This version of the form is not currently in use and is provided for reference only. Download this version of

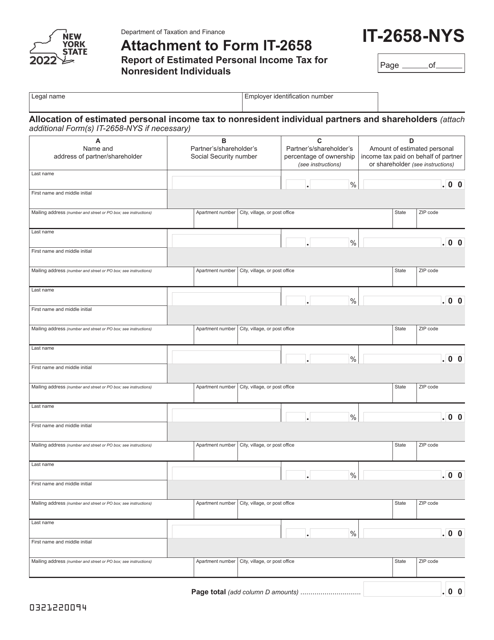

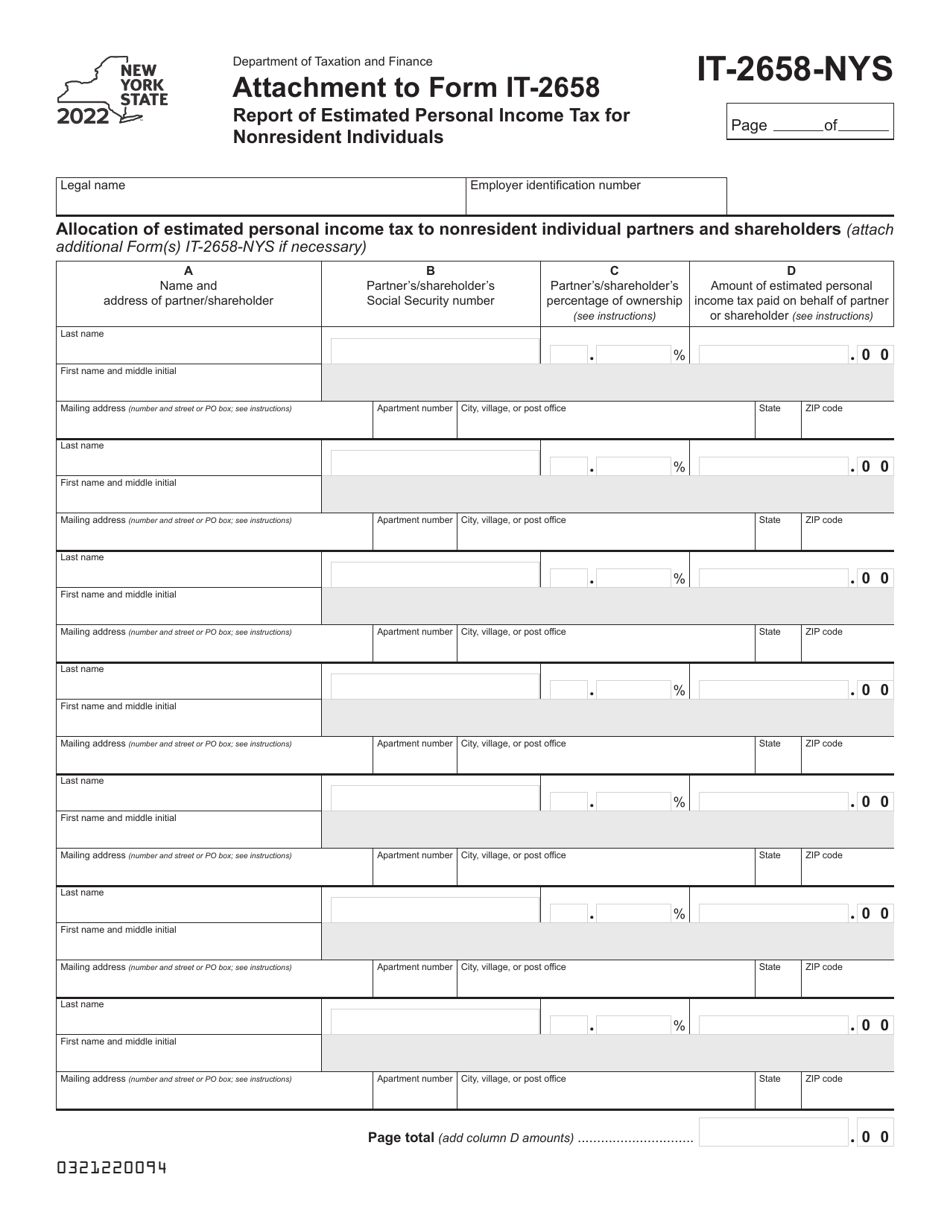

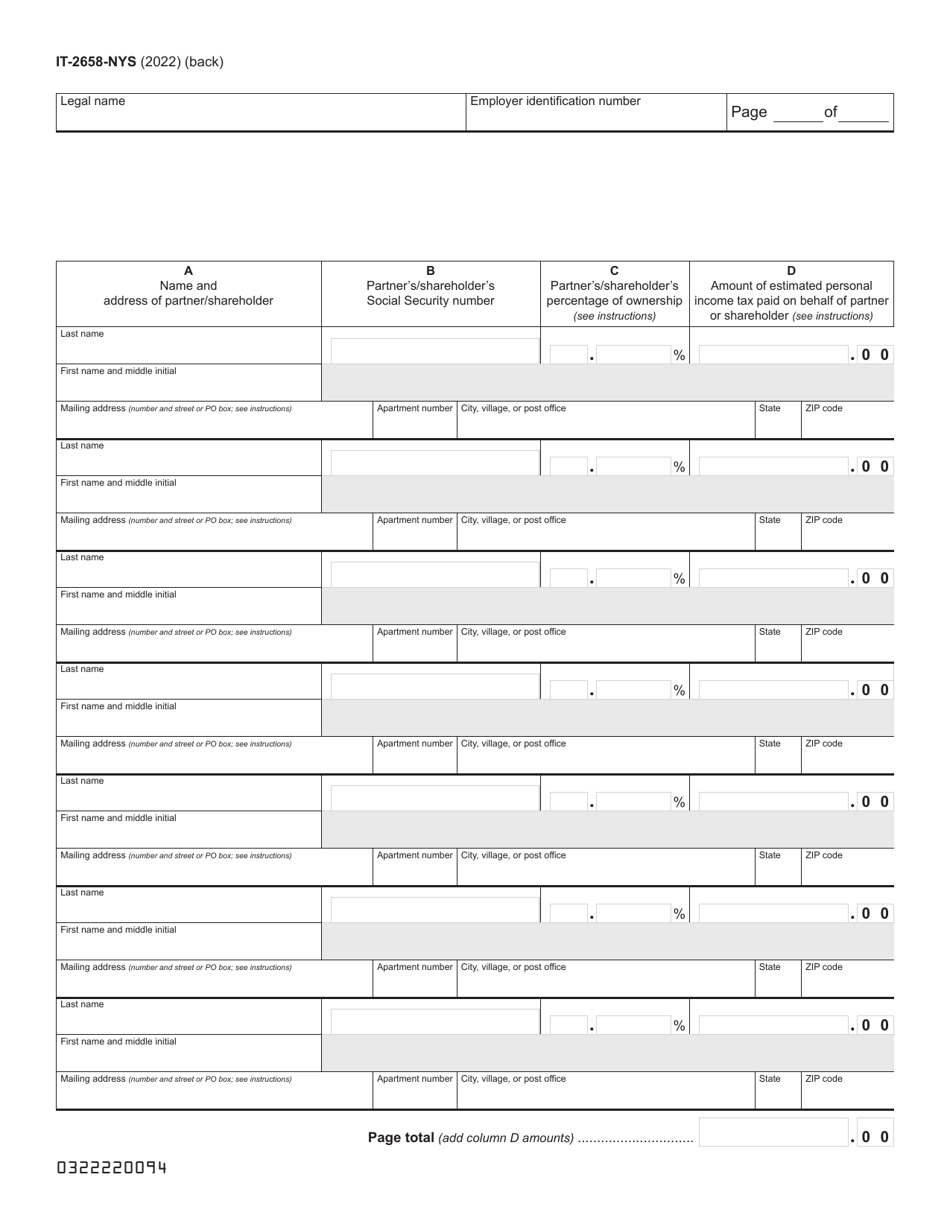

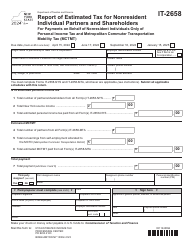

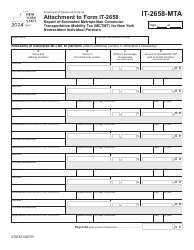

Form IT-2658-NYS

for the current year.

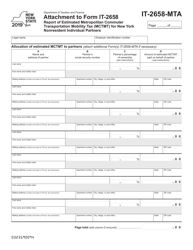

Form IT-2658-NYS Report of Estimated Personal Income Tax for Nonresident Individuals - New York

What Is Form IT-2658-NYS?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IT-2658-NYS?

A: IT-2658-NYS is a form used to report estimated personal income tax for nonresident individuals in New York.

Q: Who needs to file IT-2658-NYS?

A: Nonresident individuals who receive income from New York and are required to pay personal income tax need to file Form IT-2658-NYS.

Q: What is the purpose of filing Form IT-2658-NYS?

A: The purpose of filing Form IT-2658-NYS is to report and pay estimated personal income tax to the state of New York.

Q: When is Form IT-2658-NYS due?

A: Form IT-2658-NYS is generally due on a quarterly basis, with deadlines in April, June, September, and January.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658-NYS by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.