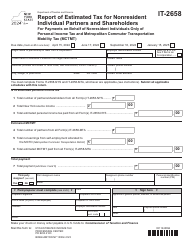

This version of the form is not currently in use and is provided for reference only. Download this version of

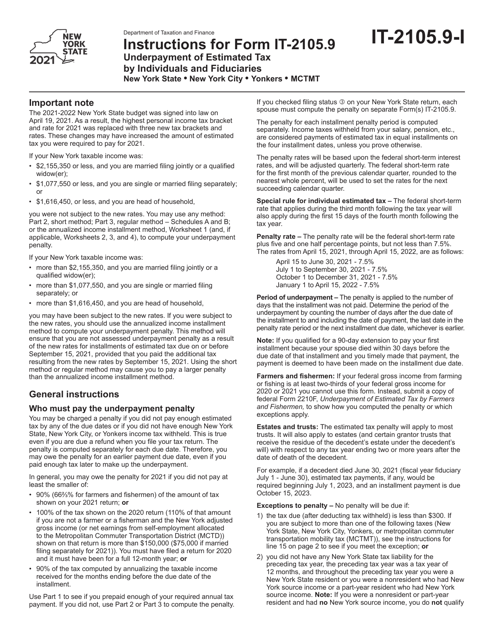

Instructions for Form IT-2105.9

for the current year.

Instructions for Form IT-2105.9 Underpayment of Estimated Tax by Individuals and Fiduciaries - New York

This document contains official instructions for Form IT-2105.9 , Underpayment of Estimated Tax by Individuals and Fiduciaries - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-2105.9 is available for download through this link.

FAQ

Q: What is Form IT-2105.9?

A: Form IT-2105.9 is a tax form used by individuals and fiduciaries in New York to report the underpayment of estimated tax.

Q: Who needs to file Form IT-2105.9?

A: Individuals and fiduciaries in New York who have underpaid their estimated tax during the year need to file Form IT-2105.9.

Q: When is Form IT-2105.9 due?

A: Form IT-2105.9 is due on or before the due date of your New York State income tax return, which is usually April 15th.

