This version of the form is not currently in use and is provided for reference only. Download this version of

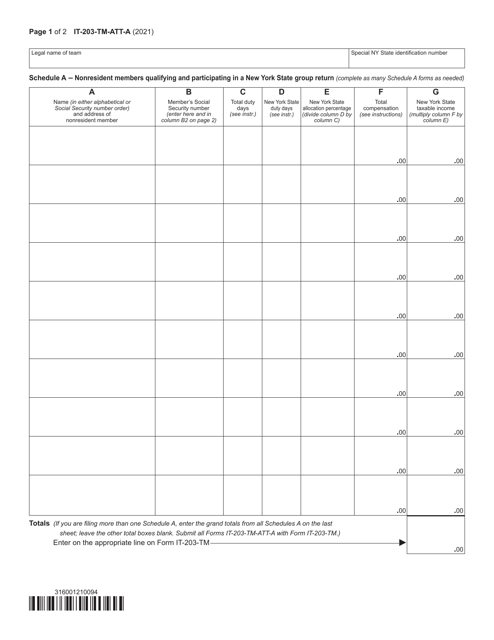

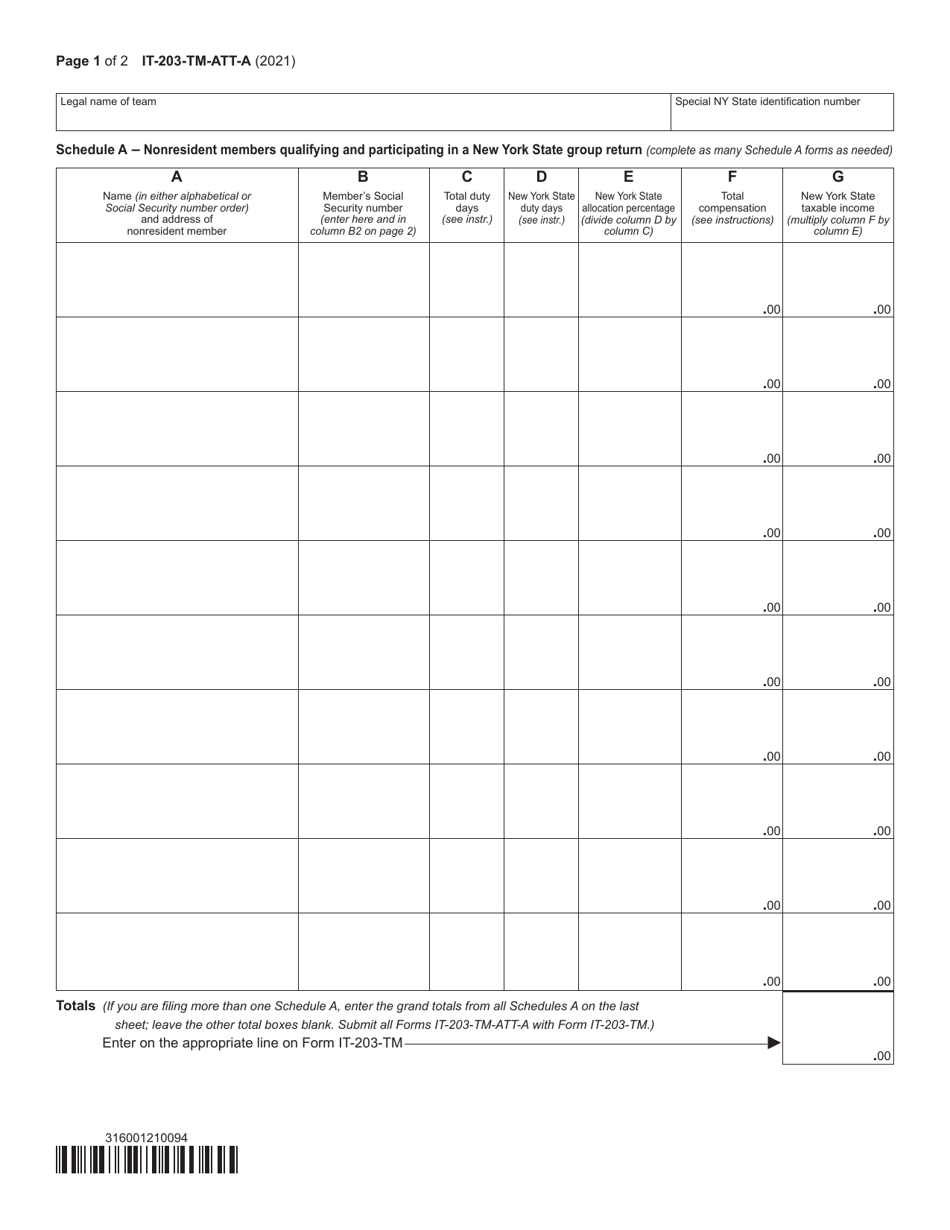

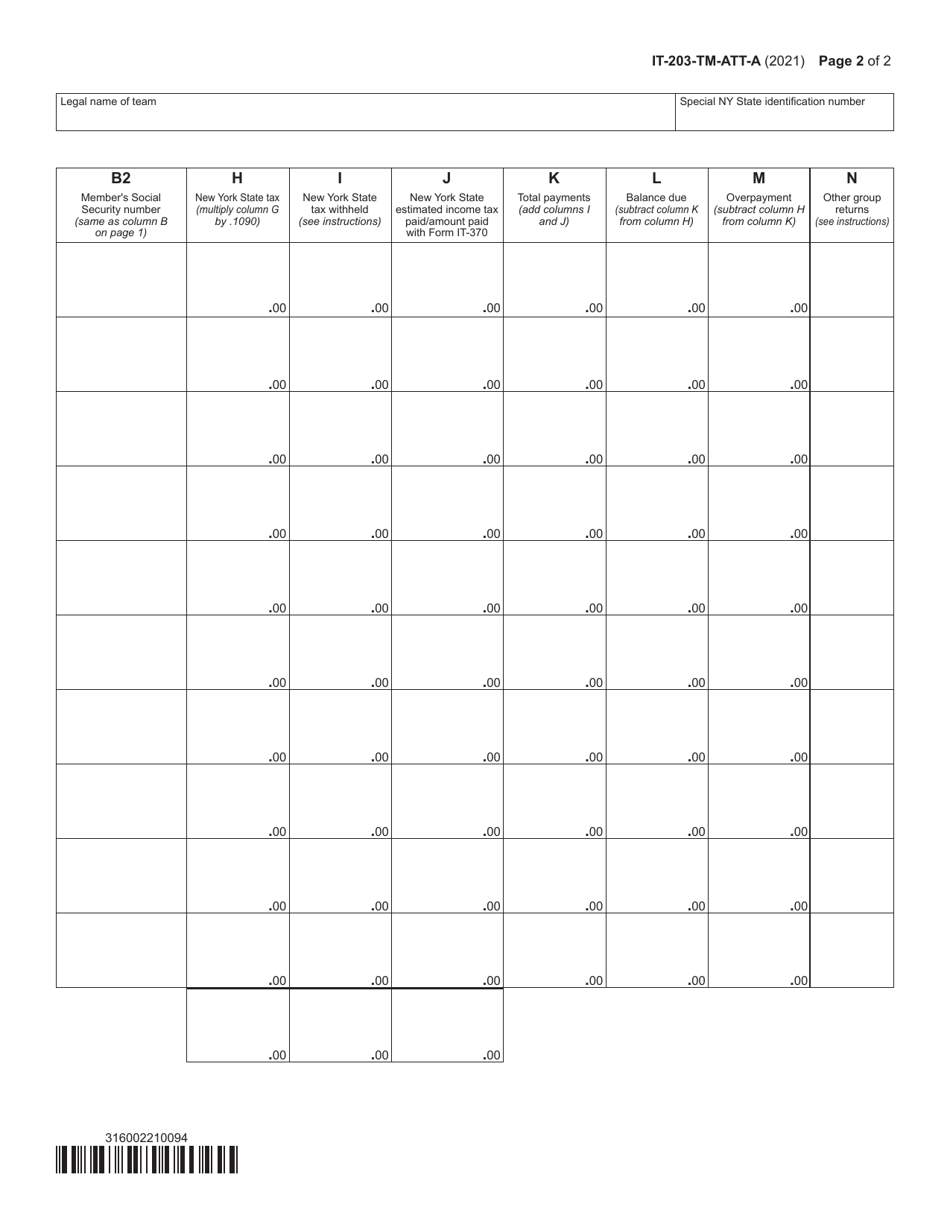

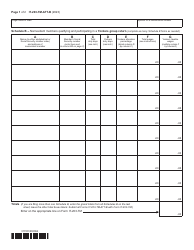

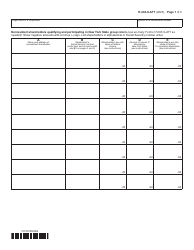

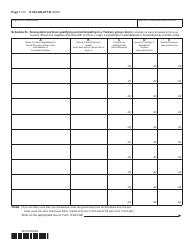

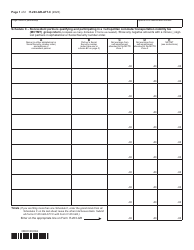

Form IT-203-TM-ATT-A Schedule A

for the current year.

Form IT-203-TM-ATT-A Schedule A Nonresident Members Qualifying and Participating in a New York State Group Return - New York

What Is Form IT-203-TM-ATT-A Schedule A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-TM-ATT-A?

A: Form IT-203-TM-ATT-A is a schedule used for nonresident members who qualify and participate in a New York State group return.

Q: Who should use Form IT-203-TM-ATT-A?

A: Form IT-203-TM-ATT-A should be used by nonresident members who qualify and participate in a New York State group return.

Q: What is the purpose of Form IT-203-TM-ATT-A?

A: The purpose of Form IT-203-TM-ATT-A is to report information about nonresident members who qualify and participate in a New York State group return.

Q: Is Form IT-203-TM-ATT-A required for all nonresident members?

A: No, Form IT-203-TM-ATT-A is only required for nonresident members who qualify and participate in a New York State group return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-TM-ATT-A Schedule A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.