This version of the form is not currently in use and is provided for reference only. Download this version of

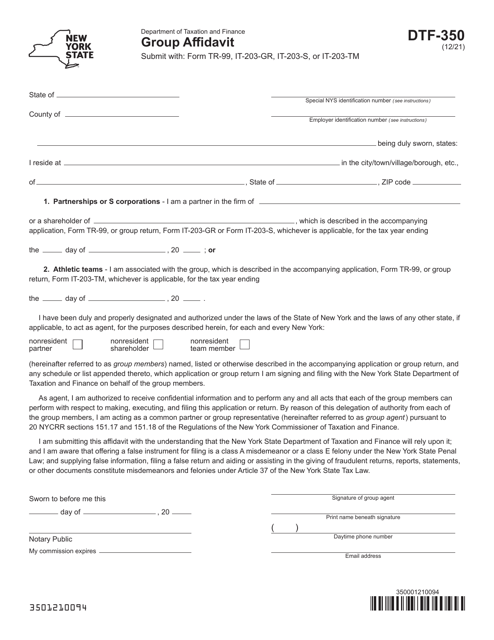

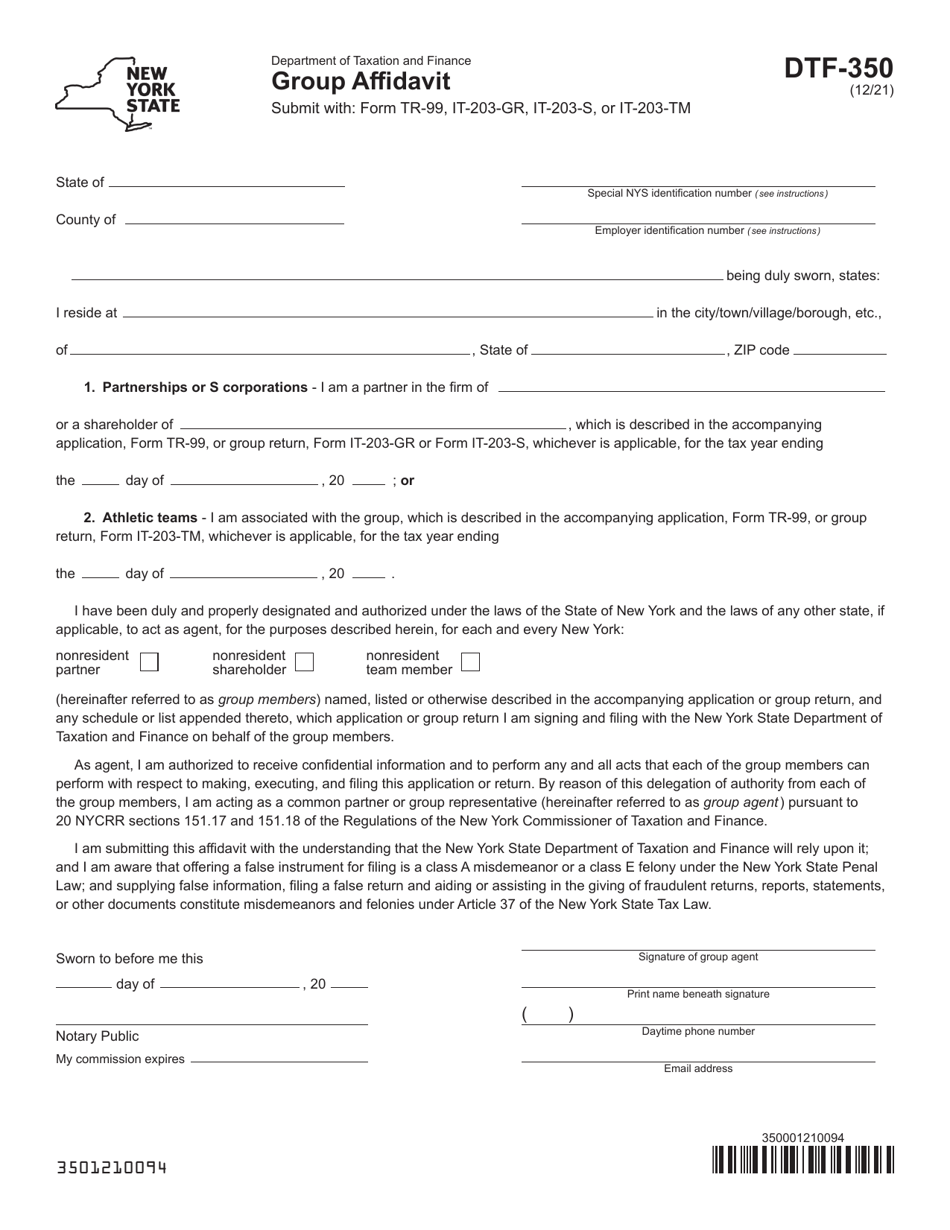

Form DTF-350

for the current year.