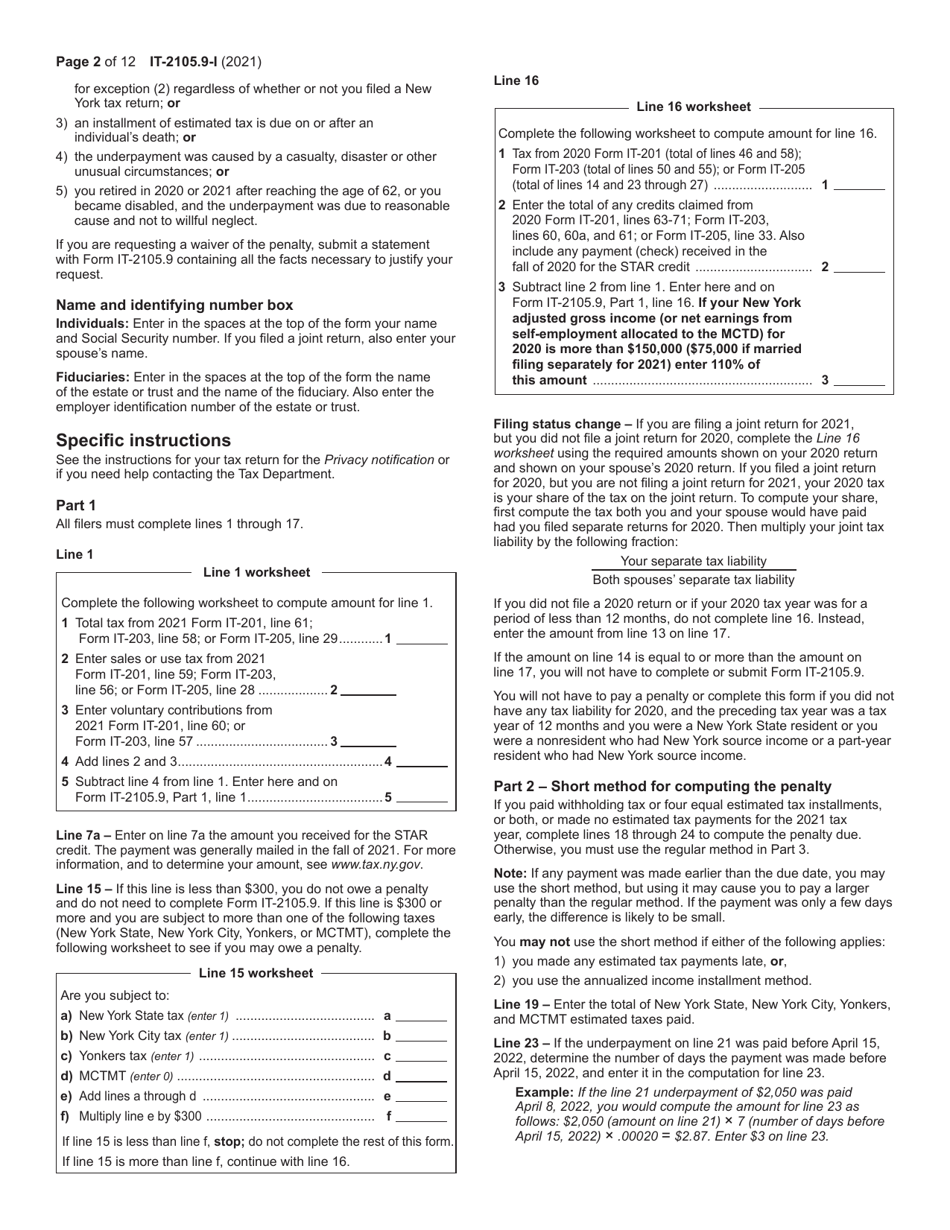

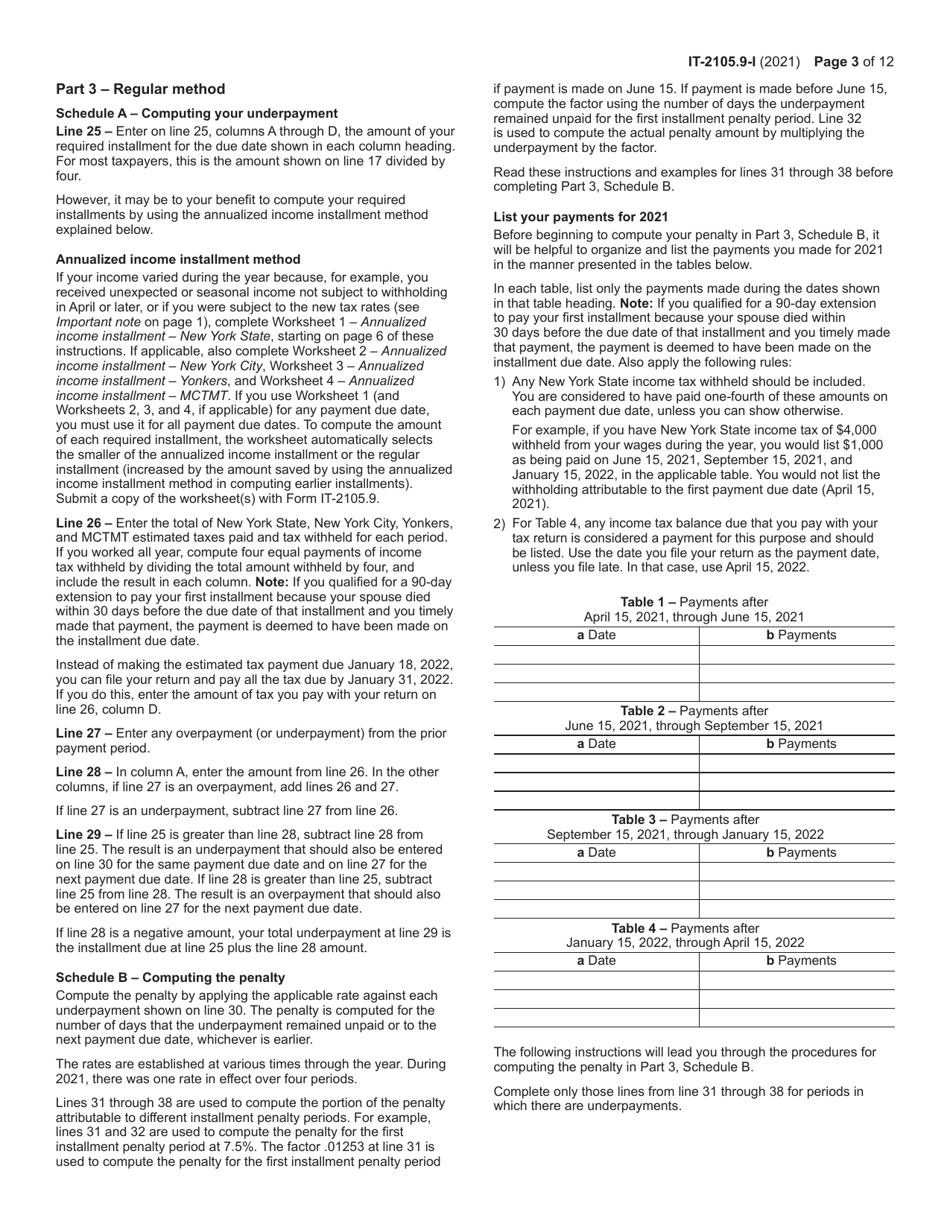

