This version of the form is not currently in use and is provided for reference only. Download this version of

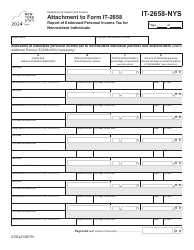

Form IT-2658

for the current year.

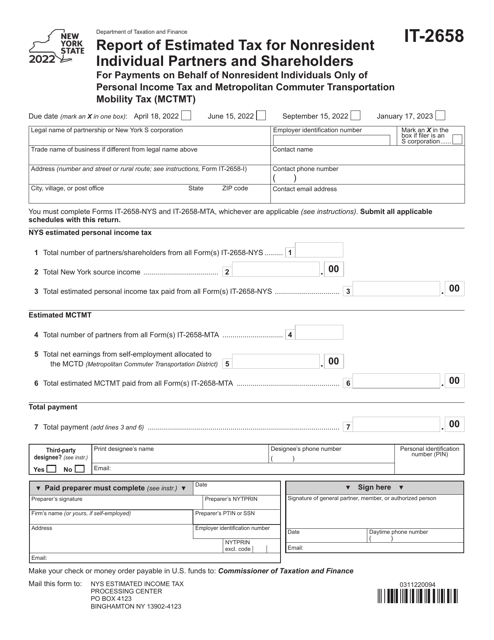

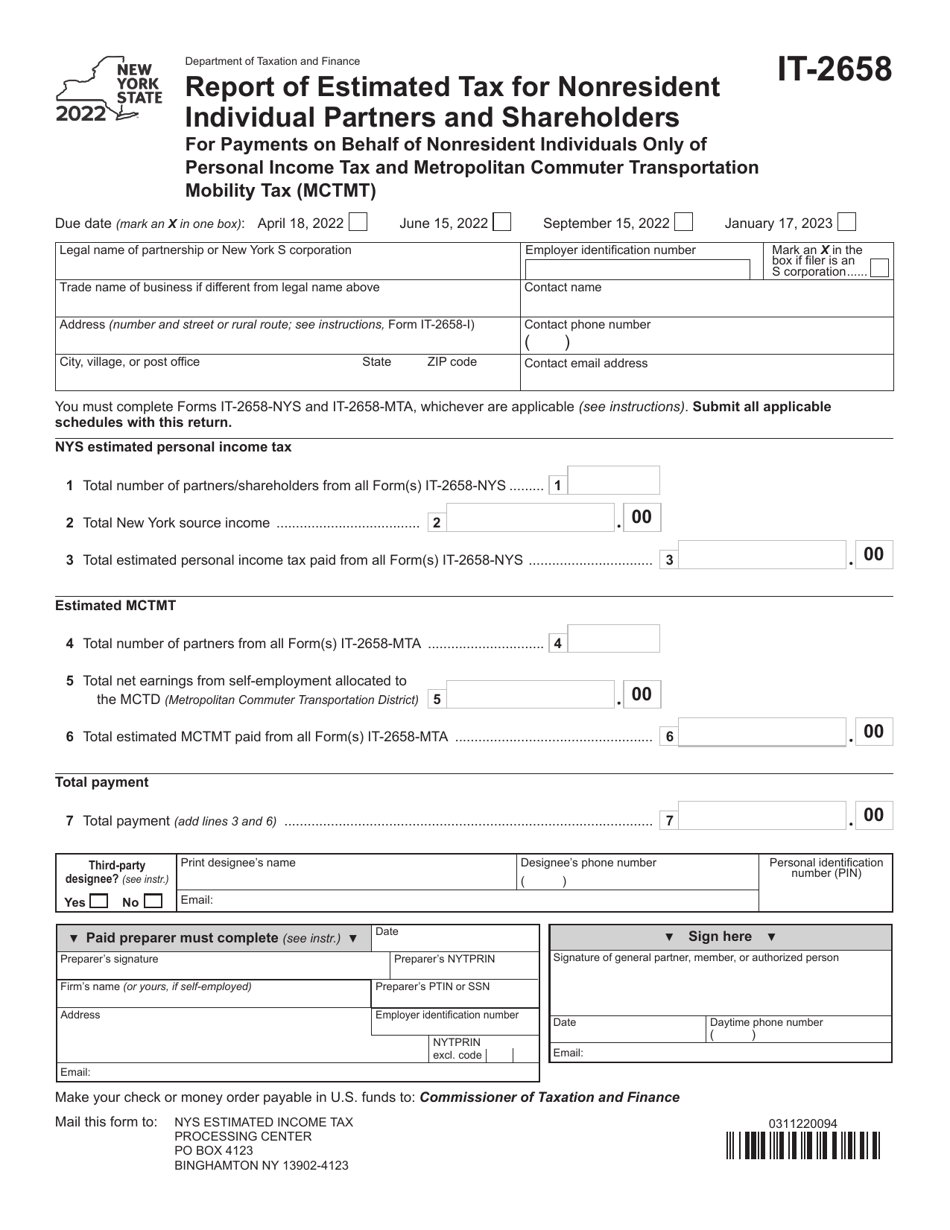

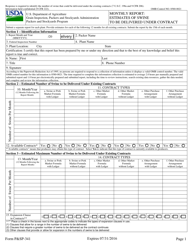

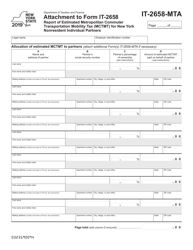

Form IT-2658 Report of Estimated Tax for Nonresident Individual Partners and Shareholders for Payments on Behalf of Nonresident Individuals Only of Personal Income Tax and Metropolitan Commuter Transportation Mobility Tax (Mctmt) - New York

What Is Form IT-2658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2658?

A: Form IT-2658 is a report used by nonresident individual partners and shareholders in New York to make estimated tax payments on behalf of nonresident individuals for personal income tax and Metropolitan Commuter Transportation Mobility Tax (MCTMT).

Q: Who should file Form IT-2658?

A: Nonresident individual partners and shareholders who are making estimated tax payments on behalf of nonresident individuals for personal income tax and MCTMT in New York should file Form IT-2658.

Q: What is the purpose of Form IT-2658?

A: The purpose of Form IT-2658 is to report and remit estimated tax payments on behalf of nonresident individuals for personal income tax and MCTMT in New York.

Q: What taxes are covered by Form IT-2658?

A: Form IT-2658 covers payments for personal income tax and Metropolitan Commuter Transportation Mobility Tax (MCTMT) on behalf of nonresident individuals in New York.

Q: When should Form IT-2658 be filed?

A: Form IT-2658 should be filed by nonresident individual partners and shareholders on a quarterly basis, with payment due on April 15, June 15, September 15, and January 15 of the following year.

Q: Are there any penalties for not filing Form IT-2658?

A: Yes, failure to file Form IT-2658 or pay the required estimated tax amounts on time may result in penalties and interest charges imposed by the New York State Department of Taxation and Finance.

Q: Are there any exemptions or deductions available on Form IT-2658?

A: The specific exemptions or deductions available on Form IT-2658 may vary depending on individual circumstances. It is best to consult the instructions provided with the form or seek professional tax advice for accurate information.

Q: How should I submit the completed Form IT-2658?

A: The completed Form IT-2658 should be filed with the New York State Department of Taxation and Finance, either electronically or by mail, along with the appropriate payment for the estimated tax amounts.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.