This version of the form is not currently in use and is provided for reference only. Download this version of

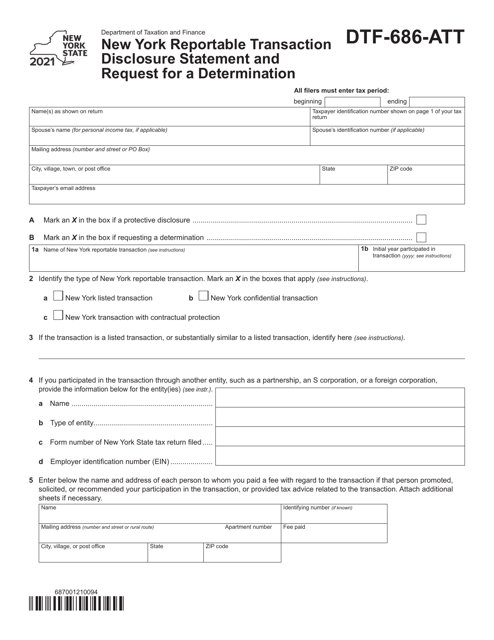

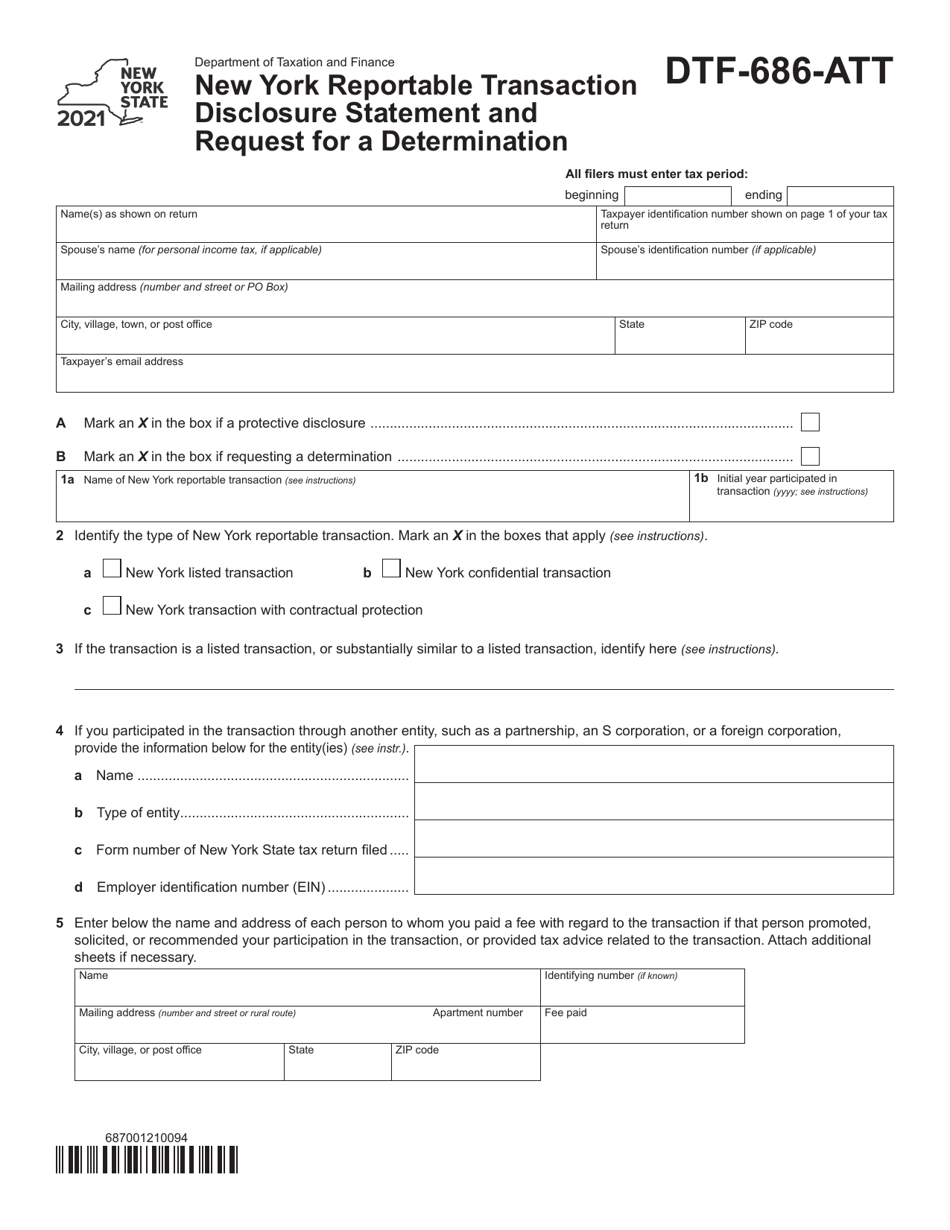

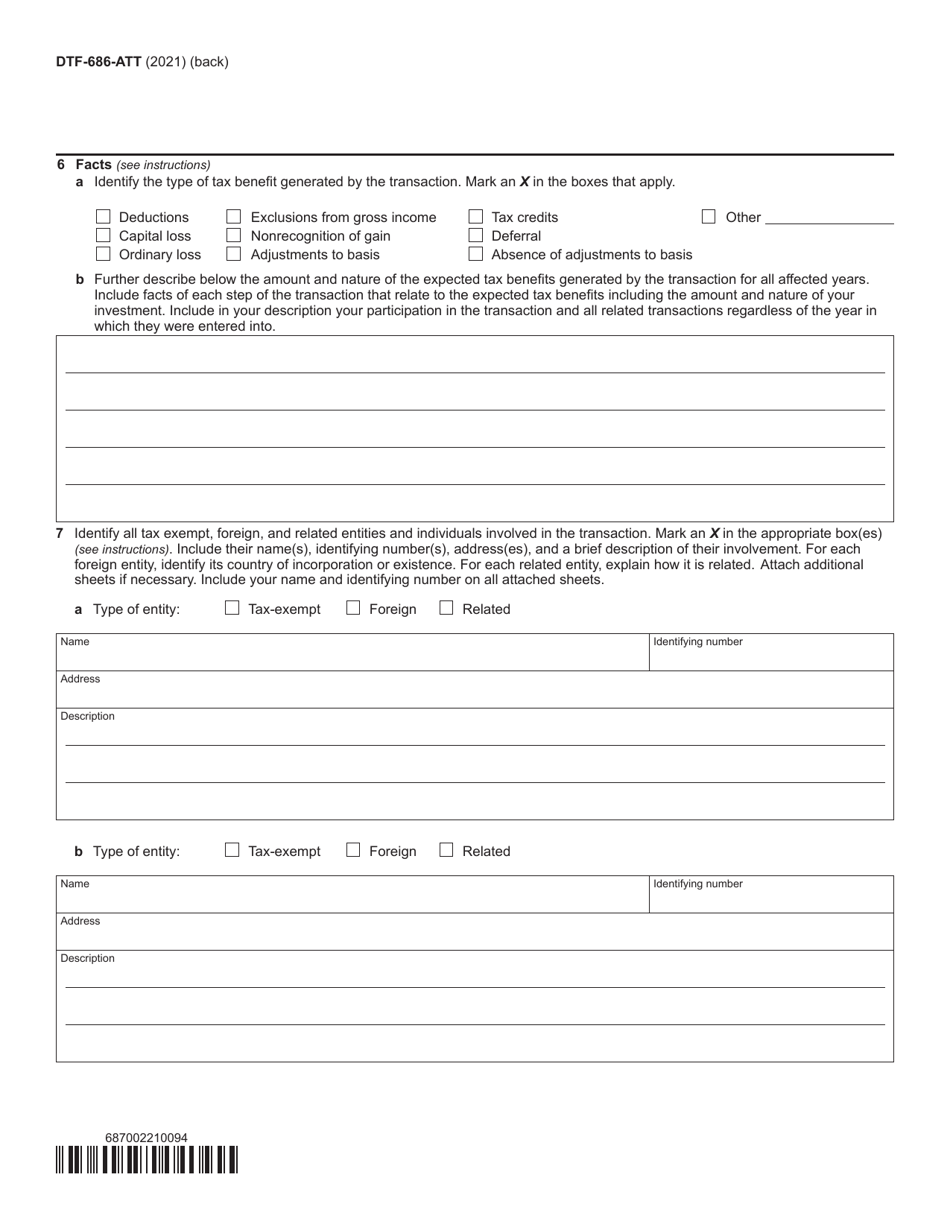

Form DTF-686-ATT

for the current year.

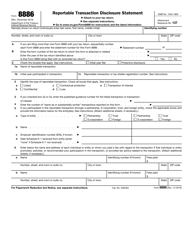

Form DTF-686-ATT New York Reportable Transaction Disclosure Statement and Request for a Determination - New York

What Is Form DTF-686-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-686-ATT?

A: Form DTF-686-ATT is a Reportable Transaction Disclosure Statement and Request for a Determination specific to New York state.

Q: What is the purpose of Form DTF-686-ATT?

A: The purpose of Form DTF-686-ATT is to disclose transactions that are subject to certain reporting requirements in New York and request a determination from the New York State Department of Taxation and Finance.

Q: Who needs to file Form DTF-686-ATT?

A: Any taxpayer who engages in certain reportable transactions in New York is required to file Form DTF-686-ATT.

Q: What are reportable transactions?

A: Reportable transactions are specific types of transactions that are subject to reporting requirements in New York. These transactions are generally complex or potentially abusive in nature.

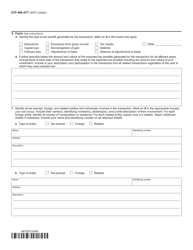

Q: What information is required on Form DTF-686-ATT?

A: Form DTF-686-ATT requires detailed information about the reportable transaction, including the parties involved, the nature of the transaction, and the potential tax implications.

Q: Is there a deadline for filing Form DTF-686-ATT?

A: Yes, Form DTF-686-ATT must be filed within 30 days after the transaction becomes a reportable transaction.

Q: What happens after I file Form DTF-686-ATT?

A: After filing Form DTF-686-ATT, the New York State Department of Taxation and Finance will review the information provided and make a determination regarding the tax treatment of the transaction.

Q: Are there any penalties for failing to file Form DTF-686-ATT?

A: Yes, failure to file Form DTF-686-ATT can result in penalties imposed by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-686-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.