This version of the form is not currently in use and is provided for reference only. Download this version of

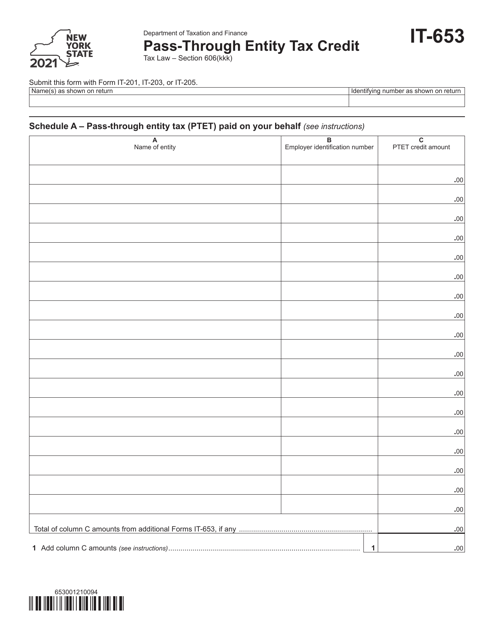

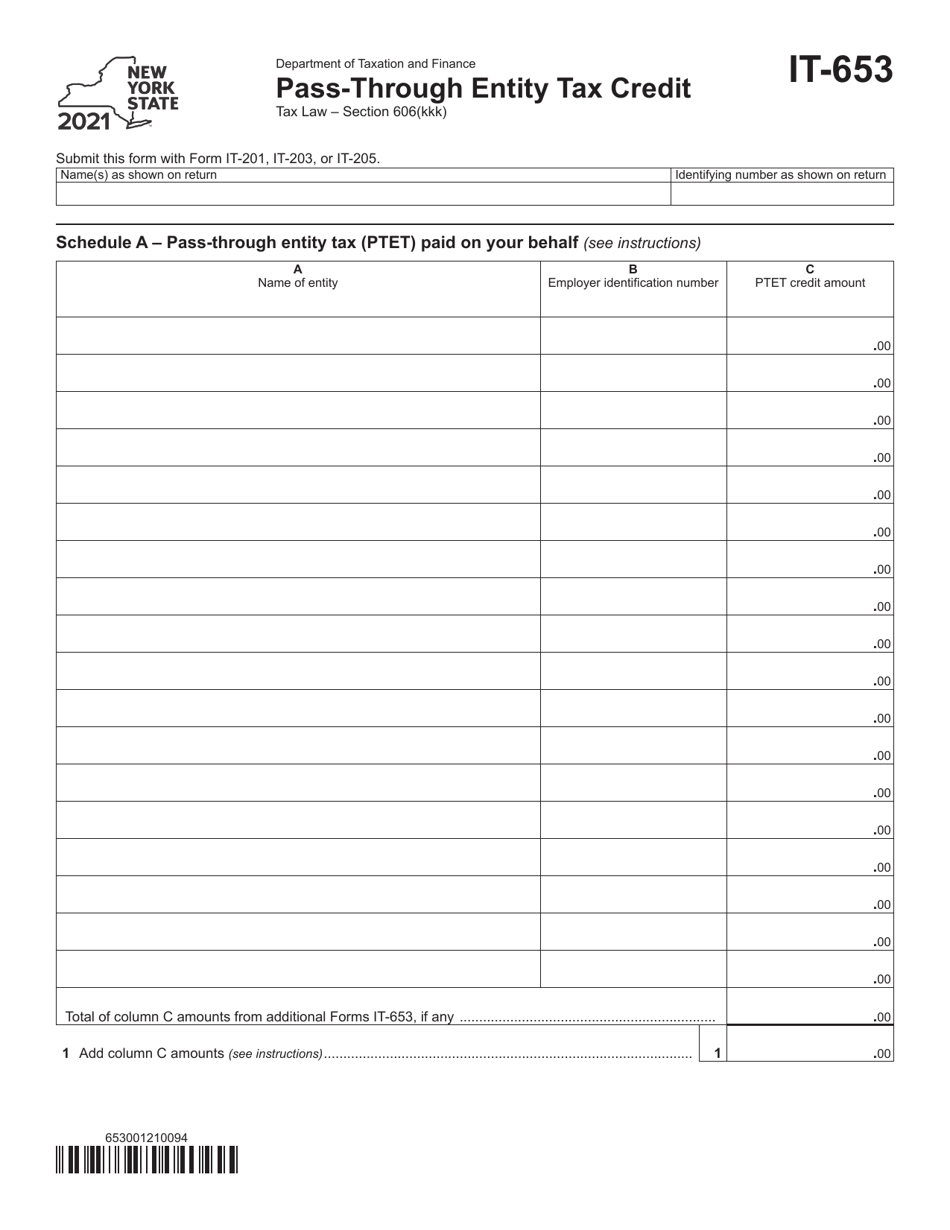

Form IT-653

for the current year.

