This version of the form is not currently in use and is provided for reference only. Download this version of

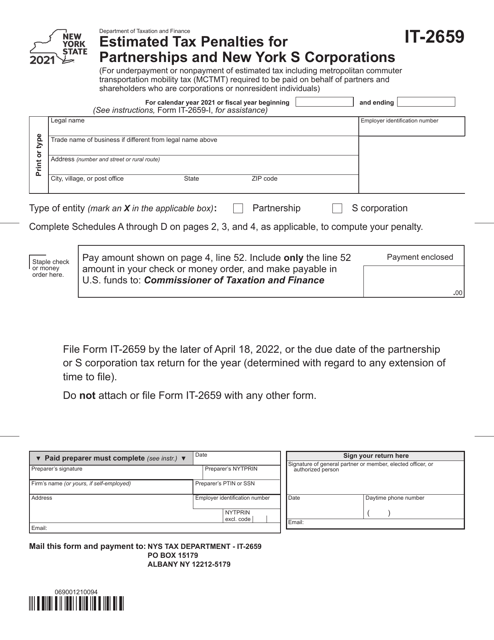

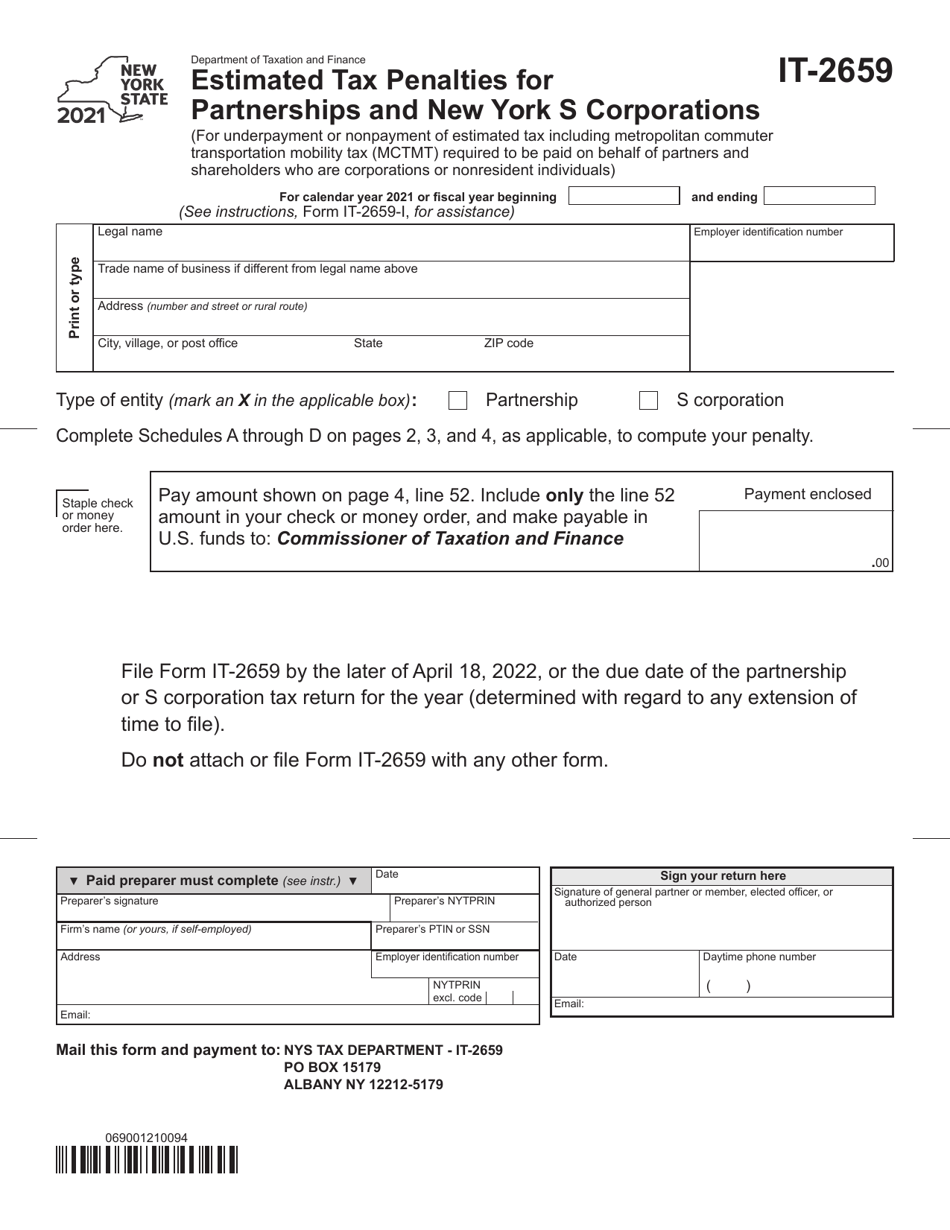

Form IT-2659

for the current year.

Form IT-2659 Estimated Tax Penalties for Partnerships and New York S Corporations - New York

What Is Form IT-2659?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2659?

A: Form IT-2659 is the Estimated Tax Penalties form for Partnerships and New York S Corporations in New York.

Q: Who needs to file Form IT-2659?

A: Partnerships and New York S Corporations in New York need to file Form IT-2659.

Q: What is the purpose of Form IT-2659?

A: The purpose of Form IT-2659 is to calculate and report estimated tax penalties for Partnerships and New York S Corporations.

Q: When is Form IT-2659 due?

A: Form IT-2659 is due on or before the 15th day of the 3rd month following the close of the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2659 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.