This version of the form is not currently in use and is provided for reference only. Download this version of

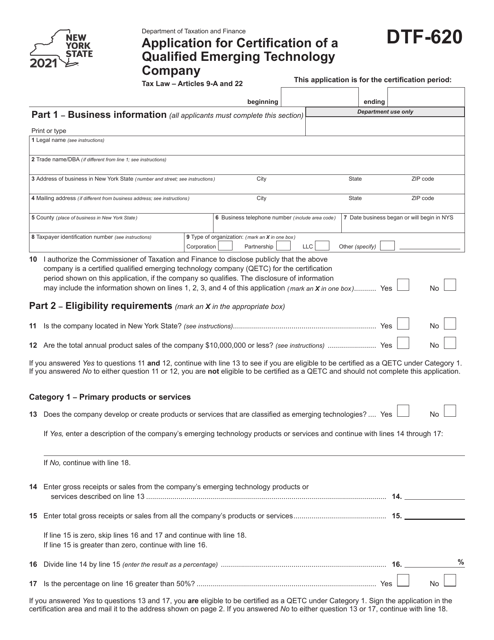

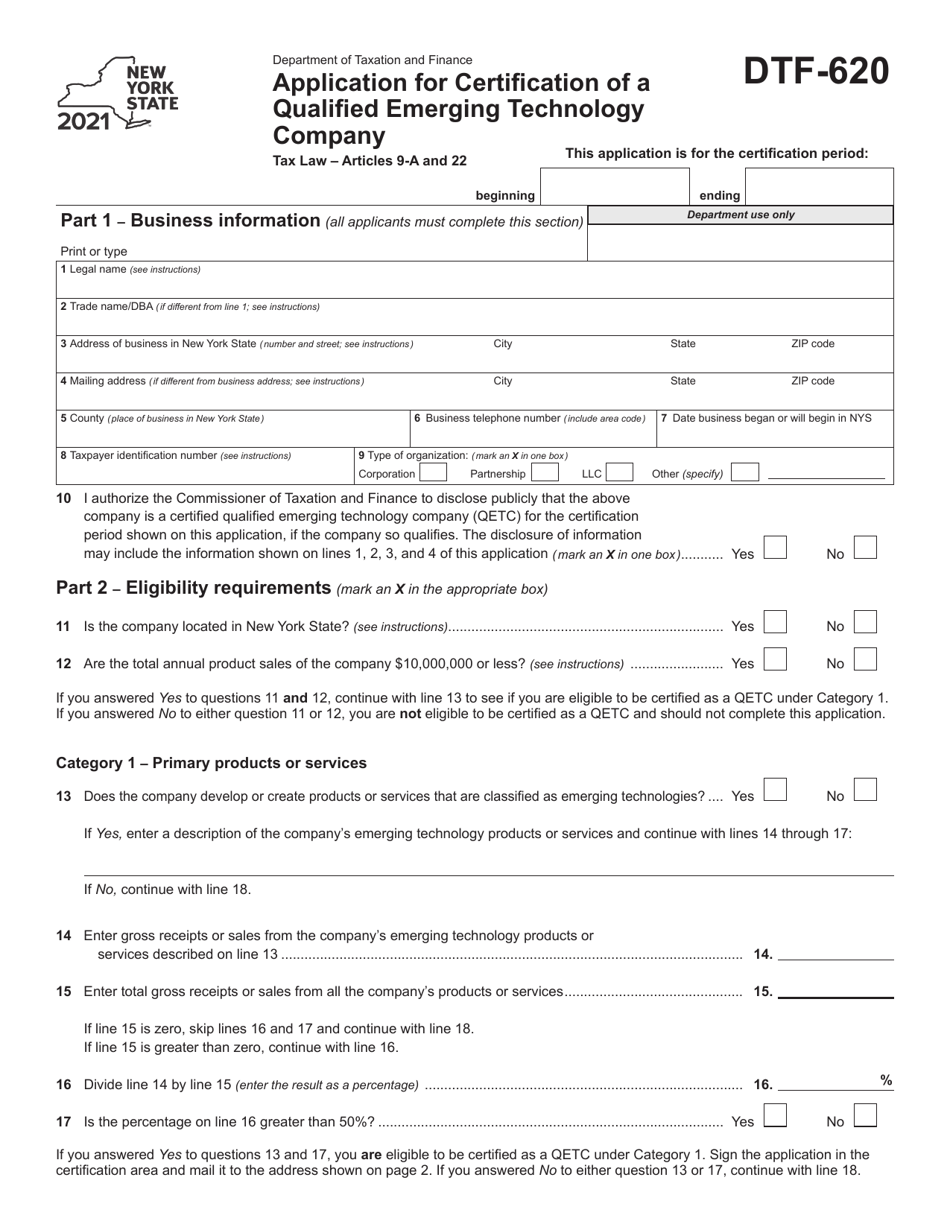

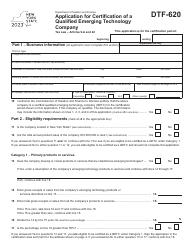

Form DTF-620

for the current year.

Form DTF-620 Application for Certification of a Qualified Emerging Technology Company - New York

What Is Form DTF-620?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-620?

A: Form DTF-620 is an application for certification of a Qualified Emerging Technology Company in New York.

Q: What is a Qualified Emerging Technology Company?

A: A Qualified Emerging Technology Company is a business that meets certain criteria and is eligible for tax benefits in New York.

Q: How can I obtain Form DTF-620?

A: You can obtain Form DTF-620 from the New York State Department of Taxation and Finance.

Q: What are the tax benefits available for Qualified Emerging Technology Companies?

A: Qualified Emerging Technology Companies may be eligible for tax credits, exemptions, or other benefits.

Q: Who is eligible to apply for certification as a Qualified Emerging Technology Company?

A: Businesses that meet certain criteria, such as being engaged in qualified emerging technologies and having less than a certain amount of full-time employees, may be eligible to apply.

Q: Are there any fees associated with the application?

A: There is no fee associated with the application for certification as a Qualified Emerging Technology Company.

Q: What documents should be submitted along with Form DTF-620?

A: The specific documents required may vary, but generally, you will need to provide financial statements, certifications, and supporting documentation relating to your business.

Q: What are the criteria for being considered a Qualified Emerging Technology Company?

A: The criteria may include being engaged in qualified emerging technologies, having less than a certain amount of full-time employees, and meeting certain revenue thresholds.

Q: Is the certification as a Qualified Emerging Technology Company permanent?

A: No, the certification is not permanent and needs to be renewed periodically.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-620 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.