This version of the form is not currently in use and is provided for reference only. Download this version of

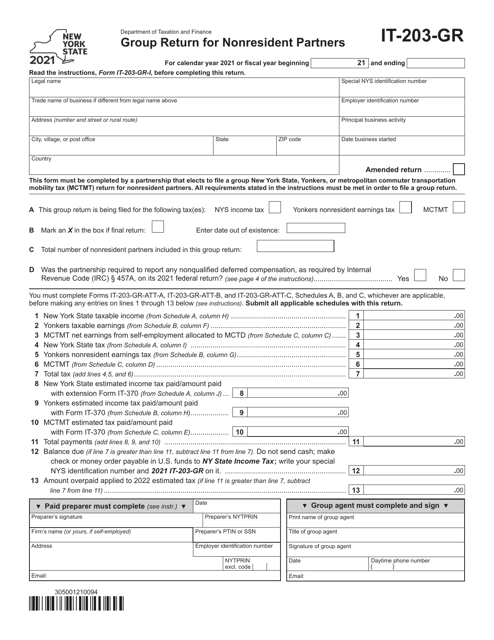

Form IT-203-GR

for the current year.

Form IT-203-GR Group Return for Nonresident Partners - New York

What Is Form IT-203-GR?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-203-GR?

A: Form IT-203-GR is a tax form used by nonresident partners in New York to file a group return.

Q: Who should file Form IT-203-GR?

A: Nonresident partners in New York who are part of a group return should file Form IT-203-GR.

Q: What is a group return?

A: A group return is a consolidated tax return filed by partnerships or limited liability companies (LLCs) that have nonresident partners or members in New York.

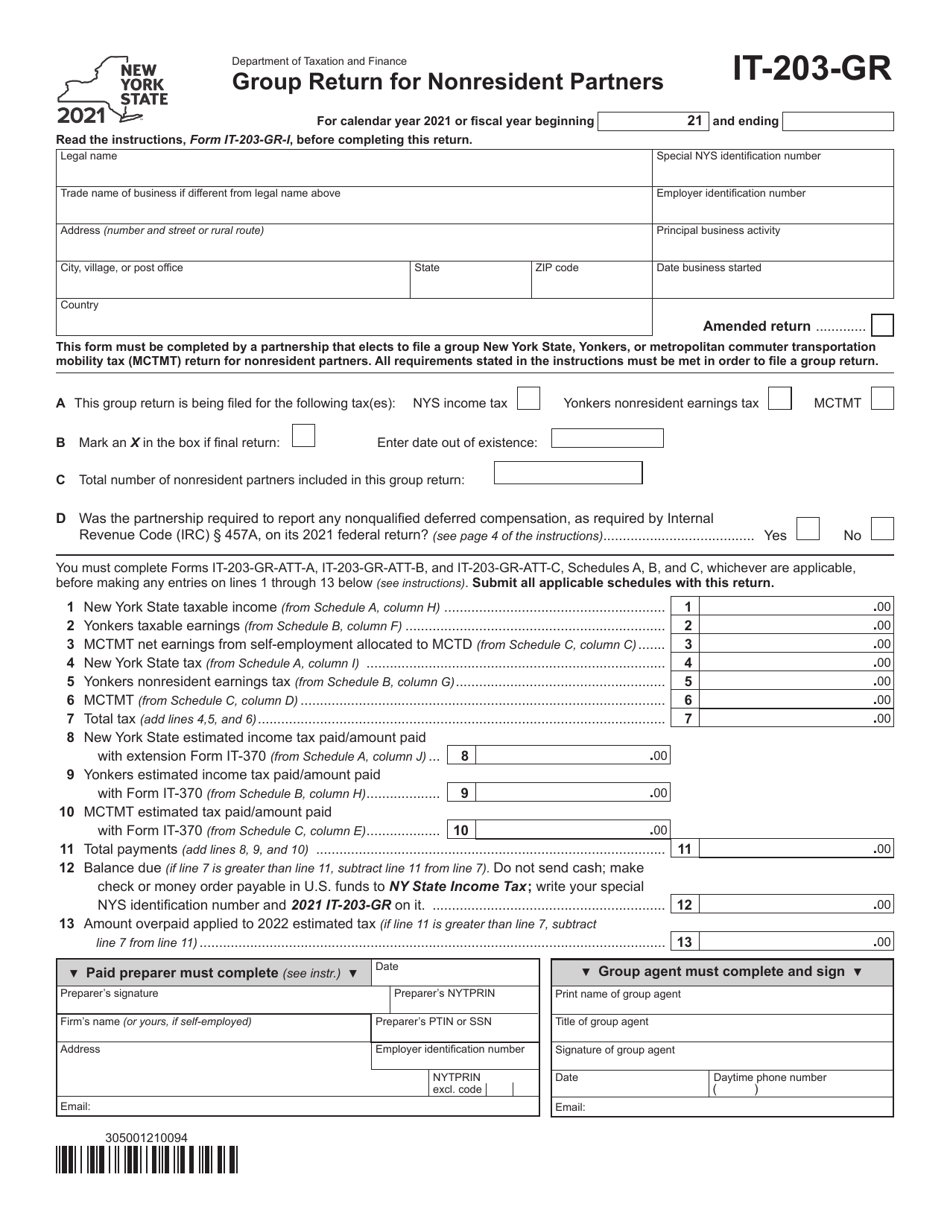

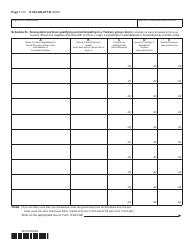

Q: What information is required on Form IT-203-GR?

A: Form IT-203-GR requires information about each nonresident partner, including their share of partnership income and any credits or deductions.

Q: When is Form IT-203-GR due?

A: Form IT-203-GR is due on or before the 15th day of the third month following the close of the partnership's tax year.

Q: Are there any penalties for late filing of Form IT-203-GR?

A: Yes, there may be penalties for late filing of Form IT-203-GR. It's important to file the form on time to avoid these penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-GR by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.