This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-399

for the current year.

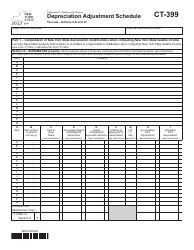

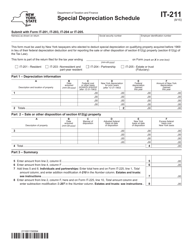

Form IT-399 New York State Depreciation Schedule - New York

What Is Form IT-399?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

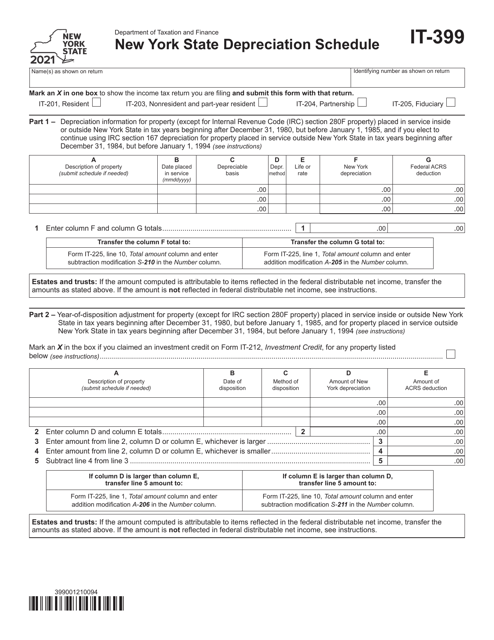

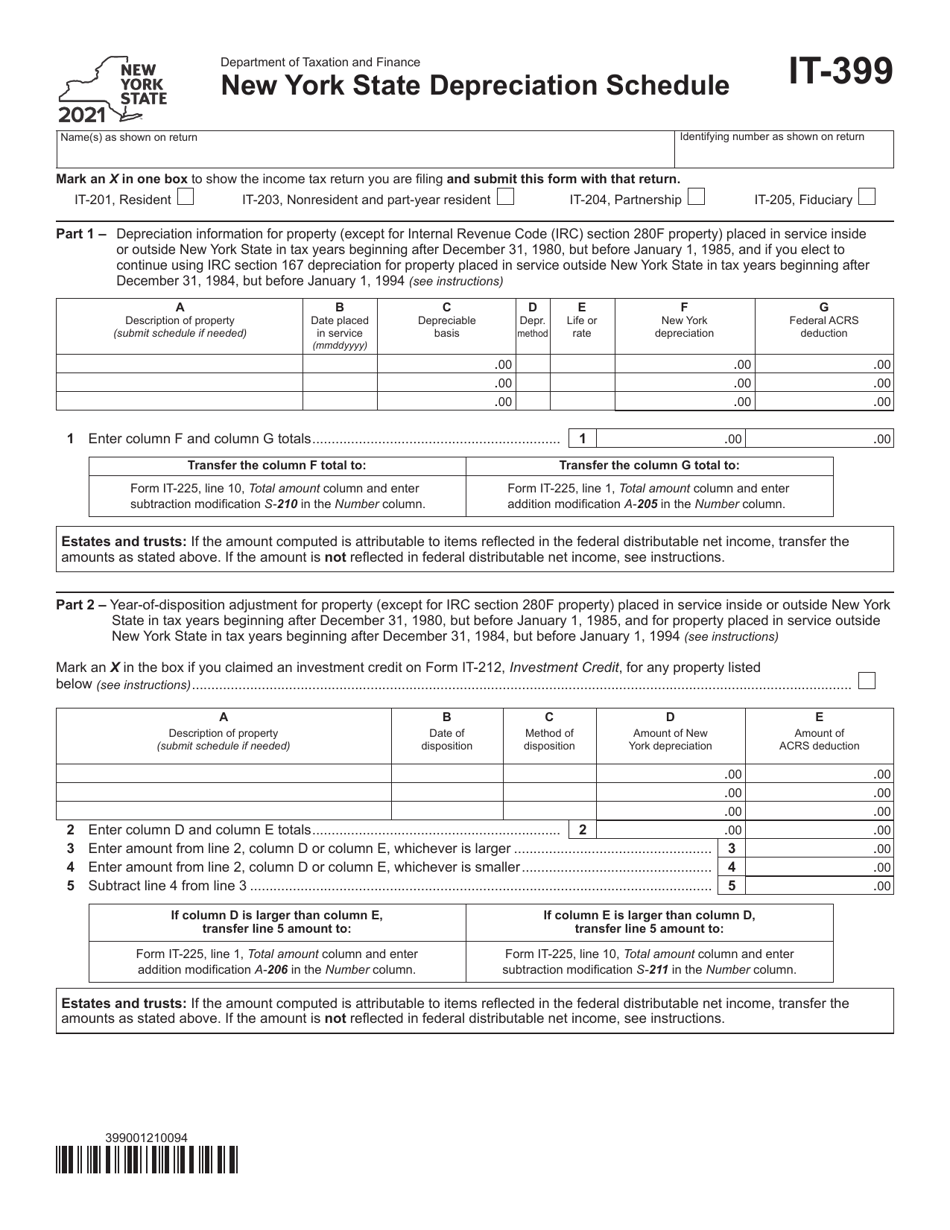

Q: What is Form IT-399?

