This version of the form is not currently in use and is provided for reference only. Download this version of

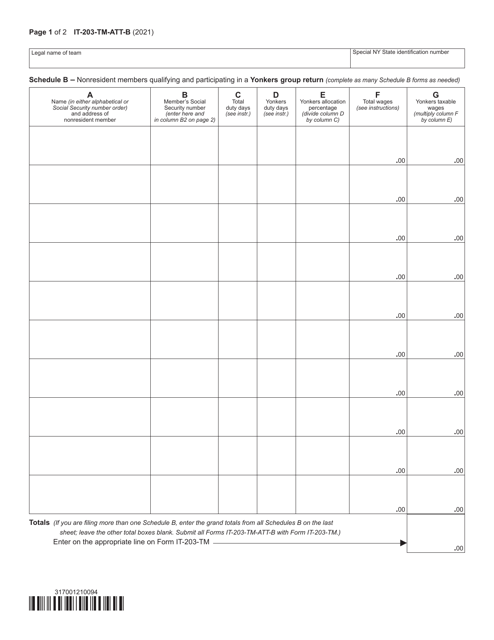

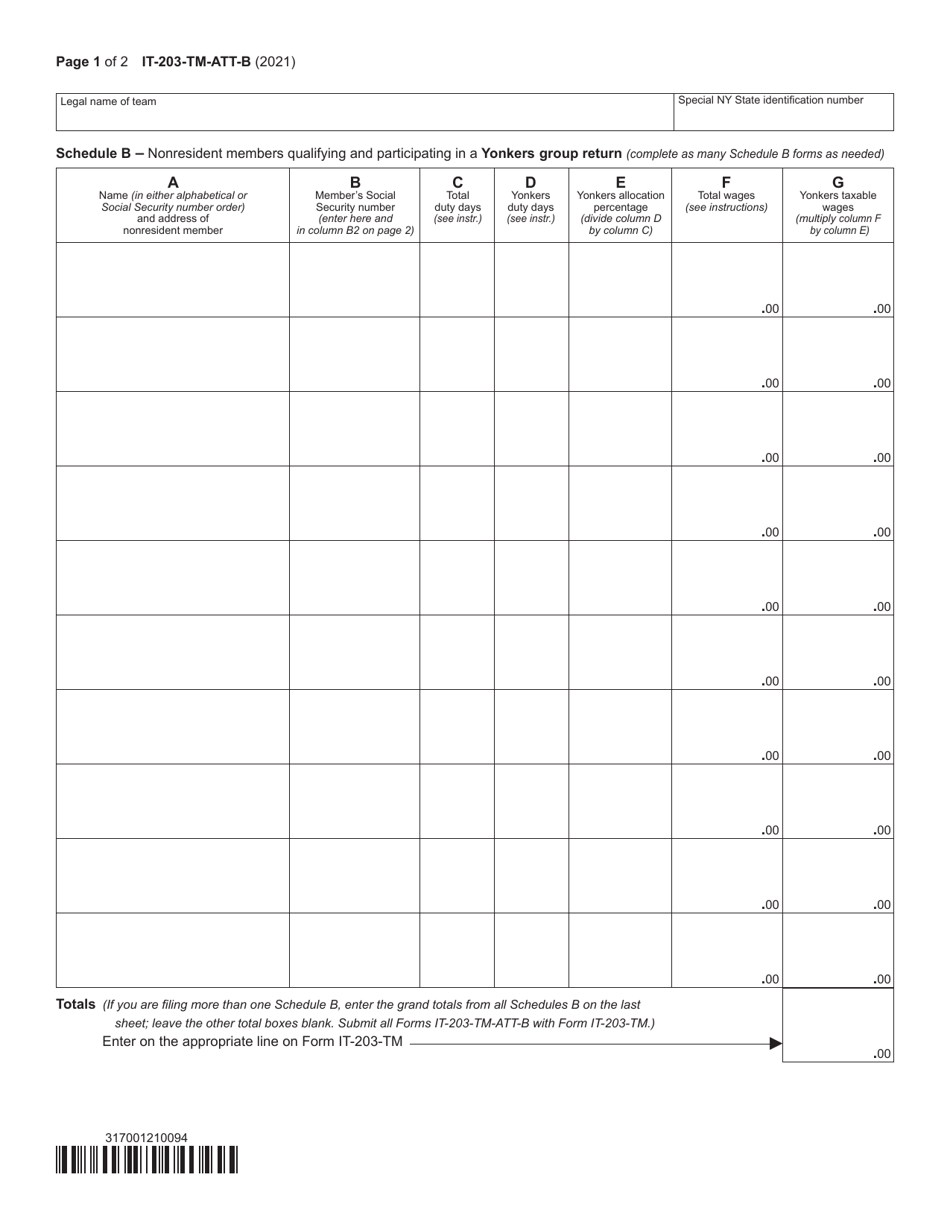

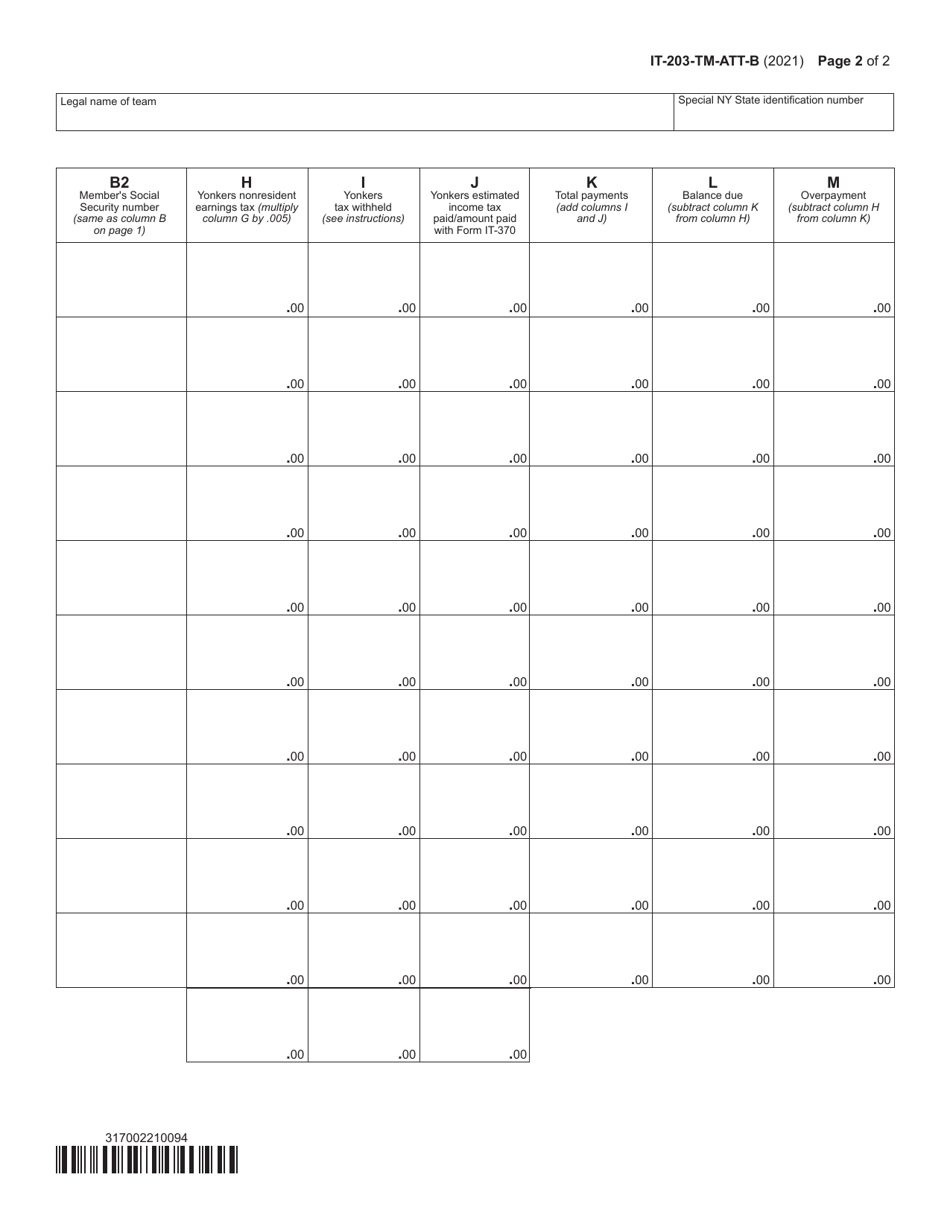

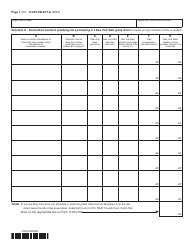

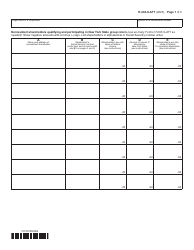

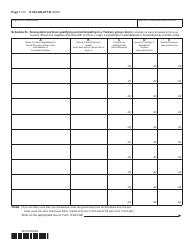

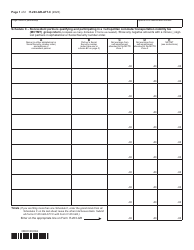

Form IT-203-TM-ATT-B Schedule B

for the current year.

Form IT-203-TM-ATT-B Schedule B Nonresident Members Qualifying and Participating in a Yonkers Group Return - New York

What Is Form IT-203-TM-ATT-B Schedule B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IT-203-TM-ATT-B Schedule B?

A: IT-203-TM-ATT-B Schedule B is a form used by nonresident members to report their qualifying and participating status in a Yonkers group return in New York.

Q: Who needs to file IT-203-TM-ATT-B Schedule B?

A: Nonresident members who qualify and participate in a Yonkers group return in New York need to file IT-203-TM-ATT-B Schedule B.

Q: What does IT-203-TM-ATT-B Schedule B report?

A: IT-203-TM-ATT-B Schedule B reports the qualifying and participating status of nonresident members in a Yonkers group return.

Q: Is IT-203-TM-ATT-B Schedule B only for individuals?

A: No, IT-203-TM-ATT-B Schedule B is not only for individuals. It can be used by any nonresident member who qualifies and participates in a Yonkers group return.

Q: When is the deadline to file IT-203-TM-ATT-B Schedule B?

A: The deadline to file IT-203-TM-ATT-B Schedule B is the same as the deadline for the Yonkers group return, which is generally April 15th of the following year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-TM-ATT-B Schedule B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.