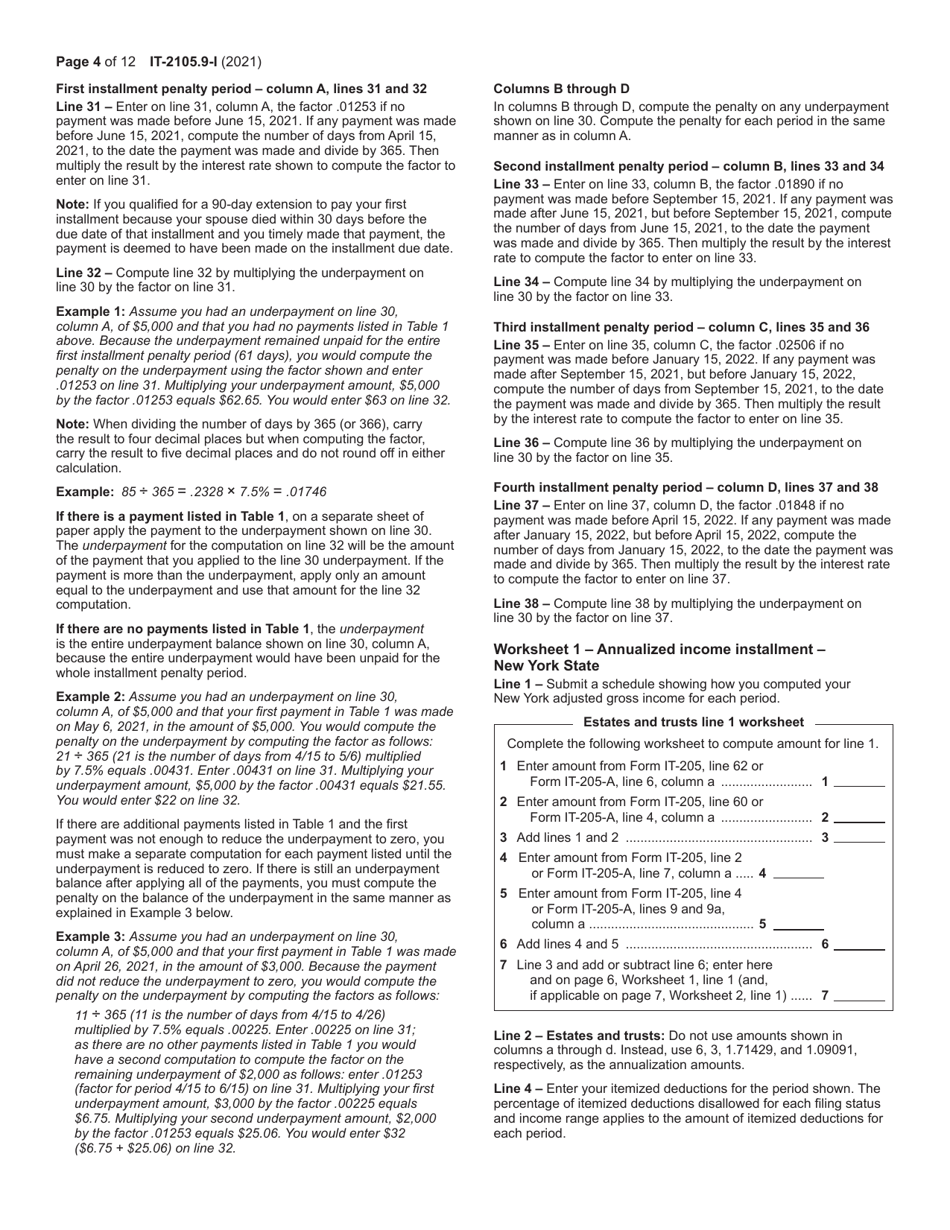

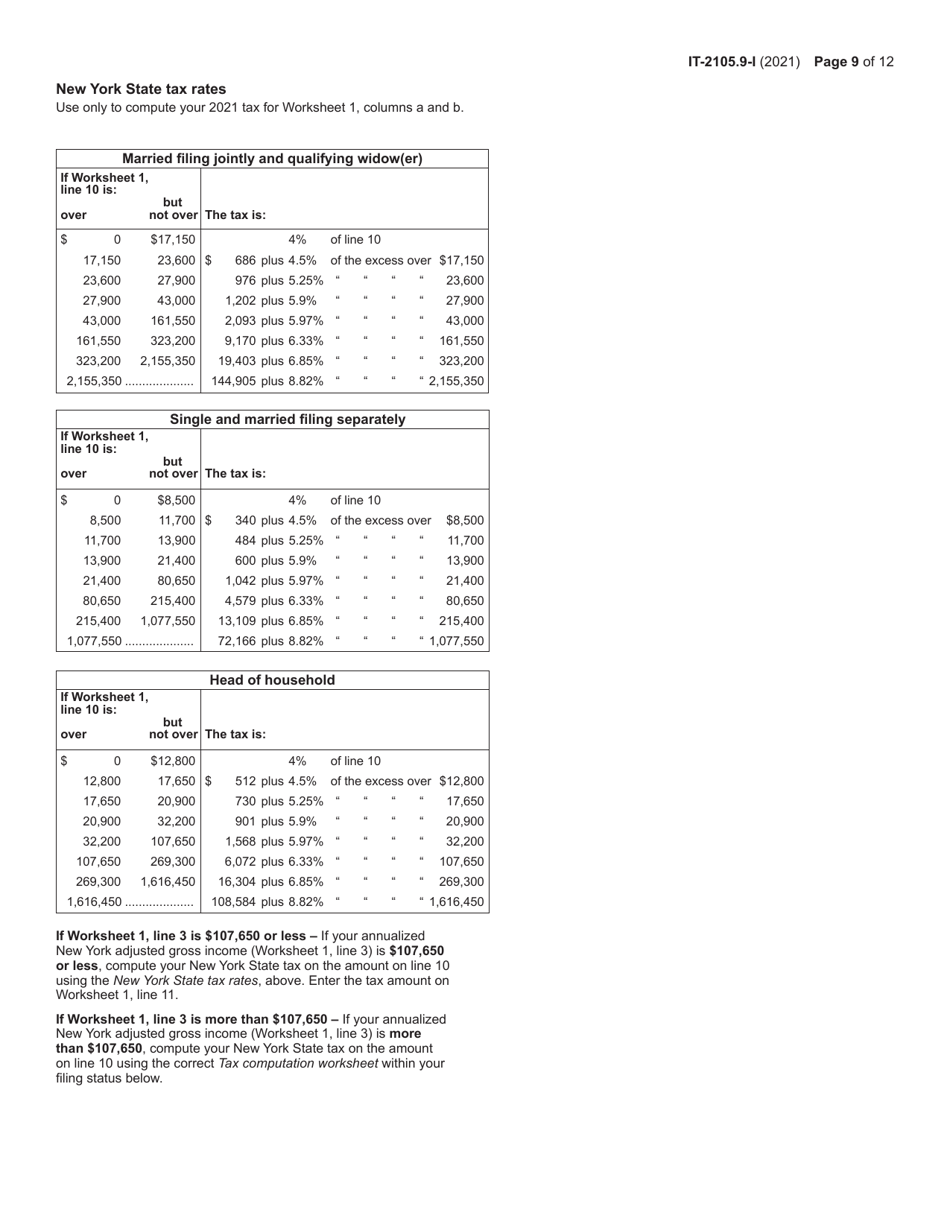