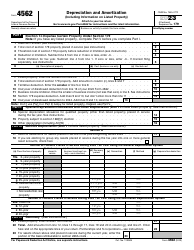

A: Form IT-399 is the New York State Depreciation Schedule used by individuals and businesses in New York to report depreciation expenses.

Q: Who needs to file Form IT-399?

A: Individuals and businesses in New York who wish to claim depreciation expenses on their tax returns need to file Form IT-399.

Q: What information is required on Form IT-399?

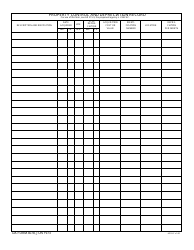

A: Form IT-399 requires information about the asset, such as its description, date placed into service, cost, and method of depreciation.

Q: When is Form IT-399 due?

A: Form IT-399 is typically due with your New York State tax return, which is generally due by April 15th each year.

Q: Can I e-file Form IT-399?

A: Yes, you can e-file Form IT-399 if you are filing your New York State tax return electronically.

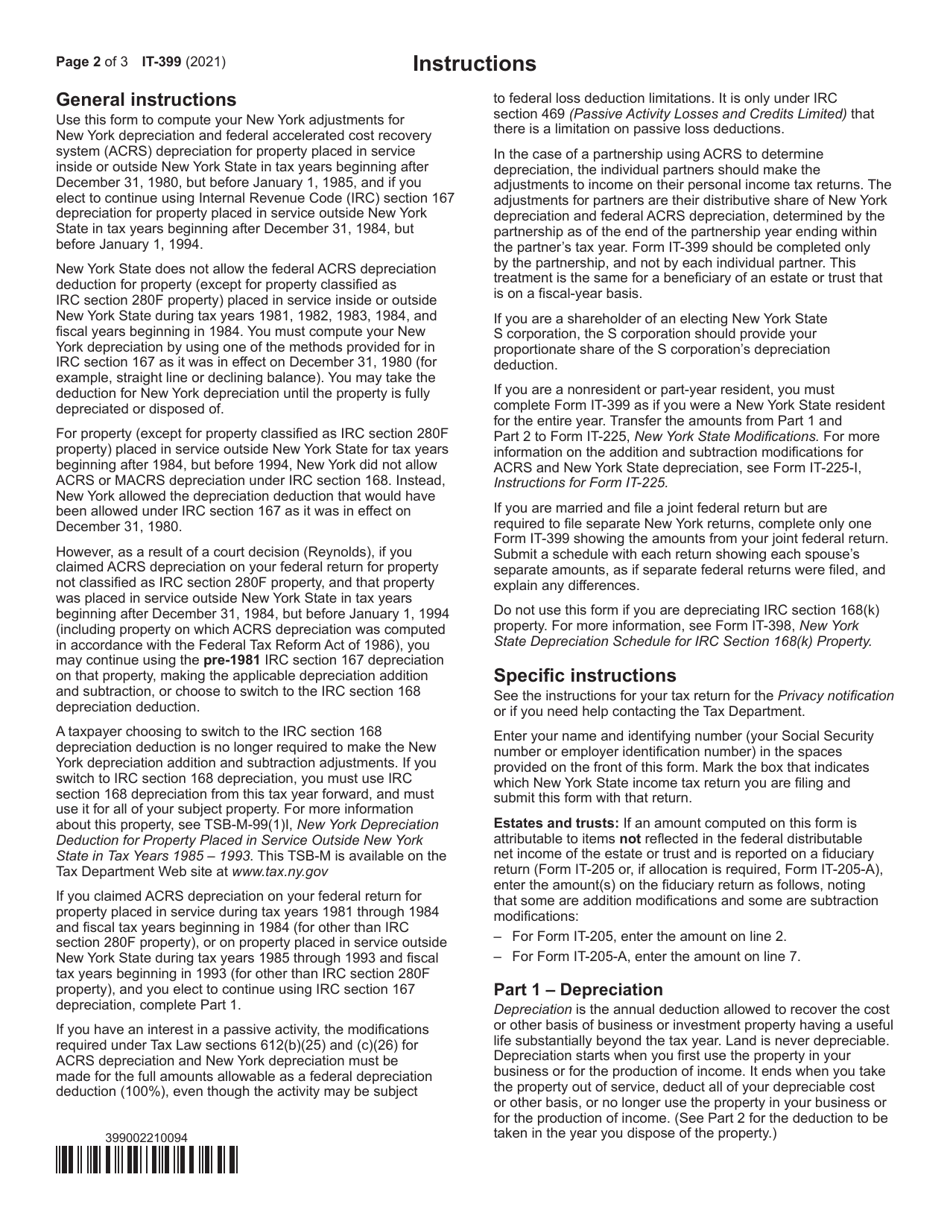

