This version of the form is not currently in use and is provided for reference only. Download this version of

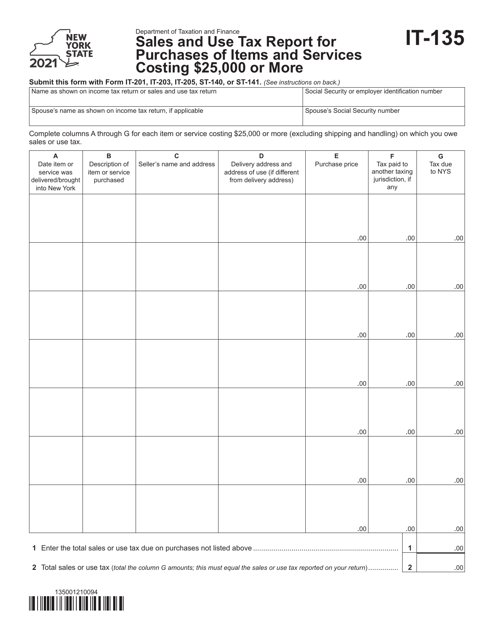

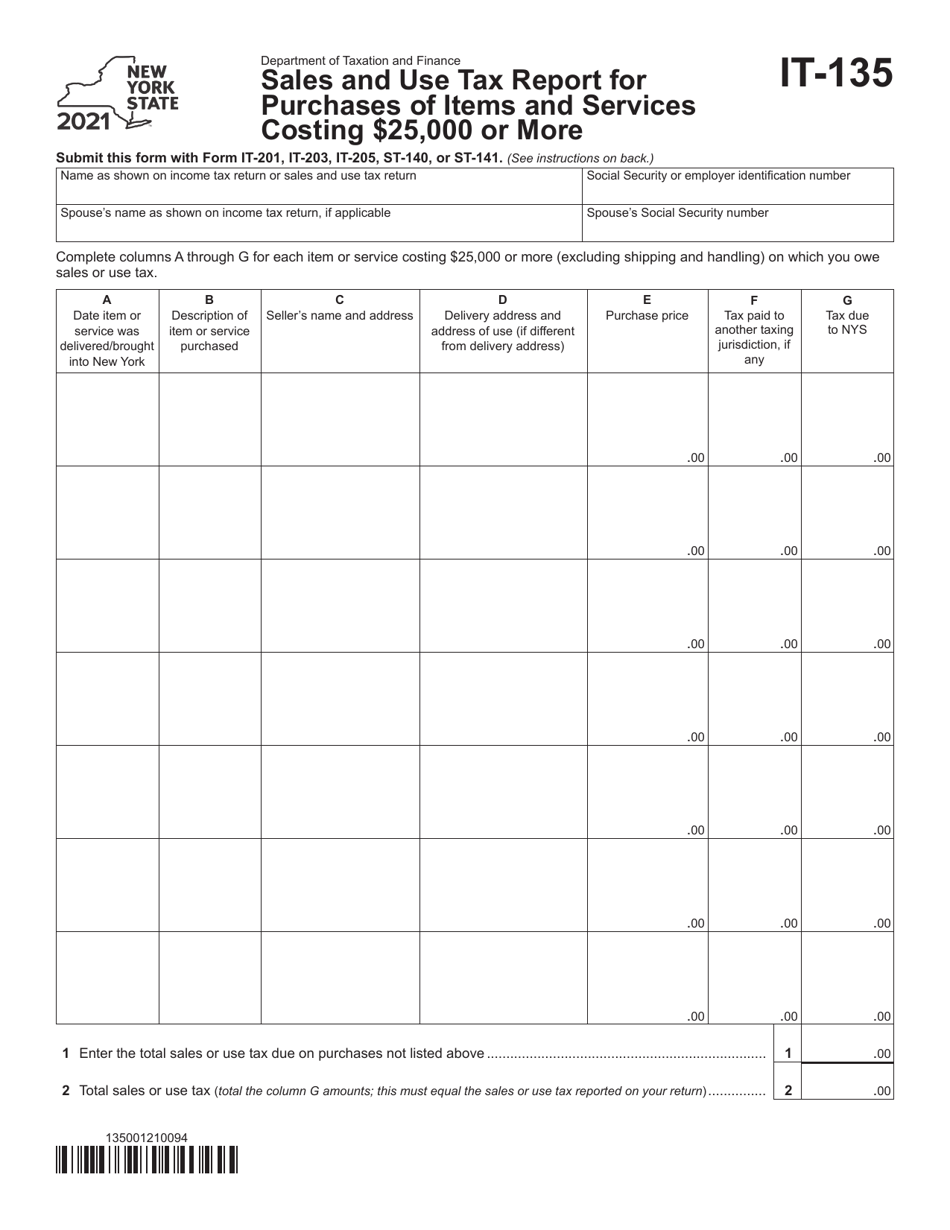

Form IT-135

for the current year.

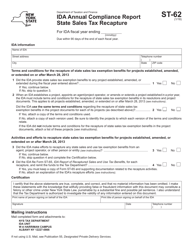

Form IT-135 Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More - New York

What Is Form IT-135?

