This version of the form is not currently in use and is provided for reference only. Download this version of

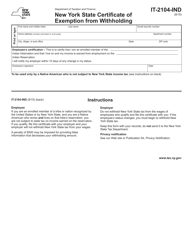

Form IT-2658-E

for the current year.

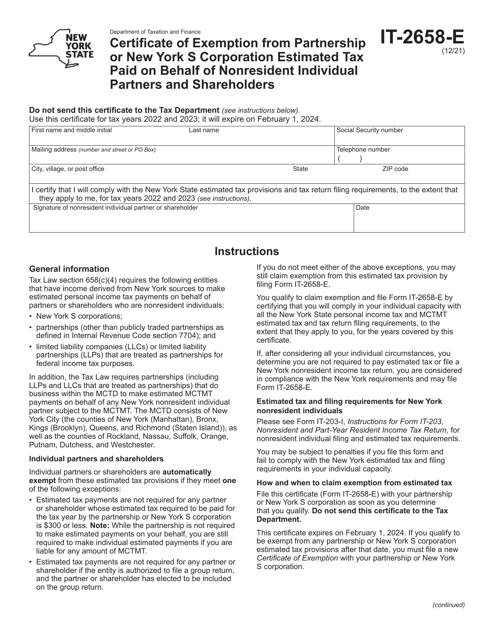

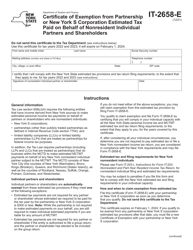

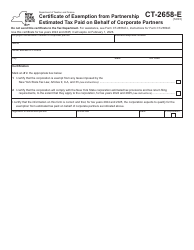

Form IT-2658-E Certificate of Exemption From Partnership or New York S Corporation Estimated Tax Paid on Behalf of Nonresident Individual Partners and Shareholders - New York

What Is Form IT-2658-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

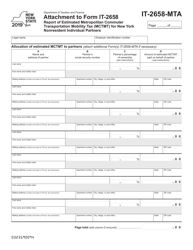

Q: What is Form IT-2658-E?

A: Form IT-2658-E is a certificate of exemption from partnership or New York S corporation estimated tax paid on behalf of nonresident individual partners and shareholders.

Q: Who uses Form IT-2658-E?

A: Partnerships or New York S corporations use Form IT-2658-E.

Q: What is the purpose of Form IT-2658-E?

A: Form IT-2658-E is used to certify that no estimated tax is due from a nonresident individual partner or shareholder.

Q: When should Form IT-2658-E be filed?

A: Form IT-2658-E should be filed by the due date of the first estimated tax installment for the year.

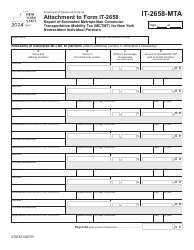

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.