This version of the form is not currently in use and is provided for reference only. Download this version of

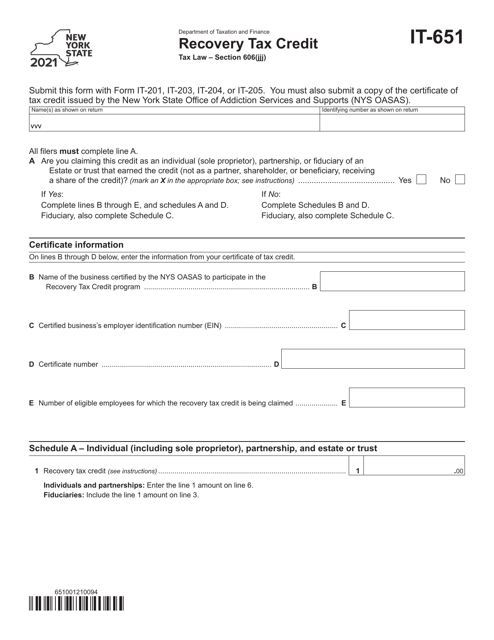

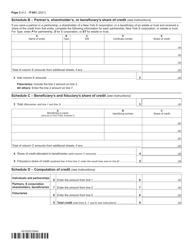

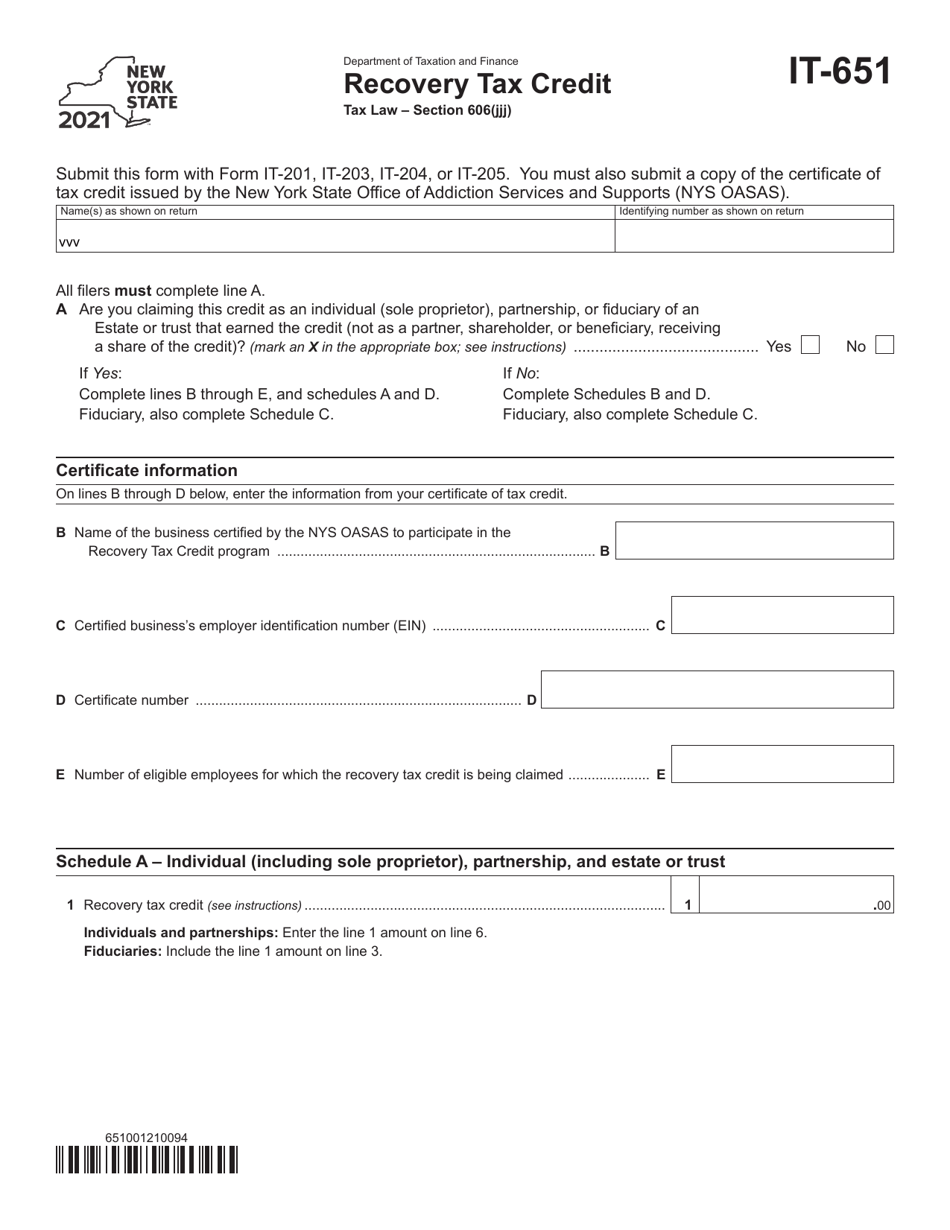

Form IT-651

for the current year.

Form IT-651 Recovery Tax Credit - New York

What Is Form IT-651?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form IT-651 Recovery Tax Credit?

A: Form IT-651 Recovery Tax Credit is a tax form specific to New York residents.

Q: Who is eligible to file form IT-651 Recovery Tax Credit?

A: New York residents who meet certain qualifications are eligible to file form IT-651 Recovery Tax Credit.

Q: What is the purpose of form IT-651 Recovery Tax Credit?

A: The purpose of form IT-651 Recovery Tax Credit is to claim a tax credit for certain recovery taxes paid to the government.

Q: Are there any deadlines for filing form IT-651 Recovery Tax Credit?

A: Yes, there are specific deadlines for filing form IT-651 Recovery Tax Credit. It is important to check the official guidelines and deadlines provided by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-651 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.