This version of the form is not currently in use and is provided for reference only. Download this version of

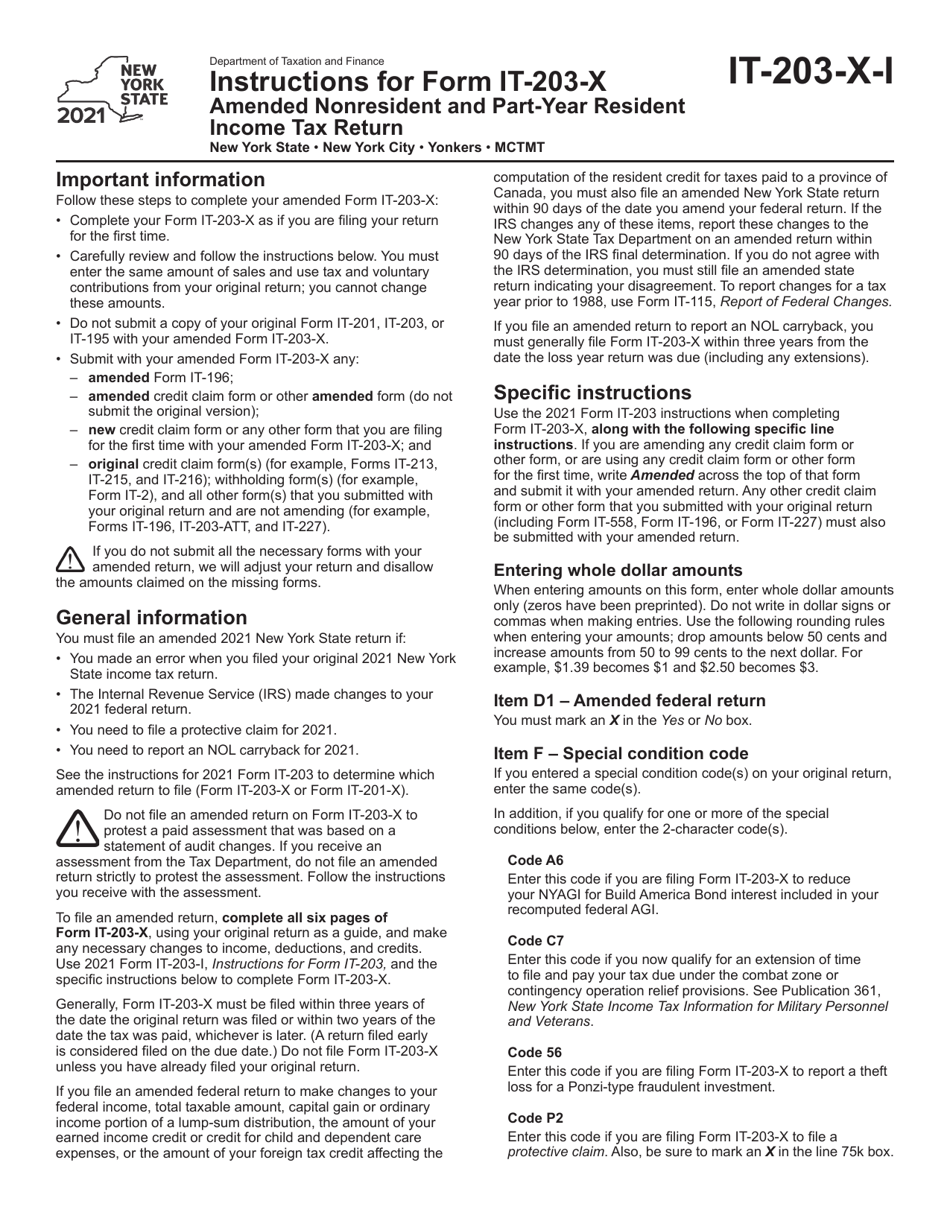

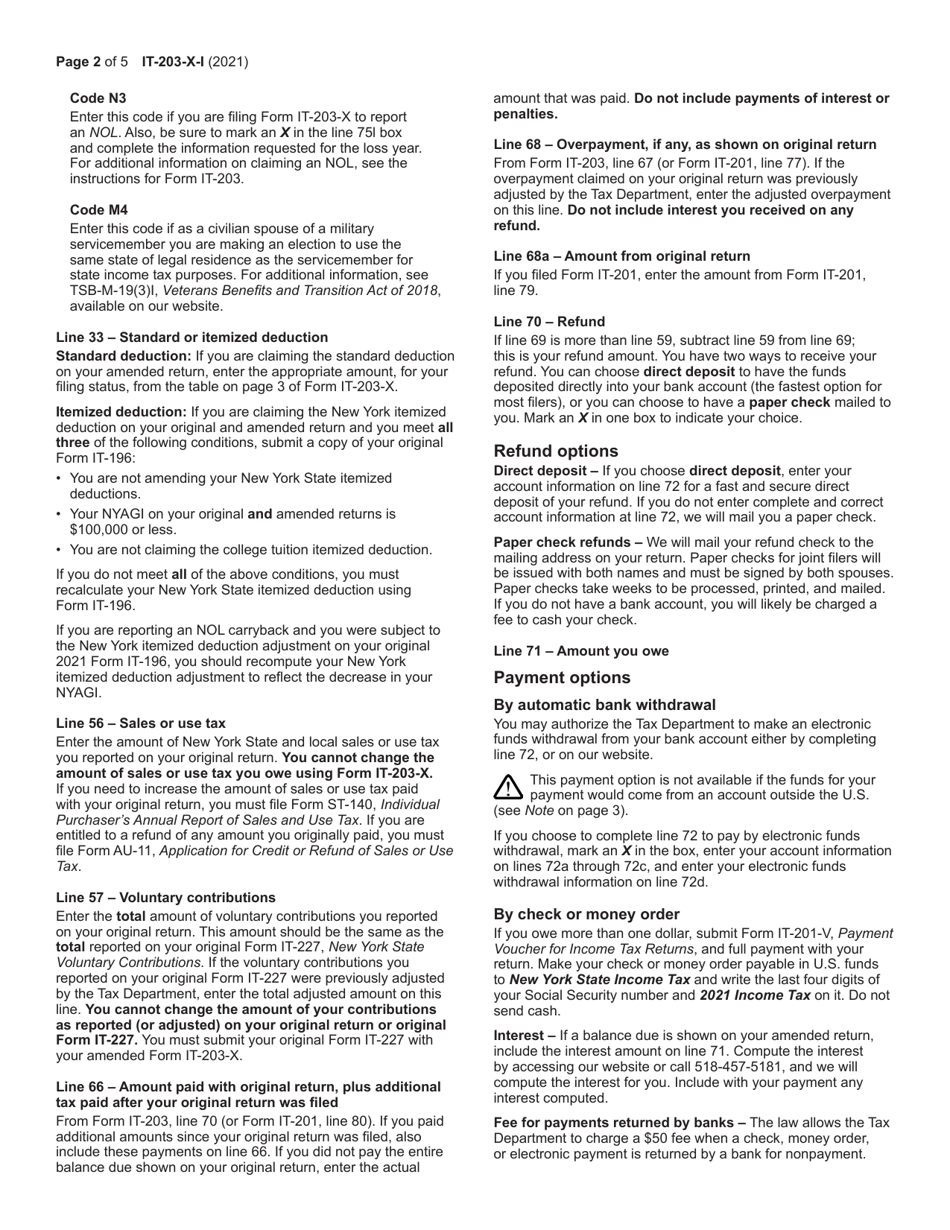

Instructions for Form IT-203-X

for the current year.

Instructions for Form IT-203-X Amended Nonresident and Part-Year Resident Income Tax Return - New York

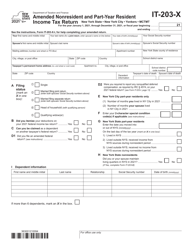

This document contains official instructions for Form IT-203-X , Amended Nonresident and Part-Year Resident Income Tax Return - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-203-X is available for download through this link.

FAQ

Q: What is Form IT-203-X?

A: Form IT-203-X is an amended income tax return for nonresidents and part-year residents in New York.

Q: Who should file Form IT-203-X?

A: Nonresidents and part-year residents in New York who need to amend their income tax return should file Form IT-203-X.

Q: What is the purpose of Form IT-203-X?

A: Form IT-203-X is used to correct errors or make changes to a previously filed New York income tax return.

Q: Do I need to file Form IT-203-X if I made a mistake on my New York income tax return?

A: Yes, if you made a mistake on your previously filed New York income tax return, you should file Form IT-203-X to correct the error.

Q: How do I file Form IT-203-X?

A: Form IT-203-X can be filed by mail or electronically using tax software or a professional tax preparer.

Q: Are there any deadlines for filing Form IT-203-X?

A: Form IT-203-X should be filed within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later.

Q: What documents do I need to include with Form IT-203-X?

A: You should include copies of any supporting documents or schedules that are affected by the changes you are making on Form IT-203-X.

Q: Can I e-file Form IT-203-X?

A: Yes, you can e-file Form IT-203-X if you are using tax software or if you are working with a professional tax preparer who offers e-filing services.

Q: What if I need help with completing Form IT-203-X?

A: If you need assistance with completing Form IT-203-X, you can seek help from a professional tax preparer or contact the New York State Department of Taxation and Finance for guidance.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.