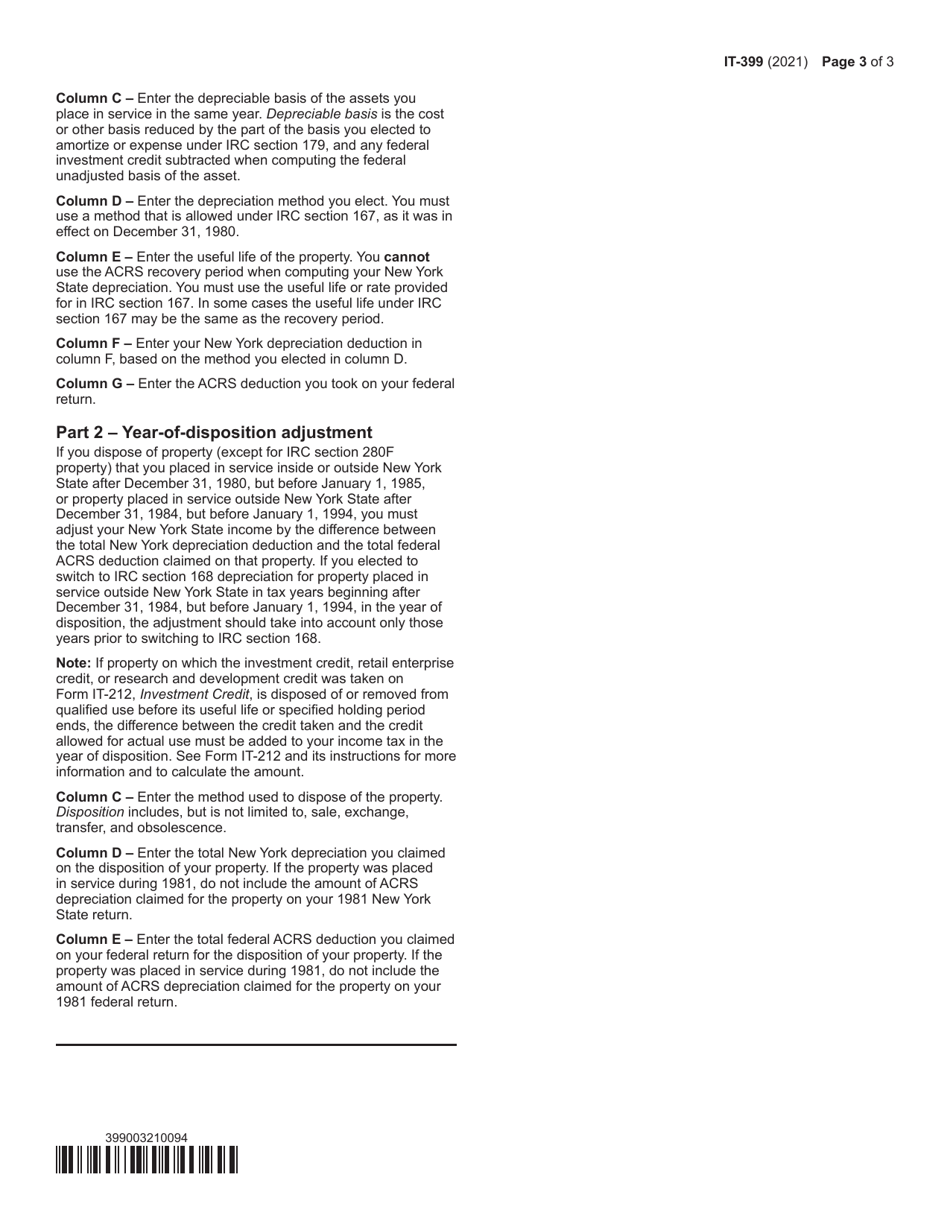

Q: Are there any special instructions for completing Form IT-399?

A: Yes, the instructions accompanying Form IT-399 provide guidance on how to correctly report depreciation expenses for New York State purposes.

Q: Can I claim depreciation expenses on my New York State return?

A: Yes, if you are a New York State resident or have income from New York State sources, you can claim depreciation expenses on your New York State return.

Q: Is there a fee for filing Form IT-399?

A: No, there is no additional fee for filing Form IT-399. However, you may need to pay any applicable New York State income tax owed.

Q: Can I amend my Form IT-399 if needed?

A: Yes, you can file an amended Form IT-399 if you need to make changes to your previously filed depreciation schedule.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.