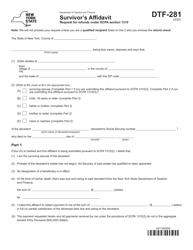

Form DTF-350 Group Affidavit - New York

What Is Form DTF-350?

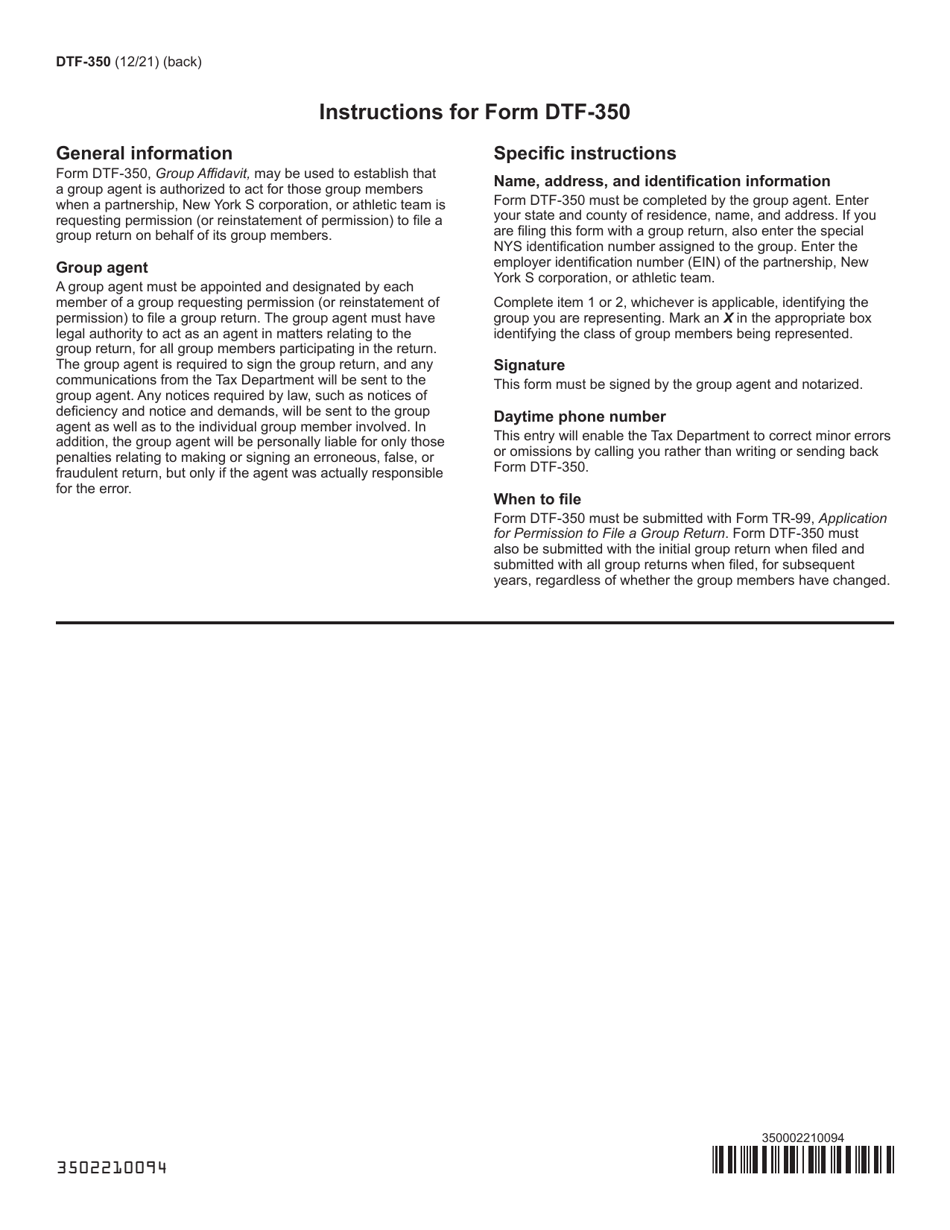

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-350?

A: Form DTF-350 is a Group Affidavit used in the state of New York.

Q: What is the purpose of Form DTF-350?

A: The purpose of Form DTF-350 is to report information about a group of related entities for tax purposes.

Q: Who needs to file Form DTF-350?

A: If you are part of a group of related entities and you meet the criteria set by the New York State Department of Taxation and Finance, you may need to file Form DTF-350.

Q: Is there a deadline for filing Form DTF-350?

A: Yes, the deadline for filing Form DTF-350 depends on the tax year of the group and is specified by the New York State Department of Taxation and Finance.

Q: Are there any fees associated with filing Form DTF-350?

A: There are no fees associated with filing Form DTF-350.

Q: What information do I need to provide on Form DTF-350?

A: Form DTF-350 requires information about the group of related entities, including their names, addresses, federal identification numbers, and other relevant details.

Q: What should I do if I have additional questions about Form DTF-350?

A: If you have any additional questions or need further assistance regarding Form DTF-350, you should contact the New York State Department of Taxation and Finance directly.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-350 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.