Form IT-653 Pass-Through Entity Tax Credit - New York

What Is Form IT-653?

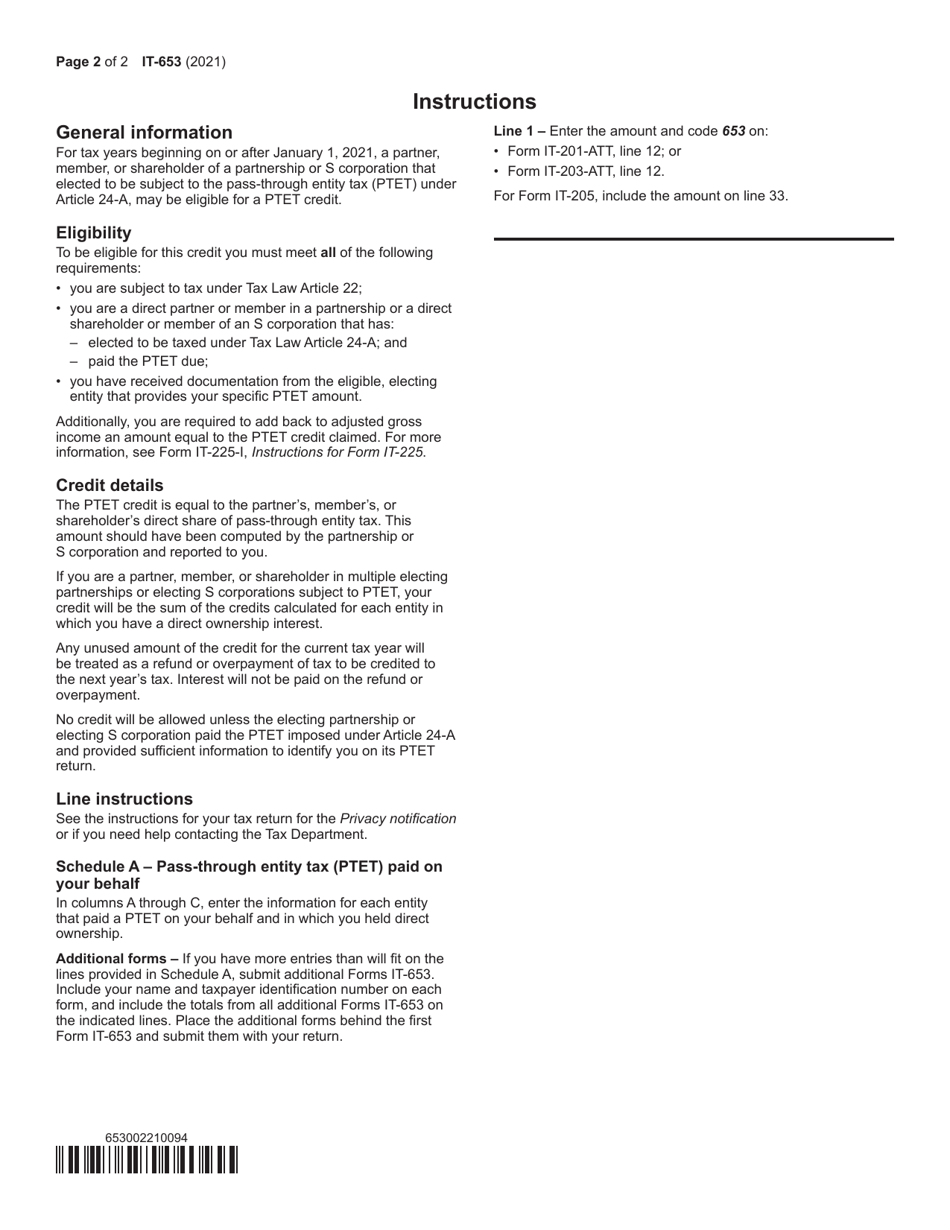

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-653?

A: Form IT-653 is the Pass-Through Entity Tax Credit form for New York.

Q: Who needs to file Form IT-653?

A: Pass-through entities in New York that qualify for the pass-through entity tax credit.

Q: What is the purpose of Form IT-653?

A: Form IT-653 is used to claim the pass-through entity tax credit in New York.

Q: When is the deadline to file Form IT-653?

A: The deadline to file Form IT-653 is generally the same as the deadline to file the pass-through entity's tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-653 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.