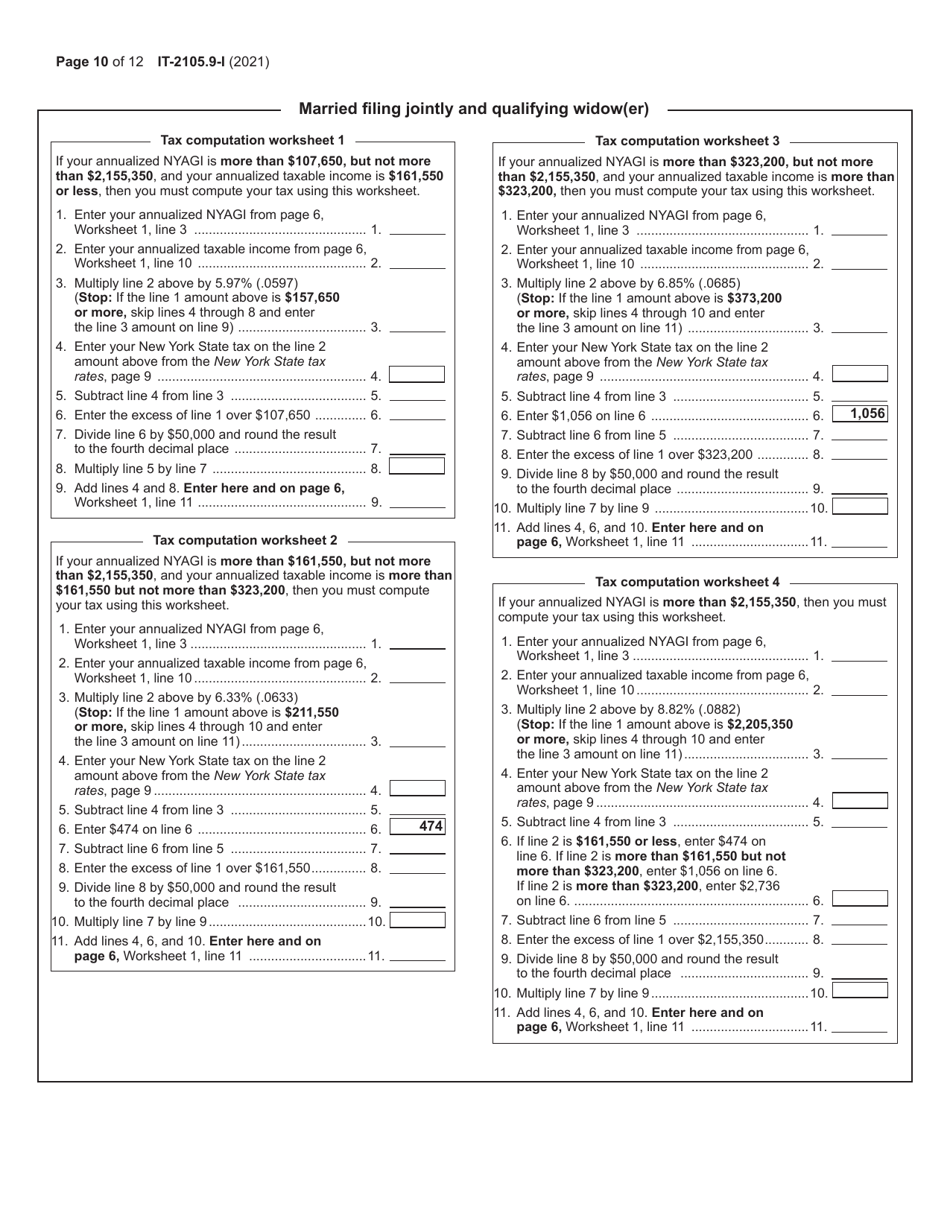

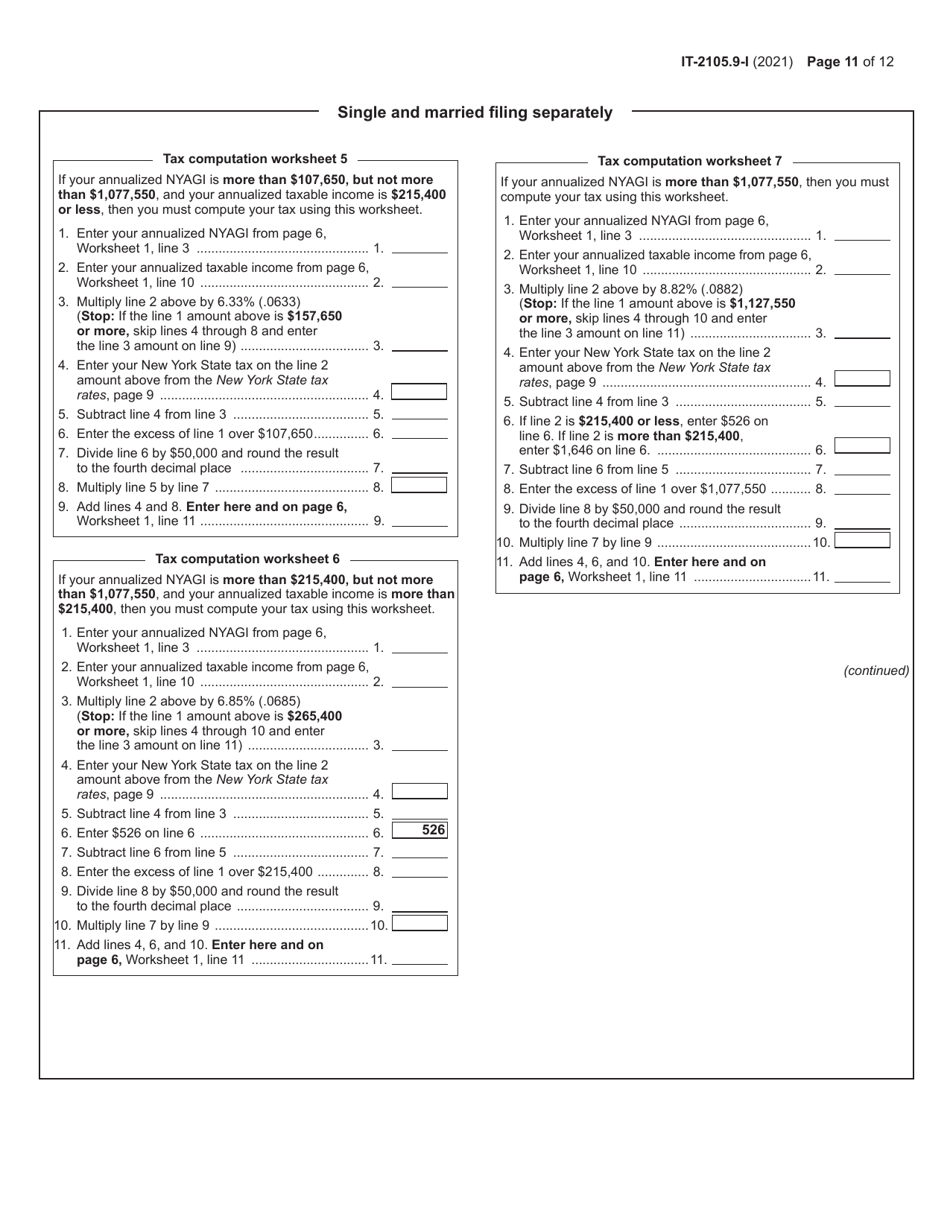