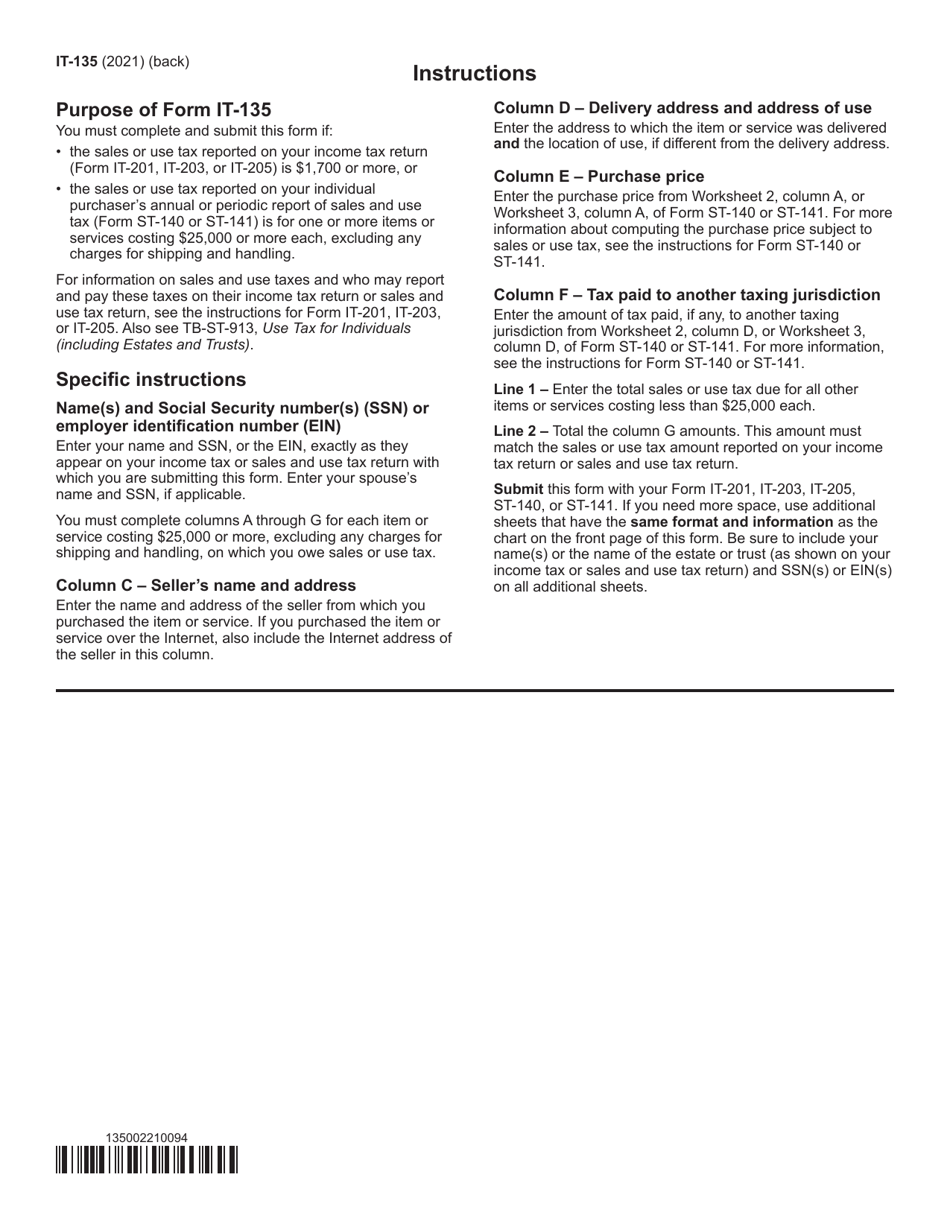

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

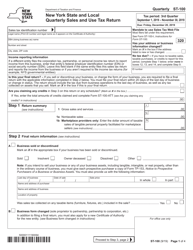

Q: What is Form IT-135?

A: Form IT-135 is the Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More in New York.

Q: Who needs to file Form IT-135?

A: Any individual or business in New York who made purchases of items or services costing $25,000 or more needs to file Form IT-135.

Q: What is the purpose of Form IT-135?

A: The purpose of Form IT-135 is to report and pay sales and use tax on purchases of items and services costing $25,000 or more in New York.

Q: When is Form IT-135 due?

A: Form IT-135 is due on a quarterly basis, along with the payment of the sales and use tax.

Q: Are there any penalties for not filing Form IT-135?

A: Yes, there are penalties for not filing Form IT-135, including interest charges and possible legal action.

Q: What information do I need to provide on Form IT-135?

A: You will need to provide details about your purchases of items and services costing $25,000 or more, including the amount, description, and date of each purchase.

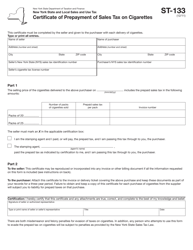

Q: Do I need to include supporting documentation with Form IT-135?

A: Yes, you may need to include supporting documentation to substantiate your purchases, such as invoices or receipts.

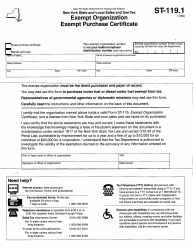

Q: Can I claim any exemptions on Form IT-135?

A: Yes, you may be able to claim certain exemptions on Form IT-135, depending on the nature of your purchases.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-135 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.