can be included in a group return filed by a New York State partnership or S corporation.

Q: Are there any eligibility requirements to use Form IT-203-S-ATT?

A: Yes, nonresident shareholders must meet certain eligibility requirements to use Form IT-203-S-ATT such as having a certain minimum ownership percentage and meeting residency requirements.

Q: Is there a deadline to file Form IT-203-S-ATT?

A: Yes, Form IT-203-S-ATT must be filed by the due date of the partnership or S corporation return.

Q: What should I do if I have questions about Form IT-203-S-ATT?

A: If you have questions about Form IT-203-S-ATT, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-S-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.