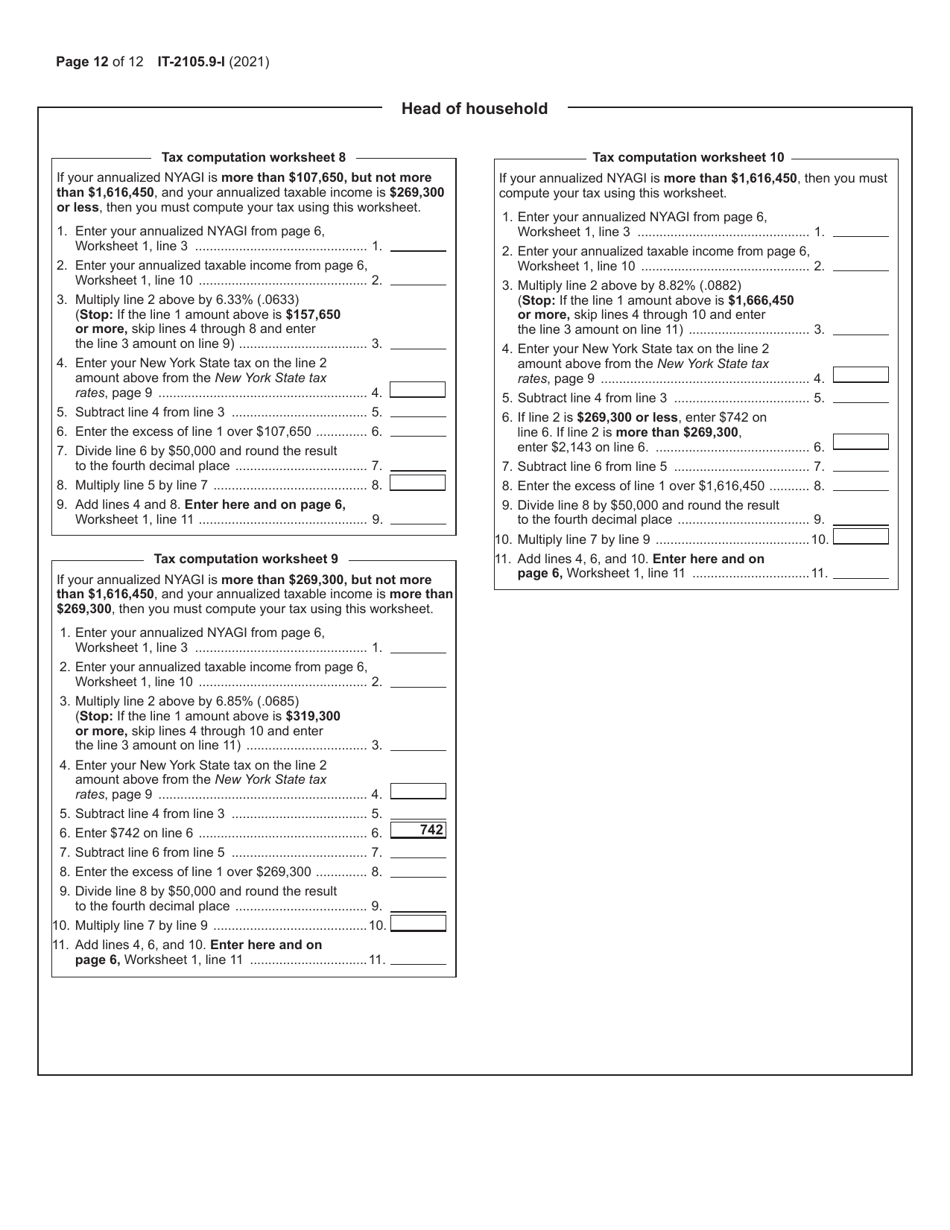

Q: How do I calculate the underpayment penalty?

