This version of the form is not currently in use and is provided for reference only. Download this version of

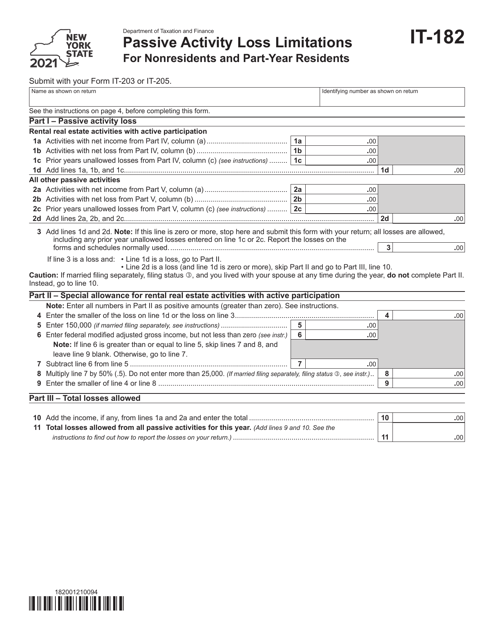

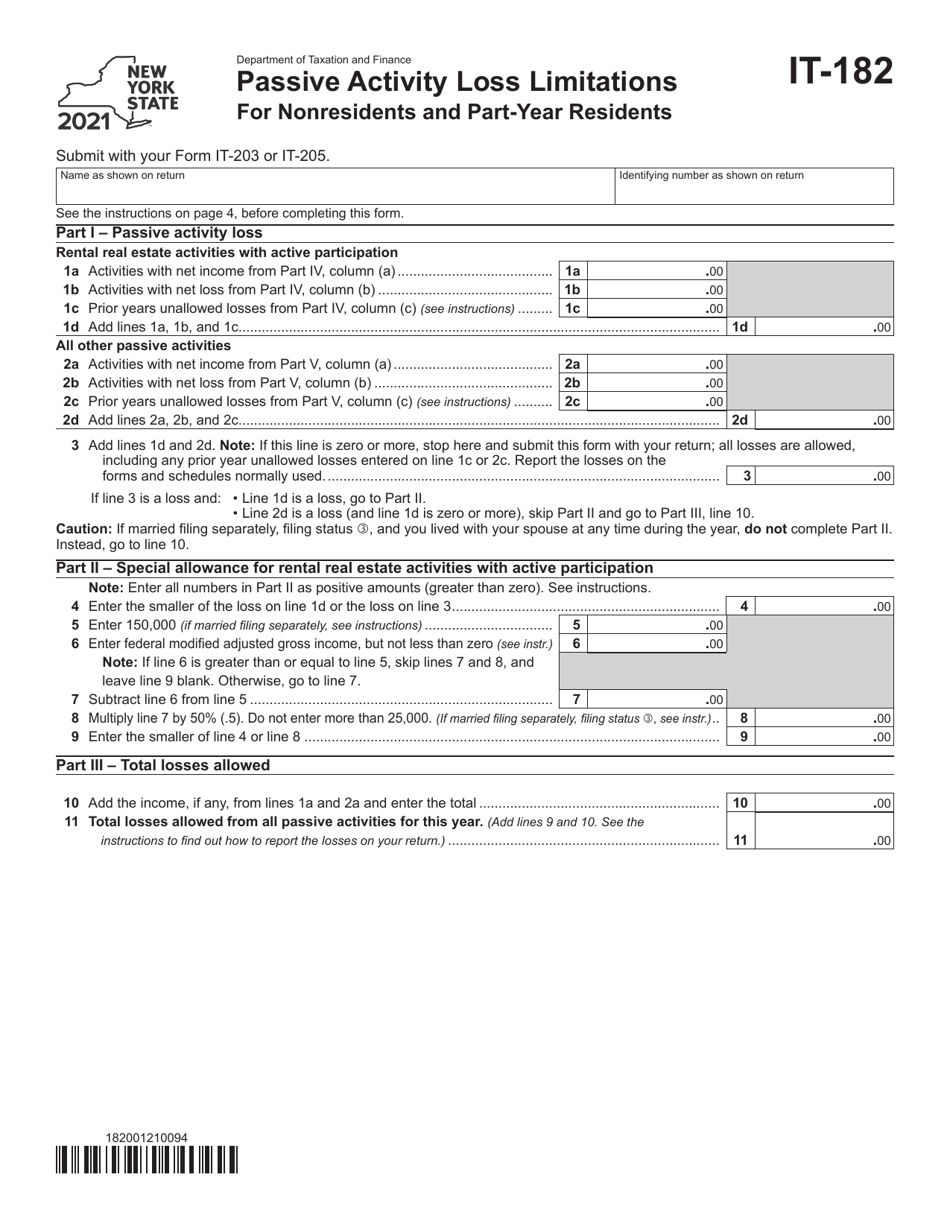

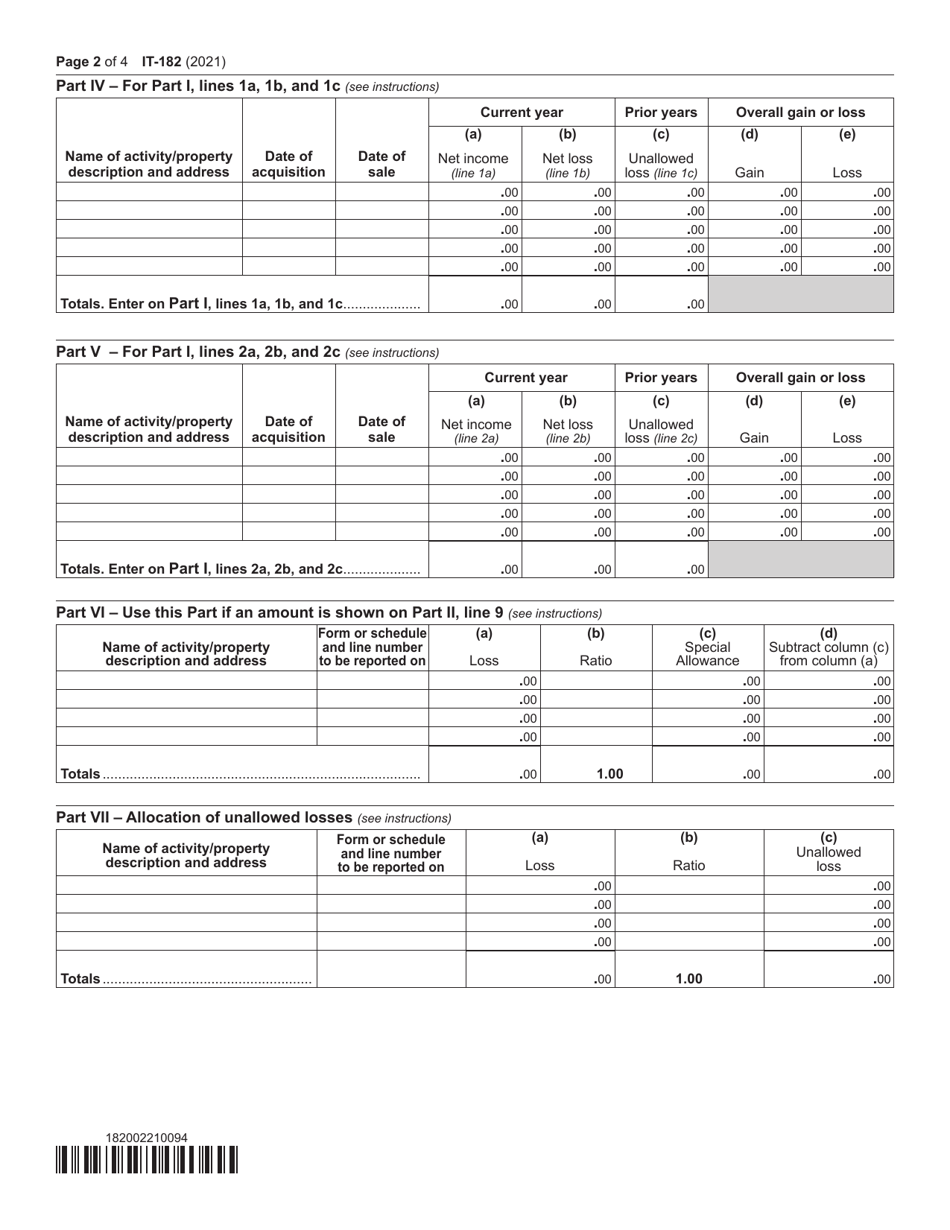

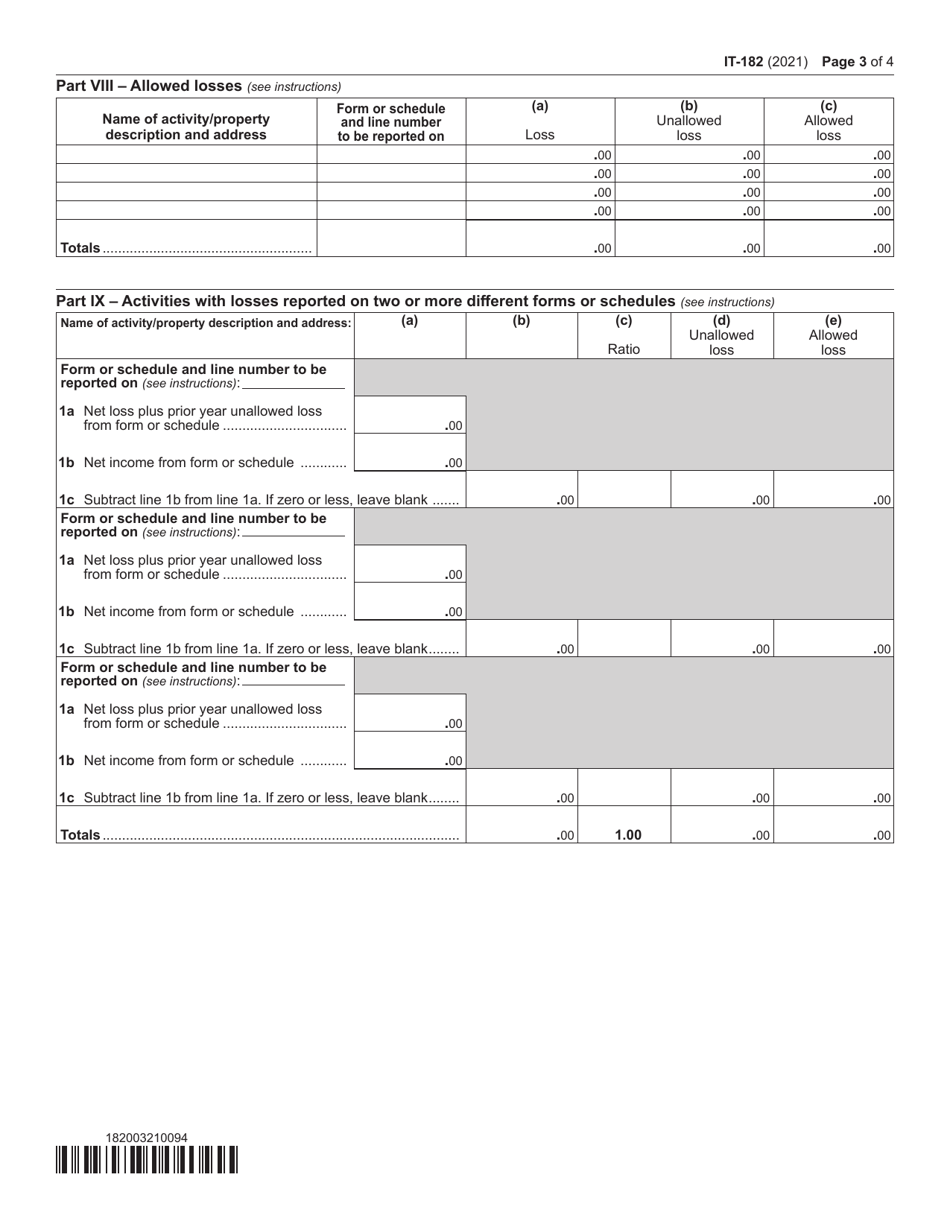

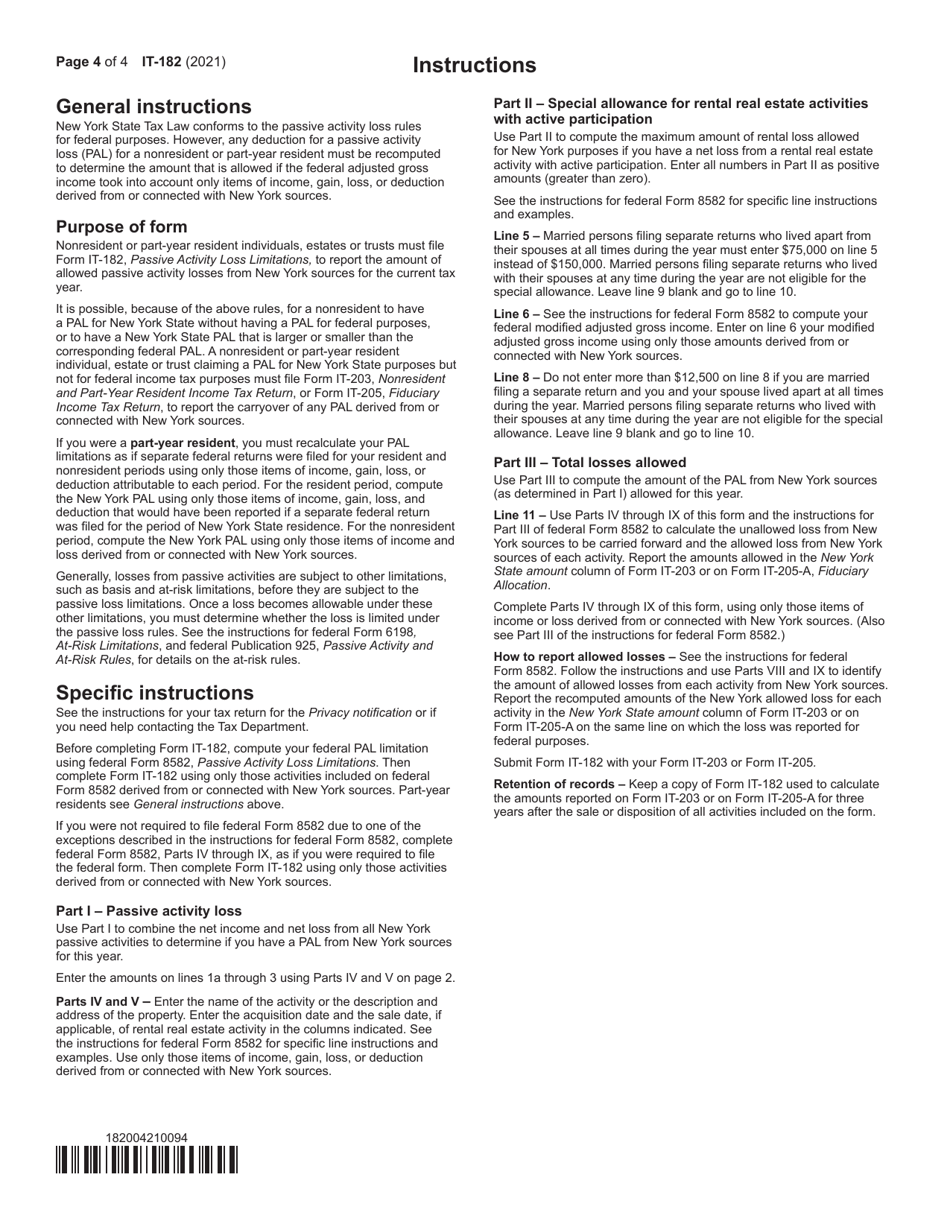

Form IT-182

for the current year.

Form IT-182 Passive Activity Loss Limitations for Nonresidents and Part-Year Residents - New York

What Is Form IT-182?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form IT-182?

A: Nonresidents and part-year residents who have passive activity losses in New York.

Q: What is Form IT-182 used for?

A: Form IT-182 is used to calculate and report passive activity loss limitations for nonresidents and part-year residents in New York.

Q: What are passive activity losses?

A: Passive activity losses are losses from rental real estate, limited partnerships, or other passive activities.

Q: Are there any exceptions to the passive activity loss limitations?

A: Yes, there are exceptions for certain real estate professionals and for individuals with certified historic structures.

Q: When is Form IT-182 due?

A: Form IT-182 is due on the same date as your New York state income tax return, usually April 15th.

Q: Do I need to file a separate Form IT-182 for each passive activity?

A: No, you only need to file one Form IT-182 to report all your passive activity losses in New York.

Q: What happens if I don't file Form IT-182?

A: If you have passive activity losses and do not file Form IT-182, you may not be able to deduct those losses on your New York state tax return.

Q: Can I e-file Form IT-182?

A: No, currently e-filing is not available for Form IT-182. You must file a paper return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-182 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.