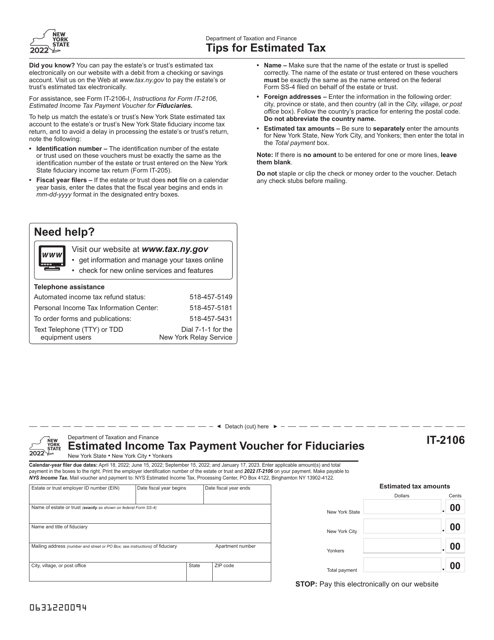

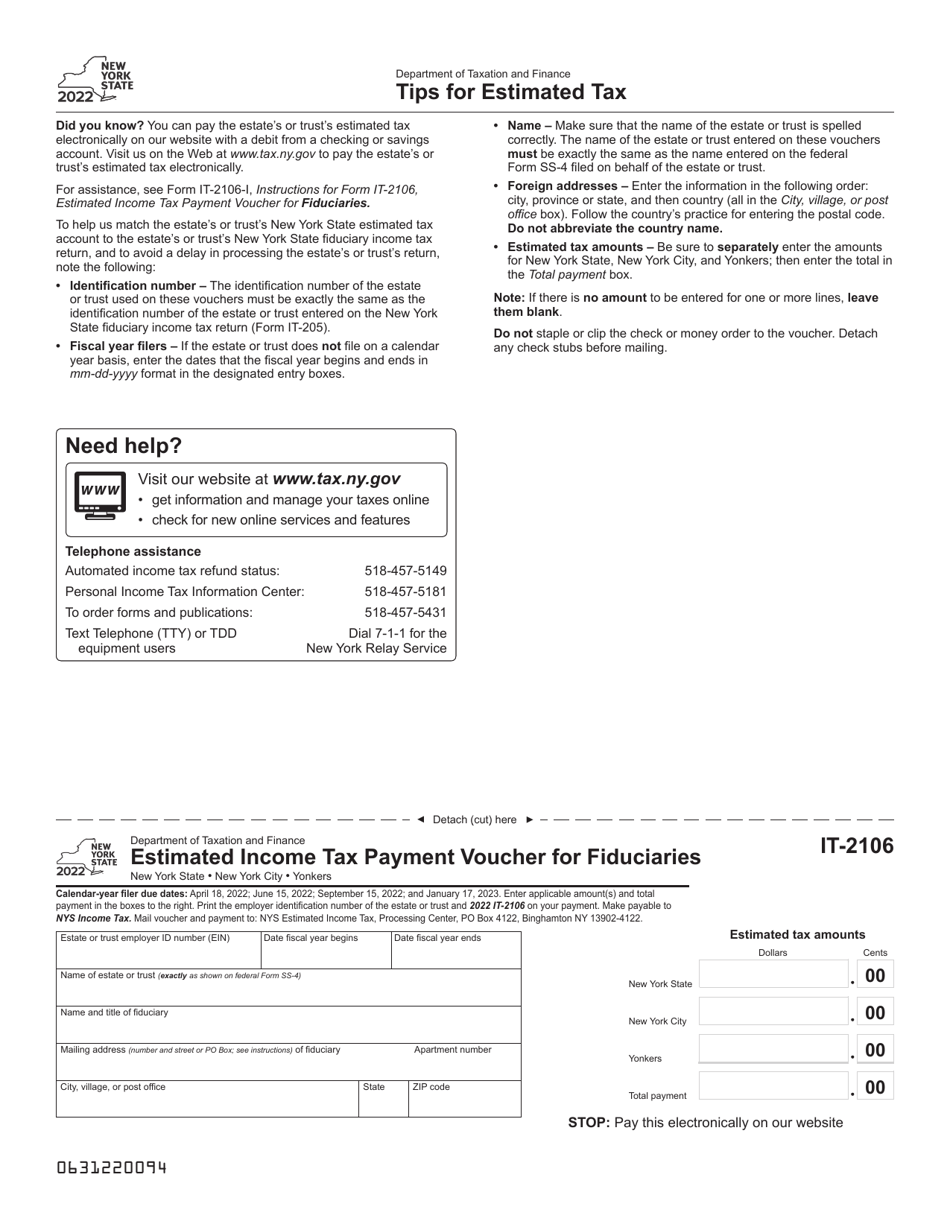

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-2106

for the current year.

Form IT-2106 Estimated Income Tax Payment Voucher for Fiduciaries - New York

What Is Form IT-2106?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2106?

A: Form IT-2106 is a Estimated Income Tax Payment Voucher for Fiduciaries in New York.

Q: Who needs to file Form IT-2106?

A: Fiduciaries in New York need to file Form IT-2106.

Q: What is the purpose of Form IT-2106?

A: The purpose of Form IT-2106 is to make estimated income tax payments for fiduciaries in New York.

Q: When is Form IT-2106 due?

A: Form IT-2106 is due on or before the 15th day of the fourth month following the close of the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2106 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.