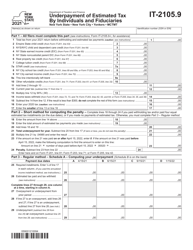

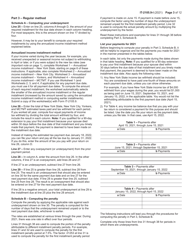

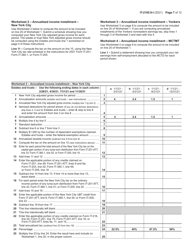

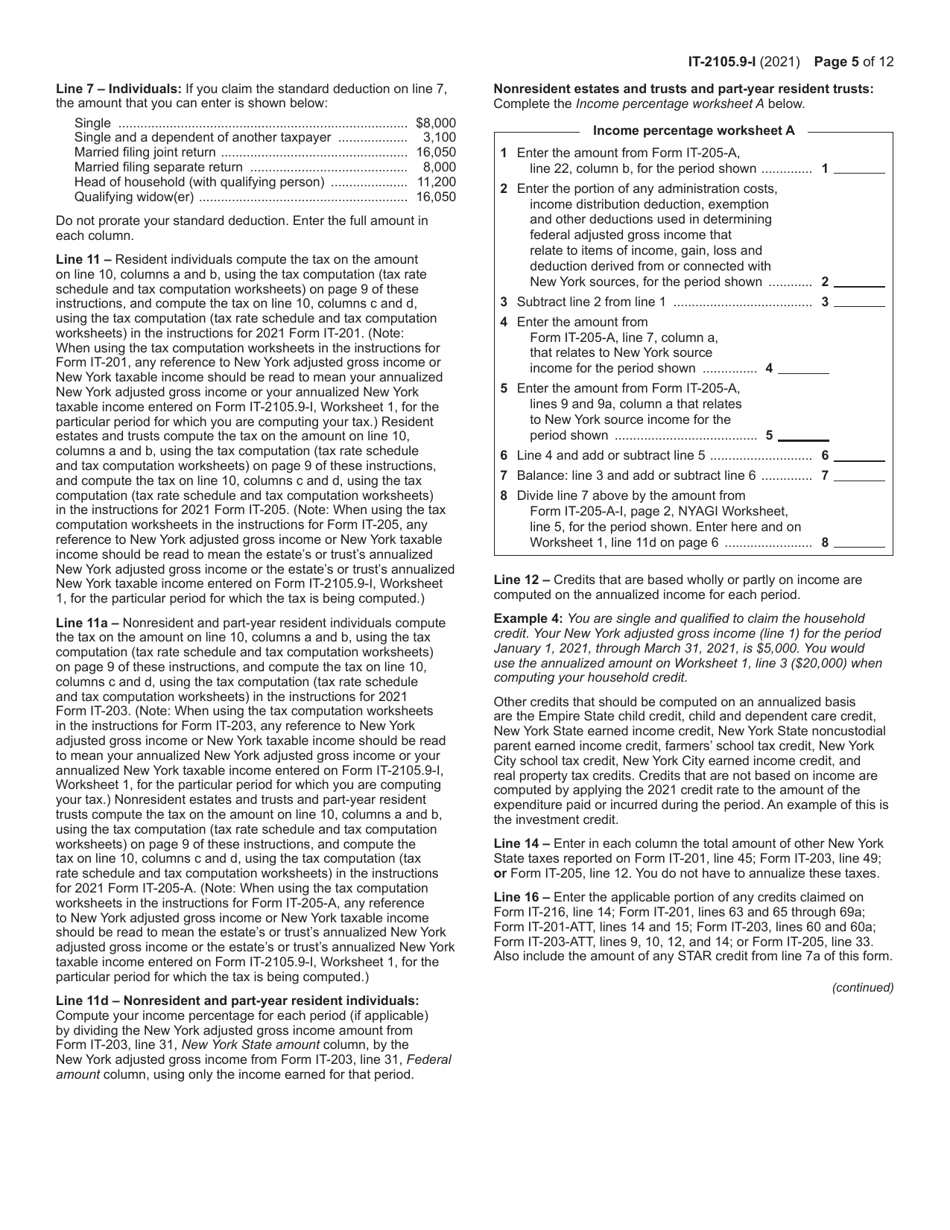

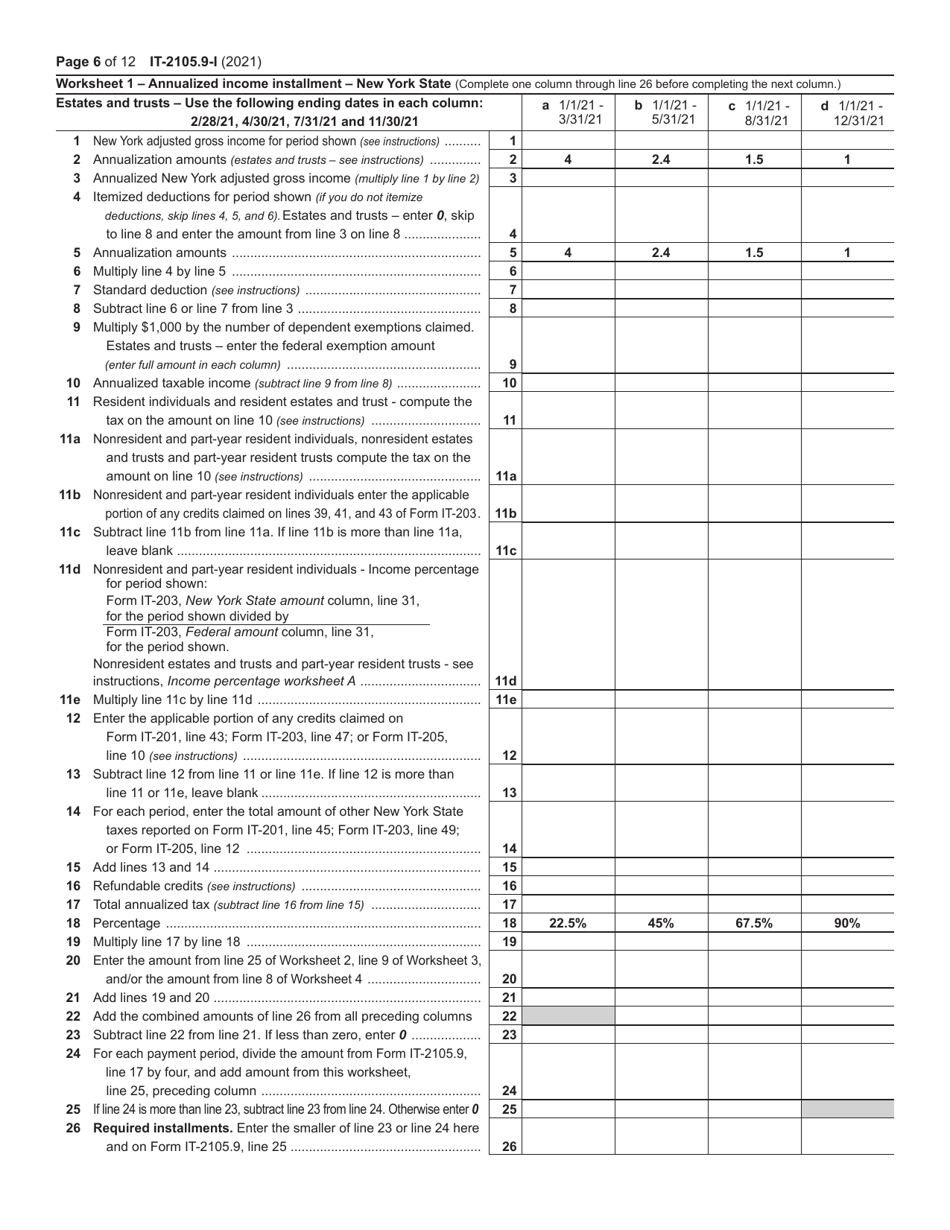

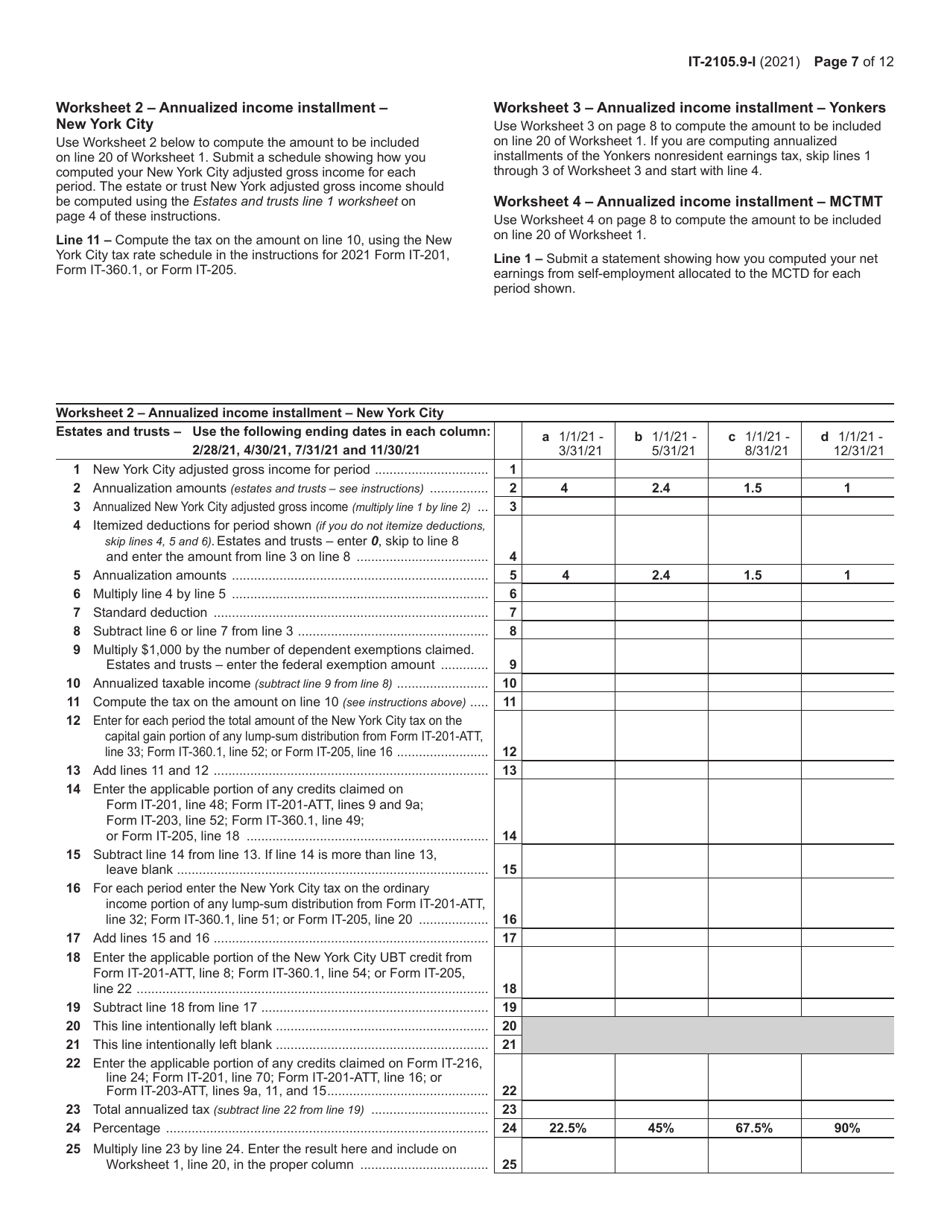

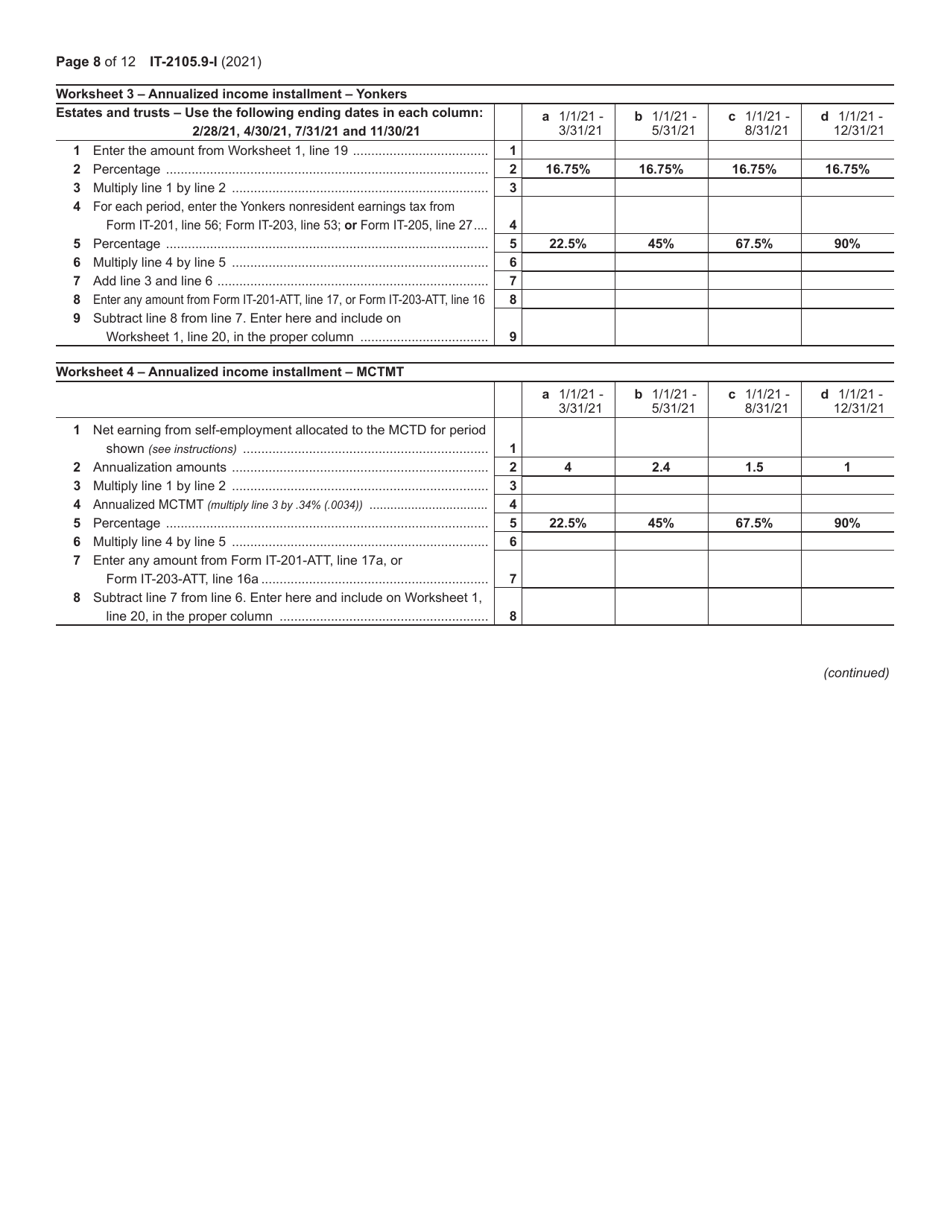

A: The underpayment penalty is calculated based on the amount of underpayment and the applicable interest rate. You can use the worksheet provided with Form IT-2105.9 to calculate the penalty.

Q: Can I request a waiver of the underpayment penalty?

A: Yes, you can request a waiver of the underpayment penalty if you meet certain criteria. Details about the waiver request process are provided in the instructions for Form IT-2105.9.

Q: Are there any other forms or documents that need to be filed along with Form IT-2105.9?

A: In most cases, you will need to include a copy of your federal income tax return (Form 1040) and your New York State income tax return (Form IT-201) along with Form IT-2105.9.

Q: Can I file Form IT-2105.9 electronically?

A: No, currently electronic filing is not available for Form IT-2105.9. You must file a paper copy of the form by mail.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.